Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Jun

2023

Japan Yen 139.20

Reports From Japan

Addressing the demographic crisis

Japan is currently experiencing one of the most severe demographic

crises in the world. According to Japan’s Ministry of Health the number of

newborrns decreased to 799,728 in 2022, the lowest number since records

began to be kept in 1899.

This decline in Japan’s birth rate has significant negative consequences for

the economy as a high proportion of GDP growth is dependent on domestic

consumption.

The nation’s finances are being drained by the soaring expense of caring for

the elderly who make up a large percent of the population. Japan now has the

world’s second highest proportion of people aged 65 and over according to

World Bank data.

In January this year the Prime Minister warned of the consequences of the

country’s population decline, saying the country was “on the brink of not

being able to maintain social functions” due to the falling birth rate. This

prompted action to stem the falling birth rate details of which have just

been announced by the government.

At a press conference in mid-June the Prime Minister outlined a package of

measures including financial support aimed at helping young families raise

children.

See:

https://www3.nhk.or.jp/nhkworld/en/news/20230614_01/

Economy expanded faster than expected

Cabinet Office data shows that Japan’s economy expanded at a faster

pace than initially estimated as businesses increased investments. GDP grew

at an annualised 2.7% in the first quarter of 2023 from the previous three

months. The revised data also showed that Japan avoided a technical

recession at the end of last year. In less positive news, the growth figures

gained a boost mainly from increased inventories.

Analysts point out that it will be the trends in inflation and wages that

will be key to whether the current recovery will be sustainable and if the

BoJ will change its ultra-loose policy.

See:

https://www.japantimes.co.jp/news/2023/06/08/business/economy-business/gdp-beats-forecast-investment/

Near normal times return

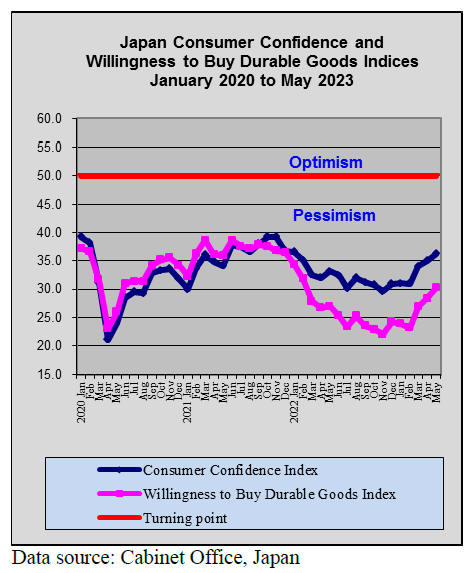

Japanese consumer sentiment improved for the third consecutive

month in May thanks to the continued recovery in economic activities after a

slump amid the pandemic.

The Cabinet Office maintained its basic assessment, of the economy, saying

that consumer sentiment is picking up attributing the improvement in

consumer sentiment to the shift from the COVID-19 pandemic to “normal times”

and the ongoing effects of the government’s measures to reduce electricity

and gas bills.

Japan’s industrial output declined for the first time in four months in May,

the result of the global economic slowdown. The weakness in domestic

production is a drag on the Japanese economy which has recently shown some

signs of recovery, especially in the first quarter.

See:

https://www.japantimes.co.jp/news/2023/05/31/business/factory-output-april-decline/

Yen at 140 to the US dollar

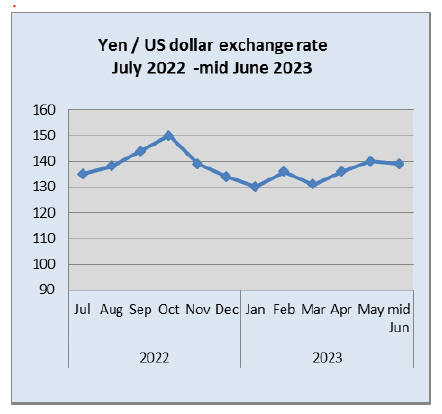

The much anticipated policy shift by the Bank of Japan (BoJ) has

had currency markets on alert especially since the announcement of a new BoJ

Governor earlier this year. Yen strength at the end of last month was

largely because market participants still thought a change was coming.

However, a statement by BoJ Deputy Governo, Masazumi Wakatabe, along the

lines of “don't expect a change from BoJ any time soon” rules out any change

in the BoJ monetary policy. In mid-June the yen was at 139 plus to the US

dollar.

Import update

Assembled wooden flooring imports

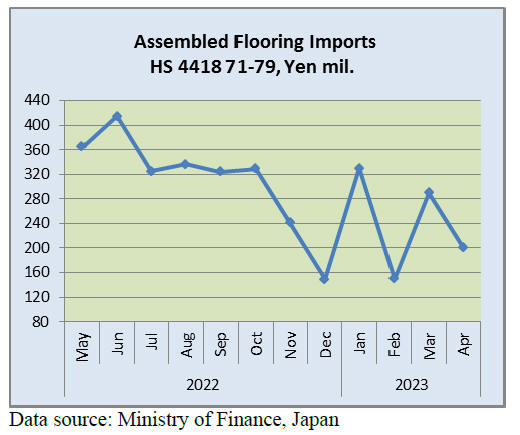

The value of Japan’s imports of assembled wooden flooring

(HS441871-79) in April was little changed from April 2022 but compared to

the value of March imports there was a drop of over 30% in April. As in

previous months the main shippers of assembled flooring in April were China,

Vietnam, Malaysia and Indonesia.

HS441875 comprised the bulk of Japan’s April imports at around 85% of all

categories of assembled flooring of which almost 60% was from China.

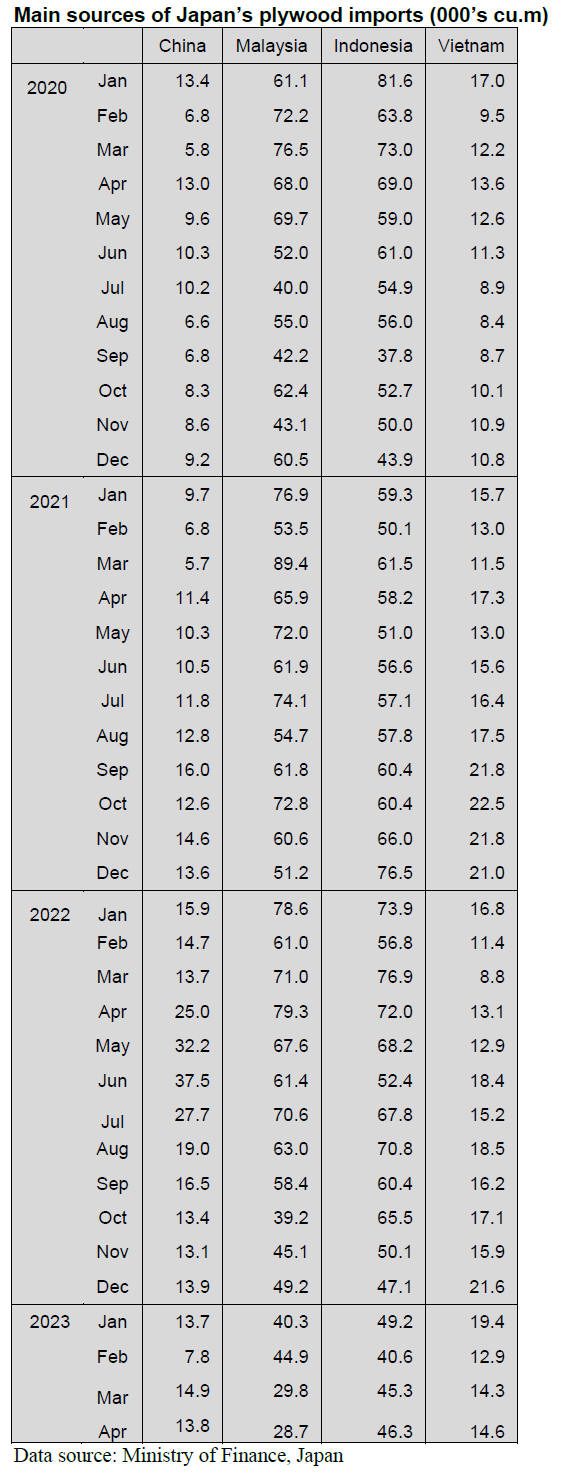

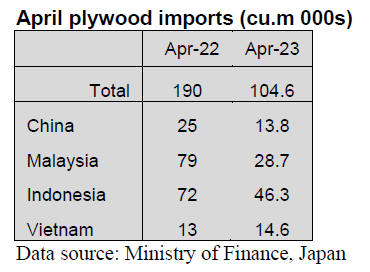

Plywood imports

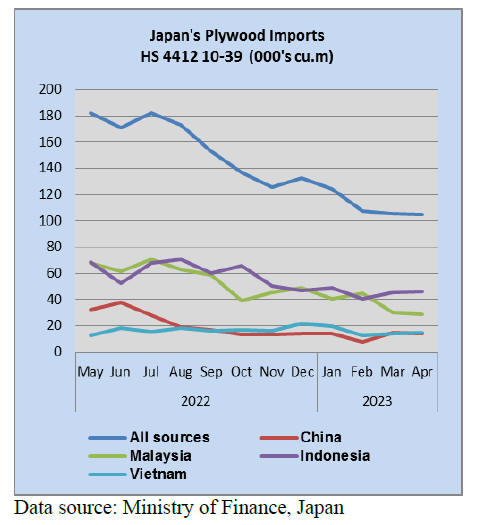

The downward trend in the volume of Japan’s plywood imports

extended into April. April shipments from the four suppliers were down year

on year and little changed from the volumes shipped in March.

There has been a significant decline in the volume

of plywood shipments to Japan from both of the main suppliers, Indonesia and

Malaysia. For both Indonesia and Malaysia the volumes of April 2023

shipments were around half that in April 2022.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade journal published every

two weeks in English, is generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market precisely as it appears in

the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

New glue for MDF

Daiken Corporation in Osaka Prefecture announced that the company

succeeded producing MDF by using new glue made of bark-based ingredient.

The company had been studying about the new glue and now the company is able

to prepare selling the MDF. Also, the company confirmed that the MDF made of

the new glue has the same quality as its other MDF products. Daiken’s MDF,

which are already on sale, consists of 85% natural materials such as wood

scraps and 15% glue or a water-repellent made of fossil fuel-derived.

Since the company succeeded to produce MDF by using bark-based glue, the new

MDF consists 98% of natural materials. Moreover, it does not take a lot of

cost. The company has been developing on producing eco-friendly MDF since

2019. The company started using barks of Acacia.

A goal of the company for producing and selling new MDF is by 2025. In the

future, the company develops more deeply to produce and sell MDF made of

100% natural materials.

Revised the Clean Wood Act

Revised The Act on Promotion of Use and Distribution of

Legally-Harvested Wood and Wood Products called ‘the Clean Wood Act’ for

short became law on 26th April 2023 and it was promulgated on 8th May 2023.

It will be enforced within two years.

The objective of the Clean Wood Act is to achieve sustainable and sound

development of the wood products industry by encouraging the Wood-related

Business Entities to take measures to ensure the use of Legally-harvested

Wood and Wood Products and thereby to contribute to the conservation of the

regional / global environment.

About 40% of Wood-related companies were confirmed inconformity with the

revised law. Another 40% of Wood-related companies were confirmed by other

legal conditions.

Nisshin restarted operations

Nisshin Co., Ltd. restarted operations at its plywood plants, which

produces long plywood, for the first time in eleven months. There was a fire

at the plywood plant on 19th June, 2022. The plywood plants have the ability

to produce 8,400 cbms in a month but it will produce 6,000 cbms plywood for

a while.

Plywood

The price of domestic softwood plywood kept falling in May.

Inquiries to precutting plants and wholesalers began to increase but the

shipment was not good atter the big holiday ended in May. The price of 12mm

3 x 6 structural softwood plywood is 1,700 yen, delivered per sheet and this

is 100 yen down from last month. 24mm 3 x 6 structural softwood plywood is

3,400 yen, delivered per sheet and this is 200 yen down from last month. In

some areas, the price of structural softwood plywood for the precutting

plants is lower than those prices.

Since demand of houses is low, the housing companies request the precutting

plants to lower the price strongly and the precutting plants had to accept

the housing companies’ requests. Plywood companies also lower the price if

there were a large number of orders. However, if the precutting plants lower

the price before the plywood companies do, there would be anticipation of

falling prices from buyers. This is the reason for a slow movement of

domestic softwood plywood and the price keeps falling.

The price of imported South Sea plywood recovers to increase from April,

2023. Volume of Malaysian and Indonesian plywood has been decreasing and

there is no need to lower the price to sell anymore.

12mm 3 x 6 painted plywood for concrete form is 2,000 yen, delivered per

sheet. Form plywood is 1,800 yen, delivered per sheet. Structural plywood is

1,700 yen, delivered per sheet. 2.5 mm plywood is 780 yen, delivered per

sheet. 4mm plywood is 950 yen, delivered per sheet. 5.5 mm plywood is 1,150

yen, delivered per sheet.

Domestic logs and lumber

There is an atmosphere of a stop for the price falling on domestic

lumber in the middle of May. The price of laminated whitewood post or

laminated cedar post, which are rivals of KD cedar posts, reaches the bottom

price and the inventory of imported lumber is controlled.

Demand and supply of domestic lumber has been linked to demand and supply of

imported lumber since the wood shock in 2021’s spring. Therefore, demand and

supply of domestic lumber would be tight as the inventory of imported lumber

decreases.

Actually, there is a shortage of whitewood studs

with low quality and also production of cedar studs is not able to keep up

with the demand. The price of 3m 20 x 105/ 45 x 105 mm cedar KD studs is

around 70,000 yen, delivered per cbm. However, the price of cedar squares at

some markets was lower than 70,000 yen so some sellers are still worried

about anticipation of lower prices. It is difficult for lumber companies to

lower the price so the price leveled off in May.

The log prices kept falling May as the lumber prices fell. Especially, the

price of cedar logs for lumber or plywood was weak from Northeastern Japan

to Kyushu area. In Eastern Japan, the price of cedar logs has been

decreasing since February, 2023. The price of cedar logs in Western Japan

started decreasing in April, 2023 so the price of cedar logs in Eastern

Japan and Western Japan is different.

The price of 4m cedar logs for lumber plants, laminated lumber plants and

plywood plants is around 11,000 -12,000 yen in Eastern Japan. This is about

1,000 yen lower than the previous month. The price of 3m cedar logs is

around 12,000 yen in Kanto region and it is around 14,000 – 17,000 yen in

Kyushu area.

|