|

Report from

the UK

Milan furniture fair takes sustainability focus to another

level

After several years of disruption during and in the aftermath

of the COVID pandemic, this year the Milan Salone del Mobile furniture

fair returned to its traditional April slot for the first time since

2019. Although visitor numbers were still down on pre-pandemic figures

of around 400,000 in 2018 and 2019, at 307,418 they were 15% more than

in 2022.

During the pandemic, overseas visitors to the fair fell dramatically.

However, the continuing influence of the show in the global furniture

sector was once again apparent from the numbers this year. Fully 65% of

visitors came from 180 countries outside Italy.

There were 2000 exhibiting brands of which 34% came from 37 different

countries. There were 550 young designers exhibiting at the show from 31

countries. Also present were 28 design schools and universities from 18

countries.

Over 5,400 accredited journalists attended, 47% of whom came from

abroad. China formed the largest contingent of visitors to the show

after Italy, followed by Germany, France, the United States, and Spain.

Visitors from Brazil and India were prominent amongst tropical furniture

supplying countries.

One lasting effect of the pandemic has been to encourage an even bigger

focus on the show’s digital presence to further expand its influence on

global furniture design trends. The international design community

responded enthusiastically to the show’s social media which reached 30

million users, notched up 6 million video views, and around 80 million

page impressions.

There were around a million visitors to the show’s website site and more

than 7 million page views. The show’s mobile app registered more than

350,000 sessions during the fair and enabled more than 750,000 scans

through the matchmaking service supporting the visitor experience and

promoting effective interface with the exhibitors.

Sustainable furniture design has been a key theme of past Milan shows.

However, the extent to which this theme pervaded the show was taken to

another level this year.

Reuse, regeneration, circularity, sustainable materials, and innovative

energy saving and efficient production methods were at the very heart of

the event. This extended not only to the products and processes on

display, but also to the exhibition stands.

As the event organisers observed “Goodbye to monumental stands with a

short life cycle. The new installations are lightweight, modular and

reusable, made from wood and recycled cardboard”. The heightened focus

on sustainability at the Milan show reflects the considerable policy and

public concern for climate change that now pervades society nearly

everywhere.

In Europe, the need for furniture designers, manufacturers and traders

to adapt has been given added impetus by a whole raft of new regulations

now passing through the EU law-making process as part of the European

Green Deal (see sections on new EU regulations below).

While the organisers of the Salone del Mobile and many exhibitors were

keen to emphasise the sustainability message, some commentators were

more cynical.

An article in the London Times conceded that “this was the year that

designers acknowledged that flying to Milan and launching annual

collections was not optimal, environment-wise”.

The article went on to suggest that “Milan’s annual design week was

beamed to us from the future but, this being Milan, it was more of an

arty, cinematic sci-fi future than one where design experts had fathomed

how to house, feed and furnish the world with zero carbon emissions”.

Nevertheless, some exhibitors communicated powerful messages about the

challenges and opportunities to furniture manufacturers and their

suppliers of tackling environmental issues head on. This was true of the

‘Wood You Believe?’ installation for the Italian wood panels company

Gruppo Saviola by designers Carlo Ratti Associati (CRA) and Italo Rota.

The exhibit transformed four tons of post-consumer wooden objects into a

structure that questions how design can act to reduce waste and at the

same time be inspired by it. “The use-and-dispose consumption pattern is

one of the main underlying causes of the environmental problems we are

facing now,” says Carlo Ratti, “Wood You Believe? taps into an enormous

pool of resources that have always been available to us.”

Passing into the structure, visitors enter a space constructed out of

more than one hundred panels from the Gruppo Saviola ‘pannello ecologico’

technology. Made of fully recycled wood, these panels are digitally

treated to display a wide range of textured finishes that complement

different designs. Gruppo Saviola manages the whole process from the

collection of waste wood, to recycling, and transformation into a new

and functional product.

Other exhibitors were willing and able to spell out a strategic vision

for furniture companies to move towards more sustainable practices. In

an interview with the Salone show organisers, Anna Pellizzari, Executive

Director of Materially, a company that helps other companies innovate

their products starting from materials, summarised the various

strategies now being adopted by Italian companies.

Materially is a partner of FLA-PLUS, a project led by the Italian wood

furniture industry association FederlegnoArredo (https://fla-plus.it) to

develop and implement a strategic plan on sustainability to support and

respond pragmatically to the needs of manufacturing companies.

Ms. Pellizzari noted that “with respect to sustainability, one of the

central points of the wood-furniture sector – in my opinion already very

virtuous because of the type of materials it uses – is the durability of

the product.

The Italian supply chain in particular is focused on durable products

that the consumer can use for a very long time, so contributing

positively to reducing the environmental impact of an object”.

Ms. Pellizzari went on to identify three approaches to circularity that

can be adopted by furniture and wood product manufacturers:

1. Design for disassembling, “a principle that, from the early stages,

guides the design of objects that are easily dismantled: eliminating

glues and adhesives, using joints and adopting all the solutions that

allow easy replacement and repair of the components, so lengthening the

product’s lifespan. This also simplifies end-of-life disassembly, which

facilitates recycling”.

2. ‘Systemic’ design involving detailed measurement of the company’s

environmental impacts, developing actions dealing with the production

process as a whole and identifying hotspots of environmental harm and

tailored mitigation measures. These might include the use of renewable

energies, increasing energy efficiency of processes, the elimination of

pollutants, and much else.

3. The approach centered on recycling and closing the circle of the

material. According to Ms. Pellizzari this “is a supply chain approach

encompassing the whole world of recycled panels, and includes the main

Italian players in the sector.

These absorb the waste from the wood supply chain and recycle it to make

panels to be reintroduced into the production cycle”.

World furniture trade stagnated in 2022

The latest issue of the World Furniture magazine (freely

available at www.worldfurnitureonline.com/magazine/) from CSIL, the

Italian furniture research organisation, provides a lot of information

on recent trends in the global furniture sector and links to more

detailed reports (available for a fee). Highlights include:

CSIL’s update on the world furniture outlook which notes that “after

the 2020 stall, 2021 was a year of very strong growth [for global

furniture trade], reaching US$ 189 billion. The uncertainties caused by

the war in Ukraine, the supply chain constraints, logistics problems,

and strong inflationary pressures, together with the devaluation of

major currencies in relation to the US$, are countervailing factors that

resulted in a stagnation in 2022”.

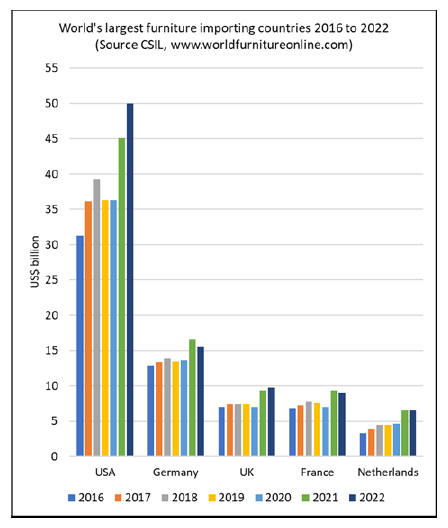

CSIL’s ‘World Furniture Outlook’ report identifies the leading

importers of furniture in 2022 as the United States, Germany, the United

Kingdom, France and Netherlands (a trading hub) which together accounted

for about one half of total imports. Preliminary CSIL data for 2022 show

a substantial increase in imports into the US and virtual stagnation for

European countries (in current US$) (see chart right).

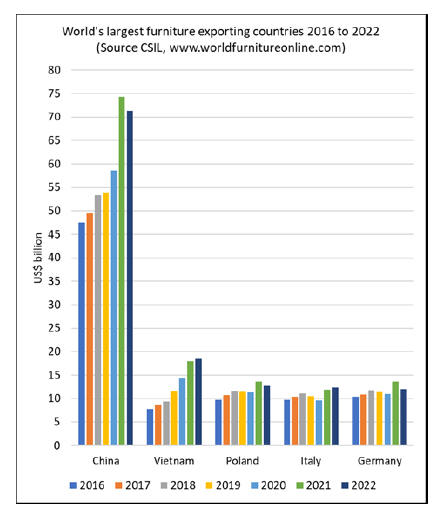

CSIL’s ‘World Furniture Outlook’ report notes that China, the main

furniture producing and exporting country, alone accounted for more than

one third of world furniture production and of exports in 2022, followed

at a distance by Vietnam, Poland, Italy and Germany.

After a major increase in 2021, China’s exports decreased in 2022 (see

chart below) mostly as a consequence of continuing production

difficulties caused by COVID. China’s struggling real estate sector also

contributed an economic slowdown in the country last year, impacting on

Chinese furniture production and consumption and on global supply chains

and trade.

CSIL’s ‘World Furniture Outlook’ report suggests that global prospects

will result in a declining consumer confidence and in the weakening of

furniture demand during 2023. For the world as a whole (100 countries),

CSIL forecast furniture consumption to decrease slightly in real terms

in 2023 but that growth should resume in 2024.

An article by Mindaugas Morkunas, Regional Sales Head of the German

company Henkel on “current trends in the European furniture supply chain

and the influences behind them” observes that “currently, the furniture

industry is still exposed to significant uncertainty” and that “having

recently travelled around multiple furniture factories, I have seen

manufacturers in countries like Poland and Sweden suffering from

decreased demand. The decrease is drastic…. Some major manufacturers

admit having never faced such a fall. The numbers vary, but I have

personally been told that certain orders have been reduced by 43%, 50%

or even 73%”.

Mr Morkunas notes that companies are adapting to the changed market

situation by: a “focus on product improvement….to maximize lean

manufacturing.

This means minimizing unnecessary expenses while retaining product

quality”; “energy saving” since “highly increased energy prices are

forcing manufacturers to look for ways to save on energy….popular

methods include performing professional audits on energy consumption,

using state aid, regular unit maintenance, and so on”; and “changes in

people management….Many employees are being laid off or sent on holiday

for a week or even a month.

It comes as no surprise that the furniture industry has faced multiple

protests from dissatisfied employees”.

CSIL’s latest report on the “200 largest furniture companies

worldwide” shows that this group of companies has turnover of nearly USD

120 billion related specifically to the furniture sector. Concentration

in the global furniture sector continues to increase year-on-year, the

top 200 accounting for more than 20% of world furniture production in

2022. The Top 200 have headquarters in 30 countries, with companies in

Asia and the Pacific accounting for nearly 40% of Top 200 turnover and

European and Americas companies accounting for 30% each.

According to CSIL, since the start of the pandemic in 2020, the Top

200 have consistently outperformed the global furniture sector as a

whole driven by larger financial capabilities that allowed leading

companies to quickly re-align business strategies, implement new sales

channels (e.g. online), and reposition their supply chain. Large Asian

manufacturers have grown particularly rapidly over the last five years.

European players have also shown promising results, particularly in 2021

(surpassing the pre-pandemic level). North American manufacturers

experienced significant development in 2019 and stabilized in 2021.

CSIL note that the strategies of the Top 200 have evolved in recent

years with a growing focus on “delocalization”, that is expanding

activities outside the companies headquarters country to reduce

logistical and transport costs and the time-to-market. About half of the

Top 200 companies now have manufacturing activities outside their

headquarters country. Companies specializing in outdoor furniture have

been particularly prone to delocalize production (80% of the companies

selected opened manufacturing plants abroad), followed by companies

specializing in office furniture and upholstered furniture

manufacturing.

CSIL latest report on ecommerce in the global furniture sector has

grown rapidly in recent years and in 2022 the global value of furniture

sold online was worth about USD 96 billion, representing about 11% of

the worldwide furniture consumption at enduser prices. While global

consumption of furniture decreased on average by 3% each year between

2019 and 2022, e-commerce consumption increased by 18% on average each

year during the same period.

Most of the growth was concentraded in 2020 and 2021, while in 2022 the

trend was broadly flat.

CSIL note that the market for online furniture is a highly competitive

and rapidly changing one. An overarching trend is a move by retailers

towards an “omnichannel strategy”. Consumers “expect a seamless

experience that is joined up between physical stores, online, or phone,

and where they can switch among channels easily”. This has re-written

the rules of traditional retailing. According to CSIL “a retailer’s

success no longer depends on its ability to provide many products. It no

longer depends on offering promotions. And the number of stores is less

relevant now….brick-and-mortar retailers are establishing a strong

online presence. But, at the same time, we are seeing e-commerce

platforms moving towards brick-and-mortar”.

CSIL’s free magazine and all CSIL reports can be purchased online and

downloaded from:

www.worldfurnitureonline.com

Raft of EU Green Deal measures set to impact on furniture sector

A raft of EU regulatory measures designed to reduce carbon

emissions and other environmental impacts are set to have a significant

impact on Europe’s furniture sector.

The high political priority attached to such measures as the EU

Deforestation Regulation (EUDR), the Ecodesign for Sustainable Products

Regulation (ESPR), and the EU-single use Plastics Directive is due to

EU-wide commitment to the European Green Deal. This aims to make the

EU's climate, energy, transport and taxation policies fit for reducing

net greenhouse gas emissions by at least 55% by 2030 and to achieve zero

net emissions by 2050.

A large proportion of the EU’s long-term budget and NextGenerationEU,

the temporary instrument designed to boost the post-COVID recovery,

which together form the largest stimulus package ever financed in

Europe, are tied to Green Deal initiatives.

One measure now starting to impact on the wood products sector,

including furniture, is designed to directly raise funds for the Green

Deal.

Since January 1st, 2021, every EU member state has had to pay a plastic

tax of 80 cents per kilogram of non-recycled plastic waste. Due to that,

some EU countries are now introducing their own plastic taxes which

impose new requirements on all product suppliers to provide data on the

quantity of plastic packaging with each consignment before it can be

placed on the market.

The EUDR, reported on in the previous Tropical Timber Market Report, was

passed by the European Parliament in a vote on 19 April and looks set to

have a particularly immediate effect on the trade in wood fruniture.

The text now just needs to be formally endorsed by the European Council,

expected in May. It will then be published in the EU Official Journal

and enter into force 20 days later. The requirements are estimated to be

enforced for large operators from 18 months after the law enters into

force (i.e. from around December 2014) and twelve months later (i.e.

from around December 2015) for SMEs.

The EUDR will likely have a major impact on supply of some materials to

the furniture sector - including wood, textiles and leather. It will

also impact significantly on manufacturers of wood furniture both inside

and outside the EU.

Under the terms of EUDR, both importers and exporters of wood furniture

in the EU – together with large operators even if only engaged in

internal EU trade - will be obliged to gather and provide geolocation

data for all the harvest sites from which all wood components have been

derived with each individual consignment before it can be placed on, or

exported from, the EU market.

This applies to all wood furniture including items such as wood seating

not formerly covered by EUTR. The same applies to wood-based textile

fibres and to leathers derived from cattle contained in furniture

products.

The geolocation requirement will apply irrespective of risk of illegal

harvest, deforestation, or forest degradation in the region of supply.

Furthermore, if regulated material components of furniture products

derive from harvest sites in any country or region except those

identified by the EC as “low risk”, these operators will be obliged to

undertake due diligence to identify and mitigate these risks.

Ecodesign for Sustainable Products Regulation (ESPR)

In the absence of other factors, a far-reaching regulation such

as EUDR would likely lead more manufacturers to switch away from wood

and increase their use of other materials such as plastics and metals.

However, this tendency should be offset by the ESPR which aims,

according to the EC, to “make sustainable products the norm in the EU by

increasing their durability, reusability, repairability, recyclability

and energy efficiency”. Wood products are inherently well adapted to

delivering against most of these goals.

Presented as a proposal by the European Commission on 30th March 2022,

the ESPR is currently working its way through the legislative process

and, if adopted by the EU, will set out a general framework imposing

ecodesign requirements on products intended for sale on EU markets. The

proposal builds on the existing Ecodesign Directive which currently only

covers energy-related products.

The process towards passage of the ESPR is currently some way behind the

EUDR. The Commission’s proposal for the ESPR was discussed by the

European Parliament’s Environment Committee on 12 January 2023 when MEPs

tabled 628 amendments. The vote in the committee is now expected on 5

June 2023. Beyond that the law will need to be agreed by both the full

Parliament and the European Council.

The ESPR proposal establishes a framework to set ecodesign requirements

for specific product groups to significantly improve their circularity,

energy performance and other environmental sustainability aspects. It

will enable the setting of performance and information requirements for

almost all categories of physical goods placed on the EU market

including furniture.

Any organisation placing goods for sale on the European market, whether or

not they are based within Europe, will be required to comply with the

requirements of the regulation. Furniture products, alongside various

other product groups such as iron, steel, aluminium, textiles, and

cement have been identified as priority products for the establishment

of eco-design requirements.

The ESPR framework will allow for the setting of a wide range of

requirements, including on

product durability, reusability, upgradability and reparability;

presence of substances that inhibit circularity;

energy and resource efficiency;

recycled content;

remanufacturing and recycling;

carbon and environmental footprints;

information requirements, including a Digital Product Passport.

The new “Digital Product Passport” will provide information about

products’ environmental sustainability. It should help consumers and

businesses make informed choices when purchasing products, facilitate

repairs and recycling and improve transparency about products’ life

cycle impacts on the environment. The product passport should also help

public authorities to better perform checks and controls.

The specific requirements to be imposed on different product groups are

not yet clear. The EU’s approach has been to start with a big picture

proposal for a framework and a process — via which the Commission

(“working in close cooperation with all those concerned”) will gradually

set out requirements for each product or group of products, developing

specific stipulations down the line.

This approach also suggests there could end up being a degree of

variability in ESPR requirements across different types of products, as

various trade-offs (perhaps product longevity vs energy efficiency of

manufacture, say) are weighed up and variously assessed in each specific

product context.

EU taxes on plastic packaging

While there is still some way to go before the ESPR

requirements will be imposed in the EU market, the EU’s decision to

require all EU Member States to make a national contribution to the EU

budget in support of the Green Deal based on the amount of plastic

packaging waste that is not recycled within their territory, is already

being felt in some countries.

The mechanisms by which Member States raise the money to pay this

EU-wide levy are not harmonised. Each Member State designs its own

regulation to capture the underlying taxes and contributions from market

players and industries.

Spain has moved faster than other EU countries to implement specific

legislation to implement a tax at national level to fund the EU levy.

Starting on 1 January this year, Spain began enforcement of a new tax

(referred to as IEPNR) on “non-reusable plastic packaging”. The tax

applies throughout Spain, including Ceuta, Melilla, and the Canary

Islands, and taxes both the import and manufacture of non-reusable

plastic in the country.

The definition of "packaging" taxed under the Spanish law includes not

only that used directly for selling products but also packaging required

in transport. Items such as plastic straps around packs of lumber or

shrink wrapped plastics to protect veneer, flooring and furniture are

therefore subject to the tax. The IEPNR applies the rate of €0.45 per

kilogram of plastic in packaging.

Recycled plastics are not subject to the tax. However, to avoid paying

the tax, the importer must demonstrate that plastics are certified by an

ISO 17065 accredited Certification Body as containing only recycled

material in accordance with UNE EN 15343:2008. This is the European

standard for “plastics recycling traceability and assessment of

conformity and recycled content”.

At present, there is no clear information on how widely this standard is

applied by plastic packaging suppliers, but it is understood to be not

widespread. In practice therefore, as things stand, most Spanish

importers are likely to be obliged to pay the tax.

While Spanish manufacturers and traders operating in the EU single

market have to self-assess and pay the tax in the same periods (monthly

or quarterly) as their VAT self-assessment, Spanish importers are

required to settle the tax through the Single Administrative Document

(SAD) used for customs declarations. The taxable amount of non-recycled

plastic in kg (to two decimal places) is required to be entered into box

47 of the SAD.

Further details on customs formalities for importing goods subject to

the tax are provided by the Spanish government at:

https://sede.agenciatributaria.gob.es/Sede/en_gb/impuestos-especiales-medioambientales/impuesto-especial-sobre-envases-plastico-reutilizables/formalidades-aduaneras-impuesto.html

Some other EU Member States are expected soon to adopt a similar

approach. In fact Italy planned to introduce a very similar tax - known

as MACSI - from 1st January 2023, but a decision was taken in November

last year to suspend application until further notice.

While the tax was not imposed, since the start of this year all

suppliers placing packaged product on the Italian market must indicate

material type using an alphanumeric code (which is defined in EC

Decision 97/129/EC). The code may be provided on the packaging itself

or, if this is not possible, it should be available via the website or

similar documentation of the supplier.

Elsewhere, Poland, Germany, and Sweden have already announced that they

will implement new plastic-related legislation soon. Other EU countries

may adopt a different approach, for example by imposing so-called

“extended producer responsibility” (EPR) fees and obligations on

manufacturing companies, or developing new deposit-return systems. Some

EU countries may go so far as to completely ban single-use plastics.

|