4.

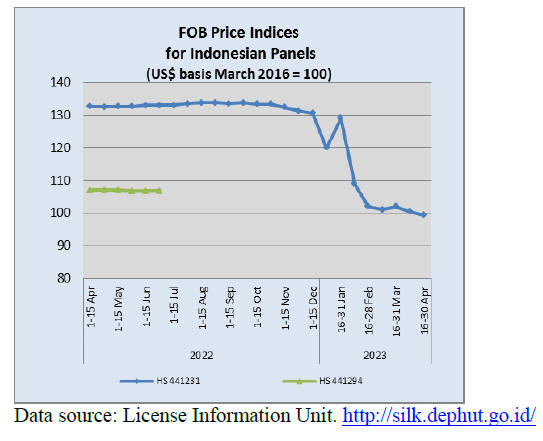

INDONESIA

Contribution from forestry to GDP can

be increased

The Minister for the Economy, Airlangga Hartarto, has stated that

the forestry sector's contribution to GDP at 0.66% in 2022 should be

increased and the carbon trade may offer opportunities. He added that

Indonesia’s forestry development policies are aimed at maximising benefits

for people while maintaining forest functions.

He said the government continues to implement its Social Forestry policy

that opens up opportunities for communities living around the forest to

apply for forest area management rights.

In related news, Airlangga met with German Minister for Economic Affairs and

Climate Action, Robert Habeck, to discuss a ‘green economy’ sector.

Airlangga said Indonesia and Germany had sealed business agreements in

various sectors such as energy transition, downstream industries and

accelerating the completion of the Indonesia-EU Comprehensive Economic

Partnership Agreement (IEU-CEPA) especially related to flexibility in

sustainability issues.

One of the issues discussed with Minister Habeck was related to the European

Union's deforestation regulation.

According to Airlangga this will make it more difficult for Indonesia to

export commodities such as palm oil, cocoa, coffee and timber to the EU.

Airlangga asked Germany to help encourage cooperation in recognising

standards that have been implemented in Indonesia.

In terms of industrial downistreaming, especially mining, Airlangga

emphasised that Indonesia is open to foreign investment in order to increase

added value.

See:

https://en.antaranews.com/news/278475/contribution-from-forestry-sector-to-gdp-can-be-increased-minister

and

https://www.msn.com/id-id/ekonomi/ekonomi/menko-airlangga-temui-menteri-iklim-jerman-bahas-aturan-deforestasi-ue/ar-AA19ZCDF#image=1

Philippines and Indonesia partnership on reforestation

Indonesia and the Philippines are working on a bilateral

partnership for a major reforestation project which may catalyze net zero

and carbon market development in the ASEAN region.

Indonesian Chamber of Commerce and Industry (Kadin) chairman and ASEAN-BAC

2023 chairman, Arsjad Rasjid, said the reforestation partnership was among

the projects being pushed by the ASEAN Business Advisory Council (ASEAN-BAC)

this year.

Indonesia has 91.2 million hectares of forest while the Philippines has 23.3

million hectares. With the growing demand for carbon credits globally the

reforestation partnership presents an opportunity for both countries.

See:

https://dinsights.katadata.co.id/read/2023/04/13/indonesia-philippines-work-on-large-scale-reforestation-project

Exports topped US$23 bil. in March

The value of Indonesia's exports in March 2023 reached US$23.50

billion, up 10% month-on-month according to Statistics Indonesia (BPS).

At a press conference Deputy for Methodology and Statistical Information at

BPS, Imam Machdi, reported that in each of the past three years

month-to-month export growth in March has always increased. However, the

increase in March this year was not as high as in 2022 and 2021. The growth

in March was supported by an increase in the exports of raw minerals as well

as the iron and steel industry.

See:

https://swa.co.id/swa/trends/economic-issues/ekspor-indonesia-maret-2023-capai-us2350-miliar

Economic growth below 5% in first quarter

The Executive Director of the Center of Reform on Economics (CORE)

Indonesia, Mohammad Faisal, forecast that Indonesia's economy will record

less than 5% growth in the first quarter of 2023.

According to CORE the projected growth will be supported by household

consumption and investment. Household consumption is estimated to still

account for half of the economic growth while investment is projected to

contribute more to economic growth this year.

See:

https://en.antaranews.com/news/278559/see-economic-growth-dipping-below-5-in-q1-core

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Indonesia.

See:

https://www.itto-ggsc.org/static/upload/file/20230414/1681442042214477.pdf

5.

MYANMAR

Efforts to de-escalate violence

24 April marked the second anniversary since ASEAN agreed on a Five

Point Consensus in response to the military coup in Myanmar, sadly the

Myanmar military has ignored this opportunity for peace in the country.

Amnesty International has assessed ASEAN’s five point consensus and its

conclusions have been published;

“Myanmar: ASEAN needs to address its failing approach to the crisis in

Myanmar following the military coup”

In relate news, the Bangkok Post has reported that government

representatives from Myanmar and its neighbours met recently in New Delhi in

an effort de-escalate the violence in the country. The New Delhi talks were

a follow-up to an earlier meeting held in Thailand, the so-called Track 1.5

dialogue.

See:

https://reliefweb.int/report/myanmar/myanmar-asean-needs-address-its-failing-approach-crisis-myanmar-following-military-coup

and

See:

https://www.bangkokpost.com/world/2557711/secretive-talks-on-myanmar-held-in-india

Power supply a challenge

Prime Minister, General Min Aung Hlaing, has been reported as

saying that securing an adequate electricity supply is a major challenge

An editorial in the state run newspaper lays the blame on those who have

destroyed power plants and power lines. All sectors, including the timber

industries are facing a serious power shortage and operating generators for

industial production is far too expensive.

Most of the industries in Yangon area are supplied only four hours in a day.

The residential areas in Yangon are faced with interrupted power supplies

sometimes for eight to twelve hours daily.

The long term power issue in Myanmar has now become problematic as the

Swedish/Finnish engineering services supplier AFRY has withdrawn from

Myanmar’s hydropower projects. AFRY was working on 13 hydropower projects.

See:

https://www.irrawaddy.com/news/burma/european-dam-specialists-withdraw-from-myanmar-amid-rights-concerns.html

Trade deficit

According to the Ministry of Economy and Commerce the trade deficit

was over US$774 million at the end of the fiscal year despite the target of

having a trade surplus of US$1,500 million dollars in the 2022-2023 fiscal

year.

In the 2022-2023 fiscal year (April to March) exports were valued at

US$16.575 billion. The value of imports was US$17.349 billion. Myanmar

exports agricultural products, animal products, fishery products, mining

equipment, forest products and industrial goods.

6.

INDIA

Surge in Covid infections

India recorded over 18,450 new Covid cases in the period 26 March

to 1 April, a doubling of the number in the previous seven days and the

number of cases continues to rise. A new variant of Covid-19 named “Arcturus”

is said to be behind the surge of infections. But an Omicron sub-variant

strain is on the verge of devastating the country as cases have soared

13-fold in the last month.

India's health ministry launched drills this week in an attempt to see if

hospitals are prepared to deal with a possible influx of patients following

the rise in cases.

See:https://www.independent.co.uk/news/health/arcturus-new-covid-variant-india-uk-b2319005.html

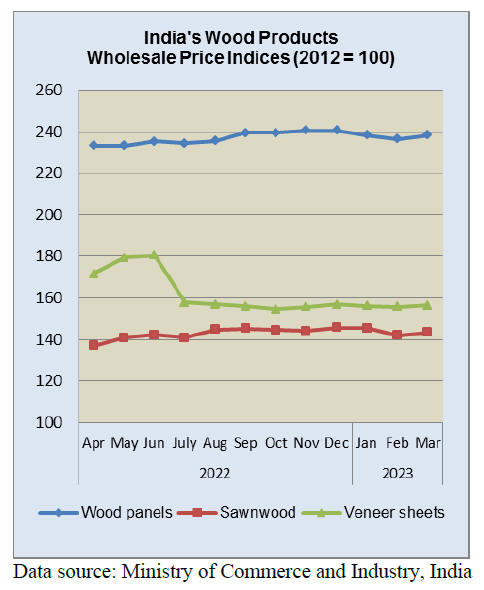

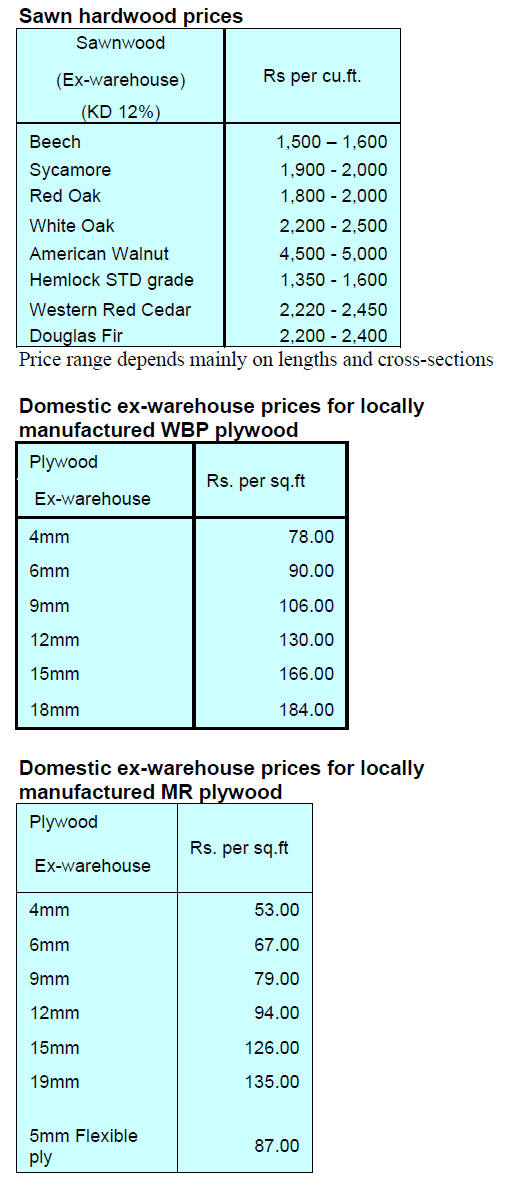

Timber price indices trend up

The annual rate of inflation based on all India Wholesale Price

Index (WPI) in March was 1.34% compared to 3.85% recorded in February 2023.

The decline in the rate of inflation in March was due to a fall in prices of

basic metals, food products, textiles, non-food articles, minerals, rubber

and plastic products, crude petroleum and natural gas and paper and paper

products.

Out of the 22 NIC two-digit groups for manufactured products 12 groups saw

increased prices while 9 saw a decline and one group remained unchanged.

The increase in prices was mainly contributed by machinery and equipment,

other transport equipment, leather and related products, electrical

equipment; fabricated metal products and other manufacturing.

The indices for wood panels, sawnwood and veneer sheets all rose in March.

See:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Growing demand for US hardwoods

US hardwood exports to India were at an all-time high in 2022 with

the value of hardwood sawnwood and veneer exports totalling US$8.62 million

according to the American Hardwood Export Council (AHEC).

The value of sawn hardwoods shipped from the US to India increased by 13%

US$6.902 million (up from US$6.120 million in 2021) but were down by around

4% in volume compared to 2021. Direct exports of US hardwood veneers to

India were worth US$ 1.716 million. India has seen a growing demand for US

hardwoods in recent years. AHEC participated at Delhiwood hich included 12

US based sawn hardwood exporters.

The top six American hardwood species exported to India last year were

Hickory (2,581cu.m), White Oak (3,173cu.m), Red Oak (2,334 cu.m), Ash (514

cu.m), Walnut (214 cu.m) and Maple (428 cu.m). Significant increases were

seen in the value and volume of exports of Red Oak, Maple, White Oak and

Walnut.

Roderick Wiles, AHEC Regional Director, is quoted by Miller Wood Trade as

saying “Increasing certification requirements and the restricted and

deteriorating quality of supply of domestic species is driving Indian

furniture manufacturers to look at viable alternative hardwood species not

only for the domestic furniture and interiors market but also for re-exports

of value-added product.“

See:

https://millerwoodtradepub.com/u-s-hardwood-exports-to-india-reach-all-time-high/

Plywood sales steady despite weakening housing market

Despite weakened demand for plywood new construction is sustaining

production by door and film faced shuttering plywood factories. PlyReporter

says demand has improved in all product categories including LVL, H beams,

non-densified and densified plywood.

Since the end of 2022 construction work slowed in many cities with 37

districts in the Indo-Gangetic Plain (IGP) being identified as air pollution

‘hotspots’, including nine districts in Delhi and those of Noida, Gurgaon,

Faridabad and Ghaziabad and there was a considerable drop in orders placed

with plywood manufacturers. PlyReporter says as the air quality has improved

construction work has resumed helping lift demand for plywood.

In other news, PlyReporter has said the 2023 government budget will boost

demand for plywood in the construction sector as plywood has been accepted

for use tier 3 and rural markets as traditional shuttering wood has become

more expensive.

See:

https://www.plyreporter.com/article/123486/booming-real-estate-helping-film-faced-plywood-demand

Urban housing shortage

According to a report from the Ministry of Housing and Urban

Poverty Alleviation (MHUPA), the urban housing shortage in India is

currently estimated at around 19 million. This gap is expected to further

widen to an estimated 38 million homes by 2030, largely due to the rising

population and increased urbanisation.

India built 5.28 million houses through the ural housing scheme in fiscal

2023, up 25% from a year earlier. The country proposes to build 5.73 million

houses under the Pradhan Mantri Awas Yojana (PMAY-G) in order to meet the

overall target of building 29.5 million houses under the scheme. Under the

PMAY-G, the central government bears 60% of the construction cost in most

states. However, this contribution goes up to 90% for north-eastern and

hilly states and to 100% for Union territories.

See:

https://economictimes.indiatimes.com/industry/services/property-/-cstruction/rural-housing-under-flagship-scheme-rises-25-in-fy23/articleshow/99648976.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

India-made containers

The Covid pandemic disrupted global trade and also impacted the

supply of shipping containers. Because there were only a few companies

manufacturing containers and because global output dropped demand exceeded

supply. India, as other countries, faced problems securing containers and

exports were delayed.

In response a decision was made by the government to help Indian container

manufacturers by providing them with advance orders channelled through the

Container Corporation of India (COCOR) which previously relied on China for

most of its containers. Now, CONCOR will be sourcing 8,000 containers from

domestic companies.

See:

https://www.oneindia.com/india/india-made-containers-a-success-story-3510171.html?story=3

Import cost driven up by weak rupee

The Indian rupee ended 2022 as the worst-performing Asian currency

having fallen 11% against the US dollar, its biggest annual decline since

2013. The rupee is anticipated to weaken against the US dollar in the first

half of 2023 because of concerns about global inflation and the risk to the

Indian economy. However, recovery prospects appear brighter in the second

half as crude oil and other commodity prices should fall.

See:

https://www.compareremit.com/money-transfer-tips/usd-to-inr-forecast-2023/

Falling productivity caused by high temperatures

Extreme heat as well air pollution are a health hazards and a

recent study from the University of Cambridge warns that heatwaves were

weakening India’s efforts to meet its Social Development Goals as extreme

heat could lead to a 15% decline in outdoor working capacity, reduce the

quality of life for up to 480 million people and cost 2.8% of GDP by 2050.

Falling productivity caused by extremely high temperatures could already be

costing India 5.4% of its GDP according to the Climate Transparency Report.

See:https://www.aljazeera.com/news/2023/4/20/indias-heat-putting-economy-development-goals-at-risk-study

and

https://www.climate-transparency.org/

7.

VIETNAM

Wood and Wood Product (W&WP) trade

highlights

Over the first 4 months of 2023 W&WP exports were valued at US$4

billion, down 28.5% against the same period in 2022. In particular, WP

exports contributed at US$2.6 billion, down 36.7% over the same period in

2022.

Vietnam's imports of wood raw material (logs and sawn-wood) in April 2023

is estimated at 432,300 cu.m worth US$155.6 million, up 15.4% in volume and

15.0% in value compared to March 2023.

However, compared to April 2022 imports are down 16% in value and down 22%

in value.

In the first 4 months of 2023, imports of wood raw material reached 1,309

million cu.m, worth US$474 million, down 25.4% in value and down 29% in

value over the same period in 2022.

Vietnam's exports of NTFPs in March 2023 earned US$62.53 million, up 10.4%

compared to February 2023 but down 30% compared to March 2022.

Overall, in the first quarter of 2023 Vietnam's exports of NTFPs amounted to

US$164.95 million, down 37.7% over the same period in 2022.

W&WP exports declining

W&WP exports during April 2023 are forecast to reach US$1.2

billion, up 5.5% compared to March 2023 but down 24.5% compared to April

2022.

WP exports, in particular, are estimated at US$820 million, up 6% compared

to March 2023 but down 28% compared to April 2022. Over the first 4 months

of 2023 W&WP exports are estimated at US$4.0 billion, down 28.5% against the

same period in 2022. Of this, WP exports are estimated at US$2.6 billion,

down 36.7% over the same period in 2022.

With the current growth rate W&WP exports in the first half of 2023 are

predicted to drop around 30% compared to the same period in 2022.

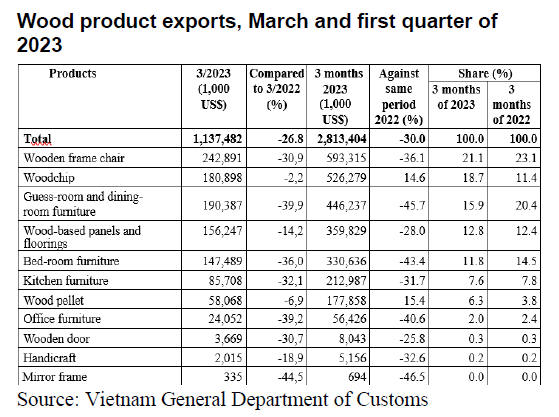

Export categories

In the first 3 months of 2023 wooden frame chairs were the leading

export product, contributing US$593.3 million, year-on-year down 36%;

followed by wood chips reaching US$526.3 million, up 14.6%; living and

dining room furniture US$446.2 million, down 46%; wood-based panels and

flooring US$359.8 million, down 28%; bedroom furniture US$330.6 million,

down 43.4%.

Amongst product categories exported in the first 3 months of 2023, only wood

chips and wood pellets had a positive growth rate.

Export growth of these types of wooden products is due to the increased

demand. However, the expansion of wood chip and pellet exports cannot

compensate for the downturn in the entire sector.

US imports down - Japanese imports up

Since W&WP exports to the US account for around half of the total

W&WP exports the decline in demand in this market led to the serious drop of

total exports in the first 3 months of 2023. Statistics show that in the

first 3 months of 2023 W&WP exports to US were valued at US$1.4 billion,

down 42.3% year-on-year.

The second largest market, Japan, imported W&WPs worth US$428.5 million in

the first quarter of 2023, up 8,8% compared to the same period in 2022.

Against the background of a sharp decline in global demand growth in the

Japanese market is highly appreciated.

However, to boost further the exports to the Japanese market Vietnamese

companies have been advised to create links with Japanese partners to

diversify furniture designs and strengthen trade promotion. W&WP produced in

Vietnam are exported to a number of other markets including China (US$374.2

million, up 6% over the same period in 2022), South Korea (US$207.7 million,

down 17%), EU (US$121.1 million, down 40%); UK (US$41.7 million, down 42%).

Wood sources in the first quarter 2023

Domestic sourcing

In the first 3 months of 2023 the area of newly planted forest

plantations is estimated at 38,700 hectares, up 5% over the same period last

year. Harvested wood volumes reached 3,349,200 cu.m, up 4%.

Imports

According to preliminary statistics, Vietnam's imports of logs and

sawnwood) in April 2023 are forecast at 432,200 cu.m worth US$155.6 million,

up 15.4% in volume and 15.0% in value compared to March 2023;

However, compared to April 2022 imports are forecast to be down by 16% in

volume and 22% in value.

In the first 3 months of 2023 the volume of wood imported from major sources

including the EU, China, USA, Thailand, Laos, Chile and New Zealand declined

year on year while imports of tropical hardwoods from Cambodia, Congo,

Malaysia, Angola and Indonesia increased.

Wood imported from the EU accounted for 14.4% of total wood imports reaching

134,300 cu.m, worth US$40.8 million, down 18% in volume and 20% in value

over the same period in 2022.

Imports of wood from China decreased by 31% in volume and 36% in value over

the same period in 2022, reaching 105,900 cu.m, worth US$51.7 million and

accounted for 11% of total wood imports.

Imports of wood from other markets fell compared to the same period in 2022:

from the US decreased by 7%; Thailand decreased by 25%; Laos decreased by

12%; Chile decreased by 22.7%; New Zealand fell 21%.

In contrast, imports of tropical hardwood from Cameroon increased by 6% in

volume and 10% in value over the same period in 2022, reaching 144,600 cu.m,

worth US$62.6 million and accounting for 16% of total wood imports.

Imports from Congo were up 3%; Malaysia increased by 89%; imports from

Angola increased by 26%; Indonesia increased by 67% and imports from Canada

increased by 17%.

Imported species

In the first 3 months of 2023 the volume of major species imported

into Vietnam, such as tali, pine, ash, oak, rubberwood, teak birch, doussie

and padouk declined compared to the same period in 2022.

Tali dominated imports with a 13% share of total imported wood in the first

3 months of 2023 reaching 121,300 cu.m, worth US$49.6 million, down 7.3% in

volume and 6.7% in value over the same period in 2022.

Pine imports decreased by 51% in volume and 61% in value over the same

period in 2022 (101,300 cu.m, worth US$22.7 million), accounting for 11% of

the total wood imports.

Ash imports decreased by 1% in volume and 12% in value over the same period

in 2022, reaching 86,600 cu.m, worth US$22.3 million.

In addition imports of some other species dropped in the first quarter of

this year (birch decreased by 26%, doussie by 22%, padouk by 8%, eucalypt by

74%, spruce decreased by 35%).

In contrast, oak imports in the first 3 months of 2023 increased by 1% in

volume but decreased by 7% in value over the same period in 2022, reaching

51,800 cu.m, worth US$29.0 million or 5.5% of total imports.

Exporters faced a severe challenge in the first quarter 2023

Vietnam's exports of wood and wood products are faced severe

challenge in the first 3 months of the year with a year-on-year drop of 30%.

To promote W&WP exports, wood businesses have been advised to look for new

customers available in various markets, such as Japan, China, South Korea,

the Middle East rather than just focus on the US and EU markets.

In this recessionary time Vietnamese wood product manufacturers have been

recommended to re-structure production lines, invest in new equipment and

technology to reduce labour costs. They have been advised to increase the

use of supplementary materials, including metal, stone, glass, fabric etc.

to diversify their raw material inputs and increase product aesthetics

towards meeting customer demands.

Fortunately, freight and logistic rates have been significantly reduced

which could help the wood industry in Vietnam regain export momentum from

the third quarter of 2023.

Preparing for the EUDR

The United Nations Development Programme (UNDP) and the Vietnam

Forestry Development Department under the Ministry of Agriculture and Rural

Development, jointly organised an event on deforestation-free agricultural

production and trade.

The workshop was a part of the fourth Global Conference of the One Planet

Network's Sustainable Food Systems Programme. A side event brought together

the experience and expertise of various institutions as well as introduced

case studies of emerging good practice interventions to adapt to the

requirements of deforestation free commodity production and trade.

See:

https://vir.com.vn/deforestation-free-agricultural-production-and-trade-101434.html

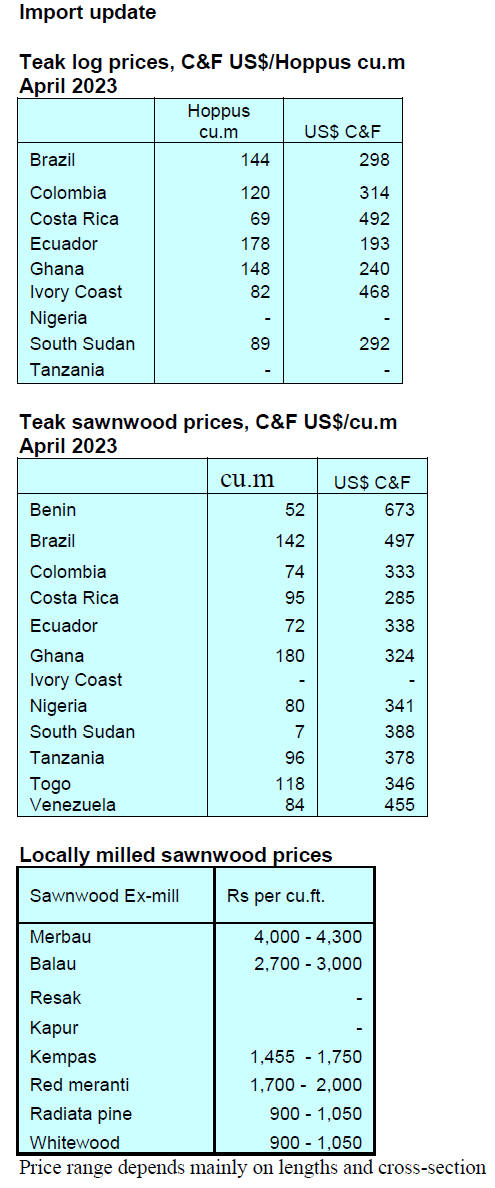

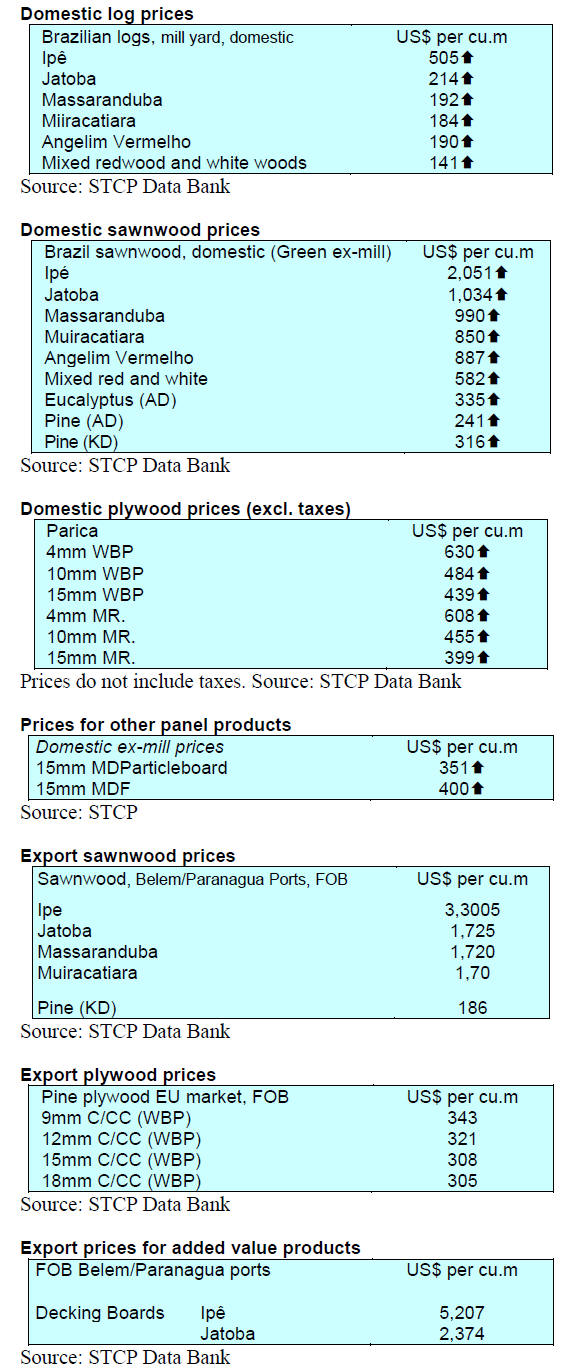

8. BRAZIL

Teak in Brazil

Teak (Tectona grandis) plantations have become profitable in the State of

Mato Grosso due to the favorable soil and climatic conditions. Brazil is the

largest teak producer in South America with 88,000 ha. according to the

Brazilian Tree Industry (IBÁ).

Of this total, 77% of the teak plantations are in Mato Grosso State. A

survey carried out by the Mato Grosso Institute of Agricultural Economics

(IMEA) shows that the area of teak forests in the state is around 68,000 ha.

According to a Brazilian company, Teak Resources Co. (TRC) plantation

technology has advanced considerably since the first afforestation efforts.

Productivity has risen and the form of the bole has improved. TRC reports it

has a traceability system and the products are FSC certified.

See:

https://www.canalrural.com.br/mato-grosso/reflorestamento-com-madeira-nobre-e-visto-como-solucao-sustentavel/

African mahogany in Brazil

African mahogany (Khaya Grandifoliola) wood, currently traded

mainly in the domestic market, comes from thinnings. Rough sawn timber is

classified into A+, A, B+ and B according to quality and size.

The measurement of A+ class is over 15 cm in width without defects and

trades at R$4,500.00/cu.m, The A class wood is between 11 cm and 15 cm wide

without defects and is traded at R$ ,800.00/cu.m.

The B+ class wood is over 15 cm in width with defined defects and is traded

at R$2,800.00/cu.m. B class is between 11 cm and 15 cm in width with defects

and traded at R$2,100.00/cu.m. All graded timber is sawn to order and

kiln-dried.

See:

https://abpma.org.br/jornais-abpma-2023/

Export update

In March 2023 Brazilian exports of wood-based products (except pulp

and paper) decreased 19% in value compared to March 2022, from US$423.2

million to US$341.9 million.

Pine sawnwood exports decreased 19% in value between March 2022 (US$73.9

million) and March 2023 (US$60.1 million). In volume, exports decreased 6%

over the same period, from 275,000 cu.m to 258,900 cu.m.

Tropical sawnwood exports fell 38% in volume, from 43,400 cu.m in March 2022

to 27,000 cu.m in March 2023. In value, exports decreased 18% from US$17.9

million to US$14.6 million over the same period.

Pine plywood exports experienced a 22% deline in value in March 2023

compared to March 2022, from US$86.6 million to US$67.5 million.

In volume, exports dropped 0.4% over the same period, from 214,300 cu.m to

213,500 cu.m.

As for tropical plywood, exports decreased in volume by 45% and in value by

44%, from 6,200 cu.m and US$3.2 million in March 2022 to 3,400 cu.m and

US$1.8 million in March 2023.

As for wooden furniture the export value fell from US$59.5 million in March

2022 to US$54.4 million in March 2023, an almost 9% drop.

IBAMA -CITES regulations on ipe and cumaru to be implemented from

2024

Two timber species from the Brazilian Amazon ipę (Handroanthus

spp.) and cumaru (Dipteryx odorata) were included in Appendix II of CITES

(Convention on International Trade in Endangered Species of Wild Flora and

Fauna) in November 2022. IBAMA (Brazilian Institute of Environment and

Renewable Natural Resources) has set November 2024 as the date for

implementing the CITES requirement for the export of these timber species,

thus applying the maximum timeframe allowed by CITES.

Ipę is used to for decks, flooring, furniture and construction and is in

great demand. According to CITES, 469,600 cu.m of ipę from the Amazon were

legally exported between 2017 and 2021, of which 96% from Brazil. During

this period the international consumption of ipę from Brazil grew 126%,

according to IBAMA. The United States is the largest market for ipę

accounting for 36% of exports.

Pará State is the largest exporter of timber from natural forests in Brazil

according to IBGE (Brazilian Institute of Geography and Statistics); 212,000

cu.m of timber were exported between 2020 and 2021, of which 4% was ipę.

For Imaflora (Institute of Agricultural and Forest Management and

Certification), the inclusion of the two species in CITES Appendix II is

important to lower the risk of these species becoming endangered.

See:

https://noticias.uol.com.br/politica/ultimas-noticias/2023/04/08/sob-governo-do-pt-ibama-adia-restricao-a-exportacao-de-madeira-nativa.htm

Furniture exports dropped at the beginning of 2023

Brazilian furniture exports started 2023 with a 25% decline in

January compared to a month earlier. The US$45 million in January 2023

exports were sharply down on the US$68 million exported in January 2022.

The US continues to be the main international market for Brazilian

furniture, US$14.4 million in January 2023 or 32% of all January exports.

Exports to Uruguay, second placed in the ranking of the main importing

countries, grew in 2023.

There are four major export categories in the

sector, wooden furniture, upholstered furniture, metal furniture and

mattresses. Wooden furniture represented 81%, upholstered furniture (12%),

mattresses (4%) and metal furniture (3%). In January this year wooden

furniture exports were down 3% year on year.

See:

https://emobile.com.br/site/industria/exportacoes-de-moveis-e-colchoes-abrem-2023-em-queda/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Brazil.

See:

https://www.itto-ggsc.org/static/upload/file/20230414/1681442042214477.pdf

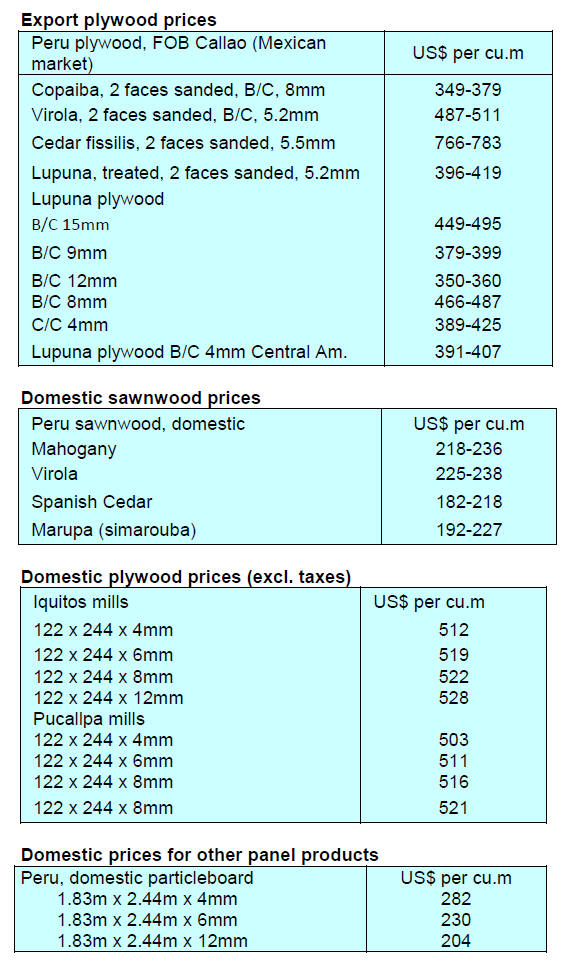

9. PERU

Export shipments of sawnwood up

slightly

Exports of sawnwood in the first two months of this year were worth

US$6.3 million, a slight increase (1.2%) year on year. Sawnwood accounted

for 35% of the value of wood product exports according to the Association of

Exporters (ADEX).

This was the highest amount (January - February period) since 2014 when

exports reached US$10.6 million. In the past five years export shipments

have not been stable, in 2019 they totalled US$3.1 million, in 2020 US$6.1

million, in 2021 US$4.0 million and in 2022 US$6.2 million.

Despite a 26% decline in the value of imports the Dominican Republic was the

top buyer of Peruvian sawnwood importing US$1.9 million in the first two

months of 2023. China was the second destination at US$1.5 million but for

China there was an over 80% increase in the value of shipments year on year.

The other markets were Mexico (US$1.1 million), Ecuador (US$0.61 million),

USA (US$0.30 million), Vietnam (US$0.19 million), South Korea (US$0.15

million), Jamaica (US$0.11 million), Canada (US$0.10 million) and Australia

(US$0.07 million).

In the first two months of the year the main regions from which sawnwood was

exported were Lima (US$2.8 million) and Ucayali (US$2.3 million). These two

regions had a share of 81% of the total shipments. Other exporting regions

were San Martín (US$0.54 million), Madre de Dios (US$0.23 million), Loreto

(US$0.18 million), Junín (US$0.16 million) and Huánuco (US$0.06 million).

New communication tool - the ‘Electronic Box’

A Regulation on the Electronic Box Notification System published on

25 April this year by the Forestry and Wildlife Resources Supervision Agency

(OSINFOR) provided that holders of forest titles will have an individual

account in the ‘Electronic Box’ that will be provided by OSINFOR to

facilitate communications, the sending of alerts and notifications in order

to improve the exchange of documentation and enhance coordination.

According to OSINFOR the ‘Electronic Box’ is a digital tool that will

guarantee the efficiency, confidentiality, authenticity, integrity and

availability of the information sent and received between holders, entities,

the general public and OSINFOR. In addition, it will contribute to saving

time in procedures and other administrative actions both for OSINFOR and for

forest owners and agent as well as other entities related to the sector.

SERFOR works with regional governments to

verify the legality

With the technical assistance of the National Forestry and Wildlife

Service (SERFOR) the regional governments of Madre de Dios, Loreto, Ucayali

San Martín and the Central Forestry and Wildlife Technical Administration

have developed digital tools that will help verify the legal origin of wood.

There are three applications that are part of the Control Module of the

National Forest and Wildlife Information System (MC-SNIFFS), the Issuance

and Registration of Forest Transport Guide, the Electronic Operations Books

of Authorising Titles and the Electronic Operations Books of Primary

Transformation Centers.

The new tools provide a means for recording information on the traceability

of the wood from its origin, tracking the location and movement of forest

products throughout the production chain in order to be able to corroborate

the legal origin and promote competitiveness.