|

Report from

North America

Imports show signs of rebounding in March

While still nowhere near as strong as a few months ago imports

of tropical hardwood and related products showed some strength in March,

fueling hopes of a rebound or, at least, finding a bottom after several

months of decline.

While imports of sawn tropical hardwood, hardwood plywood and assembled

flooring panels all saw gains of more than 10% in March they remain well

behind March 2022 levels. Meanwhile imports of hardwood mouldings and

wooden furniture continue to slide.

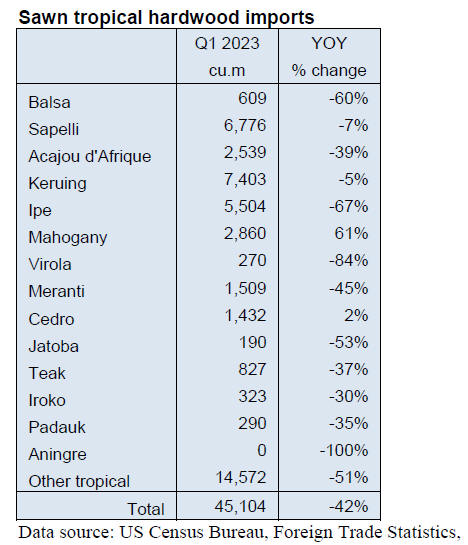

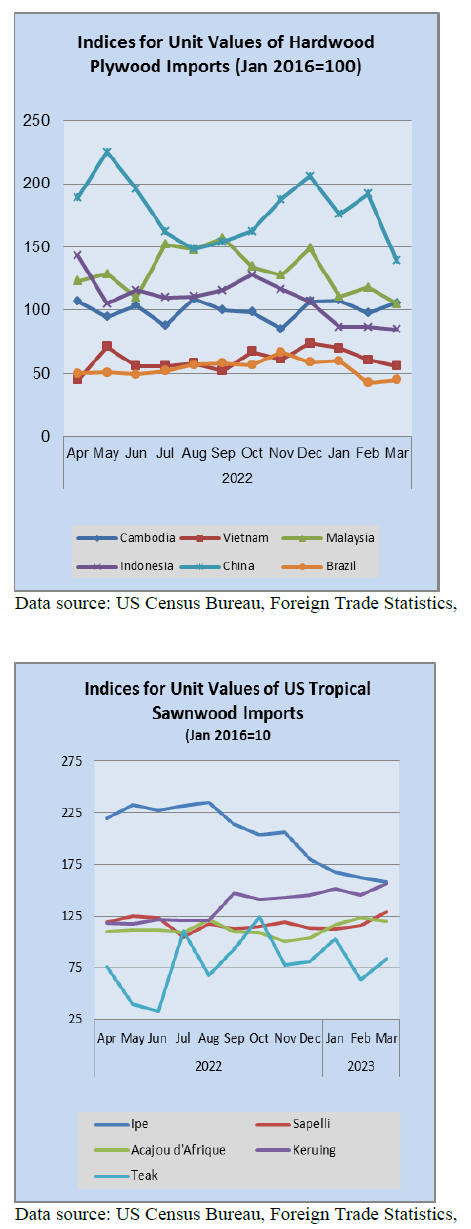

Sawn tropical hardwood imports halt slide

Imports of sawn tropical hardwoods rose for the first time in

six months, gaining 11% in March after falling steadily for the previous

five months. The 14,525 cubic metres imported in March was only a little

more than half that imported in February.

Imports from Cameroon, Cote d’Ivoire and Congo (Brazzaville) all more

than doubled their February volumes. Imports from the top trading

partner, Brazil, were down 48% in March and are off last year’s volume

by 52% through the first quarter of the year.

Imports from Indonesia, the other leading trading partner, are down 77%

through the first quarter despite a 49% rise in March.

Imports of sapelli rebounded in March, more than tripling February

volume, yet they are still down 7% from last year through the first

quarter. Imports of meranti and cedro also rebounded.

Imports of ipe and balsa have lagged, both dropping more than 30% in

March and both down more than 60% through the first quarter. Mahogany

imports are the onlyones showing strength so far this year, up 19% in

March and ahead of last year by 61% in the first quarter. Overall US

sawn tropical hardwood imports are down 42% from last year through the

first quarter.

Canada’s imports of sawn tropical hardwood saw a 29% jump in March to

its best volume of the year, nearly 18% higher than last March.

Increased imports from Indonesia, Malaysia and the United States fueled

the gain. Total imports are ahead of last year by 10% through the first

quarter.

Hardwood plywood imports steady with a 14% gain

Imports of hardwood plywood also broke out from a downward

trend, posting a rise of 14% by volume in March. The gain was chiefly

due to a healthy 20% rise in imports from Indonesia. Despite the gains,

overall imports continue to look dismal versus last year.

Total imports were off by 64% in the first quarter with imports from the

two largest trading partners, Indonesia and Vietnam, down by 64% and

80%, respectively, through March.

Veneer imports up 7%

US imports of tropical hardwood veneer grew 7% in value in

March as imports from Italy, China and India all rose sharply. Imports

from Ghana and Cameroon fell in March while imports from Cote d’Ivoire

remained steady. Imports from Cote d’Ivoire are up 462% over 2022

through the first quarter of the year.

Total imports for March were slightly more than 1% above those of March

2022 while first quarter totals were up 17%.

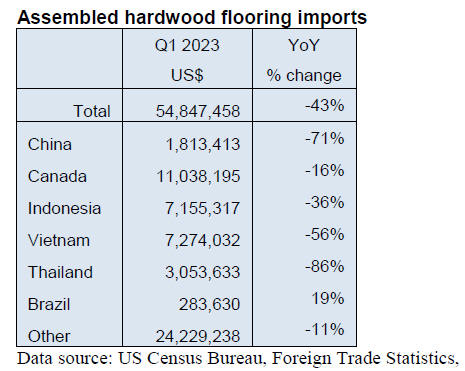

Hardwood flooring imports surge

US imports of hardwood flooring moved upward in March, rising

26% by value over the previous month. Imports from Malaysia rose 72%

while imports from Vietnam grew ten-fold over their February total.

Declines in imports from China and Brazil tempered the gains.

Total imports for March were within 1% of March 2022 totals while

imports were up 7% through the first quarter. Imports from Indonesia

have been especially strong—up 18% in March and up nearly 300% through

the first quarter.

Imports of assembled flooring panels also made a strong advance. Imports

rose 33% in March after having fallen for five consecutive months.

Imports from Canada rose 55% for the month to fuel the gain.

Despite the uptick, the March total was still lower than that of March

2022 by more than one third while imports lag behind last year’s by 43%

through the first quarter.

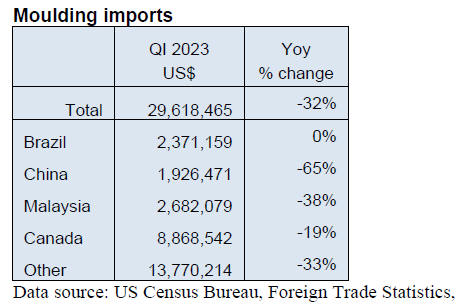

Moulding imports continue down

Imports of hardwood mouldings fell for a sixth consecutive

month in March, dropping 9% by value from the previous month. A rise in

imports from Canada helped offset an even sharper decline in imports

from China and Brazil.

Imports for the month were only slightly more than half of what they

were in March 2022. Imports for the first quarter are down sharply from

nearly all trading partners, with the exception of Brazil, where they

are up by less than 1%. Total imports are down 32% through the first

quarter of the year.

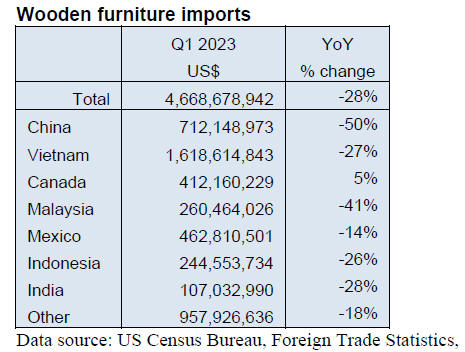

Wooden furniture imports fall for third month

Imports of wooden furniture fell slightly in March as imports

from China slowed even further. The US$1.402 billion in March imports

was 42% less than that of March 2022. Imports from the top two trading

partners, China and Vietnam, both fell by more than 20%.

Imports from China have been particularly weak so far this year, down by

50% through the first quarter of the year. With the exception of Canada,

imports from all major trade partners are down more than 10% in the

first quarter as total wooden furniture imports are down 28%.

Cabinet sales up 3.4% in March

According to the Kitchen Cabinet Manufacturers Association's

monthly Trend of Business Survey, participating cabinet manufacturers

reported an increase in overall cabinet sales of 3.4% for March 2023

compared to the same month in 2022.

Custom and semi-custom cabinet sales increased year over year as well.

Custom sales, year over year, were up more than 24% while semi-custom

sales were up just over 1%. Stock sales, however, were down 17.6%.

See:

https://kcma.org/insights/february-trend-business-report

Younger consumers unlikely to purchase furniture the way their

parents did

Furniture Today Editor, Cindy Hodnett, wrote that a CEO of one

of the furniture industry’s largest manufacturers told her we are on the

cusp of a transformative generational shift, one likely to be a slow,

painful transition for the industry.

Over the next 10 years or so as Generation Z (born between the

mid-to-late 1990s and the early 2010s) moves into adulthood and

homeownership they will bring new purchasing habits into the market.

The editor wrote that future buyers won’t be like those in the past who

saved for years on end in the 1960s, ‘70s and ‘80s to be able to

purchase their starter furniture “suite,” followed by family-with-kids

next-level up pieces,and then their aspirational living and dining room

furniture collection.

Hodnett posited the question, “What will it mean for the industry if the

next critical mass of buyers says ‘no’ to fast furniture and what they

don’t like and ‘yes’ to saving for quality pieces designed to their

taste and preference?”

See:

https://www.furnituretoday.com/furniture-retailing/is-gen-z-going-to-buy-furniture-like-their-grandparents-did-cindy-w-hodnett/

|