Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Mar

2023

Japan Yen 136.0

Reports From Japan

March disaster remembered

Events were held around Japan to commemorate the 12th

anniversary of the Great East Japan Earthquake and

tsunami. At 2:46 p.m. on March 11, 2011, a magnitude-9.0

quake struck off the coast of Japan sending waves as high

as 10 metres crashing into coastal communities. Over

120,000 homes were destroyed.

As a result of the tsunami the Fukushima Daiichi nuclear

power plant suffered a triple meltdown releasing large

amounts of radioactive substances into the atmosphere.

Hundreds of thousands of people were forced to abandon

their homes. More than 300 square kilometres of land near

the power plant are still classified as uninhabitable.

Although evacuee numbers have steadily declined, as of

November 2022, 31,438 people remain in temporary

accommodations in Tōhoku, Kanto and other regions. The

majority, some 21,000 evacuees, are from Fukushima

Prefecture home to the crippled nuclear power plant.

See:

https://www.nippon.com/en/japan-data/h01600/

Largest pay rises in two decades agreed

Every March major Japanese firms meet with unions for

wage talks and the deal struck by the big companies

influence wages at smaller firms that employ seven out of

10 Japanese workers. The outcome of this year’s

negotiations will influence how soon the BoJ could begin

to raise interest rates. Improved wages are crucial drivers

of domestic demand.

Japan’s big companies have delivered the largest pay rises

in more than two decades which policymakers hope will

lift the economy from its current deflationary mode. The

wage negotiation outcome will also impact how effective

is the Prime Minister “new capitalism” policy that aims to

more widely distribute wealth among households,

something that builders, wood product manufacturers and

importers have been hoping for.

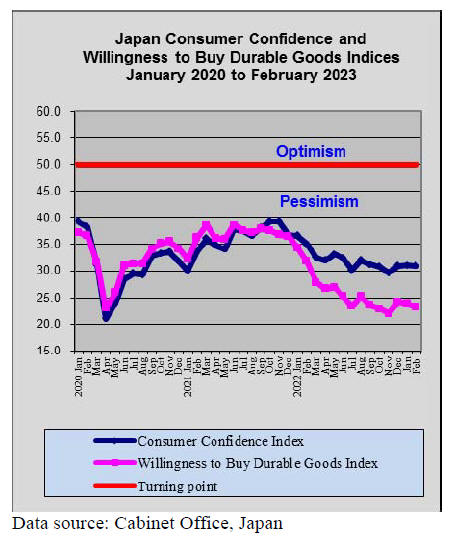

According to the Ministry of Internal Affairs and

Communications, household spending in January fell from

a year earlier and was the third successive monthly

decline. Private consumption is one of Japan’s key

economic drivers accounting for more than half of the

country’s GDP.

Companies prepare for improved demand

Finance Ministry data shows that, for a seventh straight

quarter up to the end of 2022, Japanese companies

increased capital investment. In the final quarter of 2022

there was an almost 8% increase in investment signaling

that companies prepare for the improvement in demand as

covid rules are eased and as wage increases are anticipated

which could drive up demand.

See:

https://www.japantimes.co.jp/news/2023/03/02/business/economy-business/japanese-firms-spending-raised/

‘Real’ wage shock in January

Data show Japanese ‘real’ wages fell by 4.1% from a year

earlier in January, the 10th consecutive month of decline

as inflation continued to outpace gains in wage which,

according to the Japan Times, suggests it is likely that the

Bank of Japan will maintain its easy policy in the short

term.

https://www.japantimes.co.jp/news/2023/03/07/business/economy-business/japan-wages-down-january/

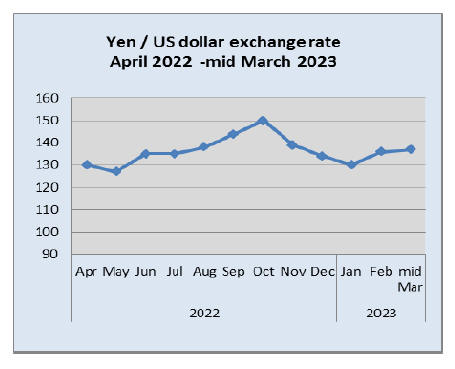

BoJ sticks to past policy, yen steady

In mid-March the yen was trading at almost 137 to the US

dollar. At the latest Bank of Japan policy meeting for the

sitting governor, the decision was to keep interest rates

where they have been pegged since 2016 until there is

evidence that inflation is being driven by wage growth

rather than external factors such as commodity prices.

Wage growth is a key factor in the Bank of Japan’s ultraloose

policy.

See:

https://www.marketpulse.com/20230310/japanese-yenslips-after-boj-maintains-policy-settings-us-nonfarm-payrollsloom/kfisher

New measures to address unoccupied house

issue

The government has introduced measures aimed at

addressing the issue of unoccupied houses said to run to

around 8 million. The measures allow municipal

governments to promote the use of vacant homes mainly

in city centers and tourist spots through easing regulations

so it is possible to change the use of land plots where

unoccupied houses stand.

The new measures also try to prevent an increase in empty

houses through excluding homes from the current low

fixed asset tax.

See:

https://www.nippon.com/en/news/yjj2023030300152/

Import update

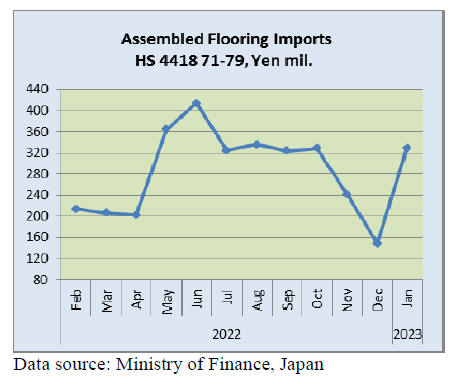

Assembled wooden flooring imports

After two consecutive months of decline the value of

Japan’s imports of assembled wooden flooring

(HS441871-79) in January almost doubled compared to

the value of December 2022 imports. This jump brings the

value of imports back to the range seen in the second

quarter of 2022.

Year on year the value of January 2023 imports of

assembled wooden flooring was up 23% with China being

the main shipper accouting for 62% of Janaury imports

followed by Malaysia (10%) and Vietnam (7%).

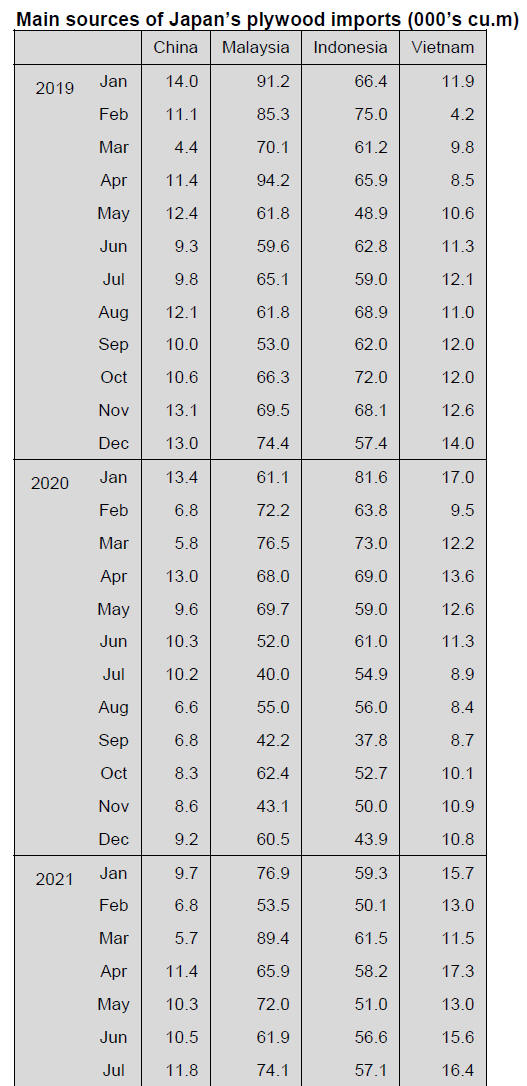

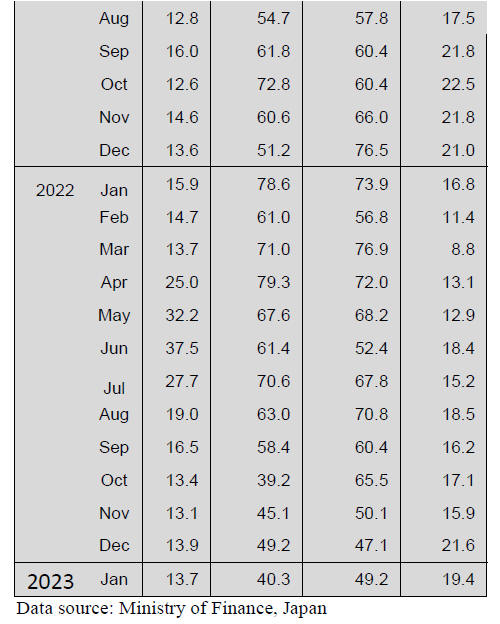

Plywood imports

In the second half of 2022 there was a steady decline in

the volume of plywood imports. Indonesia and Malaysia

are the main sources of Japan’s plywood imports and this

has not changed over the past decade. In 2022 these two

suppliers accounted for over 80% of the volume of Japan’s

plywood imports. For 2023 the Japan Lumber Importers

Association has forecast a 2-3% decline in the volume of

plywood imports.

In January 2023 shipments of plywood from Malaysia and

Indonesia were around 40% below those in January 2022.

There was a decline in shipments from China in January

2023 but shipments from Vietnam rose month on month

and year on year. Compared to the volume of plywood

arrivals in December 2022 there was a 6% decline in

January 2023.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

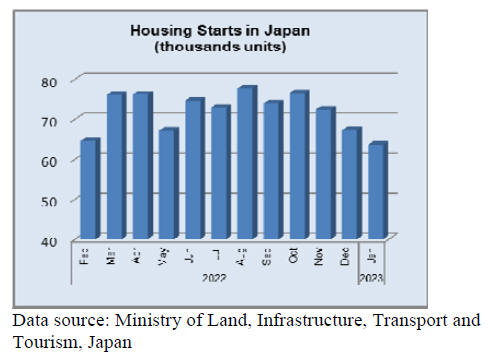

Structural laminated lumber import in 2022

Total import of structural laminated lumber in 2022 is

906,288 cbms, 9% more than 2021. This is for the first

time in two years for exceeding 900,000 cbms. However,

the imported structural laminated lumber has been

overstocking since last July in Japan because the total

starts in 2022 declined 4.9% from the previous year’s

starts.

The volume of structural laminated lumber from Finland

increases and it occupies 40% of the total volume. On the

other hand, the volume of Russian structural laminated

lumber decreases 10.3% and of Chinese structural

laminated lumber decreases 12.7% from the previous year.

Violent fluctuations in the volume of imported laminated

lumber occurred in 2022. Monthly average volume is

70,000 cbms but it was 80,000 – 100,000 cbms at the

beginning of 2022 and in the summer season. Then, the

volume declined to 40,000 cbms at the end of 2022.

Comparing the volume of November or December, 2022

against the highest volume in 2022, Estonia and Poland

are 40% down, Finland and Austria are 60% down,

Sweden is 70% down, Romania is 90% down and

Germany is zero.

By size, small is 602,984 cbms, 26.7% up. Medium is

303,110 cbms, 14.7% down. Large is 194 cbms, 59.8%

down. Total import cost is 108 billion yen. This is doubled

import cost from 2021’s import cost and this is 2.5 times

of import cost from 2020’ import cost. One of the reasons

for the increase in 2022 is that the lumber, which were

contracted at 4Q of 2021 arrived to Japan in 2022 due to a

shortage of containers.

A rule for wood business will be mandatory

The Ministry of Agriculture Forestry and Fisheries, The

Ministry of Land, Infrastructure, Transport and Tourism

and The Ministry of Economy, Trade and Industry

consider that ‘Type 1 Wood-related Business’ of the Clean

Wood Act must be mandatory in 2025. ‘Type 1 Woodrelated

Business’ means the business of processing,

exporting selling logs or importing the wood and wood

product.

The Clean Wood Act is also called The Act on Promotion

of Use and Distribution of Legally-harvested Wood and

Wood Products and it went into force on 20th May, 2017.

The Objective of the Clean Wood Act is to promote the

used and distribution of wood and wood products made

from trees harvested in compliance with the laws and

regulations of Japan and the countries of origin.

Plywood

The prices of 3 x 6 12mm thickness of domestic softwood

plywood are 1,900– 1,950 yen, delivered per sheet and of

3 x 6 24mm thickness are 3,800 – 3,900 yen, per sheet.

Many companies start controlling the inventory due to a

term for the settlement of accounts at the end of March.

Also, housing companies and precutting plants request the

plywood companies to lower the prices because the prices

of domestic lumber and laminated lumber have dropped.

A decrease in shipment of plywood is worse than a

decrease in demand of houses. The inventory of plywood

at distribution companies is declining rapidly. Plywood

companies get orders with a few amounts and they are

requested to be prompt delivery. There is enough

inventory to deliver the plywood as soon as the plywood

companies get orders so far.

In Kanto area, there is a price collapse in painted plywood

for concrete form due to the strong yen and a fall in prices

of plywood in South Asia. The prices of 3 x 6 of 12mm

thickness are 2,000 – 2,100 yen, delivered per sheet and

this is 200 yen lower than the prices at the end of 2022.

The purchase cost is 2,200 – 2,300 yen but the Japanese

buyer has bought the plywood by 2,400 yen in the past and

it shows a loss.

Some Japanese buyers sell the plywood at exceptionally

low prices because of a decrease in a futures price in South

Asia and a decrease in the import cost by the strong yen. A

trial calculation of the import cost was 2,600 yen, FOB per

sheet but it was actually 2,400 yen, FOB per sheet, caused

by the strong yen. It does not mean that the prices of

plywood at domestic markets fell 200 yen. The prices in

South Asia are now $750 – 850, C&F per cbm.

|