4.

INDONESIA

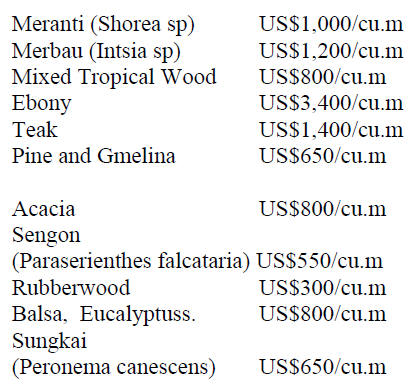

Export benchmark prices - Merbau sawnwood

price increased by US$300

The Ministry of Trade has published its Timber Export Benchmark

Price List (HPE) for timber for the period 1-31 May 2023.

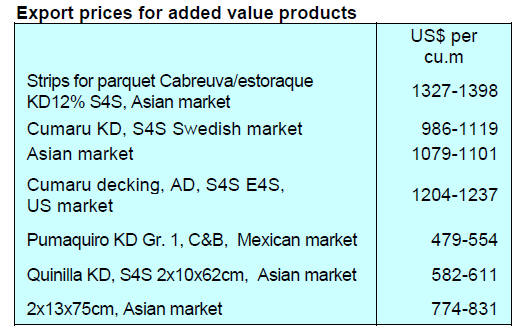

For veneer raw material from plantation forests and processed wood products

from mixed forest prices have been lowered by US$50/cu.m from the previous

month. However, veneer products from plantation logs for wooden sheets for

packing boxes have increased.

The following is a list of Timber HPE for the period 1-31 May 2023.

Processed Wood

Processed wood products which are leveled on all four sides so that the

surface becomes even and smooth with the provisions of a cross-sectional

area of 1000 mm2 to 4000 mm2 (ex 4407.11.00 to ex 4407.99.90

Processed wood product which is leveled on all four

sides so that the surface becomes even and smooth from Merbau wood (Intsia

sp) with a cross-sectional area of more than 4000 sq.mm to 10000sq. mm (ex

4407.29.91 and ex 4407.29.92): US$1,500/cu.m

See:

https://forestinsights.id/2023/05/02/kemendag-tetapkan-harga-patokan-ekspor-hpe-kayu-mei-2023-kayu-gergajian-merbau-melonjak-300-dolar-as/

Risk to timber by US debt default

The wood and furniture industries are vulnerable to being affected by a

default in the United States. The Executive Director of the Institute for

Development of Economics and Finance (Indef), Tauhid Ahmad, said the wood

and wood products, furniture, electricity, footwear, rubber and rubber

product industries are strategic export industries and the performance of

these industries has contributed to the national economy.

He suggested that if the US debt default situation drags it may result in a

recession which would affect Indonesia's economic growth.

See:

https://forestinsights.id/2023/05/08/industri-kayu-dan-furnitur-rawan-terdampak-gagal-bayar-utang-amerika-serikat/

Could EUDR strengthen competitiveness of wood products from

Indonesia?

Timber is one of the products under the European Union's regulation on

deforestation-free supply chains (EUDR) and this will have an impact on

Indonesian wood product exports to the EU. Muhammad Ichwan, the Executive

Director of the Independent Forestry Monitoring Network (JPIK), said that,

until now, there has been no detailed technical guidance regarding the EUDR.

However, he suggested the EUDR could strengthen the competitiveness of wood

products from Indonesia. He commented “although it (EUDR) regulates the

prohibition of products resulting from deforestation from entering the EU

this regulation will not hinder the timber trade as long as these wood

products do not result in deforestation.”

The domestic media commeneds that Ichwan believes implementation of EUDR

could strengthen Indonesia's Timber Legality Verification System (SVLK) as a

more moderate market instrument. However, Ichwan said that the EUDR could

also become an additional burden for timber businesses.

See:

https://www.kompas.id/baca/humaniora/2023/05/03/daya-tawar-produk-kayu-asal-indonesia-dapat-diperkuat

Human resources to boost competitiveness of furniture Industry

The Ministry of Industry has noted the furniture industry is a

significant contributor to national economic growth with export earnings of

around US$2.5 billion in 2022. The workforce in the sector is said to be

around 145,000 in 1,114 companies. In order to increase the productivity and

competitiveness of the furniture industry the Ministry of Industry plays a

role in creating skilled human resources.

The Head of the Industrial Human Resources Development Agency (BPSDMI) in

the Ministry of Industry, Masrokhan, has pointed out that one of the

vocational education units managed by the Ministry of Industry is the

Furniture Industry and Wood Processing Polytechnic (Polifurneka) in Kendal,

Central Java which has been able to produce competent human resources in the

field of furniture and wood processing.

Masrokhan explained "the purpose of establishing this polytechnic is to

encourage further investment in the industrial sector through the provision

of trained industrial workers in the furniture sector, empowering human

resources in the Semarang-Kendal region, as well as a providing a center for

innovation for the furniture and wood processing industries".

See:

https://www.viva.co.id/siaran-pers/1597221-kemenperin-sdm-kompeten-pacu-investasi-dan-daya-saing-industri-furnitur

Encouraging investment in agarwood plantations

The Chairman of the Central Leadership Council of the Indonesian

Gaharu Farmers and Entrepreneurs Union (SPPGI), Syamsu Alam, has encouraged

the community to increase establishment of agarwood plantations.

He stated that agarwood has been exported to more than 139 countries

including Europe, America, the Middle East and Asia where it is used for

making perfumes and herbal medicines.

He said natural agarwood from Papua is one of the best because it grows

naturally while most agarwood grows in plantations. Naturally grown agarwood

commands the best price and is mainly from Papua and Kalimantan. He added

“there are not enough farmers who focus on producing and that the SPPGI is

ready to provide assistance on growing agarwood.

See:

https://en.antaranews.com/news/280038/sppgi-encourages-increased-production-of-agarwood-plantations

Foreign entities can buy carbon credits in Jakarta

The government has decided to allow foreign entities to purchase

credits in the Indonesian carbon market, paving the way for multinational

companies and institutions to tap into the country’s large carbon trading

potential.

The announcement came after the Minister for Investment, Bahlil Lahadalia,

met with the President. The Minister stressed that all entities

participating in carbon-trading activities in the country should be

registered with the national registry system (SRN) and the transaction

process should be through the country’s carbon exchange.

See:

https://asianews.network/indonesian-govt-allows-foreign-entities-to-buy-carbon-credits-from-jakarta/

Indonesia economic growth keeps pace ahead of expected slowdown

In the first quarter of this year Indonesia's economic growth was

maintained but a slowdown, triggered by weakening exports and high-interest

rates, is likely. Indonesia’s economy expanded 5.03% in the first quarter,

slightly up from 5.01% in the previous quarter. First quarter growth was

driven by household spending, metal and mineral exports and tourism.

See:

https://www.thejakartapost.com/business/2023/05/05/indonesia-economic-growth-keeps-pace-ahead-of-expected-slowdown.html

5.

MYANMAR

Timber exports reported

At the end of the financial year 2022-23 (1 Apr. 2022 to 31 Mar.

2023) exports of timber earned US$140 million according to the Department of

Trade. Myanmar exported US$154 million in 2019-20 and US$128 million in

2020-2021.

It is widely expected that exports will decline in fiscal 2023-24 since

importers in the EU and USA have almost stopped buying Myanmar teak. The

Myanma Timber Enterprise (MTE) sold, by tender, 1,500 tons of teak logs and

1,000 tons of other hardwood logs on 11 May.

See:http://www.mte.com.mm/index.php/en/27-tenders/export-milling-marketing-dept-tender/teak-logs/1472-tender-announcements-of-11th-may-2023)

Border trade expanding

Myanmar’s border trade with the Thailand totalled US$393 million in

April this year surging from US$329 million in April last year.

The Myanmar/Thai border trade is via Tachilek, Myawady, Kawthoung, Myeik,

Hteekhee and Mawtaung border crossings. Among them, the Hteekhee border

crossing saw the most traffic worth US$273 million in April.

Myanmar also conducts border trade with China, Bangladesh and India and

exports mainly agricultural products while importing capital goods,

intermediate goods, consumer goods and raw materials.

See:

https://www.gnlm.com.mm/myanmar-thailand-border-trade-crosses-us390-mln-in-april-2023-2024/

ASEAN leaders’ statement on the recent attack on aid convoy

In early May a convoy delivering aid to displaced villagers in

Myanmar and carrying Indonesian and Singaporean diplomats came under fire by

unidentified men armed when travelling in Myanmar’s eastern Shan State. A

security team with the convoy returned fire and a vehicle was damaged but no

one in the convoy was injured. Indonesia, which serves as ASEAN’s chair this

year, had arranged for the delivery of aid.

A statement from the ASEAN Secretariat reads “We were deeply concerned with

ongoing violence in Myanmar and urged the immediate cessation of all forms

of violence and the use of force to create a conducive environment for the

safe and timely delivery of humanitarian assistance and inclusive national

dialogues.

We support the statement of the President of the Republic of Indonesia as

the Chair of ASEAN on 8 May 2023 in response to the recent attack on a

convoy of the AHA Center and the ASEAN Monitoring Team in Myanmar.

We condemned the attack and underlined that the perpetrators must be held

accountable. We supported the efforts of the Chair of ASEAN, including its

continued engagements with all stakeholders in Myanmar, to encourage

progress in the implementation of the Five-Point Consensus.”

See:

https://asean.org/wp-content/uploads/2023/05/STATEMENT-FINAL-RELEASE.pdf

6.

INDIA

Real Estate sentiment index dips

The January-March 2023 Real Estate Sentiment Index published by the

real estate consultant, Knight Frank and the National Real Estate

Development Council (NAREDCO) indicates that current sentiment, while

remaining positive, has weakened recently.

See:

https://www.knightfrank.com/research/report-library/real-estate-sentiment-index-q1-january-march-2023-10154.aspx

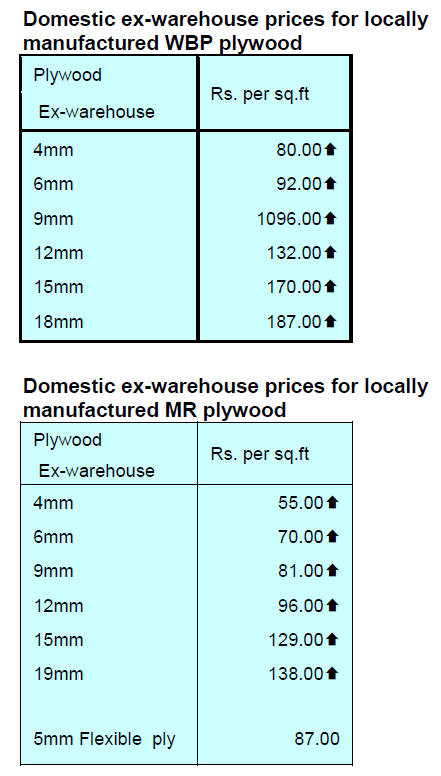

Manufacturers raise plywood prices

Plywood Manufacturers in North India have decided to raise plywood

prices citing raw material supply and price issues. These manufacturers also

decided to cut production by closing mills for two days a week in an effort

to spur demand and drive up prices.

On raw material supply the president of North India Plywood Manufacturers

Association said that as there has been active plantation establishement in

recent years and he is hopeful the supply issue will be overcome in next 3

to 4 years. However, plymills now have to compete for raw materials with new

MDF and particleboard mills.

See:

https://plyinsight.com/curtailing-production-in-the-plywood-sector-will-be-decisive/

April 2023 issue

MDF production increasing

Plyreporter has said the construction and furniture sectors in

India are booming with many new production lines coming on-stream. This has

driven up demand for particleboard and MDF.

Plyreporter says demand for MDF is good and is growing at between 35-40%

annually. The trade journal also said particleboard production capacity is

forecast to rise 20% in 2023. 2022 was excellent for the particleboard

industry with rising demand mainly from ready-made furniture manufacturers.

See:

https://www.plyreporter.com/MDF-particle-board/market-buzz

JICA loan for forestry

On behalf of Japan, JICA signed a loan agreement with the

Government of India to provide loans of up to a total of Yen 426,814 million

for four projects, one of which is for Forest and Biodiversity Conservation

for Climate Change Response in West Bengal.

The object of this forestry project is to mitigate and adapt to climate

change, conserve, and restore ecosystems by ecosystem-based climate change

measures, biodiversity conservation and restoration, livelihood improvement

activities and institutional strengthening thereby contributing to

sustainable socio-economic development in West Bengal. The Executing Agency

will be the Department of Forests, Government of West Bengal.

See:

https://www.jica.go.jp/english/news/press/2022/20230329_33.html

7.

VIETNAM

Wood and Wood Product (W&WP) trade

highlights

The Department of Customs has reported W&WP exports to the US

market in April 2023 were valued at US$584 million, down 38% compared to

April 2022. In the first 4 months of 2023 W&WP exports to the US market are

estimated at US$1.97 billion, down 41% over the same period in 2022. W&WP

exports to Canada in April 2023 were recorded at US$16.3 million, down 32%

compared to April 2022.

In the first 4 months of 2023 W&WP exports to the

Canadian market are estimated at US$57.6 million, down 35.7% over the same

period in 2022.

Exports of bedroom and dining room furniture in April 2023 are estimated at

US$184.1 million, down 39% compared to April 2022. In the first 4 months of

2023 exports of bedroom and dining room furniture amounted to US$623

million, down 44% over the same period in 2022.

Vietnam's imports of oak wood in April 2023 are estimated at 27,300 cu.m,

worth US$14.8 million, up 3.2% in volume and 3.1% in value compared to March

2023.

Compared to April 2022, imports increased by 18% in volume and 15% in value.

In the first 4 months of 2023 oak imports are estimated at 79,100 cu.m,

worth US$43.8 million, up 6.4% in volume but down 0.6% in value over the

same period in 2022.

Imports of logs and sawnwood (raw wood) from the EU to Vietnam in April 2023

showed a third consecutive month of increase, reaching 58,000 cu.m at a

value of US$18.0 million, up 11% in volume and 13% in value compared to

March 2023; but down 14% in volume and 20% in value compared to April 2022.

In the first 4 months of 2023, imports of raw wood from the EU was recorded

at 192,310 cu.m at a value of US$58.82 million, down 17% in volume and 20%

in value over the same period in 2022.

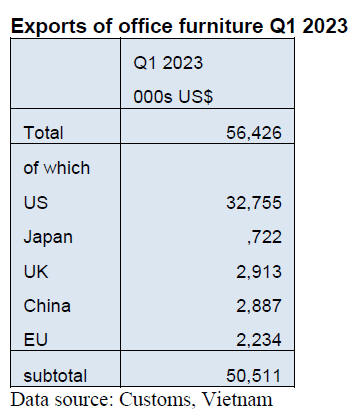

Exports of office furniture gloomy

Of office furniture, tables and cabinets are the 2 main items

topping exports. In the first 3 months of 2023 exports of these 2 items

accounts for 77% of the total export value of office furniture.

Vietnam's office furniture exports in April 2023 were valued at US$23

million, down 27% compared to April 2022. In the first 4 months of 2023

office furniture exports reached US$86.3 million, down 32% over the same

period in 2022.

In the first 4 months of 2023, W&WP imports accounted for US$665 million,

down 30.3% over the same period in 2022.

Leading the exports was tables with an export value of US$22.3 million, down

36% over the same period in 2022. Table products were exported mainly to the

US market in the first 3 months of 2023, reaching US$12 million, down 42%

over the same period in 2022; followed by Japan, China and the EU.

Exports of cabinets in the first 3 months of 2023 reached US$21.1 million,

down 44% over the same period in 2022 and accounted for 38% of total export

earnings from office furniture. Cabinet products are exported mostly to the

US, Japan and the UK.

In addition, in the first 3 months of 2023 other office furniture export

items included desks, bookshelves, chairs, study desks and computer desks.

Notably, exports of office chairs recorded a high growth in the first 3

months of 2023, reaching US$1.6 million, up over 200% over the same period

in 2022.

Exports of living and dining room furniture

As the global economy slows demand for living and dining room

furniture in the major markets such as the US, EU, UK and Japan has

weakened. Accordingly, exports turnover of this WP category continue are set

to decline further in the coming months.

Vietnamese manufacturers are being encouraged to expand and diversify export

markets, explore new and potential markets, such as India, Africa, the

Middle East and Latin America, Eastern Europe. At the same time, they should

attempt to promote the effective utilization of free trade agreements

Vietnam has concluded to promote this industry in the coming time.

Along with wekening international demand the reopening of China has also

created additional competitive pressure on the wood product industry,

especially Vietnam's furniture sector as China is still the world's largest

exporter of wooden furniture.

The Vietnam Timber and Forest Products Association (Viforest) forecasts

that, with the current growth rate exports of wood and wood products in the

first half of 2023 will fall by around 30% over the same period last year.

However, opportunities are still available if wood businesses seek to expand

markets and improve competitiveness, focusing on product price criteria in

Vietnam at reasonable levels for consumers, products following tastes,

quality products, and good after-sales policy.

Along with that is restructuring and reorganising the production of

enterprises, focusing on technological innovation, perfecting the production

management system and improving the efficiency and quality of human

resources.

The sector has been advised to step up production using domestic raw

materials to reduce costs.

Faced with great difficulties in the market due to highglobal inflation,

Vietnam's exports of wood and wood products are falling sharply. Vietnam's

wood industrystrives to find new markets. The fact shows that in the past

time, the Vietnamese wood industry has been trying to find and expand to new

and potential markets such as India, and the Middle East.

At the end of April, more than 50 Vietnamese furniture enterprises joined

together the webinar "Indian furniture export market: Market size and export

potential", organised by the Handicraft and Woodworking Association of Ho

Chi Minh City (HAWA).

In 2022 the Indian furniture market was worth US$23.12 billion and is

predicted to grow at a CAGR of 11% from 2023 to 2028. The size and demand of

the furniture market are increasing, and India is considered a potential new

market for Vietnamese furniture exporters.

See:https://vietnamagriculture.nongnghiep.vn/vietnams-woodindustry-strives-to-find-new-markets-d350081.html

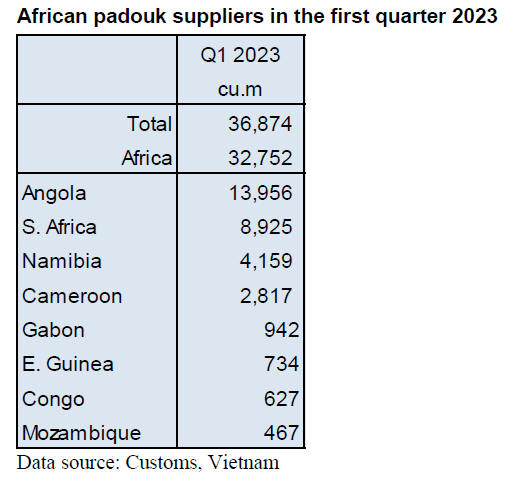

Imports of padouk from Africa

Vietnam's imports of padouk from African sources accounted for 89%

of total imports of this highly valued timber from all sources in the first

3 months of 2023 reaching 32,800 cu.m, worth US$10.1 million, up 3.5% in

volume and 8.2% in value over the same period in 2022.

Of which imports from Angola increased by 197%; Namibia rose by 5%;

Equatorial Guinea increased by 264% and Mozambique by over 2,000%

year-on-year.

In contrast, imports from Laos decreased by 59.7% in volume and 63.3% in

value over the same period in 2022, reaching 2.4 thousand cu.m, worth US$2.5

million, accounting for 6.5% of total imports.

Padouk sawn wood and log imports

In the first 3 months of 2023 imports of sawn padouk totalled

32,500 cu.m, worth US$11.8 million, down 8% in volume and 23% in value over

the same period in 2022.

At the same time, padouk log imports reached 4,4000

cu.m worth US$1.5 million, down 8% in volume and 15% in value over the same

period in 2022.

Padouk price fluctuations

The average import price for padouk wood in the first 3 months of

2023 stood at US$362/cu.m, down 16% over the same period in 2022. Imports of

padouk from Laos fell 9.0% year on year in the first quarter US$1,051/cu.m;prices

from Thailand fell 17% to US$475/cu.m; Papua New Guinea down 1% to US$330.0/cu.m.

Padouk suppliers

In the first 3 months of 2023,the volume of padouk imported into

Vietnam from Africa and Thailand increased compared to the same period in

2022 while imports from Laos, Hong Kong, Papua New Guinea, China dropped.

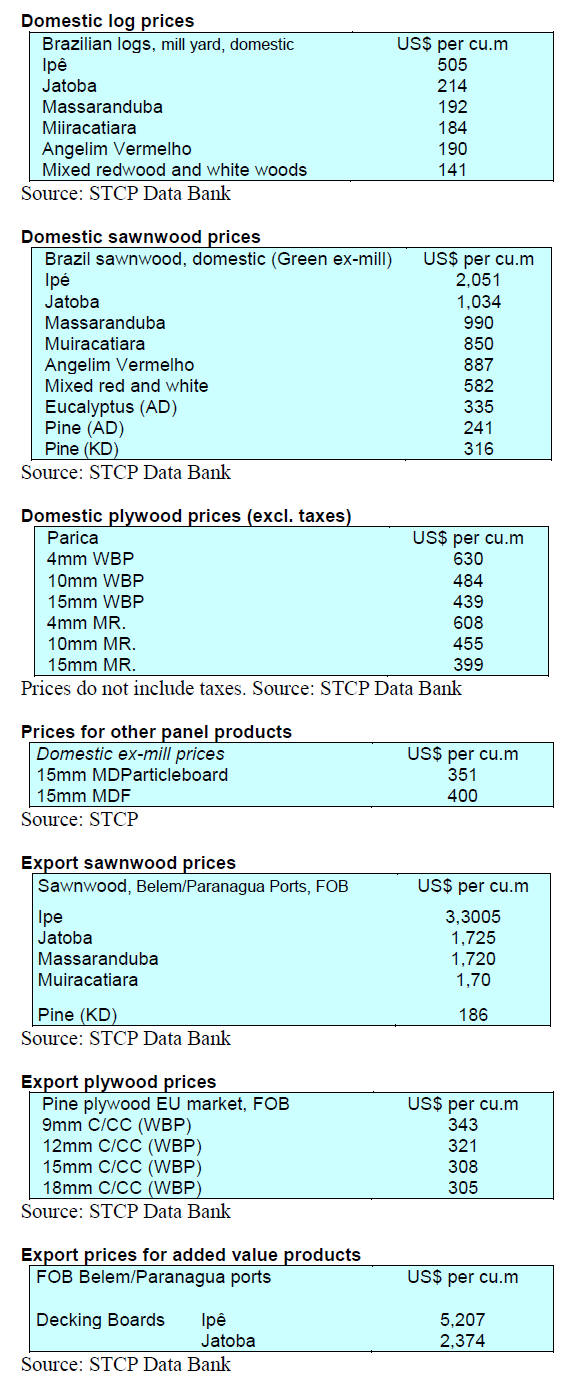

8. BRAZIL

Furniture sector alerted on EUDR

The Brazilian furniture sector has been alerted to the risks

to businesses from the recent European Union regulation

that prohibits its member countries importing wood

products unless it can be shown that the raw materialused

in manufacture did not come from forests that were

deforested or degraded.

When the regulation is implemented exporters need to

present certificates proving the origin of the raw material

including GPS coordinates and the guarantees of respect

for human rights, especially those of indigenous people.

Against this background ABIMÓVEL (Brazilian

Association of Furniture Industries) stressed the need for

certification of raw materials and production processes in

the Brazilian furniture industry. The adoption of certified

wood from sustainable forest management is already an

obligation within the sector. With more than 20,000 native

timber species in natural forests Brazilian tropical timber

has an important place in the furniture sector.

See:

https://forestnews.com.br/setor-moveleiro-industrias-leiuniao-europeia/

Prospects for the forest-based sector in Rondônia

Representatives of the private sector, public authorities

and NGOs recently gathered in Rondônia, to discuss the

current and future prospects for production forests in the

state. Rondônia is the third largest wood producing state in

the Amazon region.

The event "Rondônia's Forest Sector: opportunities for

sectoral planning" was organised by the Institute of Forest

and Agricultural Management and Certification

(Imaflora).

During the meeting, the study "Evolution of the forestbased

industry in Rondônia and opportunities for sectoral

planning and for the conservation of production forests",

published by Imaflora, was launched.

This is a comprehensive study on the development of

the forest sectory in Rondônia State which seeks to shed light on sector

dynamics, identify the main bottlenecks and present perspectives and

development opportunities.

Among the main recommendations was creating a territorial plan for Rondônia

State as a solution to further development of responsible forest management

in large production forests located in public land areas through forest

concessions and community forest management. The event was successful in

that it brought together the main relevant players in the timber sector in

the state for a discussion on the challenges that are posed to the

sustainability of the forest-based industry in the long term.

See:

https://www.imaflora.org/noticia/rondonia-o-terceiro-maior-produtor-de-madeira-da-regiao-amazonica-recebeu-evento-para-debater-o-cenario-atual-e-perspectivas-para-o-setor-de-base-florestal

Teak wood shipped from Port of Outeiro

The Atlântica Matapi Group, a company specialised in logistics in

the Amazon, made its first shipment of teak (Tectona grandis) logs produced

in forest plantations. A total of 11,500 tonnes of wood were shipped to

India. The teak shipped is from plantations, which can take 25 to 30 years

to reach the ideal age of harvesting, is widely used in Asia.

The shipment departed the Port of Outeiro, Belém Municipality, in the state

of Pará one of the main tropical timber producing states in the Amazon

Region. According to Matapi, the advantages of this port are quick vessel

turn round and competitive costs.

The partnership between Matapi and a major teak producing company in the

region gained strength in 2023. In the coming months fifteen export

shipments are planned which may total about 200,000 tonnes of teak..

See:

https://www.portosenavios.com.br/noticias/portos-e-logistica/matapi-embarca-teca-de-madeira-no-porto-de-outeiro

Timber exports drop in the first quarter of the year

Timber exports from the State of Pará, in the Amazon Region ended

the first quarter of this year lower than in the same period last year. In

total, export sales were worth US$57.3 million in the first quarter, down

47% year on year despite a 2% increase in the volume shipped.

See:

https://www.portalsantarem.com.br/noticias/conteudo/exportacoes-de-madeira-fecham-1-trimestre-em-queda/135219

Overall export prices suffered a strong retraction and closed March with an

average of US$804 per tonne, which represented a 36% drop in relation to the

previous month according to AIMEX (Association of Timber Exporting

Industries in the State of Pará).

9. PERU

Timber fair in Pucallpa City

The company, Tropical Forest, in cooperation with the Regional

Government of Ucayali, the Regional Directorate of Production of Ucayali and

the National University of Ucayali will hold a timber fair ‘Tecno Forestal

Ucayali’ for the forestry and forest industry sectors.

This fair had been held in the past and now the

organisers are relaunching it for September 14 and 15, 2023 and hope to

present a wide range of processing machinery for the first and second

transformation of wood.

Communities coached on negotiating fair harvesting agreements

It has been reported by the Agency for the Supervision of Forest

Resources and Wildlife (OSINFOR) that leaders and representatives of 38

native communities in the regions of Ucayali, Pasco and Loreto strengthened

their capacity to achieve fair treatment, within the framework of the law,

with third parties in order to ensure they can take advantage of sustainable

harvesting in forests under their care.

The trainers traveled to the provinces of Coronel Portillo (Ucayali),

Oxapampa (Pasco) and Mariscal Ramón Castilla (Loreto) to conduct three

face-to-face workshops with the communities.

The first workshops were held in April in Pucallpa and Puerto Bermúdez,

Oxapampa. The final workshop was held in the town of Pebas, Loreto. The

topics discussed were community forest management and negotiation and

agreements with third parties.

Exchanging data on the forestry sector

In order to optimise the exchange of data between forest sector

stakeholders the Organismo de Supervisión de los Recursos Forestales y de

Fauna Silvestre (OSINFOR) provided technical assistance to forestry

professionals from Ucayali on the use of the SIADO Region, a system that

allows to regional authorities to share data on management plans

facilitating decision-making and supervision planning.

Use of the system allowed Ucayali, Loreto and Madre de Dios to meet the

deadline date for submission of management plans.