4.

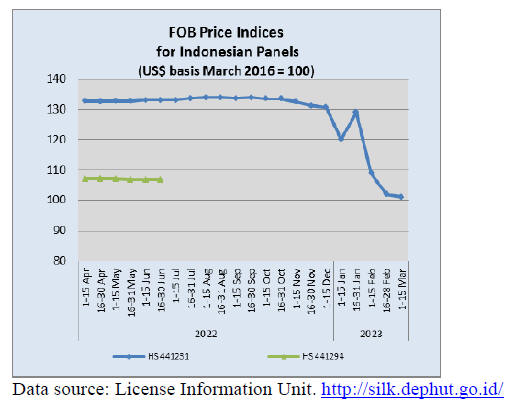

INDONESIA

Indonesian and UK companies agree

US$112 million

deal

A memorandum of understanding has been signed

between Indonesia and the UK for the purchase of wood

products worth US$112 million. The MoU is between ten

Indonesian companies and two British companies.

The Trade Minister said the British companies are

interested in paper and wood products. In 2022 wood

products were one of Indonesia's main export commodities

to the UK with a value of US$177.8 million. In the same

year Indonesian paper product exports to the UK

amounted to US$59.8 million.

See:

https://pressrelease.kontan.co.id/news/produk-kayu-kertasindonesia-diminati-inggris-mendag-saksikan-mou-usd-112-juta

Strengthening the VPA through Broader Market

Recognition (BMR)

Indonesia hosted a forum on increasing legal/sustainable

timber trade through a policy on Broader Market

Recognition (BMR). The aim is to encourage those

tropical timber producing countries which have, or plan to

negotiate, VPAs.

The Director General of Sustainable Forest Management

in the Ministry of Environment and Forestry Agus

Justianto, said Indonesia hopes that the FLEGT VPA will

be implemented consistently by parties to the agreement.

He added that producing countries need broader market

recognition of their national systems through a

partnerships based on trust, respect and mutual benefits.

See:

https://forestinsights.id/2023/03/01/indonesia-inisiasiforum-broader-market-recognition-bmr-perkuat-perdagangankayu-lestari/

No tolerance of irresponsible campaigns against

Indonesia's carbon governance

Indonesian Environment and Forestry Minister, Siti

Nurbaya, has vowed to fight against "irresponsible

campaigns" aimed at discrediting Indonesia's carbon

governance.

In a technical discussion on the role of Indonesia's carbon

markets in supporting overall mitigation in global

emissions the Minister reiterated that Indonesia has in

place legally sound carbon governance and warned against

attempts to undermine it by "systematic and irresponsible"

carbon market players.

She added that Indonesia's carbon governance was

designed to prevent double-counting practices. The

Minister also highlighted the fact that Indonesia's carbon

trading represents business opportunities worth billions of

dollars.

See:

https://foresthints.news/minister-no-tolerance-ofirresponsible-campaigns-against-indonesias-carbon-governance/

In related news the Minister announced the country is

prepared to offer results-based payments (RBP) to

interested buyers for its achievements in reducing

emissions from deforestation and forest degradation, as

well as enhancing forest stock carbon through REDD+

scheme from 2018 to 2020, resulting in a remarkable

reduction of over 577 million tonnes of CO2.

See:

https://foresthints.news/indonesia-announces-readiness-forsales-of-over-577-million-tonnes-of-co2e-from-rbp-scheme/

Carbon Trading, Financial Services Authority

prioritises domestic market

The Financial Services Authority (OJK) said carbon

trading is at an early stage and would give priority to the

domestic market.

This was determined after the Authority held discussions

with the Ministry of Environment and Forestry. "In the

first stage there will be restrictions on overseas

transactions, the priority is for domestic fulfillment first,

said the Chief Executive of the Supervision of Capital

Markets, Derivatives Finance and Carbon Exchange of the

Financial Services Authority.

See:

https://forestinsights.id/2023/03/04/ojk-soal-bursa-karbondahulukan-pasar-domestik-perdagangan-di-pasar-sekunder/

Government must be aggressive in conducting

reforestation

The World Resource Institute (WRI) said the government

must be aggressive in conducting reforestation in the

country. WRI Indonesia Programme Director, Arief

Wijaya, said Indonesia has a land area of 180 million

hectares with a composition of 95 million hectares of land

that still has forest but that around half is degraded.

During a discussion on Indonesia's 2023 Climate

Policy

Outlook Arief is quoted as saying "Currently, reforestation

is only around 3 to 5% of the annual deforestation rate and

reforestation must be accelerated.

See:

https://www.antaranews.com/berita/3410850/wripemerintah-mesti-agresif-melakukan-penghijauan-hutan-diindonesia

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sectors in Indonesia.

See:

https://www.ittoggsc.org/static/upload/file/20230214/1676340295137619.pdf

5.

MYANMAR

Economic prospects for 2023

According to the Asian Development Bank Myanmar’s

economy looks set to remain moribund this year with

forecasters predicting the country will see the region’s

lowest growth and highest inflation rate. Myanmar’s GDP

is expected to grow 2.6% this year, the lowest among

ASEAN countries, while inflation could be higher than

any other member of ASEAN.

Myanmar is struggling to revive a fragile economy by

promoting foreign investment. The country approved over

US$92 billion worth of foreign investment in 2022

according to the Directorate of Investment and Company

Administration.

See:

https://www.irrawaddy.com/business/economy/myanmarstough-economic-times-forecast-to-continue.html

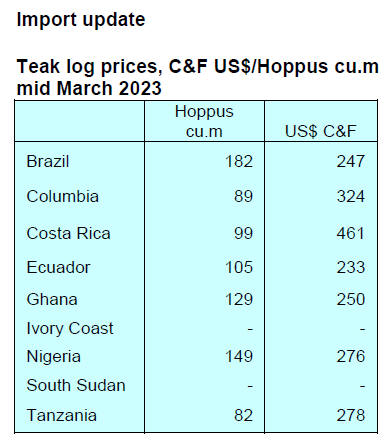

Trade in Myanmar teak

Under a headline ‘Myanmar teak trade: Highly prized,

highly dodgy’ the Indian Express reports on conversations

with traders in Myanmar and India who say the conflict on

the ground in Myanmar and frequent changes to

regulations by the Myanmar authorities are challenging.

Since the February 2021 millitary take over in Myanmar

the junta took control of Myanma Timber Enterprises

(MTE), the state-owned company which has exclusive

rights over the country’s timber trade. The MTE has been

sanctioned by many countries.

Quoting a report from the International Consortium of

Investigative Journalists (ICIJ) the India Times says India

is the second largest importer of "conflict wood" from

Myanmar following China. The ICIJ investigation also

implicates importers in western countries.

According to Forest Watch Indian companies imported

over US$10 million worth of teak from Myanmar between

February 2021 and April 2022. The India Times points out

that “despite the controversy surrounding "conflict wood"

from Myanmar India has not banned the import of teak

wood from the country”.

See:

https://indianexpress.com/article/explained/explainedclimate/myanmar-teak-trade-highly-prized-highly-dodgy-8476232/

and

https://www.indiatimes.com/explainers/news/explained-whyteak-imported-from-myanmar-is-called-conflict-wood-595202.html

and

https://www.icij.org/investigations/deforestation-inc/myanmarteak-trade-sanctions-military-regime/

Export target

In fiscal 2022-2023 Myanmar's foreign trade target is

US$29.5 billion but more than US$1,949 million has been

received according to statistics released by the Ministry of

Economy and Commerce.

From April to March of fiscal 2022-2023 Myanmar's

foreign trade was US$15.5 billion from exports of

agricultural products, animal products, water products,

mining equipment, forest products and industrial goods.

A National Export Strategy is being implemented to

increase exports and the priority sectors are the

agricultural product-based food production sector; textile

and clothing sector; industrial and electrical

sector; Aquatic industry sector; forest products

sector; digital products and services sector; logistics

service sector; quality management sector; Trade

Information Services Sector and innovation and

entrepreneurship sector.

See:

https://news-eleven.com/article/245617

6.

INDIA

Pace of growth cools

India's domestic economy is the main drive of growth and

there was a slowdown in economic activity late last year.

The economy grew 13.2% in April-June quarter and 6.3%

between July and September but GDP growth slowed to

4.4% in the final quarter of 2022.

Rising interest rates have weakened domestic demand and

the weaker rupee has pushed up the cost of imports.

See: https://www.livemint.com/

Scaling up of current policies could help lower

emissions

India will be the fastest-growing economy among the

seven largest emerging markets and developing economies

according to the World Bank in its Global Economic

Prospects report and the pace of urbanisation will increase

driving demand for wood products.

According to the IMF India has made significant progress

towards meeting its emissions reductions targets under the

Paris Agreement but, with current policies, total GHG

emissions would nonetheless increase by more than 40%

by 2030.

While a modest increase in short-term emissions may be

necessary to meet poverty reduction and energy security

goals, a more rapid scaling up of current policies could

help lower emissions considerably over the medium-term

and bring India closer to a path to net zero by 2070.

See:

https://www.imf.org/en/News/Articles/2023/03/06/cf-indiacan-balance-curbing-emissions-and-economic-growth

Sharp rise in demand for decorative laminates

Plyrepoter has commented that 2022 saw a sharp rise in

demand for decorative laminates in India as well as in

international markets which has encouraged investment in

local laminate manufacturing capacity.

However, with some 300 laminate manufacturers in the

country and others about to become operational in 2023

will see changes in the market for laminates. Plyreporter

foresees intense competition in laminate sector which will

likely bring down margins.

See:

https://www.plyreporter.com/article/93399/the-laminatemarket-to-witness-intense-competition-in-2023-ply-reporterprediction-2023

7.

VIETNAM

Wood and wood product (W&WP)

trade highlights

Statistics provided by the General Department of

Customs reveal that in February 2023 W&WP exports

earned US$800 million, down 0.7% compared to January

2023 and down 11% compared to February 2022.

In particular, WP exports are estimated at US$490

million, down 0.3% compared to January 2023 and down

30% compared to February 2022.

In the first 2 months of 2023 W&WP exports earned

US$1.6 billion, down 35% over the same period in 2022.

In particular, WP exports stood at US$982 million, down

48% over the same period in 2022.

Vietnam's W&WP imports in February 2023 were

reported at US$150 million, up 25% over the previous

month. However, compared to February 2022 imports

fell by 21%.

In the first 2 months of 2023, W&WP imports have been

estimated at US$270 million, down 39% over the same

period in 2022.Vietnam's imports of logs and sawnwood

in February 2023 stood at 290,400 cu.m, worth US$109.2

million, up 24% in volume and 25% in value compared

to January 2023.

However, compared to February 2022, wood imports

decreased by 21% in volume and 19% in value.

In the first 2 months of 2023 imports of wood reached

466,900 cu.m worth US$175.4 million, down 41% in

volume and 41% in value over the same period in 2022.

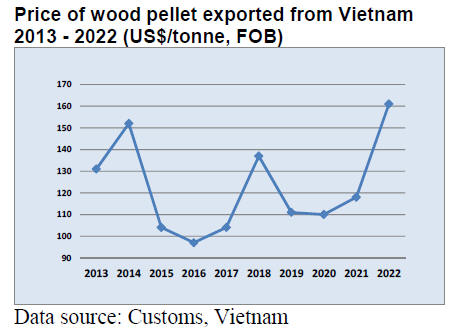

Wood pellet exports in 2022

In 2022 Vietnam’s wood pellet exports increased

substantially, making Vietnam the second largest wood

pellet exporter after the US. The volume of exported

reached over 4.88 million tonnes, up 39% compared to

2021 while the value surged to US$787 million, 90% up

compared to 2021.

Pellet export prices soaring

The average price of wood pellets exported from Vietnam

in 2022 reached a 10 year record as price increased

continuously but showed signs of a slightly slower pace of

increase between June and September. However, the price

rebounded after that and reached the record of over

US$189/tonne in December 2022.

Japan and South Korea leading Vietnam’s wood

pellet

markets

Almost all wood pellets produced in Vietnam are exported

to Japan and South Korea. In 2022, the volume of wood

pellet exported to these two markets accounted for 98% of

the total export and 97% of Vietnam's total export turnover

in the year. Exports to Japan increased strongly compared

to 2021.

Forecast of wood pellet market in 2023

There are a number of factors that may impact the

production and trade of wood pellets in 2023. The first

factor is the global wood pellet supply and demand

situation. At present Vietnam represents the 2nd largest

supplier of wood pellets in the world (after the US) and

therefore the fluctuation in supply and demand of this

biomass fuel in the world will have a direct impact.

In 2023, the supply of Canadian and US wood pellets to

the EU market may expand after a recent period of

scarcity of sources due to the Russian invasion of

Ukrainian as well as the increased maritime freight rates.

In the first half of 2022 North American pellet

manufacturers redirected their supply flows from the

Japanese and Korean markets to the EU to capture the

much higher prices in the EU markets.

The sharp drop in supply from North America, thus,

forced Japanese and South Korean businesses to find

alternative sources. This created opportunities for

Vietnamese businesses to expand export markets.

Because of the instability in energy supplies the result of

the Russian aggression Japan and South Korea stockpiled

pellets. Up to now the wood pellet stock in these two

markets is at a high level. Against this backdrop

Vietnamese exporters will hardly have the opportunity to

expand their markets in these two markets in 2023.

The switch to biomass fuel in Japan and South Korea is

directly affecting prices of wood pellets from Vietnam.

Currently, the export price of wood pellets from Vietnam

is on a downward trend. Information from some

exporters shows that in the coming months, the export

price to Korea may drop down to US$125-135/tonne

FOB and to Japan down to US$150-160/tonne FOB. This

will lead to a very sharp reduction of wood pellet exports

from Vietnam.

Large stocks also allow Japanese consumers to tighten

standards for quality and sustainability requirements.

Certain Japanese traders are asking Vietnamese suppliers

to strictly follow environmental and quality requirements.

The power crisis in the EU in 2022 created an over

optimistic expectation of the market potential for

Vietnam's wood pellets.

Statistics from the General Department of Customs show

that by the end of 2022 Vietnam's wood pellet exports to

the EU stood at just US$15.2 million, equivalent to 1.9%

of the total exports.

The major reason behind this modest shipment of

Vietnamese wood pellets to the EU is the quality and

environmental standards that this market sets including

the sustainability certification that very few local wood

pellet businesses can meet.

The expanding export market in the first half of 2022 has

boosted investment in wood pellet production in

Vietnam. From the beginning of 2023 export prices have

been falling rapidly and this is likely to have a huge

negative impact especially for new or under construction

wood pellet plants.

In 2022 alone, about 70 new wood pellet factories were

built. Of these newly built factories about 20 are large,

using EU technology, while 50 factories are using

Vietnamese and Chinese technologies.

From the beginning of 2023 the export price of wood

pellets has been falling while the price of logs, mainly of

acacia planted by thousands of Vietnamese farmers, after

a period of "price fever", has also sharply decreased.

These fluctuations in wood pellet markets and production

may negatively impact the entire supply/value chain of

Vietnam’s wooden products. Vietnamese operators have

been urged to scrutinise their wood pellet business and to

reshape the industry.

Statistics provided by Vietnam General Department of Customs

and analysed by a Technical Group of Vietnam’s wood

associations with support from Forest Trends

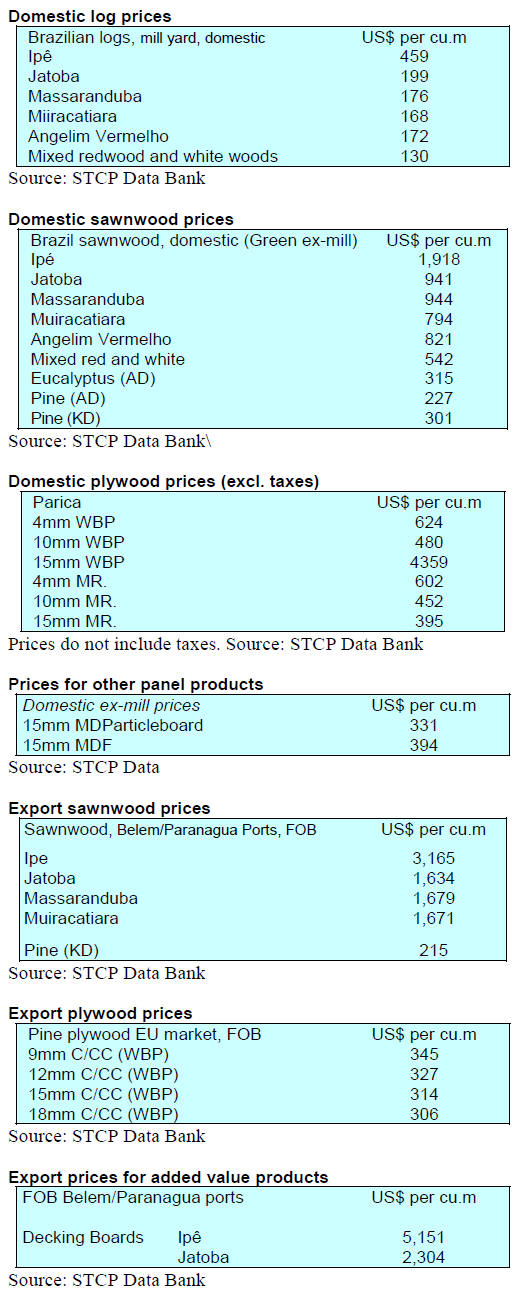

8. BRAZIL

Engineered wood for Brazil’s

construction sector

A Woodlife Sweden International Exhibition, focusing on

engineered wood promoted by FIEP (Federation of

Industries of Paraná State) the Sweden Embassy and a

Swedish Institute was held in Curitiba, Paraná State.

Engineered wood products have definable mechanical

properties and can be manufactured from a variety of

timbers.

One of the advantages claimed of engineered wood

technology it is a material that helps develop a green

circular economy and that the construction processes are

shorter when engineered wood products are used.

Representatives from the Center for Timber Producers and

Exporters of Mato Grosso State (CIPEM) attended the

exhibition.

See:

https://cipem.org.br/noticias/cipem-marcara-presenca-emexposicao-internacional-com-foco-na-madeira-engenheirada/

http://www.madeiratotal.com.br/madeira-ganha-destaque-comoalternativa-sustentavel-em-sistemas-construtivos/

Mahogany plantations - revisited

Following a news item the last Market Report (Vol. 27

No. 4) on African mahogany plantations in Brazil a

representative of the Brazilian Association of African

Mahogany Producers provided the following additional

details:

“In Brazil today we have around 42,000 hectares planted

with Khaya Grandifoliola. About 23,000 hectares planted

with Khaya Senegalensis. About 800 hectares planted with

Khaya Anthotheca and about 500 hectares planted with

Khaya Ivorensis. These plantations are all over Brazil. The

states with the most plantations are Minas Gerais, Pará,

São Paulo, Roraima, Goiás, Espírito Santo, Mato Grosso,

Mato Grosso do Sul, Tocantins, Paraná and the block of

states in Northeastern Brazil.

There are already several producers carrying out thinning

in plantations that are already 11, 12 and 14 years old.

This thinned wood is being commercialised in the internal

market and with it we are already manufacturing chairs,

doors, decoration objects, wood for roofs, pergolas and

other utilities and the wood is being sold in its entirety

here in our Brazilian market.

There are plantations that are over 20 years old and are

ready for harvesting. These are Khaya Grandifoliola

plantations and the Association estimates the around 5,000

hectares ready for cutting in Pará. Small volumes of

African mahogany are exported to the Caribbean.

The Association is working to strengthen the image of

Khaya Grandifoliola outside Brazil. Within Brazil this

wood is already well known and there are already

creations by the best designers in Brazil”.

For more information see the Association presentation at:

https://www.youtube.com/watch?v=nbg_GZXNyps

Acre support for wooden flooring company

The Acre Business Agency (ANAC), an agency linked to

the state government visited a wood flooring company in

Xapuri, State of Acre in the Amazon region in order to

strengthen outreach partnerships with the company.The

partnership focuses on the creation of technical

cooperation mechanisms and professional qualification

training.

The company has an average annual production of 25,000

cu.m and utilizes native timbers such as Cerejeira

(Torresea acreana), Cumaru (Dipteryx Odorata) and

Garapeira (Apuleia Leocarpa). All timbers used in the

wood processing are verified legal and come from

sustainable forest management (SFM) projects. This

partner company exports products to countries in Asia and

Europe and corresponds to 30% of the trade balance of the

timber sector of Acre State.

See:

https://forestnews.com.br/acre-parceria-industria-madeira/

Trade Mission in Mexico

A trade mission to Mexico promoted by ABIMÓVEL

(Brazilian Furniture Industry Association) and APEXBrazil

(Brazilian Trade and Investment Promotion

Agency) through the sectoral project “Brazilian Furniture”

was undertaken in February and resulted expected trade

worth around US$32 million. Dozens of Brazilian

companies exhibited at the fair and participated in

business to business rounds. The prospective business was

concluded with buyers from Central America, North

America and neighbouring countries.

See:

http://abimovel.com/mais-de-us-35-milhoes-em-negociosprospectados-em-acoes-do-brazilian-furniture-no-mexico/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sectors in Brazil.

See:

https://www.ittoggsc.org/static/upload/file/20230214/1676340295137619.pdf

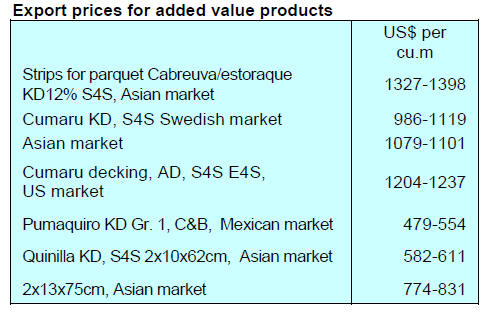

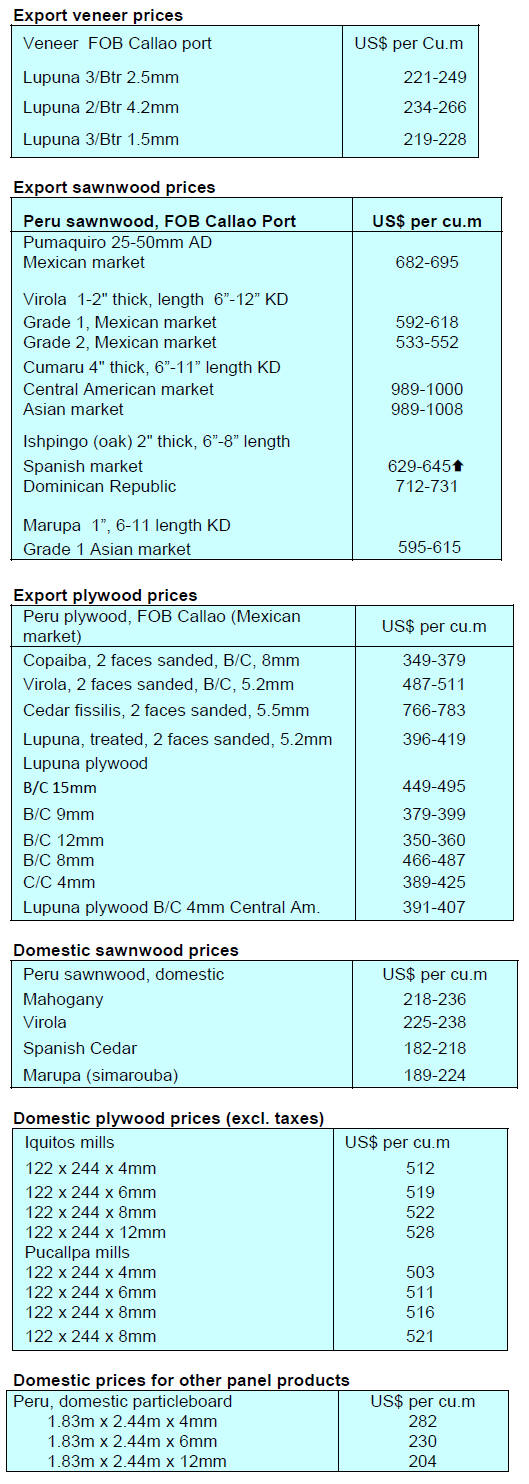

9. PERU

Rain season storms damage homes and

infrastructure

Heavy rains and cyclone Yaku continue to cause damage

to homes and infrastructure such that hopes of an

economic recovery in March are fading. The National

Civil Defense Authority reported 60 deaths and 14,000

homes damaged since the rain season started in September

last year. The rains intensified in early March. The

government has declared a state of emergency in six

regions and several districts in Lima.

Peruvian wood exports grew in 2022

Exports of wood products in 2022 totalled US$146.6

million, a scenario above what was around 20% more than

in 2021 according to the Management of Services and

Extractive Industries Division of the Association of

Exporters (ADEX).

The recovery of wood shipments in 2022 was driven by

demand in China and the Dominican Republic which

accounted for 19% and 14% respectively of total

shipments. France and Mexico were the third and fourth

placed markets. Exports to France in 2022 droped year on

year while there was a sharp rise in exports to Mexico.

Semi-manufactured products accounted for just over 40%

of all shipments but there was a decline in the value of

shipments compared to 2021. Sawnwood exports account

for a further 40% of all wood product exports and were

higher than in 2021.

Reforestation research activities

Within the framework of the inter-institutional cooperation

agreement, Reforestadora Inca S.A. - Refinca and INIA

are conducting various activities in the field of research

and transfer of agricultural technology. The purpose is to

strengthen research, development and technological

innovation and conservation of genetic resources through

forestry activities.

Timber industrialists to attend Ligna

To learn more on the latest technological advances in the

industry the Peruvian consultant, Fenafor, is organising a

visit for Peruvian industrialists to ligna which will take

place in Hannover, Germany from 15-19 May. Ligna is a

leading fair for the timber sector.