Japan

Wood Products Prices

Dollar Exchange Rates of 10th

May

2023

Japan Yen 134.40

Reports From Japan

Corona reclassified to same level as

seasonal influenza

As of 8 May the Japanese government categorised the corona virus at

the same risk level as seasonal influenza. This means the government will no

longer restrict people’s movements and everyone will be free to make

decisions on protection. Under the new category, Covid-19 vaccinations will

continue to be free through this fiscal year as infections could continue

spreading.

See:

https://www3.nhk.or.jp/nhkworld/en/news/20230507_13/

Wage increases made to hold onto staff

A Finance Ministry survey showed over 60% of companies in Japan

have raised or plan to raise base pay in fiscal 2023 as they struggle to

find and keep skilled workers. Most of the companies saying they will raise

wages were in the manufacturing sector with almost 70% saying they have, or

will, raise wages this year compared to 52% last year.

The survey asked the reasons for raising wages and over 80% said this is to

motivate employees, improve their labour conditions and encourage them to

stay with the company. Other respondents said they did so"to respond to

rising prices”.

See:

https://english.kyodonews.net/news/2023/05/e40b323fe662-62-of-japan-firms-raise-base-pay-in-fy-2023-amid-inflation.html

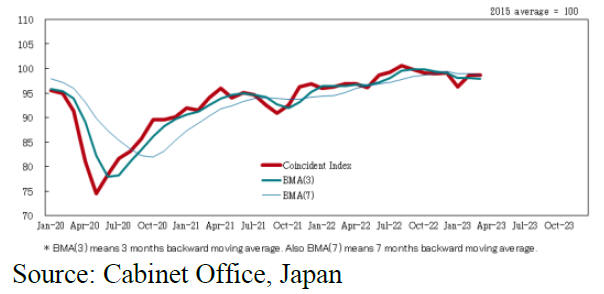

Business sentiment at lowest level in two years

A Bank of Japan survey showed that in the first quarter of this

year business sentiment dropped to the lowest level in more than two years

as weak global growth was viewed as a risk to the export-reliant economy.

The sentiment index for big manufacturers fell in the first quarter, the

fifth straight quarter of decline and the worst since December 2020. In

contrast, mood in the service sector recovered in the first quarter as

border controls were eased and the easing of covid restrictions opened the

way for a rebound in tourism and personal consumption.

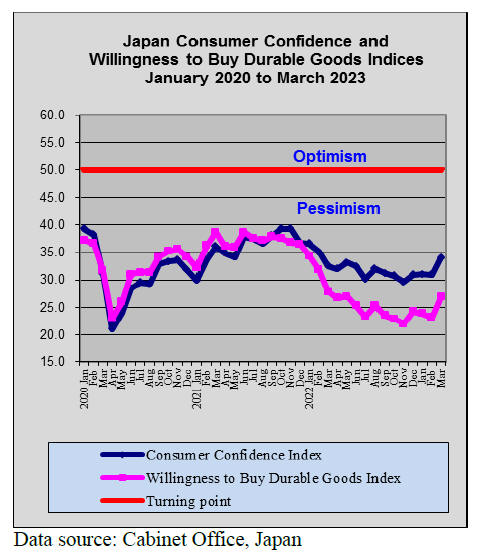

Modest recovery in consumer sentiment

The modest recovery in consumer sentiment since January this year

continued in April with household’s expectations of inflation coming down

slightly. The positive consumption data has been considered as a possible

trigger for the Bank of Japan to adopt a more normal monetary policy.

Behind the more positive sentiment was the wage increases agreed at the

start of the year, but inflation and price inceases for basics have whittled

away most of the wage hike gains.

The government kept its assessment of consumer confidence unchanged as the

improvement in April was small. The rising cost of living could result in a

slowdown in consumer spending later this year as the Bank of Japan has said

consumers will continue to face more inflationary pressures.

See:

https://www.japantimes.co.jp/news/2022/05/02/business/april-consumer-confidence-index-up/

Address economic fundamentals to stabiles

yen

Late last year the domestic newspaper The Mainichi published an

editorial on the yen exchange rate and the sentiment expressed back in

October 2022 is just as valid today.

The Maninchi said the yen’s rapid depreciation is

not just the result of the US dollar rising but also suggests currency

traders are "selling off Japan" as the economy weakens. The Mainichi warns

action is needed.

The yen's depreciation stands out in comparison to other major currencies

which seem to signal a need to address some economic fundamentals. As a

resource poor country Japan depends on imported energy and much of its food

needs and the weak yen has created a record trade deficit.

See:

https://mainichi.jp/english/articles/20221022/p2a/00m/0op/011000c

Concept of ‘workation’ promoted

Seven prefectural and 58 municipal governments in rural Japan have

come together to promote the concept of “workation” or telecommuting from

resorts and other vacation spots thus combining work and vacation. The new

group aims to build a business model that involves more than sightseeing but

less than permanent migration.

Getting urbanites to appreciate rural life is expected to lead to migration

growth in these areas and help rural authorities solve problems stemming

from a shrinking population.

Start-Up offers forest management to private owners

Much of the private forests in Japan are in poor condition but harvesting

and reforestation are beginning to attract attention. A start-up company in

Tanabe, Wakayama Prefecture has begun offering forest management services to

private forest owners and is promoting reforestation of unused land.

The company claims reforestation is attractive to young people from urban

areas as they can work in a natural environment. The company adopted a

flexible work style allowing employees to decide their own shifts and have

second jobs. The company has said the domestic timber industry has long been

in a slump because of low priced timber imports and an increasing area of

forests has been left untended or abandoned after logging.

According to the Forestry Agency only around 30-40% of land logged each year

is replanted. In the five years through fiscal 2018 the cumulative total of

unplanted land was around 2,560 square kilometres. In 2016, the government

designated forestry as a “growth industry” and will introduce a tax of yen

1,000 per taxpayer from fiscal 2024 for subsidies. The government is already

expanding subsidies to forest owners to encourage them to grow trees. A

forest management law of April 2019 allowed municipalities to entrust forest

management to private companies on behalf of owners.

Import update

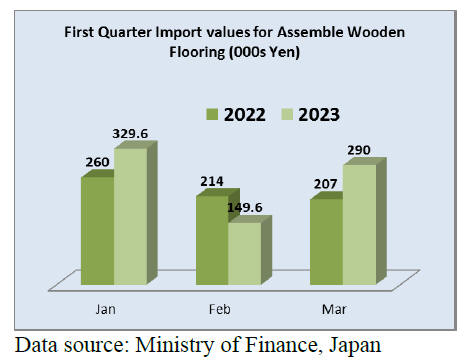

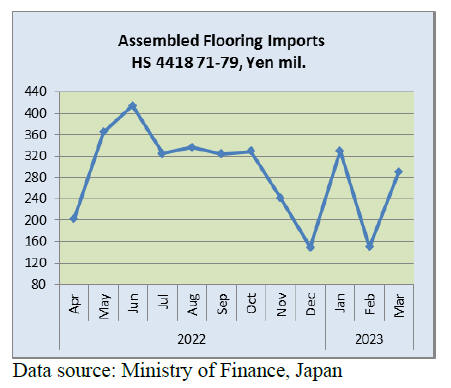

Assembled wooden flooring imports

Over the past 5 years there has not been such an erratic swing in

the monthly values of assembled flooring imports. Clearly the trading

pattern changed in the first quarter of this year.

The value of Japan’s imports of assembled wooden

flooring (HS441871-79) in March was up 40% year on year and month on moth

there was a massive 90% rise in the value of imports. The monthly rise in

imports stems from a sharp increase in imports from both China and Vietnam

as in each country full production and export deliveries recovered after the

Spring Festivals.

Three shippers accounted for over 70% of Japan’s imports of assembled

flooring in March, China 50%, up on February and Vietnam 16%. There were no

shipments from Vietnam in February. Other significant shippers in March were

Malaysia contributing 7% to the total value of imports and Thailand

accounting for 5.5%.

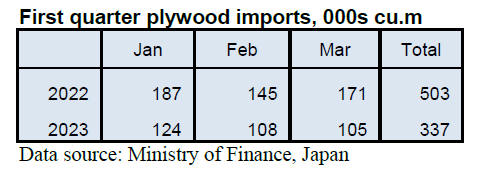

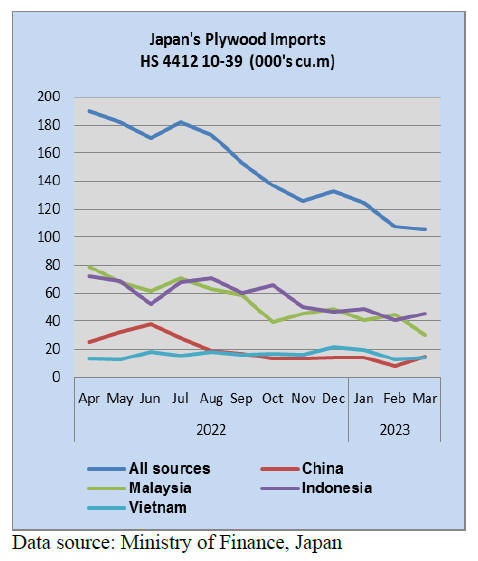

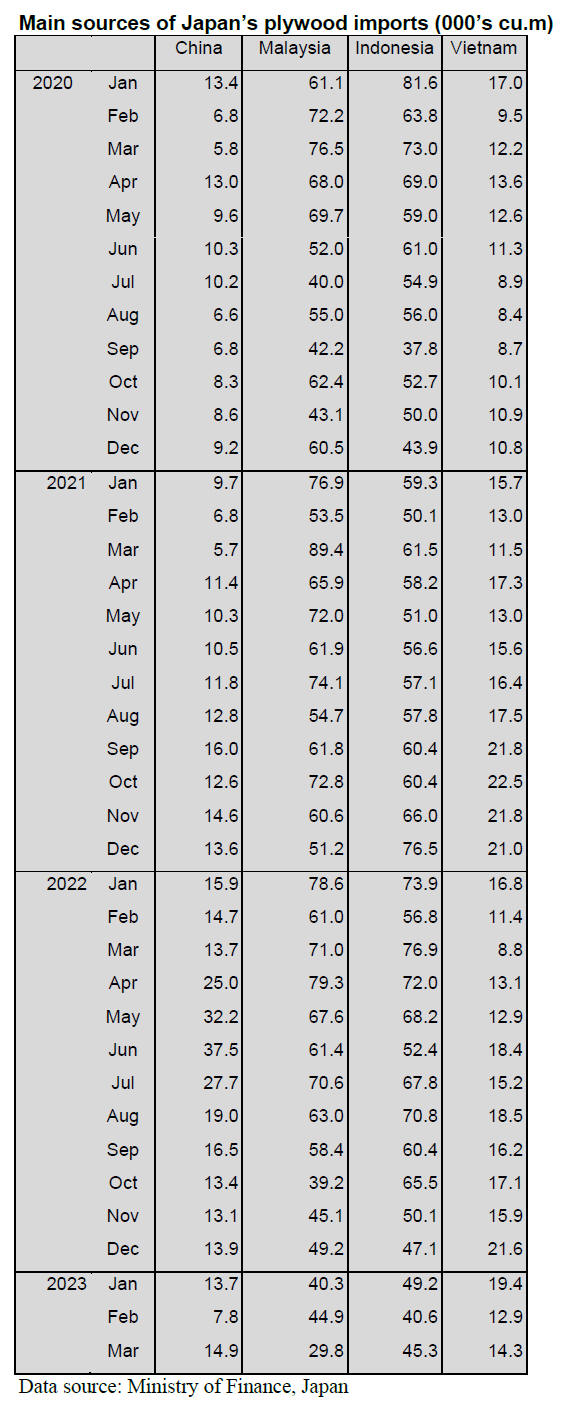

Plywood imports

First quarter 2023 plywood imports were down over 30% compared to

the first quarter of 2022.

The downward trend in Japan’s plywood imports

continued in March 2023 with both of the main shippers, Malaysia and

Indonesia seeing volumes drop. On the other hand shippers in China and

Vietnam have seen volumes holding steady over the past 12 months.

In March this year shipments of plywood from

Malaysia were down around 35% compared to a month earlier with shippers in

Indonesia seeing a slight rise in volumes shipped to Japan.

Plywood shipments to Japan from China picked up in March (doubling compared

to February) bringing shipments back to the average for the past 12 months.

March shipments of plywood from Vietnam rose slightly after the downturn

seen in February.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade journal published every

two weeks in English, is generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market precisely as it appears in

the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Wood use promotion

There was an announcement about a result of using wood for

buildings of 2022 from The Ministry of Agriculture, Forestry and Fisheries

and other departments. Agreements of using wood for buildings were concluded

with Japanese government for 10 cases and with local government for 60

cases. 15,100 cbms of lumber were used for buildings during October, 2021 to

March, 2023. It was 732 cases.

Plywood

Buyers purchase domestic softwood plywood only for the present use.

The prices of 12mm, 3 x 6 structural softwood plywood are 1,800 – 1,850 yen,

delivered per sheet. This is around 50 yen down from last month. At some

precutting plants, the prices are lower than 1,800 yen.

Plywood companies started reducing production since last October. Total

production during October, 2022 to March, 2023 is 23.6% down from the same

periods last year. Shipment had been sluggish and the inventory increased

until February. However, the shipment exceeded production in March.

Plywood companies in Eastern Japan continue reducing production in May and

the companies took the holiday longer than usual holiday at the beginning of

May. The prices of 12mm 3 x 6 painted plywood for concrete form are 2,000

yen, delivered per sheet. However, a purchase price was around 2,300 yen so

it is hard to get profits.

Some of the reasons are that the future price of painted plywood for

concrete form in overseas decreased to $750, C&F per cbm from $850, C&F per

cbm last year. Also, the import cost decreased around 2,000 yen, C&F per cbm.

145,716 cbms, of imported plywood were received in February, 2023 and this

was 22.9% less than the same month last year. This is nearly 40% down from

the peak in last year. A small amount of imported plywood will be received

until May and the inventory will decline.

Domestic logs and lumber

The prices of domestic lumber and logs have been adjusted. The log

market is getting weak as the prices of domestic lumber fall through the

nation. The prices of domestic lumber in Kanto region had been low until

February and then the prices of domestic lumber in Western Japan also

started to fall in March.

The price competition between laminated whitewood post, laminated cedar post

and solid KD cedar post became intense.

Since there were too much laminated whitewood posts and laminated cedar

posts, the prices were declined for major precutting plants.

The log market in Tohoku region started falling since last autumn. The log

market in Northern Kanto region declined in February, 2023 and in Kyushu

area and Western Japan declined at the end of March through April.

Plywood companies in Tohoku region reduced producing plywood since last

autumn and log demand decreased rapidly. Log demand for plywood companies is

over 30% less than the previous year. Moreover, the production of lumber and

laminated lumber decreased and the log market fell.

In Northern Kanto region, the prices of cedar log plunged to around 12,000

yen from 18,000 yen, delivered per cbm in February to March. The prices of

cedar log stopped declining in April.

In Kyushu region, the prices of cedar and cypress are now around 17,000 yen

in April. The prices had been over 20,000 yen until February.

Production of CLT will rise at Cypress Sunadaya

Cypress Sunadaya Co., Ltd. in Ehime Prefecture estimates that the

product of CLT will be 9,000 cbms in a year. It is doubled volume of the

previous year’s result. The company is the largest cedar lumber and

laminated lumber company in Japan. 30,000 cbms of logs are consumed in a

month.

The CLT production in 2022 was 4,500 cbms. A reason for an increase of

production is that the company does business for World Expo 2025 in Osaka

Kansai. Also, the company introduces a new special machine for producing

large CLT panels in this October.

The production of laminated structural lumber will be 60,000 cbms in a year

and it is 3% up from the previous year’s result. 50,000 cbms of 60,000 cbms

logs will be cypress lumber such as posts, foundations and beams.

Consumption of logs will be 300,000 cbms in a year.

The production of cedar dimensional lumber will be 1,000 cbms from 700 cbms

in a month. The prices of SPF decreased after the woodshock but cedar

dimensional lumber is more popular than SPF. The company purchased four new

dryers and special automatic cutting machines to expand production.

|