Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Feb

2023

Japan Yen 136.40

Reports From Japan

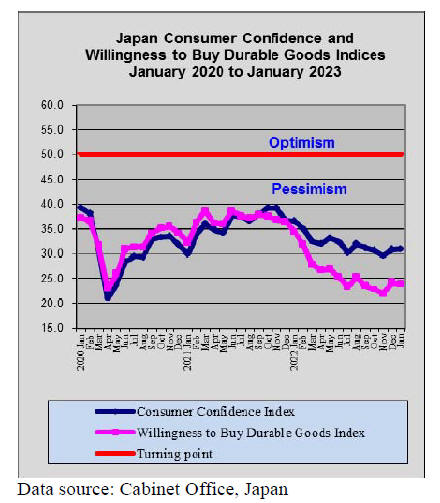

Recession avoided

Japan’s economy rebounded but at a slower pace than

expected in the final quarter of 2022 despite the impact on

growth from reopening of the country’s borders to visitors

and a recovery in private consumption. The economy grew

just 0.2% in the final quarter of 2022.

The modest growth meant that Japan avoid a technical

recession but the rebound was weak highlighting the

difficult task for the incoming next BoJ governor as he

attempts to unwind the massive stimulus programme

without derailing the fragile recovery.

See:

https://www.japantimes.co.jp/news/2023/02/14/business/economy-business/japan-gdp-fourth-quarter/

‘Now or never’ to reverse population decline

Japan has one of the lowest birth rates in the world the

Ministry of Health has reported there were fewer than

800,000 births in 2022, the first time since records began

in 1899. Japan also has one of the highest life expectancies

in the world and these trends have driven a growing

demographic crisis with a rapidly aging society, a

shrinking workforce and not enough young people.

Japan’s Prime Minister recently said the country was “on

the brink of not being able to maintain social functions due

to the falling birth rate and it is a case of “now or never” to

secure the sustainability and inclusiveness of our nation’s

economy and society’. He added that the government will

prioritise child-rearing support for families.

.

Inflation at 40 year high

With core consumer inflation hitting its highest levels in

41 years, there are signs that wage growth in Japan is

about to begin trending upwards. But, where job security

is prioritised over pay, there will need to be a long term

commitment on the part of companies to lift wages and the

issues of structural and demographic reforms have to be

addressed to create labour market flexibility.

Plan to attract talent

The government intends to introduce new immigration

regulations making it easier for high-income earners and

graduates of prestigious overseas universities to invest or

find employment in Japan. When speaking to the press an

Immigration Services Agency spokesperson said the aim is

to simplify the process and add incentives in order to

attract top-level talent.

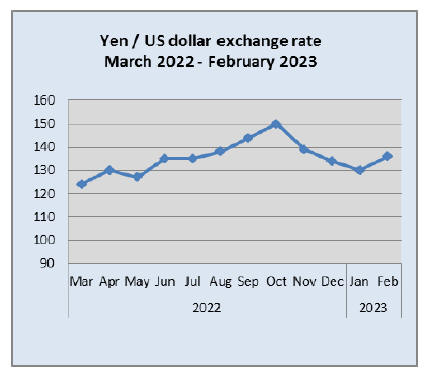

Yen dips again

Kazuo Ueda, the next Bank of Japan (BoJ) Governor will

face many challenges when he starts work in April this

year. Inflation hit 4% in December 2022, the highest level

since January 1991. The new governor will have to decide

when and by how much, the BoJ needs to start paring back

its ultra-loose monetary policy while allowing enough

monetary slack to allow the economy to grow.

The US dollar yen exchange rate has become more

volatile

since the middle of January as traders try and decide

which way Japanese monetary policy against a US dollar

will move especially as the dollar has strengthened after

the recent strong US employment report driving the yen

down to 136 to the dollar.

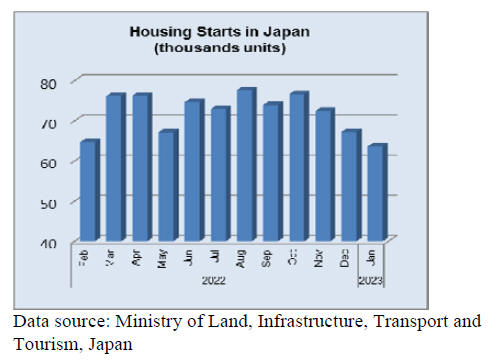

January housing starts higer year on year

January 2023 housing starts were up around 6% year on

year. This was partially due to the mild winter which

allowed building work to continue longer than usual.

Import update

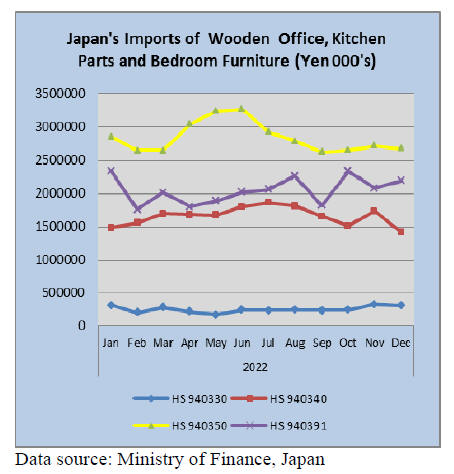

Furniture imports

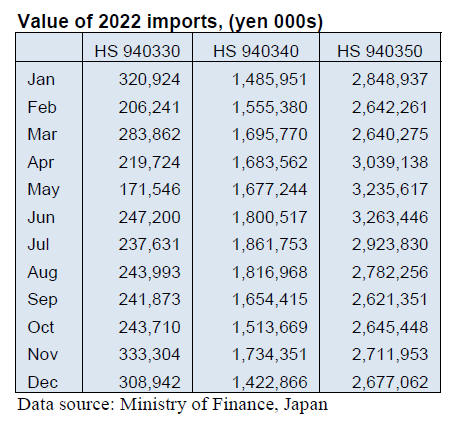

There was a partial recovery in the value of wooden

kitchen and bedroom furniture imports in 2022. The value

of 2022 imports of wooden kitchen furniture (HS940340)

were up 15% year on year and the value of wooden

bedroom furniture rose 25% in 2022 compared to 2021.

There was an encouraging rise in imports of both kitchen

and bedroom furniture in the first half of 2022 but demand

sagged in the second half of the year as households saw

costs rising and the yen weakening which pushed up

import prices.

In contrast to the year on year rise in imports of wooden

kitchen and bedroom furniture, the value of wooden office

furniture (HS940330) imports in 2022 was down 10% on

2021.

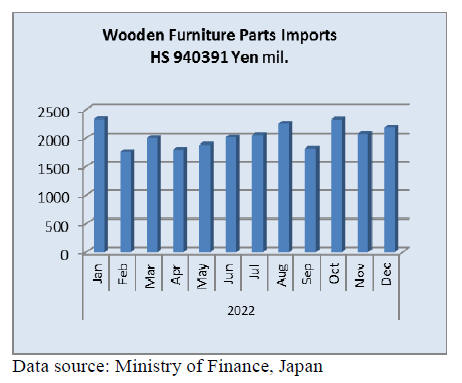

The Ministry of Finance in Japan began reporting the

value of wooden furniture parts (HS940391) in 2022. The

statistics show that there were 55 supply countries in 2022

and the top 5 accounted for over 85% of the value of

imports. Shippers in China topped the list of suplliers of

wooden furniture parts in 2022, accounting for 41% of the

total value followed by Indonesia (18%), Vietnam (13%)

Malaysia (10%) and Thailand (3%). The value of monthly

shipments of wooden furniture parts shows little vaiation

with monthly imports averaging around Yen 2,000 mil.

Wood pellet imports surge 40%

Japan’s imports of wood pellets expanded over 40% yearon-

year to 4.4 million tonnes in 2022. The value of

imports jumped 60% to almost US$900 million. Imports

from Vietnam jumped to over 50% of Japan’s total wood

pellets imports in 2022 with Canada, the US and Malaysia

as other major suppliers.

See:

https://www.lesprom.com/en/analytics//

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Total volume of imports in 2022

Japan Lumber Importers’ Association totalized the volume

of imported logs, lumber, plywood, laminated structural

lumber, MDF, particleboards and OSB in 2022. The total

volume is 1.8% higher than 2021.

The volumes of Russian logs and New Zealand logs

decrease 100,000 cbms. North American lumber declines

21% and European lumber rises 18%. Plywood is 1,500

cbms more than European lumber. MDF records high. The

third woodshock started in April, 2021 but the prices of

domestic / imported softwood products stopped rising

within 2021. Moreover, the prices of domestic structural

softwood plywood kept rising until June, 2022.

It had been controlled the volume of arrival since

the

beginning of 2022 because the imported lumber was

overstocking but the movement of lumber was slow.

Therefore, the volume started to decline in a second half of

the year. European lumber increases because the volume

of 2021 was very low, which was 2,212,000 cbms.

New Zealand logs are less than before because buyers

prefer cedar logs. The prices of cedar logs are lower than

New Zealand logs. Chilean lumber is 20,000 cbms higher

than the previous year.

Russian logs were banned to export in February, 2022.

Additionally, Russia banned to export veneers and chips.

Russia faced economic sanctions because Russia invaded

in Ukraine on 24Th, February, 2022. Also, Japan banned

to import logs from Russia.

Russian lumber falls nearly 8% from 2021. Some reasons

are that Japanese buyers hesitated to do business with

Russian sellers and there were problems on remitting

money to Russia. South Sea log increases 46,000 cbms

from the previous year. South Sea plywood remains on the

same level. Laminated structural lumber is 9% up. Glulam

is 75,000 cbms up. MDF is 124,000 cbms up. Particle

boards and OSB are 110,000 cbms up from 2021.

Domestic logs

There are not many domestic logs, especially in Western

Japan due to the snow. The snow covered through the

nation and the log prices are still high.

The prices of 3m cypress logs for posts are over 20,000

yen, delivered per cbm. 4m cypress logs are around 23,000

yen. Average prices of 3m cedar logs are about 15,000

yen. In southern part of Kyusyu area, the prices are around

20,000 yen and around 17,000 yen in Northern part of

Kanto.

A wave of extremely cold weather that used to happen

only once every 10 years occurred and there was a heavy

snowfall in Western Japan. Therefore, it has been difficult

to hold log markets since the middle of January due to a

shortage of logs. Cypress logs used to cost around 30,000

yen in 2021, under 20,000 yen in last summer and then the

prices increased over 20,000 yen in last autumn. Cedar

logs were about 20,000 yen at the end of 2021 and about

15,000 yen in last summer.

The log prices at log markets in Kumamoto Prefecture,

Oita Prefecture and Miyazaki Prefecture have been high

even after the woodshock ended and the prices of cypress

in Kumamoto Prefecture would increase again. 3m cypress

logs were around 21,000 yen at the end of January and 4m

cypress logs were around 23,000 yen. These are 1,000 yen

higher than the previous month. 3m cedar logs were

around 21,000 yen and 4m cedar logs were around 19,000

yen.

In Miyazaki Prefecture, 3m and 4m cypress logs were

21,000 yen. 3m cedar logs were 17,000 – 18,000 yen.

There are also not many logs in Okayama Prefecture but

the prices of cypress logs are not high. The prices of 4m

cypress logs in Northern part of Kanto area are 26,000

yen. 3m cedar logs are 17,000 yen and 4m cedar logs are

17,500 yen.

South Sea logs and Lumber

Demand and supply of South Sea logs are balanced. The

volume in 2022 is 46,809 cbms, 121.7% higher than

2021. There were many orders for lumber used as a plat

form in Western Japan. Since there was a shortage of

workers in South Asia, South Sea lumber

was not produced enough. That is why Japanese buyers

purchased South Sea logs instead.

A problem is that ships arrive to Japan once in three

months. It takes a lot of times. It is able to

deliver logs to Japan by container vessels, but it takes a

lot of money. Now, it is a rainy season in South

Asia and there are not enough logs Japanese

buyer concern about how many logs would be there after

March. The prices of laminated South Sea

/Chinese boards are enjoying temporary lull.

The prices in South Asia and China started declining

since a second half of 2022 but there

were not enough orders.

Suppliers South Asia and China wish to avoid

lowering the prices. Especially, Indonesian suppliers are

concerned about the strong Rupiah against dollar.

A trading company worker in Japan says that Chinese

suppliers also would stop lowering the prices

because there was the Chinese New Year’s holiday and

was not enough orders.

Export cedar logs to China

Cedar log prices for China are in a bullish trend since the

beginning of the year. The Chinese government eased

restriction on the zero-Covid policy and the economic is

lively again. The prices of radiata pine logs from New

Zealand rose due to the torrential rain at the end of January

in New Zealand. Japanese exporter says that inquiries for

cedar logs in Japan are increasing.

Cedar log prices declined to $100 from $110, C&F per

cbm at the end of 2022. Now, the cedar log prices are

$115 – 120 in the middle of February, 2023 because the

prices of radiata pine logs in New Zealand are higher than

before. It takes about 10,000 yen to export logs and the

price has not changed since the end of last year. There was

a log market held in southern part of Kyusyu area on 6th,

February and many exporters bought curved of damaged

logs.

Freight is $40,000 – 45,000 in the middle of February and

this is lower than $60,000 at the end of last year. Freight

would rise if there were not only wood products but also a

lot of other products. The selling prices depend on each

Japanese exporter and if the selling prices are $115 – 120,

there would be a deficit slightly.

|