US Dollar Exchange Rates of

10th

Feb

2023

China Yuan 6.78

Report from China

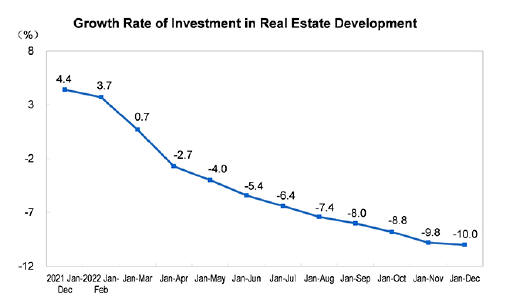

2022 investment in real estate tumbled

A press release the National Bureau of Statistics of China

provides data on national real estate development and

sales in 2022. This shows that there was a 10% decline in

real estate investment with investment in residential

properties dropping 9.5%.

See:

http://www.stats.gov.cn/english/PressRelease/202301/t20230118_1892298.html

In related news, during the opening remarks at a press

briefing on the IMF report for China, Thomas Helbling,

Deputy Director, Asia and Pacific Department said the

Fund projects China’s economic growth to increase from

3% in 2022 to 5.2% in 2023 driven by a rebound in private

consumption amid the earlier-than-anticipated re-opening

in China.

On the real estate sector the IMF welcomed China’s recent

policy measures but suggested additional action is needed

to end the real estate crisis, including applying funds for

completion of troubled projects as this would also help

restore homebuyer confidence and contain financial

stability risks.

See:https://www.imf.org/en/News/Articles/2023/02/01/sp-chinaaiv-press-briefing-opening-remarks

Decline in log imports in 2022

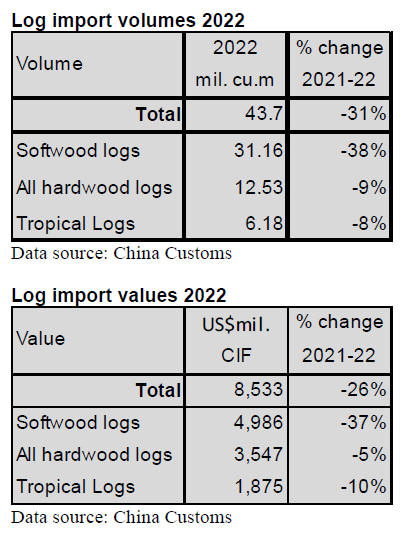

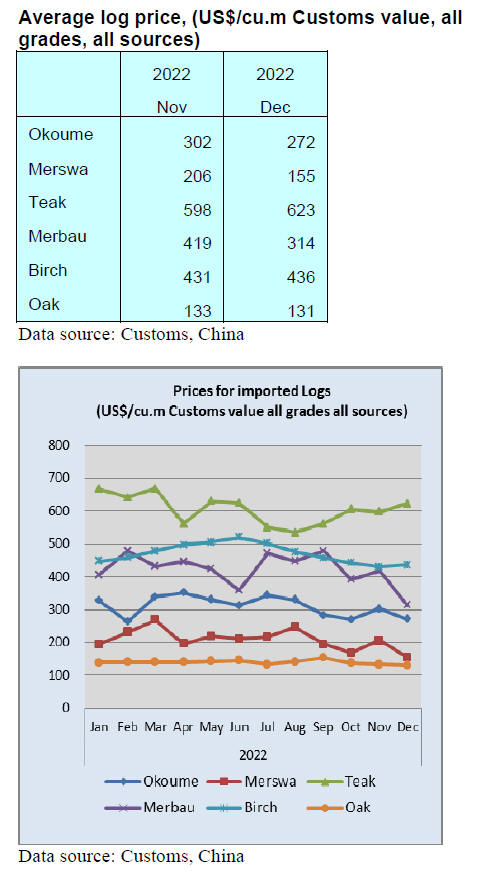

According to China Customs log imports in 2022 totalled

43.70 million cubic metres valued at US$8.533 billion, a

decline of 31% in volume and 26% in value year on year.

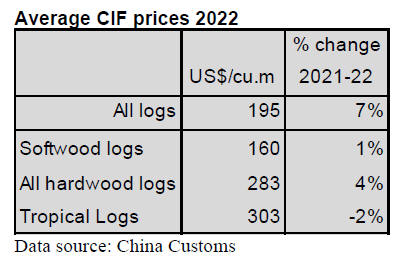

The average price for imported logs was US$195 (CIF)

per cubic metre, up 7% on levels in 2021.

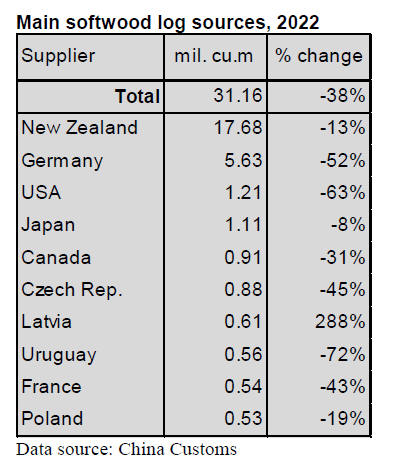

In 2022 softwood log imports fell 38% to 31.16 million

cubic metres, accounting for 71% of the national total,

down 7% from 2021. The average price for imported

softwood logs was US$160 (CIF) per cubic metre, up 1%

on levels in 2021.

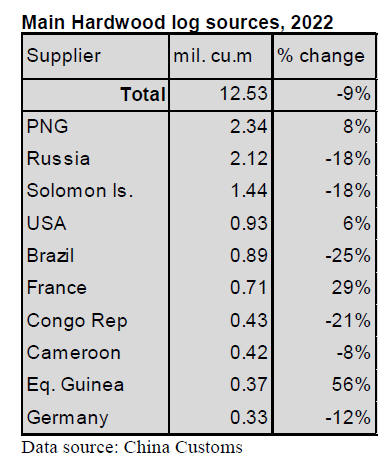

Hardwood log imports in 2022 fell 9% to 12.53 million

cubic metres (29% of the national total log imports). The

average price for imported hardwood logs in 2022 was

US$283 (CIF) per cubic metre, up 4% on 2021.

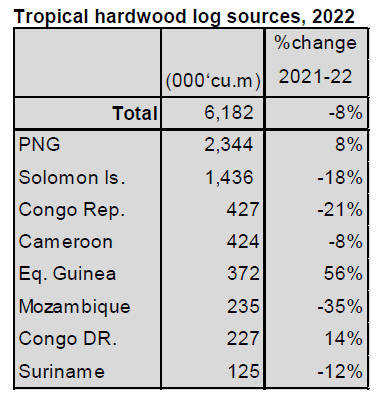

Of total hardwood log imports, tropical log imports were

6.18 million cubic metres valued at US$1.875 billion,

down 8% in volume and down 10% in value from 2021,

accounting for 14% of the national total import volume in

2022.

Decline in log imports from all the main

suppliers

except PNG

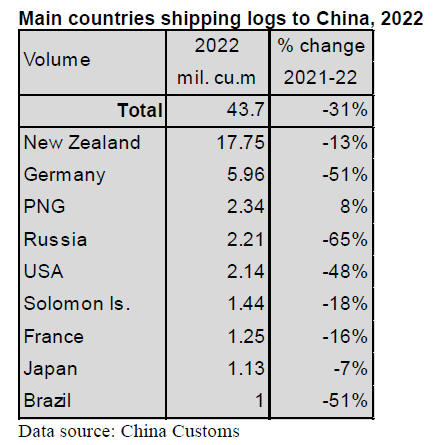

According to China Customs the volume of log imports

from all the main suppliers in 2022 declined except for

PNG where import volumes rose 8% to 2.34 million cubic

meters valued at US$549 million, up 11% year on year.

The average price for imported logs from PNG in 2022

rose 3% to US$234 (CIF) per cubic metre.

New Zealand and Germany were main suppliers for

China’s log imports and the proportion supplied by the

two countries was 55% of the national total in 2022.

New Zealand was the largest supplier of logs to China’s in

2022 accounting for 41% of the national total, up 9% from

2021. China’s log imports from New Zealand were 17.75

million cubic metres valued at US$2.689 billion, down

13% in volume and down 20% in value. The average price

for imported logs from New Zealand was US$151 (CIF)

per cubic metre.

Germany was ranked the second for log imports to China

in 2022 making up 14% of the national total but, down 5%

from 2021. China’s log imports from Germany totalled

5.96 million cubic meters valued at US$1.024 billion,

down 51% in volume and down 47% in value. The

average price for imported logs from Germany was

US$172 (CIF) per cubic metre.

China’s log imports from Russia plummeted 65%, from

USA, Solomon, France and Brazil log imports also

declined sharply.

Soaring softwood log imports from Latvia

China’s softwood log imports from Latvia in 2022 soared

288% to 610,000 cubic metres mainly because China

imported a lot of large diameter fir, spruce, Korean pine

and scots pine. China’s large diameter fir and spruce

imports from Latvia soared 451% to 523,161 cubic metres,

however, the CIF price for fir and spruce declined 23% in

2022. China’s large diameter Korean pine and scots pine

imports from Latvia rose 79% to 78,979 cubic metres, the

CIF price for fir and spruce declined 1% slightly in 2022.

Germany is the main supplier of China’s fir and spruce

imports and accounted for 67% of the national total in

2021 but fell 54% in 2022. Latvia was the main supplier of

fir and spruce imports to make up for the reduction from

Germany. While log prices generally rose in 2022, Latvian

log prices fell, hence the surge in imports, especially for

fir and spruce, down 23% year on year.

PNG the largest supplier of hardwood logs

PNG was the largest supplier of hardwood logs replacing

Russia in 2022. China’s hardwood log imports from PNG

rose 8% to 2.34 million cubic metres valued at US$549

million, up 11% year on year. The CIF prices for

hardwood log imports from PNG rose 64% largely.

China’s hardwood log imports from Russia were 2.12

million cubic metres valued at US$261 million, down 18%

in volume and 29% in value in 2022. The CIF for

hardwood log imports from Russia fell 54%.

80% of the national total log imports are from PNG (19%),

Russia (17%), Solomon (11%), USA (7.4%), Brazil

(7.1%), France (5.7%), the Republic of Congo (3.4%),

Cameroon (3.38%), Equatorial Guinea (3.0%) and

Germany (2.7%).

It is worth noting that Chinese hardwood log imports from

the US increased by 8% year on year in 2022, despite a

more than 300% jump in US log prices.

Decline in tropical log imports

PNG and Solomon Is. are the main suppliers for China’s

tropical log imports and the proportion of the two

countries in 2022 was more than 60%. China’s tropical

hardwood log imports from PNG rose 8% but from

Solomon Is. fell 18%. The average price for imported

tropical logs was US$303 CIF per cubic metre, down 2%

on levels in 2021.

Decline in log imports from Myanmar

Myanmar was a major source of tropical logs for China

before its log export ban, China’s log imports from

Myanmar have been declining for many years. China’s log

imports from Myanmar fell 43% to 6,147 cubic metres

valued at US$7.49 million, down 45% year on year in

2022. China’s log imports from Myanmar in 2021 soared

more than 300% in volume.

No log imports from Australia

China used to import more than one million cubic metres

of logs from Australia but this fell to 63,000 cu.m in 2021

and zero in 2022.

There were no China’s log imports from Australia

completely in 2022. Australia has disappeared from the list

of major suppliers of logs to China.

China’s log imports from Australia have been declining

and came to zero finally because of a ban on imports as

the quarantine service in China once again detected pests

in a log shipment. Since the beginning of 2020 the

quarantine service has reported detecting live pests such as

the long horn beetle, Cerambycidae and jewel beetles,

Buprestidae in logs imported from Australia.

GTI-China Index – January 2023

In January 2023, as covid rules were eased, domestic

demand increased and the economy began to recover. In

late January a large number of employees returned to their

home towns to celebrate the Lunar New Year which meant

output from manufacturing enterprises was affected.

However, tourism, entertainment, catering and other

service industries have shown a marked and the economy

is steadily recovering.

The development of China's timber manufacturing

industry in January showed significant off-season

characteristics due to the Lunar New Year. Compared with

the previous month, the number of workers in enterprises

and factories represented by companies contributing to the

Global Timber Index GTI-China Index declined

significantly and the production volume and orders indices

also declined. In January the GTI-China Index registered

21.5%, a decrease from the previous month and was

below the critical value (50%) indicating that the business

prosperity of the timber enterprises represented in the

GTI-China Index declined from the previous month.

The production index in January fell below the critical

value indicating that the production volume of the timber

enterprises represented in the GTI-China Index was less

than that of the previous month.

The new orders index registered from the previous month

to fall below the critical value indicating that the number

of new orders of the timber enterprises represented in the

GTI-China shrank sharply from the previous month.

The export orders index registered a decrease from the

previous month and has been below the critical value for 5

consecutive months indicating that the ability to obtain the

export orders of the timber enterprises represented in the

GTI-China difficult.

The inventory index of finished products registered a

decrease from the previous month and has been below the

critical value for 6 consecutive months indicating that the

inventory of finished products of the timber enterprises

represented in the GTI-China was declining.

The January existing orders index also registered a decline

from the previous month and has been below the critical

value for 5 consecutive months.

The purchasing quantity index has been below the critical

value for 3 consecutive months.

The purchasing price index registered a further

decline and

was below the critical value indicating that the purchasing

price of the timber enterprises represented in the GTIChina

was less than that of the previos month.

The import orders index registered a decrease from the

previous month and has been below the critical value for 3

consecutive months.

The delivery time index did not improve in January and

remains below the critical value indicating that the

delivery time from the supplier to the timber enterprises

was even slower than the previous month.

Finally, the inventory index of main raw materials

registered weakened further in January and has been

below the critical value for 6 consecutive months.

|