|

Report from

Europe

UK tropical wood product imports down 45%

The import value of tropical wood and wooden furniture into the

UK in the first four months of this year was US$314 million, 45% less

than the same period last year. In quantity terms, the UK imported

132,000 tonnes of tropical wood and wood furniture in the January to

April period, 26% less than the same period last year. The sharp decline

was expected as trade in the opening months of last year was at the

highest level (in dollar terms) since before the 2008 financial crises

and had already slowed markedly since summer 2022.

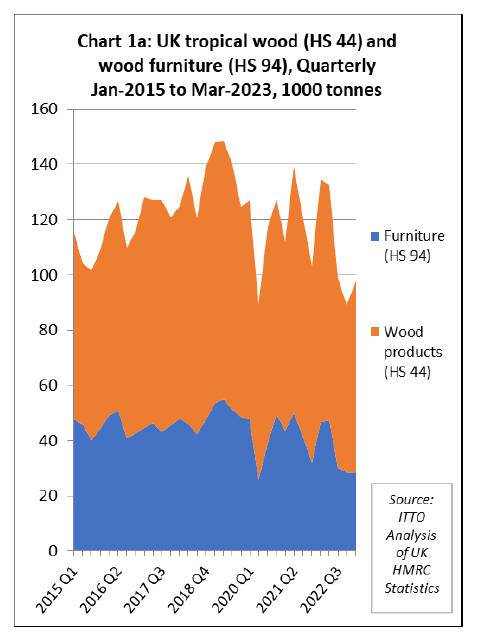

Considering the quarterly trend, the UK imported 98,000 tonnes of tropical

wood and wooden furniture in the first quarter of 2023. Although a 10%

gain compared to the previous quarter, it was the third lowest quarterly

import quantity since before the 2008 financial crises. In the last

decade, trade has only once dipped below the current level, in the

second quarter of 2020 during the first COVID lockdown (Chart 1a above).

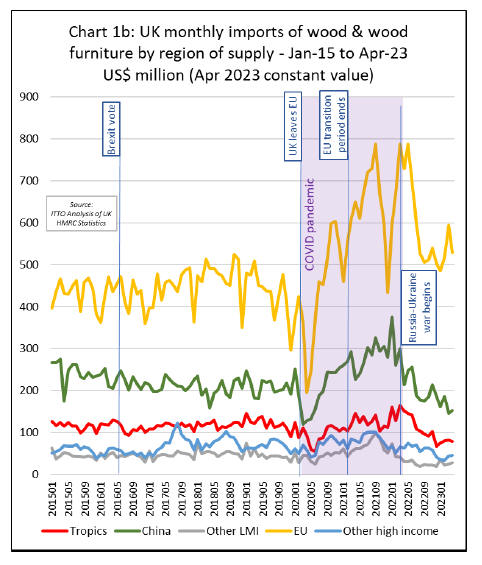

The dip in UK imports of tropical wood and wood furniture products since

the middle of last year is part of a wider fall in trade. The total

value of UK imports of all wood and wood furniture products from all

regions was US$3.34 billion in the first four months of 2023, 29% less

than the same period in 2022.

Despite the recent sharp fall in UK trade in wood and wood furniture

products and the added obstacles to UK transactions with EU countries

since Brexit, the value of UK trade with the EU so far this year remains

higher than before the COVID pandemic. However, imports from all other

regions have been significantly lower than before the pandemic (Chart

1b).

UK hardwood market slow in the face of consumer “hangover”

The UK hardwood market this year is considerably slower than

the last two years, now that the COVID home improvement boom is well and

truly over. British consumers are suffering from a “hangover” with

annual inflation still close to 8% and the bank base rate having been

pushed up to 4.5% following 12 consecutive increases since December

2021.

High stocks of hardwood products were built up in the first half of last

year when prices were higher and have only been selling slowly, often at

a loss to maintain cash flow.

Nevertheless, there are emerging signs of market stabilisation, with

some gaps beginning to open in UK stocks and some more positive economic

signals. The UK consumer confidence index, while still negative, has

risen from record lows recorded at the end of last year.

Inflation is now widely forecast to fall sharply, for example PwC expect

it to level out around 3% to 4% before the end of this year.

The S&P Global/CIPS UK Construction Purchasing Managers’ Index (PMI)

registered 51.6 in May, up from 51.1 in April and above the neutral 50.0

mark for the fourth successive month. Although indicative of only modest

growth, the latest reading pointed to “the strongest upturn in total

construction activity since February.” Commercial building (index at

54.2) was the best-performing segment, with output rising at a “robust

and accelerated pace.”

However, worries about the impact of higher interest rates and subdued

market conditions continued to dampen housing activity in May. Work on

residential building projects decreased for the sixth month running and

at the steepest pace since May 2020. Aside from the pandemic-related

downturn, the latest reading for this category of construction activity

(42.7) was reported by S&P Global/CIPS as being “the lowest for just

over 14 years.”

At a macro-economic level, in May the IMF updated their forecast for UK

GDP growth this year to 0.4%, whereas in April it forecast the economy

would contract by 0.3% in 2023. According to IMF, growth would be helped

by "resilient demand", easing concerns about Brexit, and falling energy

prices.

The IMF said faster-than-usual pay growth and global supply chains

returning to normal after the pandemic had also contributed to its

growth upgrade. However, the IMF also noted that the outlook for UK

growth "remains subdued" and forecast the economy will grow by only 1%

in 2024, rising to 2% in 2025 and 2026.

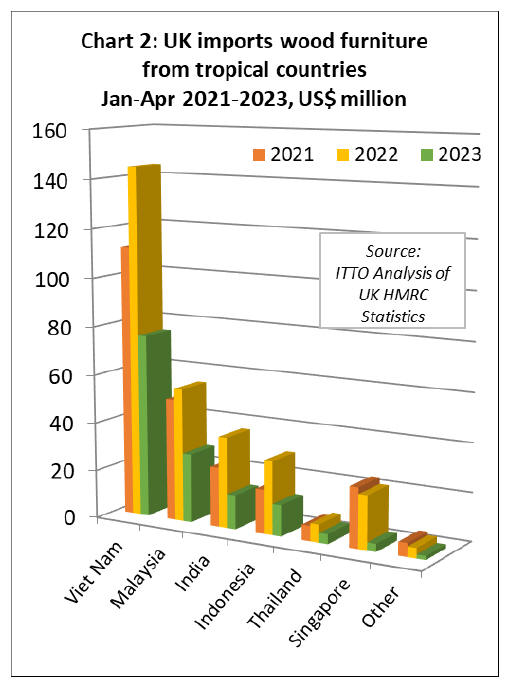

UK imports of tropical wooden furniture fall sharply

The UK imported US$140 million of tropical wood furniture

products in the first four months of 2023, which is 54% less than the

same period last year. In quantity terms, wood furniture imports were

37,100 tonnes during the four- month period, 40% less than the same

period last year.

In the first four months of 2023 compared to last year, UK import value

of wood furniture from Vietnam was down 48% to US$76 million, Malaysia

was down 48% to US$28 million, India was down 62% to US$14 million,

Indonesia was down 57% to US$13 million, Thailand was down 46% to US$4

million, and Singapore was down 85% to US$3 million. (Chart 2).

UK imports down for all tropical wood products

Total UK import value of all tropical wood products in Chapter

44 of the Harmonised System (HS) of product codes was US$314 million

between January and April this year, 45% less than the same period in

2022. In quantity terms imports decreased 18% to 95,200 tonnes during

the period.

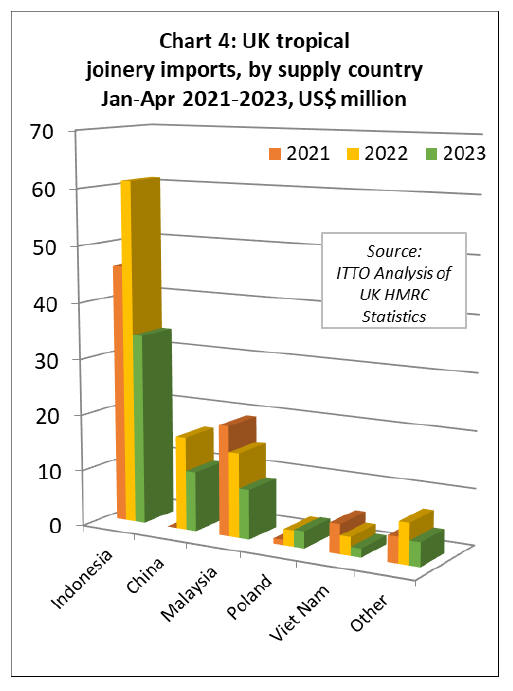

Compared to the first four months of 2022, UK import value of tropical

joinery products decreased 41% to US$66 million, import value of

tropical plywood decreased 36% to US$42 million, import value of

tropical sawnwood decreased 19% to US$37 million, and import value of

tropical mouldings/decking decreased 36% to US$8 million (Chart 3

above).

UK import value of joinery products from Indonesia (mainly doors) was

US$34 million in the first four months of 2023, down 44% compared to the

same period last year.

UK import value of joinery products from Malaysia and Vietnam (mainly

laminated products for kitchen and window applications) fell

respectively 41% to US$9 million and 52% to US$2 million during the same

period.

UK import value of Chinese tropical joinery products, nearly all

comprising doors, was US$11 million in the January to April period, 36%

less than the same period last year.

Direct imports of tropical hardwood plywood offset by rise from

China

In the first four months of 2023, the UK imported 75,600 cu.m

of tropical hardwood plywood, 9% less than the same period last year,

with a significant decline in direct imports from tropical countries

partly offset by a rise in imports from China (Chart 5).

The UK imported 32,400 cu.m of tropical hardwood plywood from China in the

first four months of 2023, 42% more than the same period last year. Last

year, UK imports of Chinese products faced with tropical hardwoods fell

sharply in favour of Chinese products faced with temperate hardwoods.

This trend has been reversed in 2023 with China again shipping a larger

proportion of tropical hardwood faced plywood to the UK.

UK imports of Indonesian plywood in the first four months this year

were, at 16,000 cu.m, 30% less than the same period last year. The UK

imported 14,300 cu.m of plywood from Malaysia in the first four months

of 2023, 31% less than the same period last year.

UK plywood imports from Thailand were down 76% to 1,300 cu.m in the

first four months this year. However, in the same period there were

large percentage increases from a very small base in tropical hardwood

plywood imports from Brazil (+257% to 2,100 cu.m) and Paraguay (+101% to

1,500 cu.m).

Meanwhile, the combined effects of Brexit, supply shortages and rising

energy and other material costs on the European continent continue to

impact on UK imports of tropical hardwood plywood from EU countries

which were just 6,900 cu.m in the first four months of this year, 56%

less than the same period last year.

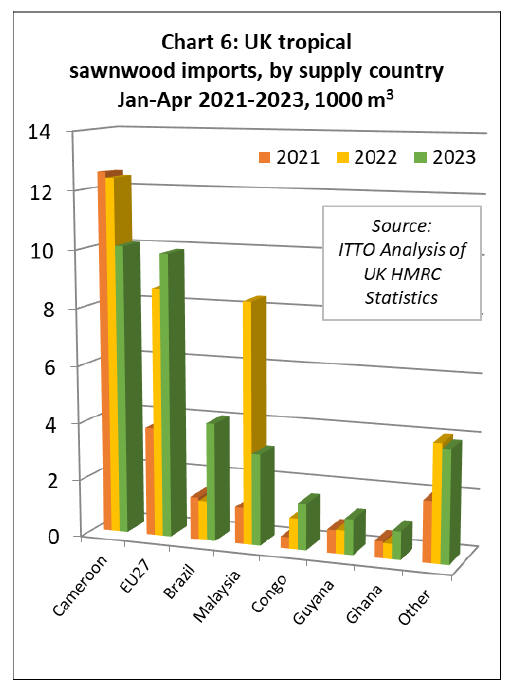

UK tropical sawnwood importers more reliant on cross-trading

this year

UK imports of tropical sawnwood were 35,000 cu.m in the first

four months of this year, 6% less than the same period in 2022.

Although UK imports of this commodity appear to have held up reasonably

well compared to other tropical products this year, a larger share has

been sourced indirectly from the EU and not direct from the tropics

(Chart 6).

Furthermore, a large increase in UK imports of tropical hardwood

sawnwood (HS 4407) from Brazil this year is also offset by a significant

decline in imports of Brazilian tropical hardwood decking/mouldings

(HS4409). Therefore, it may be that reported trends for both commodities

are distorted by changes in the way products from Brazil are being

categorised respectively as “sawnwood” and “mouldings”.

UK imports of tropical sawnwood from Cameroon were 10,000 cu.m in the

first four months of 2023, 19% less than the relatively high level in

the same period in 2022. UK tropical sawnwood imports from Malaysia,

which revived to some extent last year after many years of decline, fell

by 62% in the first four months of this year to 3,200 cu.m.

UK imports of tropical sawnwood from Brazil were reported as 4,100 cu.m

in the first four months of this year, a gain of 199% compared to the

same period in 2022. UK tropical sawnwood imports also increased in the

first four months this year from Republic of Congo (+50% to 1,600 cu.m),

Guyana (+50% to 1,200 cu.m), and Ghana (+90% to 1,000 cu.m)

Indirect UK imports of tropical sawnwood via the EU recovered more

ground despite the Brexit disruption, increasing 14% to 10,000 cu.m in

the first four months of 2023.

To some extent, UK’s continuing dependence on indirect imports of

tropical sawnwood from the EU is due to a shortage of kiln drying space

in African supply countries combined with lack of any hardwood kiln

dying capacity in the UK.

And with future market conditions now uncertain, reports of sufficient

landed stocks of sapele, the UK’s preferred tropical wood, on hand in

Europe, and in the face of long and uncertain timelines for shipping

from the main tropical supply countries, UK importers are choosing to

fill gaps in stocks as they arise by cross-trading with other importers.

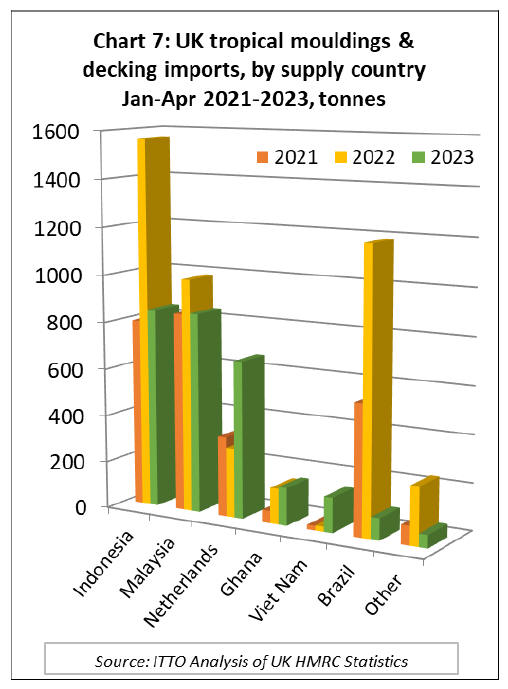

Tropical hardwood mouldings/decking imports

UK imports of tropical hardwood mouldings/decking fell 37% in

the first four months of 2023 to 2,800 tonnes. This commodity group

benefited in the UK market during 2022 from shortages of non-tropical

products, particularly since the start of the war in Ukraine and

sanctions on Russian decking products that directly compete with

tropical decking.

However, with high stocks built up in the UK last year and much reduced

consumption, imports of tropical mouldings/decking have fallen away

again this year. Imports of 850 tonnes from Indonesia were 46% less than

the same period in 2022. Imports from Malaysia also totalled 850 tonnes,

in this case down 14% compared to the same period last year.

Imports of this commodity group from Brazil were recorded at less than 100

tonnes in the first four months of this year, 92% less than the same

period last year.

In contrast, imports increased 126% from the Netherlands to 126 tonnes,

while imports from Vietnam increased 6-fold to 150 tonnes from a very

small base (Chart 7).

|