US Dollar Exchange Rates of

10th

Jun

2023

China Yuan 6.93

Report from China

Anti-dumping

and countervailing duties to remain

As a result of the determinations by the US

Department of Commerce and the US International Trade Commission in their

five-year sunset reviews that revocation of the anti-dumping duty and

countervailing duty orders on certain hardwood plywood products from China

would likely lead to the continuation or recurrence of dumping and subsidies

creating material injury to industries in the United States.

As a result of the ITC's decision existing tariffs on imports of hardwood

plywood from China will remain in effect. The move falls under the five-year

(sunset) review process required in the Uruguay Round Agreements Act. U.S.

Customs and Border Protection will continue to collect AD and CVD cash

deposits at the rates in effect at the time of entry for all imports of

subject merchandise.

The effective date of the continuation of the Orders was May 25, 2023.

Pursuant to section 751(c)(2) of the Act and 19 CFR 351.218(c)(2) Commerce

intends to initiate the next five-year reviews of the Orders not later than

30 days prior to the fifth anniversary of the effective date of

continuation.

See:

https://www.federalregister.gov/documents/2023/06/06/2023-12028/certain-hardwood-plywood-products-from-the-peoples-republic-of-china-continuation-of-the-anti-dumping

The current tariffs on plywood from China, many of which exceed 200%, will

remain in place for at least another five years.

US to impose a tax on plywood from Vietnam containing Chinese core

panels

According to the Trade Remedy Bureau of the Ministry of Industry

and Trade of Vietnam, the US Department of Commerce (DOC) continues to

extend the time for the final conclusion of the anti-tax evasion and

anti-dumping investigation on plywood using hardwood material imported from

Vietnam.

The US Department of Commerce will issue its final conclusions on July 14,

2023. This is the eighth time the Commerce Department has delayed issuing

its final conclusion.

Previously, the US Department of Commerce announced the preliminary

conclusion of the case in July 2022, saying that if the wood panel inside

the Vietnamese hardwood plywood was imported from China it will impose

anti-dumping and countervailing duties on the plywood.

According to the Trade Remedy Administration of Vietnam the temporary tax

rate could be as high as 378.26%. However, the US Commerce Department

allowed Vietnamese companies cooperating with the investigation to

self-certify that they do not use Chinese materials to avoid being subject

to the measures.

Statistics show that the exports of enterprises participating in

self-certification accounted for about 80% of Vietnam's exports during the

survey period.

Resumption of imports of Australian timber

It has been reported that China has resumed imports of Australian

timber. Australia's timber trade with China was halted in late 2020 after

China said it had found pests in timber coming from several Australian

ports.

Data show that in 2022 Australia's timber exports to China were worth

RMB42.32 million compared with RMB4.13 billion in 2019 before the ban was

implemented.

In an effort to get back into the Chinese market Australian officials

petitioned China to resume trade and presented evidence of pesticide

spraying on logs to Chinese Customs authorities. But China did not respond.

The ban showed no sign of easing until 2023.

In March 2023 Chinese Customs sent Australian agriculture officials a list

of technical rules that must be met to resume timber imports.In May the

Australian Trade Minister, Stephen Farrel, arrived in Beijing for a

three-day visit. During the talks the two sides agreed to restart economic

and trade dialogue mechanisms such as the Joint Committee on Free Trade

Agreement and the High-level Trade Remedy Dialogue. In May China announced

the resumption of timber imports from Australia.

Encouraging water-saving in wood products enterprises

China is working on a national standard for water-saving in wood

processing enterprises. The preparation group for "Water-saving Enterprises

in Wood Processing and Its Products Industry" was established and the first

working meeting was held recently.

The project implementation period is from March 2023 to September 2024. A

draft of standard has been completed, the work plan has been formulated and

the implementation period has been clarified. After the meeting industry

trials will be carried out and the participating units will be recruited to

further improve the technical content of the standard.

The national standard "Water-saving Enterprises in Wood Processing and Its

Products Industry" provides the terms and definitions, evaluation index

system and requirements of the evaluation of water-saving enterprises in the

wood processing and products industry and the standard is applicable to the

evaluation of water-saving enterprises in the wood processing and products

industry.

The list of products includes wood processing (sawnwood, veneer, wood chips,

wood-based panel manufacturing (plywood, fiberboard, particleboard, veneer,

etc.), wood products (wood doors and windows, wooden stairs, wooden floors,

wooden containers, wood building materials and cork products).

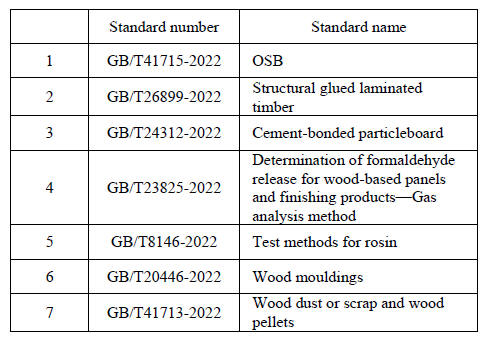

National standards on wood products officially

implemented

Seven national standards on wood products have been formally

implemented since May 1, 2023. All release dates for 7 national standards is

on 12 October 2022. These standards are as below.

Wooden door enterprises turn to whole-house

customisation

Jiangshan City in Guangdong Province is the distribution centre for

China’s wooden doors and is known as the home of custom made wood products,

a quality and safety demonstration zone and an intelligent manufacturing

pilot demonstration facility.

At present, Jiangshan City has more than 1,000 door enterprises (whole house

customisation) and supporting enterprises of which 125 enterprises create

more than RMB20 million annual income, 17 enterprises above RMB100 million,

18 national level high-tech enterprises, several large scale door

enterprises (whole house customisation) creating more than RMB10 billion

annual income.

In recent years, due to the impact of the pandemic and the economic downturn

in the real estate market the wooden door industry across the country has

suffered. Jiangshan City has taken the initiative to promote 'a door' to 'a

room' and 'a suite'.

GTI Index Report (May 2023)

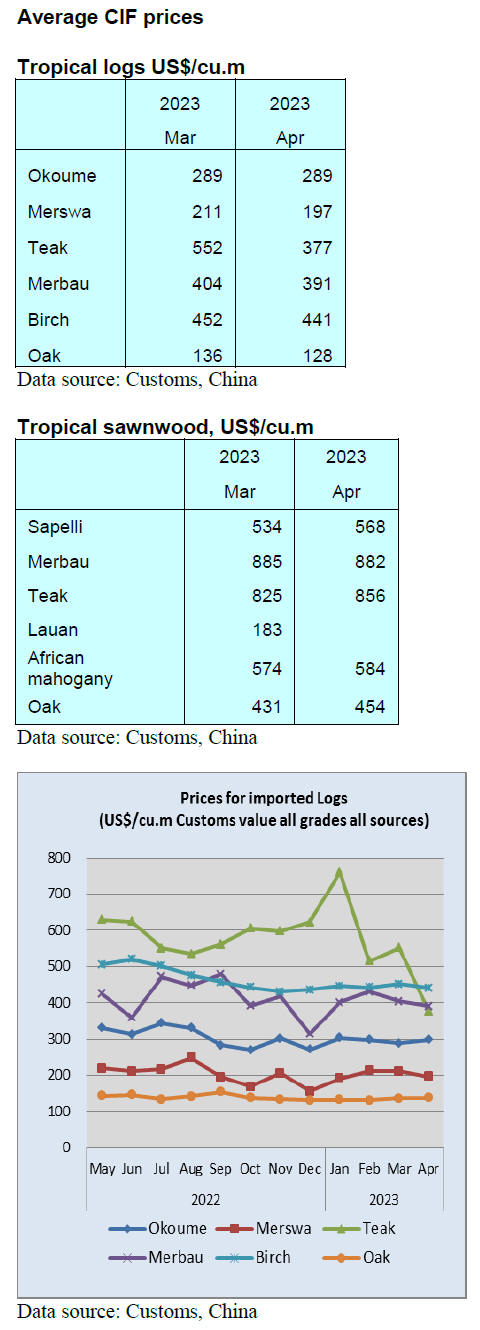

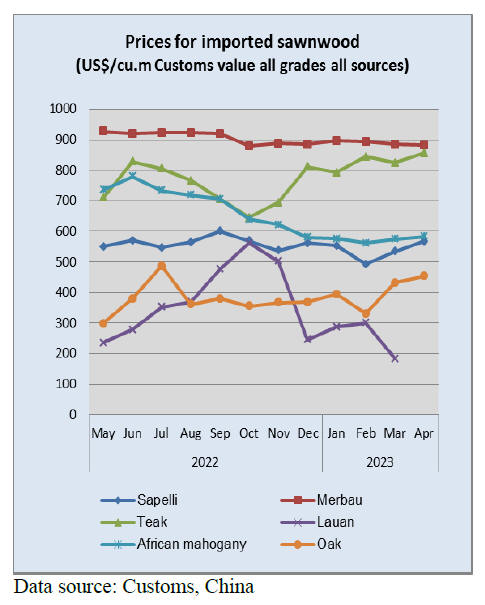

Weak international demand led to a decline in prices for some raw

materials. In May 2023, under the influence of shrinking domestic and

international demand, the upward Global Timber Index GTI- China Index trend

in the number of orders for GTI-China enterprises, which had lasted for

three months, reversed.

In May the GTI-China enterprises experienced a slight decrease in orders

compared to the previous month and there was an increase in inventories of

main raw materials and finished products while the purchase prices of raw

materials has continued to decline for 3 consecutive months.

The GTI-China enterprises reported challenges such as a long waiting period

for raw material deliveries and unstable sources of supply. In May the

GTI-China index recorded 35.3%, a decrease compared to that of the previous

month and it was the first time in the past three months that the GTI-China

index fell below the critical value (50%), indicating that the business

prosperity of the timber enterprises represented by the GTI-China index had

shrunk from April.

GGSC enterprises in China reported the following for May:

Products in Short Supply: Mahogany, Oak, High-Grade

European Oak.

Commodities with Price Increase in this Period: Solid

Wood, Engineered Wood, Particle Board, Melamine Impregnated Paper, Paraffin,

Formaldehyde-Free Adhesive, Waterproofing Agent, Adhesives, Leather.

Commodities with Price Decrease in this Period: South

American Timber, European Timber, Russian Timber, Poplar, Base Materials of

Joinery Board, Flooring Blank, Mixed Wood, Fir Wood Lath, Urea, Melamine,

Methanol, Formaldehyde, Metals, Paint, Paper Board, Glue, Kraft Paper.

Main Challenges Reported by GTI-China

Enterprises: Long procurement period, unstable sources of supply

and scarcity of oak materials.

See:

https://www.itto-ggsc.org/static/upload/file/20230615/1686792092163403.pdf

|