US Dollar Exchange Rates of

10th

May

2023

China Yuan 6.93

Report from China

Decline in China’s log imports

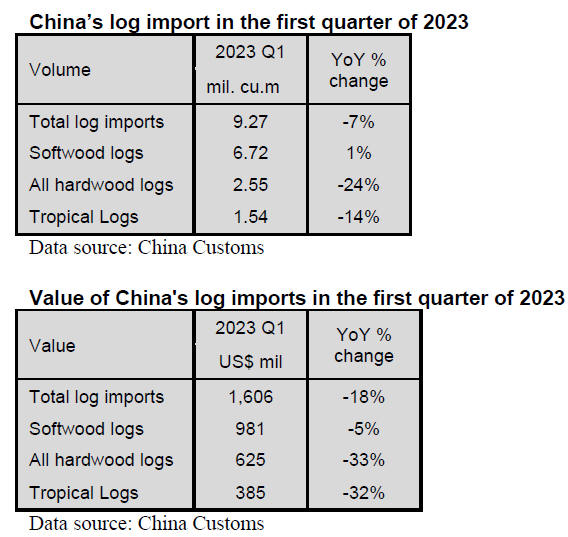

According to China Customs, log imports in the first quarter of

2023 totalled 9.27 million cubic metres valued at US$1.606 billion, down 7%

in volume and 18% in value compared to the first quarter 2022. In addition,

the average price for imported logs was US$173 (CIF) per cubic metre, down

12% from the same period of 2022.

Of total log imports, softwood log imports rose slightly by 1% to 6.72

million cubic metres, accounting for 72% of the national total. However, the

average price for imported softwood logs fell 16% to US$146 (CIF) per cubic

metre over the same period of 2022.

Hardwood log imports dropped by 24% to 2.55 million cubic metres, accounting

for 28% of the national total. The average price for imported hardwood logs

fell 12% to US$245 (CIF) per cubic metre over the same period of 2022.

Of total hardwood log imports, tropical log imports were 1.54 million cubic

metres valued at US$385 million CIF, down 14% in volume and 32% in value

from the same period of 2022, accounting for 17% of the national total

import volume.

The average price for imported tropical logs was US$251 CIF per cubic metre,

down 20% from the same period of 2022.

After abandoning its COVID policy in December last year the economy has been

recovering but at a rate much slower than expected. China's imports

contracted sharply in April (-8%) while exports grew at a slower pace of

8.5% compared to 14.8% in March.

Major log suppliers

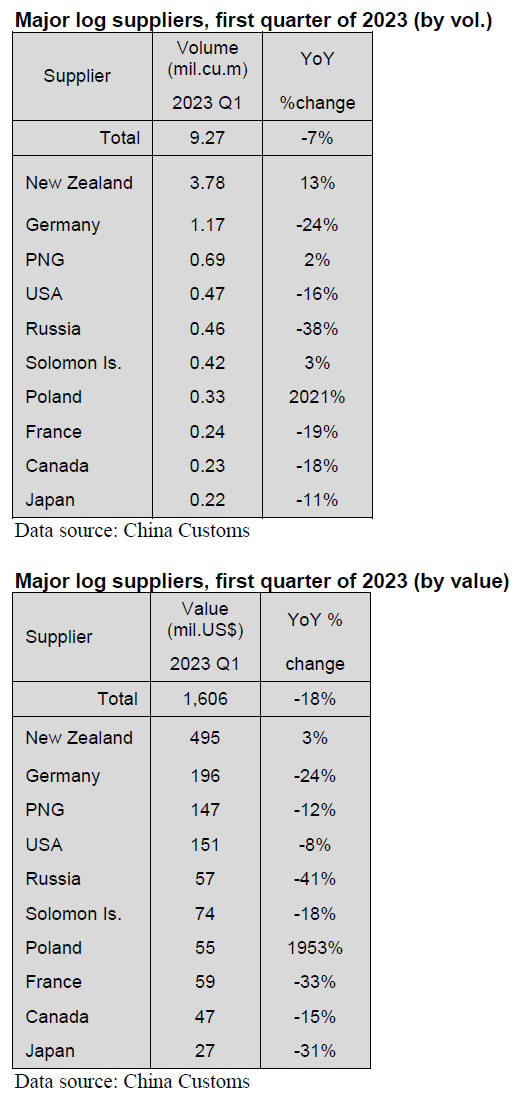

New Zealand and Germany were the largest and the second largest

suppliers of log imports to China in the first quarter of 2023. The

proportion of China’s log imports from these two suppliers accounted for

over 50% of the total log import volume. China’s log imports from New

Zealand rose 13% to 3.78 million cubic metres but from Germany fell 24% to

1.17 million cubic metres.

China's imports of Russian logs have fallen sharply, largely due to the

conflict between Russia and Ukraine. China’s log imports from Russia fell

38% to 460,000 cubic metres in the first quarter of 2023.

Surge in log imports from Poland

China’s log imports from Poland surged to 330,000 cubic metres in

the first quarter of 2023. The forests of Poland were hit by severe storms

in 2017. Nearly 10 million cubic metres of logs were blown down. A large

volume of fallen logs have been harvested and exported to China. China’s log

imports from Poland have been increasing since 2017. China’s log imports

from Poland in 2018 surged over 700%.

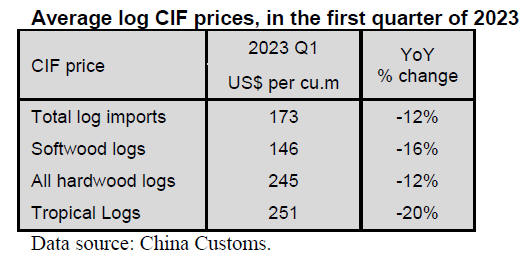

Decline in CIF prices for log imports

CIF prices for softwood logs, hardwood logs and tropical log

imports fell 12%, 16%, 12% and 20% in the first quarter of 2023.

Imports of softwood logs were relatively stable in the first quarter of 2023

while imports of hardwood logs declined significantly and log prices fell.

With the gradual recovery of logistics, ports and roads across the country

the accumulated stocks in the country are now being delivered. Analysts

suggest second quarter log prices will remain steady.

After the partial reduction of import tariffs in 2022 the overall cost of

logs is expected to decline and become stable which will further reduce the

cost pressure on manufacturers.

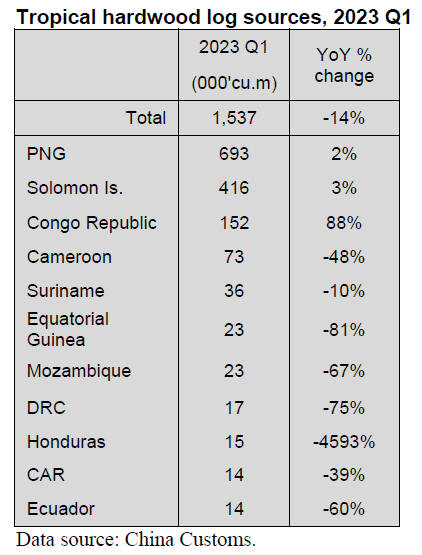

Decline in tropical log imports

China’s tropical log imports fell 14% to 1.537 million cubic metres

in the first quarter of 2023.

The top three suppliers of tropical logs to China

were Papua New Guinea (45%), Solomon Islands (27%) and the Republic of Congo

(10%). 82% of China’s tropical log imports were from these three countries

in the first quarter of 2023.

China’s tropical log imports from PNG, Solomon Is. and the Republic of Congo

grew 2%, 3% and 88% to 693,000 cubic metres, 416,000 cubic metres and

152,000 cubic metres respectively in the first quarter of 2023.

Increase in CIF price for tropical log imports from DRC

While tropical log import prices generally declined the CIF price

of China's tropical log imports from DRC increased 42% in the first quarter

of 2023. In addition, CIF prices for China’s tropical log imports from

Suriname rose 8%.

The largest decline in log CIF prices was the 20% drop for log imports from

the Republic of Congo.

|