4.

INDONESIA

EU and domestic regulations could

weaken furniture exports

The combined impact of the EUDR and the Indonesian government's

legality verification system (SVLK) could potentially hurt the domestic

furniture industry and erode Indonesia's furniture export competitiveness

according to Abdul Sobur, chairman of the Indonesian Furniture and

Handicraft Industry Association (Himki).

When the EUDR is implemented this will add to production and delivery costs

and if prices do not rise then eventually the regulations will weaken

Indonesia's competitiveness, Abdul said. He added, unnecessary costs must be

eliminated as restrictive regulations could hamper the target to achieve

US$5 billion in furniture exports.

See:

https://jakartaglobe.id/business/overlapping-deforestation-laws-in-eu-indonesia-hurt-furniture-exports

and

https://investor.id/business/331929/tumpang-tindih-regulasi-tekan-ekspor-furnitur-nasional

In related news, the Director General of Agro-Industry at the Ministry of

Industry (Kemenperin), Putu Juli Ardika, denied that the EUDR will

negatively impact exports of products from Indonesia as, according to him,

“the majority of exporters already have certificates meeting EU standards

ensuring the manufacturing process for exported products does not damage the

forest.

See:

https://www.msn.com/id-id/ekonomi/bisnis/uu-anti-deforestasi-disebut-hambat-ekspor-%20%20komoditas-indonesia-kemenperin-dampaknya-tidak-signifikan/ar-AA1chUTK

Coordinating Minister of Economic Affairs, Airlangga Hartarto, has said that

Indonesia has 18 months remaining to act before the implementation of the

EUDR, adding that the regulation would label products as originating from

high-risk, standard or low-risk countries.

He said Indonesian commodities potentially impacted by the EUDR include palm

oil and derivatives, coffee, soya, cocoa, beef and wood products.

Deforestation rate in 2022, a steady decline

The Minister of Environment and Forestry, Siti Nurbaya, reported

Indonesia's deforestation rate in recent years to the House of

Representatives. According to the Minister, Indonesia's deforestation rate

continues to decline year by year. She revealed that in 2015 Indonesia's

deforestation rate was recorded at 1.09 million hectares but it had fallen

to 460,000 hectares in 2019.

The rate of deforestation fell again in 2021 to

110,000 hectares. The Minister revealed that in 2022 deforestation extended

over 107,000 hectares. She explained that, to monitor deforestation, the

Directorate General of Forestry Planning and Environmental Management has

developed a National Forestry Monitoring System (Simontana) that records the

condition of Indonesia's forests.

See:

https://forestinsights.id/laju-deforestasi-indonesia-tahun-2022-menteri-lhk-angkanya-terus-menurun/

Social forestry creating economic growth in villages

The Minister of Environment and Forestry has said that the concept

of social forestry, which gives communities the right to manage forests in a

sustainable manner, can create economic growth in villages. Communities can

secure social forestry management rights through five schemes: village

forest management schemes, community forestry, community plantation

forestry, customary forest and partnership schemes.

The Minister said that social forestry has also expanded to the downstream

sector so that communities can now develop into productive communities.

See:

https://en.antaranews.com/news/285111/social-forestry-creating-new-economic-growth-in-villages-minister

Seek export opportunities from US-China trade dispute

Indonesia must optimise opportunities arising from the ongoing

trade dispute between the United States and China according to the

Coordinating Minister for Economic Affairs, Airlangga Hartarto. He said that

Indonesia has become a member of the first regional cooperation group to

focus on supply chain issues namely the Indo-Pacific Economic Framework

(IPEF).

The other IPEF members include Brunei, Fiji, Singapore, Thailand, Malaysia,

Vietnam, Australia, India, Japan, New Zealand, South Korea, the Philippines

and the United States.

IPEF member countries have committed to realising economic cooperation

involving the private sector as well as implementing technical assistance

and capacity-building programmes.

See:

https://en.antaranews.com/news/285141/indonesia-must-take-advantage-of-us-china-trade-war-minister

5.

MYANMAR

State-owned banks sanctioned further

The Office of Foreign Assets Control (OFAC) in the United States

has imposed fresh sanctions on Myanmar’s defense ministry and two

state-owned banks saying that they facilitated transactions between the

military-controlled government and overseas markets, including for weapons

and military equipment.

In response to US action a government spokesman said the US was pushing

Myanmar toward an economic and political crisis and that the new sanctions

won’t hurt the economy because international banking services are also

provided by local private banks and branches of foreign banks.

See:

https://home.treasury.gov/news/press-releases/jy1555

and

https://www.thestar.com.my/aseanplus/aseanplus-news/2023/06/24/us-sanctions-myanmar-defence-ministry-two-state-owned-banks-also-get-same-treatment

According to timber exporters the new OFAC sanctions came as no surprise.

The Myanma Timber Enterprise (MTE), the sole and official suppliers of

timber raw material, is already facing sanctions. The new OFAC measures

could be a serious blow to the MTE since the US dollar is the currency for

tenders.

During the first two months of the 2023-24 fiscal year the value of timber

exported was around US$13 million according to the Myanmar Trade Department

website. The timber sector is no longer a top foreign currency earner.

Currently, the agricultural sector is top earning followed by marine

products and minerals.

Slim hope for quick recovery

In its latest Economic Monitor report the World ban says “economic

conditions in Myanmar have stabilised in the first half of 2023. Exchange

rates have remained steady, while inflation in food and fuel prices has

eased. Most indicators suggest economic activity is slowly increasing,

albeit from a very low base.

Manufacturing output and new orders have risen

quickly, sales of domestic products have picked up, while passenger and

freight transport volumes are rising. Although agricultural production seems

to have weakened, profitability is improving as farmgate prices rise and

input costs ease and this is likely to prompt higher production in coming

seasons.

Firms across all sectors report operating at higher capacity in the last

quarter, with companies in non-retail services performing best. Retail

sector performance has also improved, with sales picking up and firms

sourcing more goods locally.

However, several factors are constraining the pace of this recovery.

Household incomes remain weak, limiting the ability of domestic demand to

drive growth. High prices and shortages resulting from import restrictions

make it difficult for many businesses to source essential inputs, while

power outages have become prominent. Investment remains weak, with new

business registrations at a low level. Other than in the agriculture sector,

reported profits continue to decline as the conflict raises costs and limits

activity in some areas.

Overall, the economy is still operating well below pre-pandemic levels, in

sharp contrast to the rest of the region. Policy changes continue to create

uncertainty and obstacles for doing business, with further regulations and

restrictions introduced on international trade and financial transfers”.

See:

https://www.worldbank.org/en/country/myanmar/publication/myanmar-economic-monitor-june-2023-a-fragile-recovery-key-findings

6.

INDIA

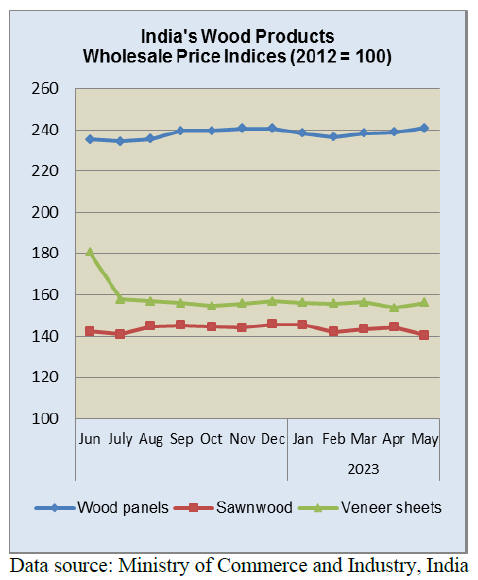

Inflation trends down

The annual rate of inflation based on the India Wholesale Price

Index (WPI) in May was minus 3.5% compared to minus 0.9% recorded in April

2023.

The decline in the rate of inflation in May was primarily due to a fall in

prices of mineral oils, basic metals, food products, textiles, non-food

articles, crude petroleum and natural gas and chemical products. Out of the

22 NIC two-digit groups for manufactured products, 7 groups saw an increase

in prices whereas 11 groups saw a decline.

The groups that have recorded major increase in prices were electrical

equipment; pharmaceuticals, medicinal, chemical and botanical products;

tobacco products; wood and products of wood and cork (except sawnwood);

leather and related products and beverages. Some of the groups that say a

decrease in prices were basic metals, food products and textiles.

See:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

State Forest Departments to report

statistics directly to national database

The Ministry of Environment, Forest and Climate Change has released

the “National Working Plan Code-2023 for forest management and this includes

a new approach to data reporting. The new Code-2023 requires state forest

departments to report data to a national centralised database. This could

result in forest data become available much faster than at present.

Code-2023 was announced by Shri. Chandra Prakash Goyal, Director General of

Forests and Special Secretary, Ministry of Environment, Forest and Climate

Change. The Code-2023 guides State Forest Departments in the preparation of

working plan for forest across the country.

See:

https://observervoice.com/national-working-plan-code-2023-released-for-scientific-management-of-forests-and-evolving-new-approaches-26261/

7.

VIETNAM

Wood and wood product (W&WP) trade

highligts

April

Imports of logs and sawnwood from the US in April 2023 stood at

42,760 cu.m worth US$19.46 million, down 12% in volume and 10% in value

compared to March 2023 but up 1.6% in volume and down 8% in value compared

to April 2022. In the first 4 months of 2023 imports of raw wood from the US

amounted to 147,260 cu.m worth US$65.05 million, down 5% in volume and 12%

in value over the same period in 2022.

Imports of logs and sawnwood in April 2023 were the lowest level in many

years, amounting to 41,330 cu.m at a value of US$15.85 million, down 37% in

volume and down 36% in value compared to March 2023 and down 49% in volume

and down 48% in value compared to April 2022.

May

Vietnam’s W&WP exports to the UK in May 2023 reached US$21 million, up 14%

compared to May 2022. In the first 5 months of 2023, exports of wood and

wood products to the UK have been estimated at US$81.3 million, down 32%

over the same period in 2022.

Vietnam’s office furniture exports in May 2023 were valued at US$23

million, down 25% compared to May 2022. In the first 5 months of 2023 office

furniture exports earned US$107.3 million, down 32% over the same period in

2022.

Vietnam's wood imports in May 2023 were at 6,700 cu.m, worth US$3.0

million, up 16% in volume and 15% in value compared to April 2023. However,

compared to May 2022 imports decreased by 79% in volume and 76% in value. In

the first 5 months of 2023 wood imports stood at 58,300 cu.m worth US$25.9

million, down 51% in volume and 44% in value over the same period in 2022.

In May 2023, exports of wood and wood products earned US$1.05 billion,

down 3.4% compared to April 2023 and down 25% compared to May 2022. In

particular, WP exports accounted for US$760.5 million, down 2% compared to

April 2023 and down 20% compared to May 2022.

In the first 5 months of 2023 W&WP exports were valued at US$4.96 billion,

down 29% over the same period in 2022. Of this WP exports contributed

US$3.37 billion, down 35% over the same period in 2022.

Vietnam’s W&WP exports to the German market in May 2023 reached US$3.7

million, down 62% compared to May 2022. In the first 5 months of 2023 W&WP

exports to Germany earned about US$27.5 million, down 57% over the same

period in 2022.

According to preliminary statistics exports of living-room and dining-room

furniture in May 2023 generated US$191 million, down 28% compared to May

2022. In the first 5 months of 2023 exports of living-room and dining-room

furniture accumulated US$836 million, down 40% over the same period in 2022.

In May 2023 W&WP imports into Vietnam were valued at US$216.7 million, up

28% compared to April 2023 but down 33% compared to May 2022. In the first 5

months of 2023 W&WP imports totalled at US$850.1 million, down 33% over the

same period in 2022.

Vietnam's imports of poplar wood in May 2023 were 38,700 cu.m, worth

US$16.3 million, up 29% in volume and 28% in value compared to April 2023.

Compared to May 2022 imprts increased by 14% in volume but decreased by 7%

in value. In the first 5 months of 2023 poplar imports reached 119,200 cu.m,

worth US$49.7 million, down 8% in volume and 22% in value over the same

period in 2022.

Declining log and sawnwood imports from Africa

Vietnam’s imports of logs and sawnwood from Africa in April 2023

declined to the lowest level in many years with a volume of 41,330 cu.m

equivalent to US$15.85 million, down 37% in volume and 36% in value compared

to March 2023 and year-on-year down 49% in volume and 48% in value.

Over the first 4 months of 2023, imports from Africa were recorded at

285,510 cu.m, with a value of US$113.25 million, down 18% in volume and 11%

in value year-on-year.

CITES has listed the entire African population of species under three genera

including Pterocarpus spp. (padouk), Afzelia spp. (mahogany/pachy/doussie)

and Khaya spp. (Acajen) in Appendix 2.

With this CITES decision trade in the newly added species from African

countries require licenses issued by the CITES management authority of the

supply country in accordance with CITES regulations.

As Africa is the top supplier of tropical hardwood to Vietnam and padouk is

the major imported timber from Africa the CITES decision has had a

significant impact on the import and use of African wood in Vietnam. Many

wood-industry villages which specialise in traditional furniture for the

domestic market are suffering a scarcity of wood raw material. Continued

imports of species listed in CITES is forecast to decrease in 2023 and

thereafter.

African hardwood suppliers

In the first 4 months of 2023 wood imports from Cameroon, the

Democratic Republic of the Congo, South Africa, Nigeria, Gabon, the Republic

of Congo declined, while imports from Angola increased.

Cameroon remains as the top supplier delivering 24,680 cu.m (equivalent to

US$10.54 million) in April 2023, down 37% in volume and 34% in value

compared to March 2023 and down 39% in volume and 40% in value compared to

April 2022.

Over the first 4 months of 2023 imports of raw wood from Cameroon reached

169,310 cu.m, with a value of US$73.16 million, down 4% in volume and 2% in

value over the same period in 2022.

Imports from Cameroon in April fell sharply compared to March 2023 and

showed a remarkable year-on-year decline. Over the first 4 months of 2023

log imports from Cameroon decreased by 3% in volume but increased by 1.3% in

value compared to the same period in 2022. Sawnwood imports fell by 5% in

volume and 6% in value.

Angola exported to Vietnam 1,240 cu.m (US$393,000) in April, down 79% in

volume and 34% in value compared to March 2023 and down 39% in volume and

40% in value compared to April 2022.

In the first 4 months of 2023 imports of raw wood from Angola totalled at

20,010 cu.m with a value of US$5.47 million, up 10% in volume and 16% in

value over the same period in 2022. Angola is currently the second largest

supplier of African hardwood to Vietnam.

The volume of sawnwood shipped from Angola to Vietnam over the first 4

months of 2023 amounted to 16,650 cu.m, with a value of US$4.77 million, up

45% in volume and 74% in value over the same period in 2022; In contrast,

imports of logs from this market decreased by 50% in volume and 65% in

value.

South Africa sold 4,670 cu.m to Vietnam worth US$1.23 million in April 2023,

down 24% in volume and 24% in value compared to March 2023 but up 2% in

volume and 14% in value compared to April 2022.

Over the first 4 months of 2023 imports of raw wood from South Africa

reached 16,240 cu.m, with a value of US$4,345 million, down 39% in volume

and 35% in value over the same period in 2022.

Nigeria’s supply dropped in the first 4 months of 2023. Sawn wood imports

from Nigeria to Vietnam were 12,840 cu.m, with a value of US$3.65 million,

down 28% in volume and 26% in value.

African log and sawnwood prices

The average price of logs imported from Africa into Vietnam in

April 2023 was US$372/cu.m, down 3.5% compared to March 2023 but up 3.3%

compared to April 2022. In the first four months of 2023 the average price

of imported logs was US$404/cu.m, up 13% over the same period in 2022.

The average price of imported sawnwood in April 2023 was US$391/cu.m, up 4%

compared to March 2023, down 3% compared to April 2022. Overall, in the

first 4 months of 2023 the price of sawnwood from Africa averaged US$387/cu.m,

up 2.4% over the same period in 2022.

Serious decline in exports of wood and wood products

At a press conference during the Vietnam ASEAN International

Furniture and Home Accessories Fair 2023 (VIFA ASEAN 2023) Tran Ngoc Liem,

Director of the Vietnam Chamber of Commerce and Industry, Ho Chi Minh City

said that because of the difficult situation in the global economy each

month there are hundreds of businesses withdrawing from exporting.

The sharp decline in exports of wood and wood products is due to rising

production costs, especially power and fuel. The slow recovery of the world

economy and the collapse of some banks in the world has also affected the

buying trend of consumers said Tran Ngoc Liem. Consumers have tight budgets

for non-essential products such as wood and wood products in some markets

such as the USA and EU and this has caused a sharp drop in demand.

Another problem is that wood industry enterprises still have difficulty in

accessing capital and bank interest rates are high. Many businesses are

short of orders but finding a solution is a challenge but essential if

companies want to maintain production and retain workers.

At the current growth rate it is forecast that exports of wood and wood

products in the first half of 2023 will have dropped by around 30% compared

to the same period in 2022.

According to Mr. Cao Ba Dang Khoa, Acting General Secretary of the Vietnam

Coconut Association in the face of the current difficult situation,

organising a furniture fair would help Ho Chi Minh City gain an opportunity

to become a regional and international furniture centre.

As one of the businesses having great success in finding orders at fairs,

Mr. Cao Van Dong, General Director of Kettle Interiors Asia Co., Ltd. said

that in March 2023 his business participated in VIFA EXPO 2023 in Ho Chi

Minh City and obtained positive results.

Mr. Dang Quoc Hung, Chairman of the Board of Directors of Alliance

Handicraft Wooden Fine Art Corporation said that the Vietnam ASEAN

International Furniture and Home Accessories Fair 2023 with the theme "

Discover the fascination of Vietnamese furniture and handicrafts”, is

expected to attract 350 domestic and international furniture and handicraft

manufacturers.

According to Mr. Hung the fair promises to become an important trade

promotion venue of ASEAN's regional stature. The diversity and abundance of

product lines displayed by enterprises from participating countries will

meet all the demands of the multi-segment interior and exterior of the world

market.

The Vietnam ASEAN International Furniture and Home Accessories Fair 2023

(VIFA ASEAN 2023) is hosted by the Alliance Handicraft Wooden Fine Art

Corporation in collaboration with Vietnam Chamber of Commerce and Industry -

Ho Chi Minh City Branch (VCCI - HCM). The event will take place from 29

August to 1 Septembe at the Saigon Exhibition and Convention Center.

See:

https://vietnamagriculture.nongnghiep.vn/wood-exports-fell-sharply-businesses-found-orders-through-fairs-d351975.html

8. BRAZIL

Pau-Brazil bows seized

Brazil imposes restrictions on the harvesting of brazilwood or

pau-brasil (also known as pau-de-pernambuco) (Paubrasilia echinata) and

sales of artifacts made of brazilwood are strictly regulated.

However, an illegal trade in brazilwood has been a major challenge for

authorities for years. The states of Espírito Santo and Bahia are the two

major states with remaining natural forest where brazilwood can be found and

it is here that there are cases of illegal logging.

At the Guarulhos International Airport the Brazilian Institute of

Environment and Renewable Natural Resources (IBAMA) inspectors have since

2016 seized more than 1,500 finished brazilwood bows and also pieces of

brazilwood. IBAMA says that, currently, no Brazilian company that is in the

bow manufacturing sector has stocks of brazilwood and that exports of

brazilwood bows and brazilwood items haveceased.

See:

https://valor.globo.com/agronegocios/noticia/2023/06/12/no-aeroporto-de-cumbica-ibama-ja-apreendeu-1-650-arcos.ghtml

In Brazil, production of bows is done by few

companies. Most of which are located in Espírito Santo state. Many foreign

bow manufacturers hold sizeable stocks of sawn brazilwood so they can

maintain production for some years.

Development of the forestry sector

About 58% of Brazil is covered by forests and yet the forest

economy contributes only a small share of GDP. Brazil accounts for less than

10% of the world production of tropical timber according to the

International Tropical Timber Organization.

According to a study by the 2030 Amazon Project the global trade in

non-timber forest products is worth more than US$150 billion but Amazonian

companies had less than a 2% share of this total so the potential for growth

is enormous.

The 2030 Amazon Project suggests SFM techniques are already applied by many

timber companies in the Amazon and if just 5% of the area of the Legal

Amazon were under SFM it would be possible to supply 10 million cubic metres

of wood per year without deforestation.

See:

https://globorural.globo.com/opiniao/vozes-do-agro/noticia/2023/06/o-brasil-e-agro-e-florestal.ghtml

and

https://amazonia2030.org.br/project/

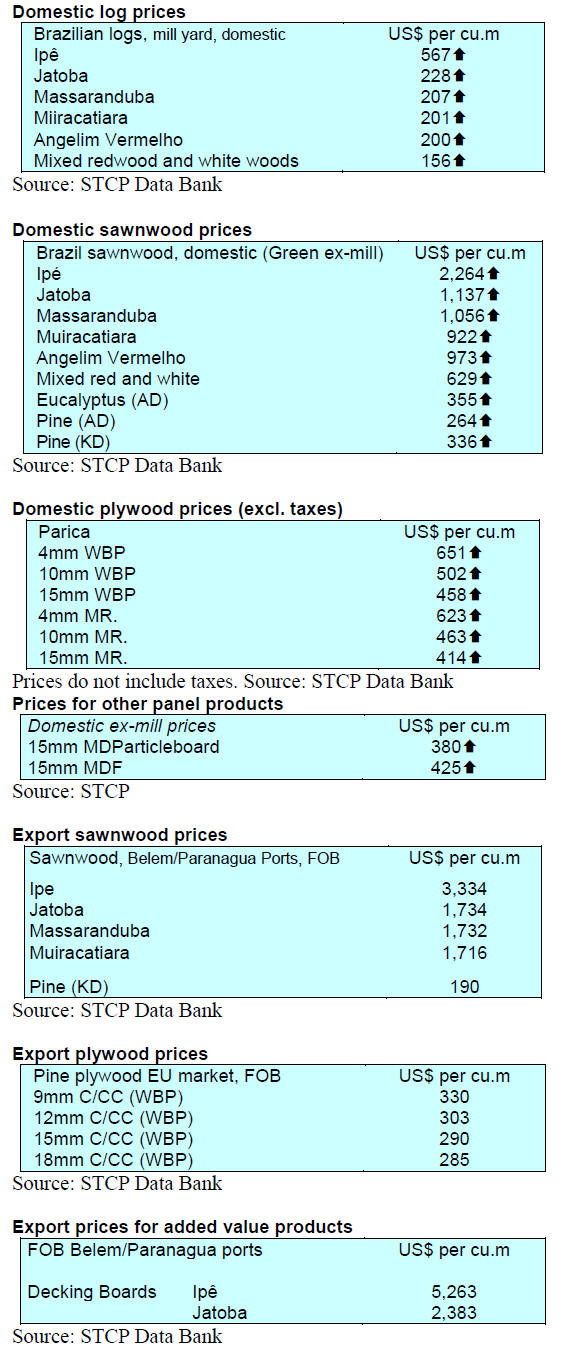

Export update

In May 2023 Brazilian exports of wood-based products (except pulp

and paper) decreased 35% in value compared to May 2022, from US$503.3

million to US$329.2 million.

Pine sawnwood exports declined 12% in value between May 2022 (US$84.6

million) and May 2023 (US$74.5 million). In volume, exports increased 4%

over the same period from 295,200 cu.m to 306,300 cu.m.

Tropical sawnwood exports dropped 34% in volume, from 43,900 cu.m in May

2022 to 29,000 cu.m in May 2023. In value exports fell 21% from US$18.8

million to US$14.9 million over the same period.

Pine plywood exports faced a 37% decline in value in May 2023 compared to

May 2022, from US$101.9 million to US$63.8 million. In volume exports fell

18% over the same period, from 239,200 cu.m to 195,900 cu.m.

As for tropical plywood, exports also declined in volume by 46% and in value

by 44%, from 5,900 cu.m and US$3.4 million in May 2022 to 3,200 cu.m and

US$1.9 million in May 2023.

As for wooden furniture the exported value decreased from US$58.8 million in

May 2022 to US$52.1 million in May 2023, an 11% fall.

Indicators of Brazilian furniture exports

The report "Monitoring of Furniture Exports" is developed for

companies associated with the Brazilian Furniture Sector Project, an

initiative organised by ABIMÓVEL (Brazilian Association of Furniture

Industries / Associação Brasileira das Indústrias do Mobiliário) and

ApexBrasil (Brazilian Trade and Investment Promotion Agency).

According to a report published in April 2023, Brazil exported about US$57

million (FOB) in furniture. This result represented a 10% decrease compared

to April 2022. Furniture exports to Germany increased 42% in the 12 months

to April this year and grew 21% year on year. However exports to Saudi

Arabia dropped 60% over the past last twelve months.

Exports to Chile fell 22% in the last twelve months. In contrast exports to

Colombia dropped 23% in the past twelve months and exports to the United

Arab Emirates fell over 14% in the last twelve months.

See:

http://abimovel.com/brazilian-furniture-monitoramento-das-exportacoes-traz-indicadores-das-exportacoes-de-moveis-e-colchoes-em-abril/

New import controls in Argentina impact exports

Recent import regulations adopted in Argentina are having a big

impact on Brazilian export sales. In order to secure greater control of

supply chains and monitor of foreign trade operations the Argentine

government introduced the “Import System of the Republic of Argentina”

(SIRA) which came into force in October 2022.

The new system restricts the granting of non-automatic licenses (licenças

não automáticas - LNAs). A non-automatic license is an instrument used by

countries to control the entry of products into their countries. Brazilian

exporters can only ship products when a permit is obtained directly from the

Argentine government.

According to a survey conducted by the National Confederation of Industry

(CNI) with 252 Brazilian exporters 77% of the companies indicated that there

was a negative impact on export operations after the creation of SIRA. Out

of these, 84% said there was a reduction in the value exported to Argentina.

Among the exporters that reported a decrease in the value exported after the

implementation of the new system, 49% said that the reduction in sales to

Argentina in the period was around 40%.

With the implementation of the new system the list of goods subject to

non-automatic licenses jumped from 1,474 at the beginning of 2020 to 4,193

by the end of 2022 and 99% of the products are from the manufacturing

industry. Considering 2022 trade data, 59% of Brazilian exports to Argentina

are subject to this measure.

The three main problems pointed out by exporters are the very long payment

terms (79%), the bureaucracy for the release of foreign exchange even after

compliance with the established deadline (55%) and the change and extension

of deadlines after approval of the SIRA (42%).

See:

https://forestnews.com.br/exportadores-impactos-sistema-argentino-importacao/

Through the eyes of industry

The latest GTI report lists the challenges identified by the private sector

in Brazil.

See:

https://www.itto-ggsc.org/static/upload/file/20230615/1686792092163403.pdf

9. PERU

Furniture imports fall in first four

months of 2023

In the first four months of 2023 the value of Peruvian imports of

wooden furniture was US$14.1 million which represented a significant

decrease of 40% compared to the same period in 2022 (US$23.6 million).

Brazil, as usual, was the main supplier at US$9.4 million representing 64%

of the total imported despite having fallen 40% compared to the same time

during 2022. China was the second largest supplier at US$1.9 million.

Shipments of semi-manufactured wood products fall

According to the Services and Extractive Industries Management of

the Association of Exporters (ADEX) export shipments of semi-manufactured

wood products in the first 4 months of the year contracted 41%, earning just

US$16.7 million compared to US$28.5 million in the same period of 2022.

The drop can be explained by lower demand from the main buyers, France down

6% (US$8.2 million), Belgium, down 39% (US$2.2 million) and China down 79%

(US$2.1 million).Among the top ten markets were Mexico (US$1.1 million),

Denmark (US$1.0 million), USA (US$0.6 million), New Zealand (US$0.4

million), Germany (US$0.2 million), Mauritius (US$0.19 million) and

Australia (US$0.14 million).

Over the past 10 years (January-April period) shipments of semi-manufactured

goods remained relatively stable. In 2014 the amount was almost US$22.2

million, in 2015 US$22.14 million, in 2016 about US$22.3 million, in 2017

US$23.4 million and in 2018 US$22.9 million.

In 2019 the amount went to US$28.4 million, to drop to US$15.6 million in

2020. In 2021 it recovered and reached US$23.9 million and in 2022 it closed

at US$28.5 million.

According to figures from the ADEX Data Trade Intelligence System between

January and April 2023 the most important item was profiled wood (except ipé)

totalling US$6.8 million.

Other shipments include moulded tropical wood (US$3.9 million) other

longitudinally profiled wood (US$2.15 million), slats and friezes for

parquet (US$1.4 million) other wood profiled on one or more faces (US $1.2

million) among others.

Lima was the region from which most semi-manufactured wood products were

exported followed by Ucayali (US$5.5 million) and Madre de Dios (US$1.2

million).

Semi-manufactured products ranked first among the

shipments of this sector surpassing sawn wood (US$14.5 million),

construction products (US$1.6 million), firewood and charcoal (US$1.4

million) and furniture and its parts (US$1.1 million).

ADEX to boost shipments from the Amazon

Over the past five years exports from the Amazon Region represented

just 0.8% of total national shipments and were from two sectors,

hydrocarbons and agro-industry. This was reported by the Association of

Exporters (ADEX) who said that last year shipments from that part of the

country totaled US$809 mil. registering an increase of 65% compared to 2021.

Traditional product shipments amounted to US$473 mil. and non-traditional at

productsthe balance.

In the first quarter of this year shipments from the Amazon amounted to

US$235.1 million, showing a growth of 6% compared to the same period in 2022

(US$220.9 million). Primary goods shipments (US$143.9 million) registered an

increase of 22% but value-added shipments (US$91.1 million) contracted 12%.

Loreto was the leading exporting region with US$89 million and the main item

was crude oil, (95%), as well as ornamental fish, multicellular centrifugal

pumps and sawn wood. San Martín, with US$4 million and an increase of 14%

exported cocoa beans, palm oil, lead and its concentrates, and coffee.

Madre de Dios with US$48 million shipped to the United Arab Emirates, India,

Belgium, China and South Korea out of a total of 24 destinations products

such as gold, Brazil nuts, sawnwood, profiled wood and others.

For its part, the Ucayali region, with US$40 million, exported crude palm

oil, tropical wood, cocoa beans, and mouldings to 23 countries including

Mexico, Colombia, France, China, Dominican Republic and Malaysia.

OSINFOR 15 anniversary

On the occasion of its fifteenth the Forest and Wildlife Resources

Supervision Agency (OSINFOR) held an event where they presented the main

achievements made in collaboration with important stakeholders in the sector

with the aim of contributing to the management, competitiveness and

sustainable use of forest resources.

The event programme included three presentations on issues of public

interest:

The contribution of inspection to forest governance for the benefit of

forest users and sustainability in the use of resources

How, through governance and within the framework of Digital

Transformation, it is possible to optimise forest supervision to achieve

improvements in its results through the efficient use of resources and

incorporation of digital technologies.

Strategic indicators to strengthen the use and trade of legal timber

contributing to improving decision-making and the implementation of public

policies.