US Dollar Exchange Rates of

10th

Apr

2023

China Yuan 6.88

Report from China

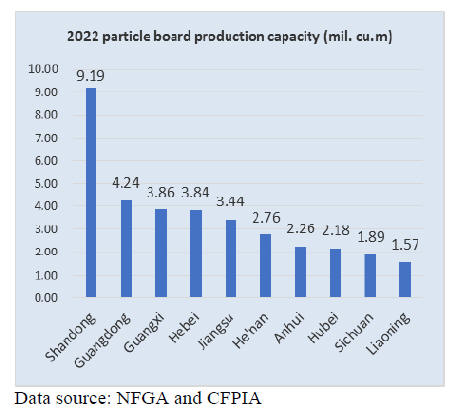

Particleboard production capacity in 2022

According to the Academy of Industry Development and

Planning under the National Forestry and Grassland

Administration (NFGA) and the China Forestry Products

Industry Association (CFPIA) there were 295

particleboard manufacturing enterprises and 314

production lines at the end of 2022 with a production

capacity of 41.48 million cubic metres, up 6% year on

year.

19 production lines began operation nationwide in 2022

adding a production capacity of 5 million cubic metres per

year. The average single-line production capacity further

increased to 132,000 cubic metres per year.

Both the number of enterprises and the number of

production lines in China's particleboard industry have

declined for three consecutive years while the total

production capacity and average single line production

capacity continued to rise.

Shandong Province was the largest in terms of

particleboard production capacity at 9.19 million cubic

metres in 2022, accounting for 22% of the national total.

The production capacity in Guangdong, Guangxi, Hebei

and Jiangsu all increased slightly, reaching 4.24 million

cubic metres, 3.86 million cubic metres, 3.84 million cubic

metres and 3.44 million cubic metres annually

respectively.

By the end of 2022 there were 92 continuous flat-pressed

particleboard production lines in China with a total

production capacity of 23.96 million cubic metres per

year, accounting for 58% of the total production capacity

distributed in 18 provinces and regions.

There were 36 large-scale particleboard production

enterprises and groups in China, an increase of 7

enterprises and groups over 2021, with a total production

capacity of 17.46 million cubic metres per year,

accounting for 43% of the total production capacity.

See:

https://www.forestry.gov.cn/main/586/20230227/090603264592795.html

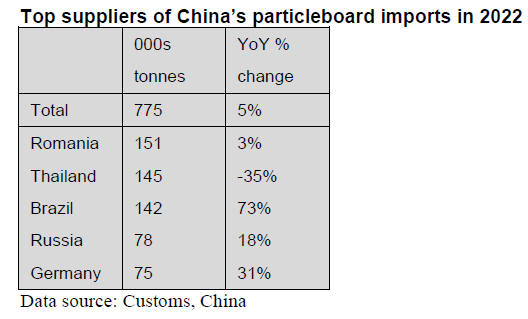

According to China Customs, particleboard imports were

775,000 tonnes valued at US$410 million, up 5% in

volume and 27% in value year on year in 2022.

The top suppliers were Romania, Thailand, Brazil,

Russia

and Germany. China’s particleboard imports from

Romania, Brazil, Russia and Germany rose 3%, 73%, 18%

and 31% to 151,000 tonnes, 142,000 tonnes, 78,000 tonnes

and 75,000 tonnes respectively. In contract, China’s

particleboard imports from Thailand fell 35% to 145,000

tonnes in 2022.

Rise in particleboard exports to Japan

According to China Customs, particleboard exports

totalled 370,000 tonnes valued at US$391 million, down

36% in volume and 9% in value year on year in 2022.

Taiwan P.o.C, Mongolia and Japan were the top three

destinations in 2022. Taiwan P.o.C was the largest

destination for China’s particleboard exports, (up 21%

year on year) in 2022. China’s particleboard exports to

Japan surged 480% to 37,000 tonnes valued at US$25

million, up more than 200% year on year in 2022.

Rubberwood imports – prices falling

It is estimated that over the past five years China's imports

of sawn rubberwood and rubberwood products from

Thailand remained stable and accounted for about 3% of

China's total import of goods from Thailand.

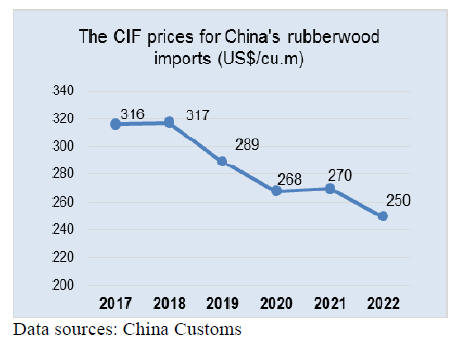

According to data from China Customs both the imported

volume and average CIF price of sawn rubberwood from

Thailand showed a decreasing trend from 2017 to 2022.

China imported 3.97 million cubic metres of sawn

rubberwood, with the average CIF price reaching the

lowest at US$250 per cubic metre in 2022. China’s sawn

rubberwood imports fell to 3.97 million cubic metres in

2022 from 4.82 million cubic metres in 2017.

The average CIF price for China’s sawn rubberwood

imports fell to US$250 per cubic metre in 2022 from

US$316 per cubic metre in 2017.

The supply-side reform of China's rubberwood industry

has accelerated since 2018 with the elimination of low-end

production capacity and products, the resilience of the

supply chain increasing and the industry moving to higher

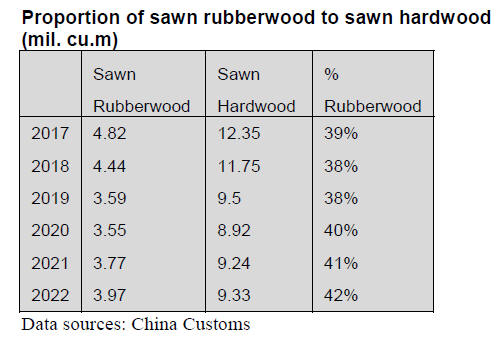

quality development. The import volume of sawn

rubberwood is the largest single category of sawn

hardwood imported from Thailand, accounting for around

40% annually in recent years.

Thai rubberwood is widely used in China. At present the

end products are mainly furniture, wooden doors,

bathroom cabinets, floors, kitchenware, custom homeware.

Now China's home furnishing market is changing to the

direction of personalisation and customisation which

constantly leads the development of rubberwood industry.

New products based on Thai rubberwood emerge in an

endless stream, the supply capacity of high-quality

products is constantly improved and the industrial

structure is further optimised.

2022 sales of flooring in China

According to initial statistics of China National Forest

Product Industry Association (CNFPIA) sales of flooring

products by enterprises with large production in China in

2022 were about 815.6 million square metres, down 11%

year-on-year.

Sales of wood and bamboo flooring were around 354

million square metres, down 14% year on year in 2022. Of

the total, sales of laminate wood flooring amounted to 158

million square metres, a year-on-year decline of 19%.

Sales of solid wood composite flooring were 128 million

square metres, down 13.3%. Solid wood flooring sales of

33 million square metres were down 15% year on year.

Sales of bamboo flooring reached 29.6 million square

metres, a year on year growth of 14%. Sales of wood and

plastic floor amounted to about 73 million square metres,

down 8% year on year. 70% of them were exported of

which 95% were outdoor wood and plastic floor in 2022.

March GGSC report

In March 2023, China's new leadership was elected and a

plan was made for the promotion of Chinese-style

modernisation. The 2023 Government Work Report set

China's GDP growth target at 5% for 2023 and pointed out

that China should encourage the expansion of domestic

demand and create a fair competition and better

development environment for enterprises.

According to data released by the National Bureau of

Statistics, in the first quarter of 2023, China's GDP

reached 9631.1 billion RMB, an increase of 9.7% over the

same period last year.

In March, China's manufacturing PMI index registered

51.9%, demand in the the manufacturing sector continued

to rise, production activities maintained a steady recovery

and shipments were relatively smooth.

In March 2023, with the better macroeconomic trends the

development of China's timber products manufacturing

sector continued to improve. The number of orders and

production of enterprises increased for two consecutive

months, export orders also showed a growth trend, market

trading activities gradually became active and purchasing

volume also increased for two consecutive months.

However, compared with previous years the performance

of timber market demand was still unsatisfactory,

especially the overall export orders have been reduced

compared with previous years.

In March the GTI-China index registered 53.9%, an

increase of 1.5% from the previous month and as above

the critical value (50%) for 2 consecutive months,

indicating that the business prosperity of the timber

enterprises represented by the GTI-China index has

expanded from February.

See:

https://www.ittoggsc.org/static/upload/file/20230414/1681442042214477.pdf

Correction

In the end March report it was stated that China had, over the

past ten years, planted more than 613 million hectares. This was

incorrect it should have read 92 mil. mu or 6.1 mil. ha.

|