US Dollar Exchange Rates of

25th

Mar

2023

China Yuan 6.872

Report from China

Real estate development

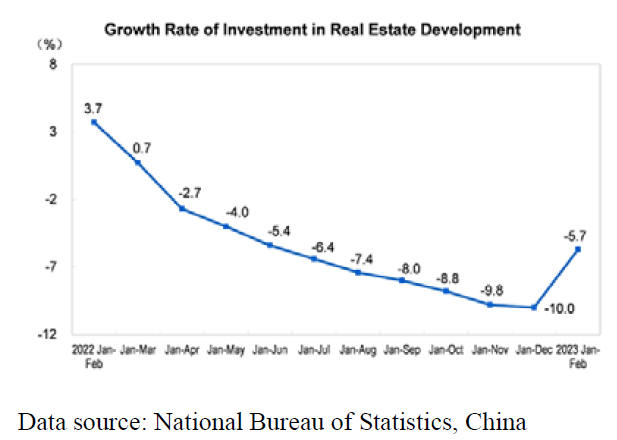

A press release from the National Bureau of Statistics

provides details of National Real Estate Development and

Sales between January and February 2023. National real

estate development investment was 1,366.9 billion yuan, a

year-on-year decline of 5.7%, residential investment was

down 4.6%.

The area of newly constructed houses was 135.67 million

square metres, down 9.4% and the area of newly started

residential homes was 98.91 million square metres, down

8.7%.

See:

http://www.stats.gov.cn/english/PressRelease/202303/t20230317_1937561.html

Sales of furniture rise 5.2%

Another press release from the National Bureau of

Statistics of China reports total retail sales of consumer

goods. From January to February retail sales of consumer

goods were 7,706.7 billion yuan, a year-on-year increase

of 3.5%; excluding cars the figure jumped to 5%. Sales of

furniture rose 5.2% in the first two months of this year but

sales of decorative materials for home interiors fell 1%.

See:

http://www.stats.gov.cn/english/PressRelease/202303/t20230317_1937555.html

Vietnam final anti-dumping ruling on tables, chairs and

accessories from China

In February 2023 the Ministry of Industry and Trade in

Vietnam issued Resolution No. 235/QD-BCT making a

final and definitive anti-dumping ruling on tables, chairs

and accessories from China imposing an anti-dumping

duty of 21.4% on chairs and 35.2% on tables and

accessories from China.The Vietnamese tax HS codes of

the products involved are 9401.3000, 9401.4000,

9401.6100, 9401.6990, 9401.7100, 9401.7990, 9401.8000,

9401.9040, 9401.9092, 9401.9099, 9403.3000, 9403.6090

and 9403.9090. The measures will take effect from 13

February 2023.

See:

http://chinawto.mofcom.gov.cn/article/dh/janghua/202302/20230203392798.shtml

Implementation Plan for National Reserve Forest

Development

It has been reported that the Implementation Plan for

National Reserve Forests Development during the 14th

Five-Year period was released recently. More than 2.46

million hectares of national reserve forests will be planted

and more than 70 million cubic metres of forest stocking

volume will be created.

Of the 2.46 million hectares of national reserve forest

during the 14th Five-Year Plan period 1.52 million

hectares of medium and short growth cycle industrial raw

material forests and nearly 0.94 million hectares of long

growth cycle, large diameter timber forest will be planted

or existing forest will transformed.

In order to establish a national timber security system the

Chinese government started the national reserve forest

project in 2012. By 2022, the project covered 29 provinces

(autonomous regions and municipalities), six forest

industry (forestry) groups and Xinjiang Production and

Construction Corps.

In the past ten years, more than 613 million hectares of

national reserve forest have been planted and the total

stock volume of the project area has increased by 270

million cubic metres with an average annual stock volume

growth of about 10.8 cubic metres per hectare.

About 150 million cubic metres of timber have been

produced from the national reserve forest.

The construction of national reserve forests has provided a

total of more than 3.6 million jobs in the past ten years and

the income of timber output has exceeded RMB150

billion.

See:

https://www.forestry.gov.cn/main/3957/20230316/142948367943510.html

and

http://www.gov.cn/xinwen/2023-03/17/content_5747136.htm

Nankang furniture makers seek secure raw material

supply in Thailand

China’s Nankang Furniture Economic and Trade

Cooperation Delegation just finished trade visits to

Malaysia and Thailand.

In order to improve the wood supply for the of Nankang

furniture industry, enhance competitiveness and secure the

supply chain an Economic and Trade Cooperation

Delegation visited the Wood Processing Branch of the

Federation of Thailand Industries and the Rubber Wood

Industry Association of Thailand.

The Delegation signed a strategic cooperation agreement

with Thailand Rubber Wood Industry Association and

promoted the implementation of "Nankang Furniture Raw

Material Reserve (Thailand) Base".

The agreement aims to ensure a raw material supply for

the Nankang furniture industry.

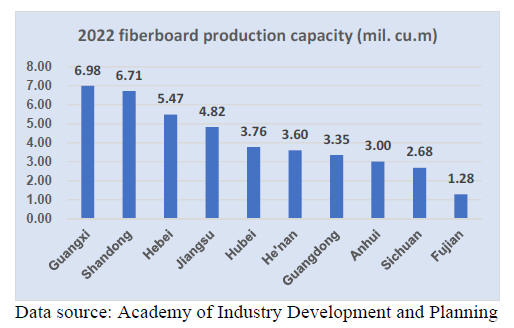

Fibreboard production capacity in 2022

According to the statistics from the Academy of Industry

Development and Planning under the National Forestry

and Grassland Administration and the China Forestry

Products Industry Association (CFPIA), both the number

of enterprises and production capacity of China’s

fibreboard industry declined in 2022.

There were more than 344 fibreboard manufacturing

enterprises (down 19% year on year) at the end of 2022

with a production capacity of 47.78 million cubic metres,

down 11% over 2021.

Guangxi Zhuang Autonomous Region was the largest in

terms of production capacity at 6.98 million cubic metres

exceeding Shandong Province in 2022. Shandong

Province's production capacity dropped sharply to 6.71

million cubic metres per year, dropping out of the first

ranking for the first time but still accounting for 14% of

the national total.

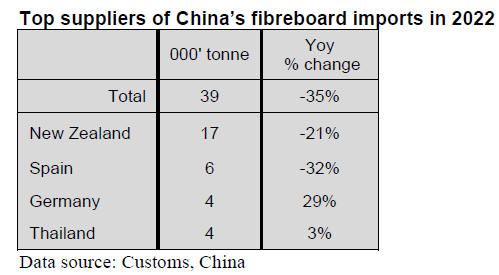

Rise in fibreboard imports from Germany

According to Customs data HS code 4411 imports

(including fibreboard + laminate floors) were 94, 000

tonnes valued at US$98 million, down 34% in volume and

26% in value year on year in 2022. China’s fibreboard

imports were 39,000 tonnes valued at US$32 million,

down 35% in volume and 25% in value year on year in

2022. New Zealand and Spain are the two top suppliers for

China’s fibreboard imports in 2022.

China’s fibreboard imports from New Zealand and Spain

fell 21% and 32% to 17,000 tonnes and 6,000 tonnes

respectively. However, China’s fibreboard imports from

Germany rose 29% year on year to 4,000 tonnes in 2022.

In addition, China’s fibreboard imports from Thailand

grew 3% also to 4,000 tonnes year on year in 2022.

Nearly 80% of national fibreboard imports were from the

above-mentioned top supplier countries, New Zealand,

Spain, Germany and Thailand in 2022.

Germany the largest suppliers for China’s

laminate

floors

China’s laminate flooring imports were 55,000 tonnes

valued at US$65 million, down 33% in volume and 27%

in value year on year in 2022. Germany was the largest

supplier in 2022. Thailand was the second largest supplier

of China’s laminate flooring imports in 2022. China’s

laminate floors imports from the two countries accounted

for nearly 60% of the national total.

China’s laminate floors imports from Germany fell 50% to

18,000 tonnes year on year in 2022 which resulted in the

decrease in China’s total laminate floors imports. In

contrast, China’s laminate floor imports from Thailand

rose 18% to 13,000 tonnes year on year in 2022.

|