|

Report from

North America

Extent of slide in US imports revealed by stark

January-to-January comparisons

Although US imports of tropical hardwood and related

products showed significant growth in 2022 they have

experienced a steady regression in recent months. As the

decline continued into January this year, comparisons

versus January 2022 show imports now lagging far behind

the previous year. While not all products are down,

imports of hardwood plywood, sawn tropical hardwood

and wooden furniture have all begun 2023 significantly

weaker than the previous year.

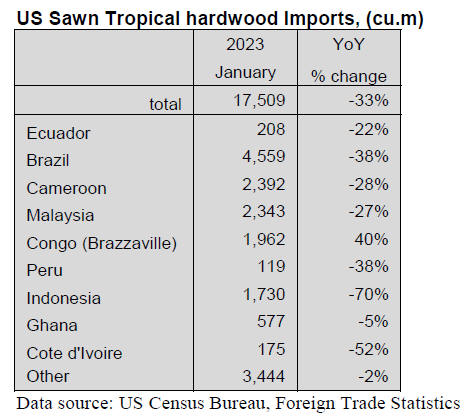

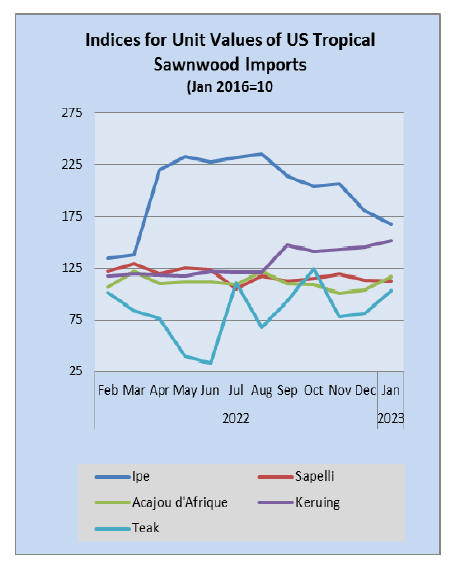

Sawn tropical hardwood imports fall for fourth

consecutive month

US imports of sawn tropical hardwood fell for a fourth

consecutive month in January. The 17,509 cubic metres

imported in January was down only 2% from December

but was 33% lower than that of January 2022. Imports

from most countries were down sharply from the previous

January with imports from Indonesia (down 70%) and

Cote d’Ivoire (down 52%) seeing the steepest declines.

Imports of Ipe more than doubled from the previous month

but were still less than half that of last January, while

imports of Keruing fell 34% for the month and 26% from

the previous January. Imports of Sapelli, Jatoba, Teak and

Balsa also showed substantial losses for the month.

On the upside, imports of Cedro rose 41% in March and

were 40% better than the previous January, while

Mahogany imports were 45% better than last January

despite a 3% drop from December.

Canada’s imports of sawn tropical hardwood also fell in

January, decreasing 15% from the previous month. The

decline was due chiefly to a 20% drop in imports of

Sapelli. Despite the decline, overall imports were 11%

higher than January of last year. Canada imported more

than US$22 million of sawn tropical hardwood in 2022, up

36% over the previous year.

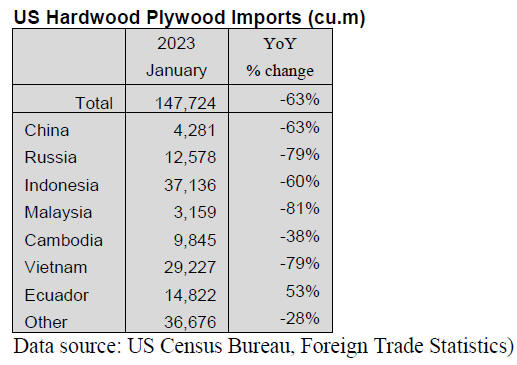

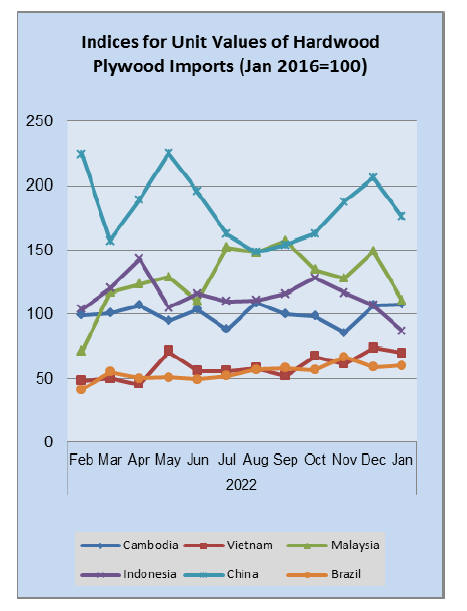

Hardwood plywood imports hit lowest level since 2010

After two months of drastic declines, US imports of

hardwood plywood fell again in January this year but only

by a small margin. The 147,724 cubic metres imported in

January was 3% lower than the previous month, but a full

63% lower than in January 2022. This volume was the

lowest since December 2010.

Imports from several top trading partners actually

improved over December but was still well behind the

levels from a year ago—imports from Vietnam, for

example, gained 39% last month over the previous month,

but were 79% less than last January. After months of

volatility, imports from Russia have appeared to stabilize

at a reduced level, falling less than 1% for the month but

also down 79% from the previous January.

US veneer imports lag on weak Italy trade

US imports of tropical hardwood veneer fell 8% in

January despite large gains by some key trading nations.

Imports from India and Cameroon were both more than

double the previous month and made even higher gains

over January 2022. Even imports from Ghana and China,

which saw significant declines from the previous month,

still more than doubled January 2022 figures.

Yet, imports from Italy, the top trading partner, fell a

striking 76% from the previous month and 83% from the

previous January. While it appears other suppliers may be

gaining market share from Italy, veneer import figures

from Italy are often erratic and not predictable by season.

This will be worth watching in the next couple of months.

Total tropical hardwood veneer imports in January

outpaced those of January 2022 by 5%.

Hardwood flooring imports rise on surge from

Indonesia

US imports of hardwood flooring rose 7% in January as

imports from Indonesia continued to surge. Imports from

Indonesia rose 15% in January, gaining for the fifth

consecutive month.

At US$1.67 million, imports from Indonesia reached their

highest total since November 2012 and greatly outpaced

January 2022 imports, which were less than US$100,000.

Imports from China and Brazil both gained nicely versus

the previous month but were well behind last January with

imports from China down 29% and imports from Brazil

down 37%.

Imports from Malaysia were flat month-to-month and

down 14% from last January. Total imports in January

were up 17% over January 2022.

Imports of assembled flooring panels fell for the fourth

straight month, losing 7% in January. The decline from

last month was chiefly due to a 36% drop in imports from

Thailand and a 25% slide in imports from China.

Total imports are down by a massive 46% versus the

previous January, with imports from Thailand down 85%,

imports from China down 48%, and imports from Vietnam

down 41%.

Moulding imports down

US imports of hardwood moulding fell 8% in January,

dropping for a fourth consecutive month. A decline in

imports from China offset gains in imports from Malaysia

and Brazil.

The 26% drop in imports from China left January imports

from China at less than half of their January 2022 level,

and despite their rise from December’s figures, imports

from Malaysia were 44% off their January 2022 pace.

Total imports of hardwood moulding are down 22% from

the previous January.

US wooden furniture imports begin to recover

US imports of wooden furniture rose 6% in January,

stemming a steady slide from the record levels set in the

summer. The US$1.8 billion in January imports is 15%

below the January 2022 figure. The gain was due to

increasing imports from India (up 38%) and Indonesia (up

25%). Despite small gains for the month from most

trading partners, imports from most counties are down

versus a year ago. The exception is imports from Canada,

which are up 10% from last month and up 8% from the

previous January.

US cabinet sales rose 16% in 2022, continued growing

in January

According to the Kitchen Cabinet Manufacturers

Association’s monthly Trend of Business Survey,

participating cabinet manufacturers reported an increase in

overall cabinet sales of 6.5% for January 2023 compared

to the same month in 2022.

KCMA reported that 2022 sales topped those of 2021

across the board. Overall cabinet sales were up 16.4% for

the year, custom sales rose 17.8%, semi-custom gained

17.4%, and stock sales rose 15.5%. KCMA Survey

participants include stock, semi-custom and custom

companies whose combined sales represent approximately

75% of the US kitchen cabinet and bath vanity market.

See:

https://kcma.org/insights/january-trend-business-report

|