|

Report from

Europe

Slow start to the year for EU27 tropical wood imports

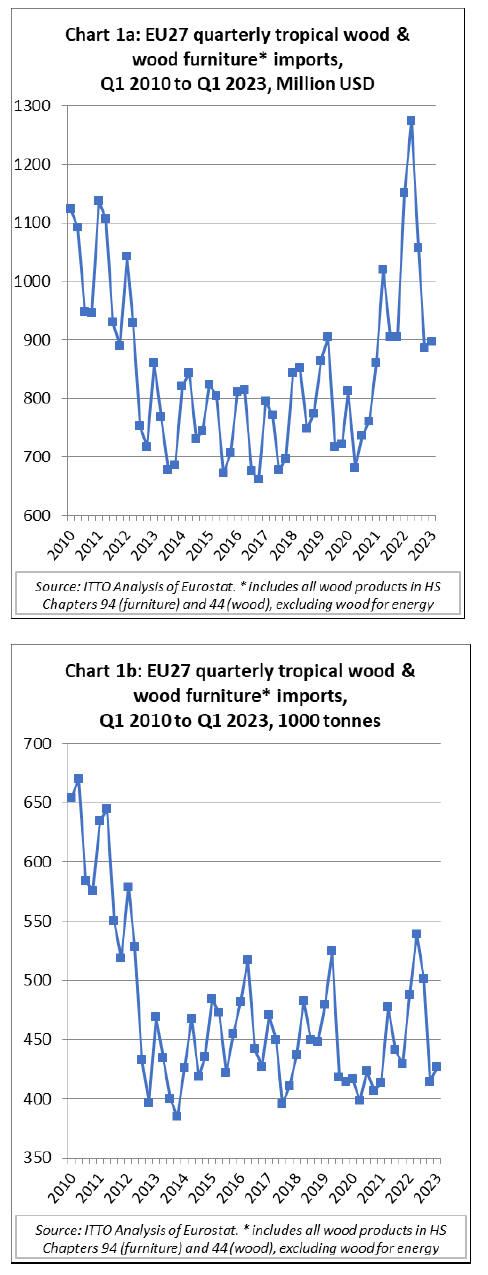

In the first quarter of this year, the EU27 imported 427,000

tonnes of tropical wood and wooden furniture products with a total value

of US$896m, respectively 12% and 22% less than the same period in 2022.

Compared to the last quarter of 2022, imports in Q1 2023 were up 1.2% in

dollar value and 3.1% in tonnage terms.

After falling sharply in the second half of 2022 from the 10-year peak

recorded in the first half of last year,, imports stabilised in the

first quarter this year.

In the first three months this year, in dollar terms, EU27 imports of

tropical wood and wooden furniture were significantly above the

long-term average of around US$800m per quarter between 2012 and 2019,

the period of relatively stagnant market conditions for tropical

products that prevailed in Europe before the COVID crises (Chart 1a).

However, in tonnage terms, EU27 imports in the first quarter this year

were below the long-term average of around 450,000 tonnes per quarter

during the 2012 to 2019 period (Chart 1b).

The weak start in the European market this year is due to a combination of

relatively high stocks and slow consumption. In 2021 and the first half

of 2022, EU importers responded to sharply rising consumption in the

European market – boosted particularly by heavy spending on home

improvement and public finance to support economic recovery after the

pandemic – by buying in larger volumes as CIF prices were rising to

record high levels.

However, demand in Europe fell dramatically during the summer months

last year with rising economic uncertainty, particularly fuelled by the

war in Ukraine and high energy costs.

At the same time, global prices for wood materials and freight rates

fell dramatically in the second half of last year. A big decline in

global trade followed on from sharply rising interest rates in the

United States and as China struggled to maintain a zero-COVID strategy

and suffered a property market slump. The price of a 40-foot container

for delivery into Europe from the Southeast Asia, which hit record

levels in excess of US$17,000 at the end of 2021, had fallen to around

US$1,500 in the first quarter of 2023.

The combined effect of these trends was that at the start of this year

many European timber importers were sitting on quite large stocks bought

earlier at high prices which they were struggling to shift on to their

customers. The value of these landed stocks was being undermined as

prices for new orders in the main supply countries were falling. Costs

of holding stock and manufacturing wood products were also rising as

interest rates were being pushed up and energy costs were soaring during

the winter months.

The problems associated with high stocks and falling prices particularly

applied to products sourced from Asia, including garden furniture,

decking, flooring, and other joinery products. In the case of African

hardwoods, although prices for existing landed stock in Europe have been

falling as large volumes arrived last year and consumption has been

slow, availability for forward orders from African sawmills in the

second half of this year is restricted and prices are firm and expected

to remain so.

This reflects rising overheads for African producers, driven by fuel and

energy inflation, which is resulting in falling output.

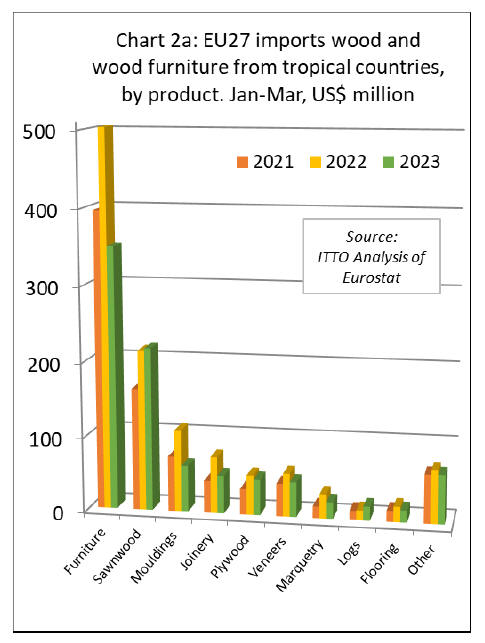

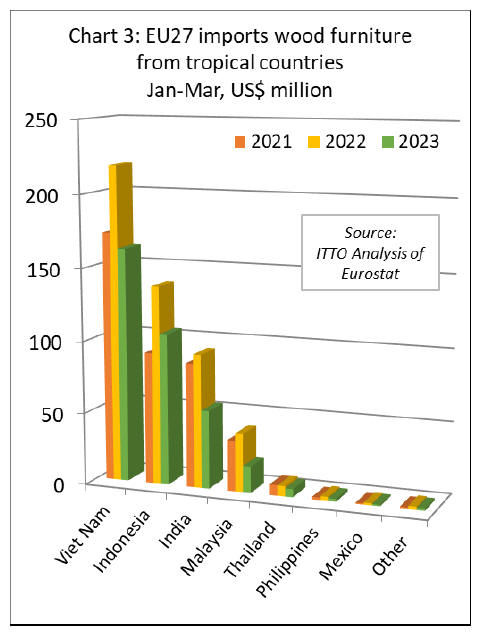

Decline in EU import value in nearly all countries and tropical

wood products

There was a year-on-year decline in EU27 import value for all

tropical wood product groups except sawnwood and logs between January

and March this year (Chart 2a).

During the three-month period, import value of sawnwood was up only

marginally, by 2% to US$218m, while for logs there was a much larger 41%

gain, to US$18.8m.

However, these increases were more than offset by large declines in import

value for: wooden furniture from tropical countries (-30% to US$350m);

tropical mouldings/decking (-44% to US$154m); tropical joinery products

(-33% to US$51m); tropical-hardwood faced plywood (-10% to US$50m);

tropical veneer (-19% to US$46m); tropical marquetry (-32% to US$22m);

and tropical flooring (-22% to US$16m).

In terms of EU destinations, import value of tropical wood and wooden

furniture in the first quarter this year was down year-on-year in all

the main markets except Spain (+5% to US$59m) and Portugal (+1% to

US$13m).

Import value fell 19% in France to US$180m, 8% in Belgium to US$160m, 36%

in the Netherlands to US$144m, 34% in Germany to US$121m, 17% in Italy

to US$73m, 17% in Denmark to US$39m, 5% to US$22 million in Poland, 33%

to US$19m in Poland, and 50% to US$16m in Ireland. (Chart 2b above).

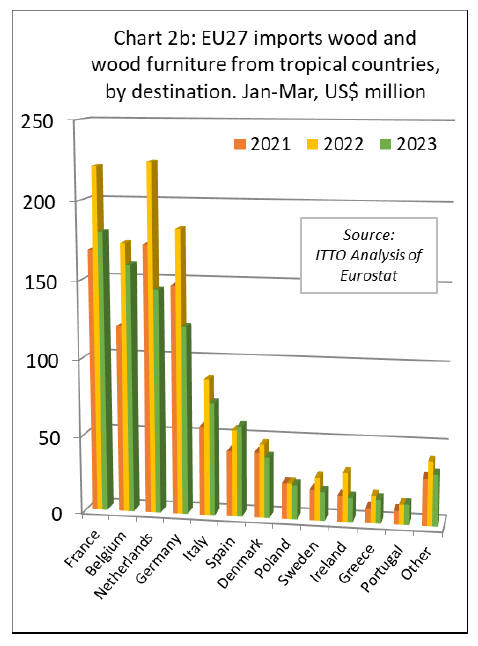

EU27 wooden furniture imports from tropical countries down 30%

in the first quarter

In the first three months of 2023, the EU27 imported 74,400

tonnes of wooden furniture from tropical countries with a total value of

US$350m, 30% less in both tonnage and value terms than the same period

in 2022.

Import value decreased 26% to US$162m from Vietnam, 24% to US$105m from

Indonesia, 41% to US$54m from India, 54% to US$18m from Malaysia, and

22% to US$6m from Thailand. EU27 wooden furniture imports from all other

tropical countries were negligible during the three-month period (Chart

3).

EU27 imports of tropical sawnwood still high but decking imports

down sharply

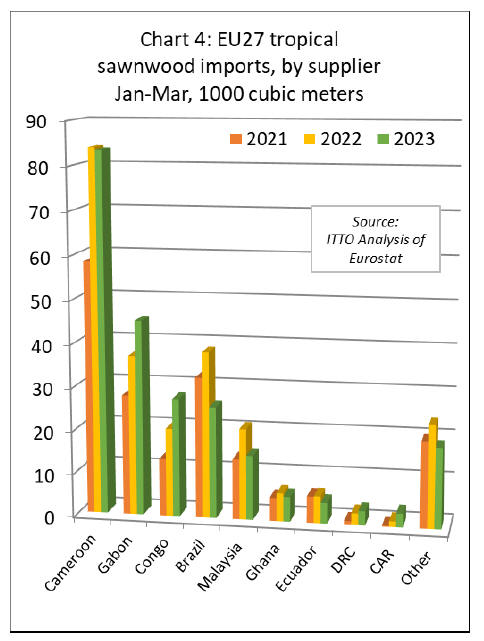

In contrast to other tropical wood products, EU27 imports of

tropical sawnwood in the first quarter of 2023 sustained the relatively

high levels recorded the previous year.

While year-on-year import volume was down 4% to 232,000 cubic metres,

import value was up 2% to US$218m. There were particularly large gains

in tropical sawnwood imports from Gabon (+22% to 45,100 cubic meters)

and Congo (+34% to 27,400 cubic metres) in the first three months this

year. Imports also increased significantly from a smaller base from DRC

(+21% to 3,300 cubic metres) and CAR (+144% to 3,200 cubic metres).

These gains offset a decline in imports from Cameroon (-1% to 83,500 cubic

meters), Brazil (-33% to 25,800 cubic metres), Malaysia (-29% to 14,900

cubic metres), Ghana (-3% to 5,800 cubic metres) and Ghana (-23% to

4,800 cubic merers) (Chart 4).

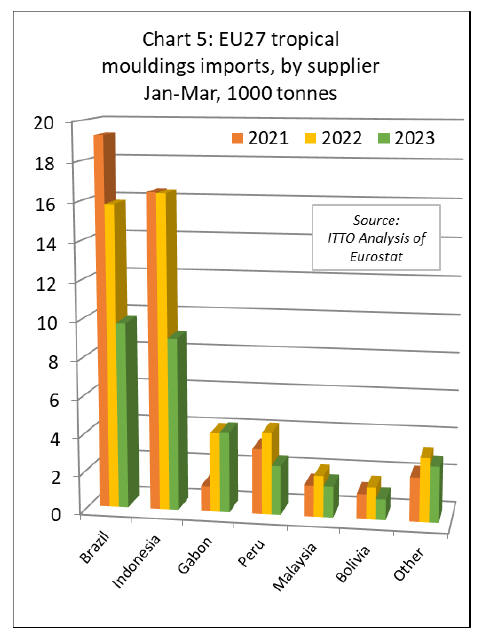

In contrast to sawnwood, EU27 imports of tropical mouldings/decking were

slow in the first three months of this year. After all the work carried

out on garden improvement during the pandemic, the European market for

tropical hardwood decking has now slowed to a crawl. European importers

are carrying heavy stocks bought at high prices last year and are not in

the market for new supplies.

EU27 imports of mouldings/decking in the first three months of 2023 were

31,100 tonnes with value of US$62m, respectively down 35% and 43%

compared to the same period last year. Imports fell sharply for the two

largest supply countries; down 38% to 9,700 tonnes from Brazil and down

45% to 9,000 tonnes from Indonesia.

There was also a sharp fall in imports from Peru (-40% to 2,600 tonnes),

Malaysia (-24% to 1,600 tonnes), and Bolivia (-35% to 1,000 tonnes).

Imports from Gabon increased, but only by 1% to 4,200 tonnes (Chart 5).

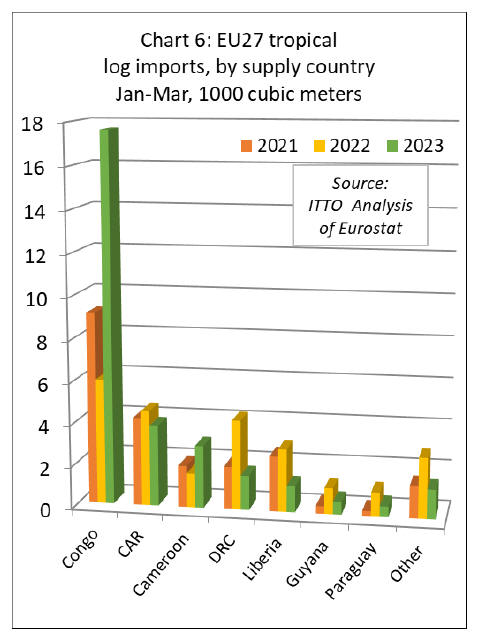

In the first three months of 2023, the EU27 imported 29,800 cubic metres

of tropical logs, 21% more than the same period in 2022. The most

significant trend was a sharp 195% rise in EU27 log imports from Congo

to 17,600 cubic metres in the first quarter this year. This surge in

European arrivals probably reflects a last-minute effort to ship logs in

advance of the log export ban imposed by the Republic of Congo from 1st

January 2023.

EU27 imports of logs also increased sharply from Cameroon (which may be

derived from neighbouring Congo or Central African Republic) in the

first quarter this year, rising 83% year-on-year to 3,000 cubic metres.

EU27 imports of tropical logs from all other supply countries declined

during the period including Central African Republic (-15% to 3,850

cubic metres), Democratic Republic of Congo (-62% to 1,650 cubic metres),

Liberia (-58% to 1,250 cubic metres), Guyana (-52% to 600 cubic metres)

and Paraguay (-56% to 500 cubic metres) (Chart 6).

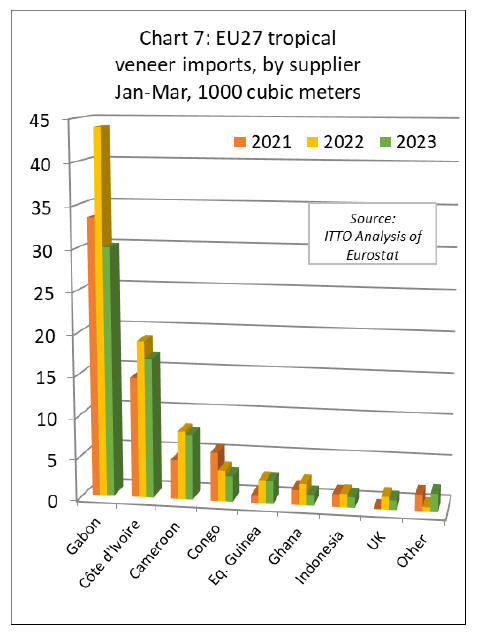

Downturn in EU27 imports of tropical veneer but plywood more

stable

In the first three months of 2023, the EU27 imported 66,500

cubic metres of tropical veneer with a value of US$46m, respectively

down 21% and 19% compared to the same period last year.

Imports of tropical veneer from Gabon, by far the largest supplier to

the EU27, decreased 32% to 30,000 cubic metres after rising sharply last

year. EU27 veneer imports in the first three months of this year also

declined from Côte d'Ivoire (-11% to 16,900 cubic metres), Cameroon (-4%

to 7,900 cubic metres), Congo (-18% to 3,100 cubic metres), Equatorial

Guinea (-2% to 2,700 cubic metres), Ghana (-50% to 1,300 cubic metres),

and Indonesia (-22% to 1,300 cubic metres) (Chart 7).

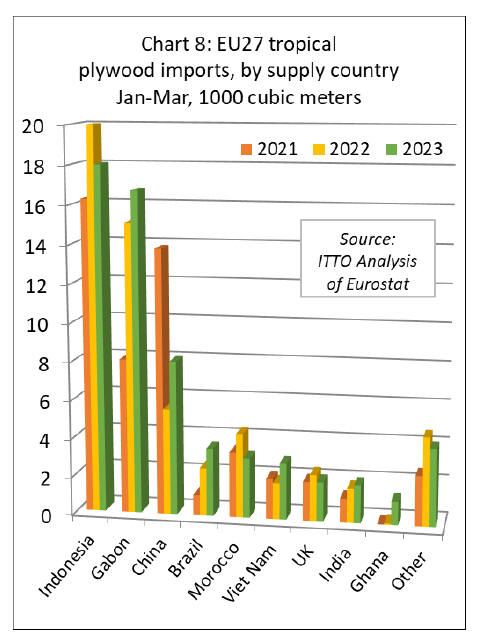

In the first three months of 2023, EU27 tropical plywood import increased

6% in volume terms to 61,700 cubic metres but declined 10% in value

terms to US$48m.

The average per cubic meter value of tropical plywood imported into the

EU in the first quarter this year was US$775 compared to US$907 in the

same period last year, a sign both of the sharp fall in prices and

freight rates and the shift in product sources this year.

Imports from Indonesia, at 18,000 cubic metres, were down 10% compared

to the same period last year. Imports also fell from Morocco, by 29% to

3,100 cubic metres.

However, imports increased from Gabon (+11% to 16,700 cubic metres),

China (+45% to 8,000 cubic metres), Brazil (+42% to 3,600 cubic metres),

Vietnam (+55% to 3,000 cubic metres), and India (+11% to 2,000 cubic

metres). For the first time in many years, there was also a significant

rise in plywood imports into the EU from Ghana in the first quarter this

year, up from negligible levels to 1,200 cubic metres (Chart 8).

Slowdown in EU27 imports of joinery products from tropical

countries in first quarter

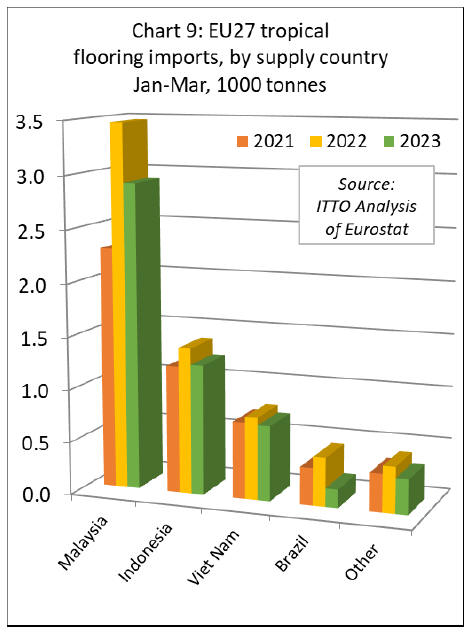

In the first three months of 2023, the EU27 imported 5,400

tonnes of tropical wood flooring with a value of US$16m, respectively

down 18% and 22% compared to the same period last year.

The consistent rise in EU27 wood flooring imports from Malaysia that

began in 2020, stalled in the first quarter this year. Imports of 2,900

tonnes from Malaysia in the first three months of 2023 were 16% less

than the same period in 2022. Imports also fell from Indonesia (-11% to

1,200 tonnes), Vietnam (-9% to 700 tonnes), and Brazil (-62% to 200

tonnes) (Chart 9).

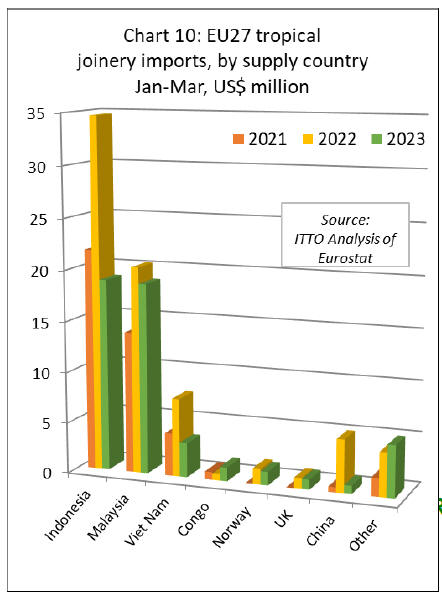

The value of EU27 imports of other joinery products from tropical

countries - which mainly comprise laminated window scantlings, kitchen

tops and wood doors – declined 33% to US$51m in the first three months

of 2023. Despite much lower prices than the same time last year, imports

are low this year as many importers already have sufficient stock to

meet current slow consumption levels.

In the first quarter this year compared to the same period in 2022,

imports were down 10% to US$19m million from Indonesia, down 8% to

US$19m from Malaysia, down 56% to US$3m from Vietnam, and down 84% to

less than US$1m from China. In a potentially significant longer-term

development, given efforts in the country to shift up the value chain as

log exports are banned, EU imports of laminated joinery products from

Congo were valued at US$1.4m in the first quarter of this year, more

than double than during the same period last year (Chart 10).

|