Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Feb

2023

Japan Yen 131.5

Reports From Japan

Economists unanimous, wage increases

essential

Japan’s economy returned to growth in the last quarter of

2022 helped by the lifting of restrictions on tourists which,

offset weakening business activity and exports.

Signs of improved growth momentum at the beginning of

2023 could be a factor when companies begin the annual

wage negotiations. Economists are unanimous that steady

wage increases are an essential for the post-pandemic

recovery along with a change of policy by the Bank of

Japan.

Real wages in Japan rose for the first time after nine

months in 2022 thanks to robust temporary bonuses but

other data showed household spending falling for a second

month in December as rising prices offset otherwise robust

private consumption.

See:

https://www.japantimes.co.jp/news/2023/02/03/business/japaneconomy-growth-tourism/

Bank of Japan Governor appointment announced

The government has nominated Kazuo Ueda an economist

and professor at Kyoritsu Women’s University as Bank of

Japan (BoJ) Governor. Haruhiko Kuroda, the current BoJ

Governor has been in the post for 10 years but has been

unsuccessful in the Bank’s aim of seeing sustainable

ecomomic expansion fueled by domestic demand.

Afforestation support for Philippines

Japan recently announced it will grant the Philippines Yen

600 billion in official development assistance to help the

country implement its economic development agenda.

This is the biggest ODA package the Philippines has

received from Japan. During a visit to Japan by the

Philippine President many agreements were signed

between Japanese companies and their Philippine

counterparts. Among the agreements was one signed by

Marubeni Corp. related to its energy, transportation, health

care and afforestation projects in the Philippines.

See:

https://www.manilatimes.net/2023/02/11/news/japangrants-ph-p246-b-aid-package/1878106

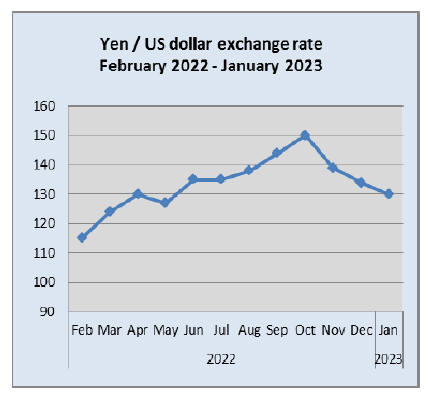

Yen reacts to debate on BoJ appointment

The yen briefly weakened to a one-month low of around

132 range against the US dollar in early February

following suggestions that the Bank of Japan Deputy

Chief was being considered as a successor to the current

governor whose terms ends in April.

The suggestion that the Deputy Chief would take over led

markets to believe the continuation of the ulta-low

monetary easing policy. The yen also took a hit after the

stronger-than-expected US employment data spurred

expectations of US interest rates staying at a high level for

longer than expected.

In currency markets the yen exchange rate against the

dollar steadied after the government announced plans to

nominate Kazuo Ueda an economist and former Bank of

Japan policy board member to succeed outgoing BOJ Gov.

Haruhiko Kuroda.

See:

https://mainichi.jp/english/articles/20230206/p2g/00m/0bu/018000c

Call to improve home insulation

In a media interview Masatoshi Takeuchi, an architect and

professor at Tohoku University of Art and Design said

"among the G7 countries, Japan is the only one not

imposing insulation requirements on housing

construction”. He added that in most developed countries

houses are built to strict insulation standards to cut energy

consumption as part of their efforts to address global

warming but Japan stuck with energy-saving policies

adopted more than twenty years ago.

The Cabinet did approve implementation of mandatory

standards for insulation by 2020 but the Ministry of Land,

Infrastructure, Transport and Tourism strongly opposed it

claiming it would affect small- and medium-sized home

builders because they 'lack experience.'

Compulsory insulation requirements will not go into effect

until 2025 but already many builders are advising home

buyers that installing insulation will save energy. When

insulation standards are finally compulsory owners of

existing structures are likely to become eligible for homeimprovement

subsidies.

See:

https://japantoday.com/category/features/kuchikomi/whyare-japanese-homes-so-poorly-insulated

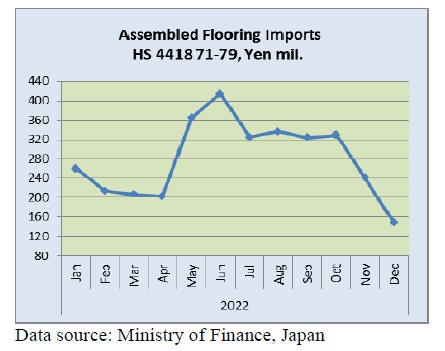

Assembled wooden flooring imports

In 2022 Japan’s imports of assembled wooden flooring

(HS441871-79) were 36% higher than in 2021 this was

despite the major downward correction in the value of

imports in the final quarter of 2022 from the peak in the

third quarter.

Throughout 2022 the top supplier of assembled wooden

flooring to Japan was China followed by Vietnam and

Austria. HS441875 was the main category of assembled

flooring imports in 2022.

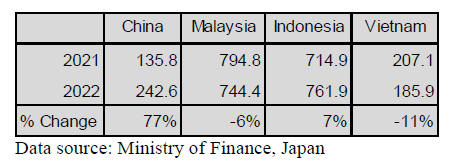

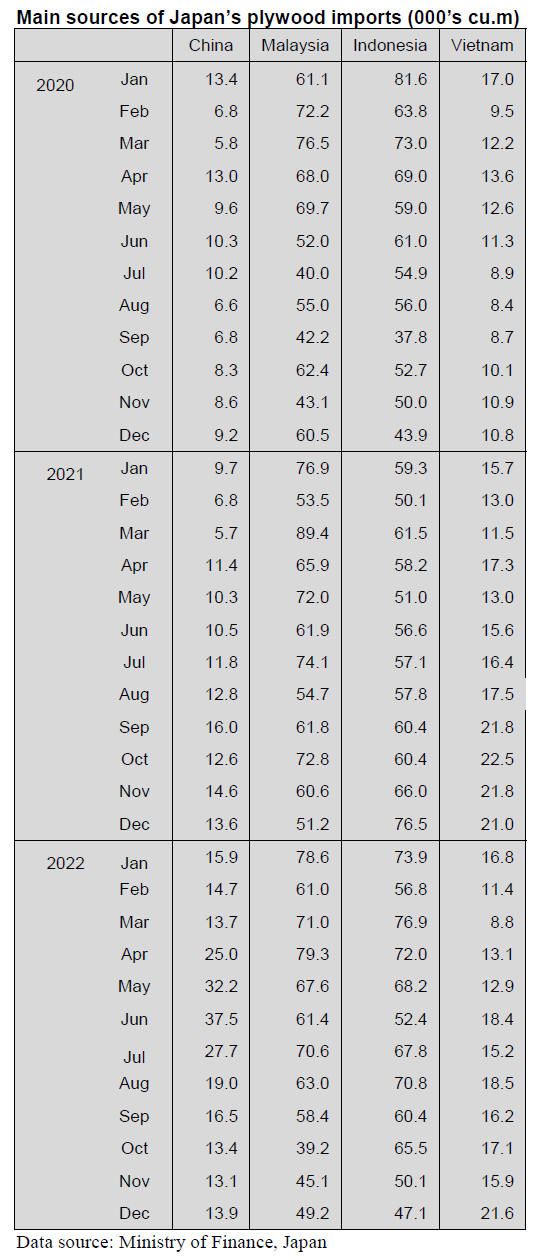

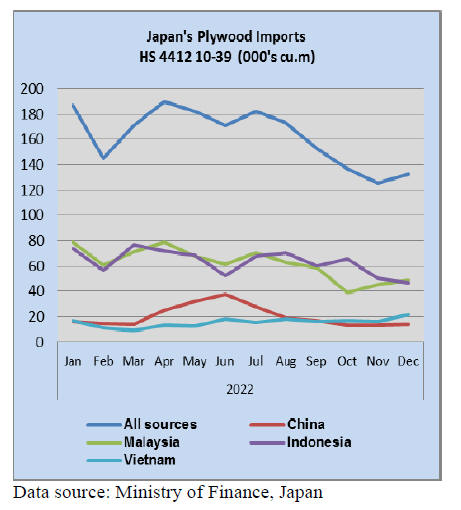

Plywood imports

Indonesia and Malaysia are the main sources of Japan’s

plywood imports and this has not changed over the past

decade. These two suppliers account for over 80% of the

volume of Japan’s plywood imports. There are modest

imports of plywood from shippers in China averaging

around 20,000 cu.m per month in 2022 and in recent years

shippers in Vietnam have captured market share filling the

gap left by reduced exports from Malaysia.

In 2022 the average monthly shipment of plywood from

Vietnam was around 15,000 cu.m. Indonesia and Malaysia

each shipped around 62,000 cu.m of plywood monthly to

Japan.

The impact on manufacturing and exports of the response

to the pandemic in China can be judged from the steep

drop in plywood exports to Japan in 2021. Shipments from

China increased over 70% in 2022 compared to a year

earlier. 2022 shipments of plywood from Malaysia were

down 6% year on year in contrast to the 7% rise in

shipments from Indonesia.

Production and exports of plywood in Vietanm continued

to be disrupted by the covid control measures in 2022.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

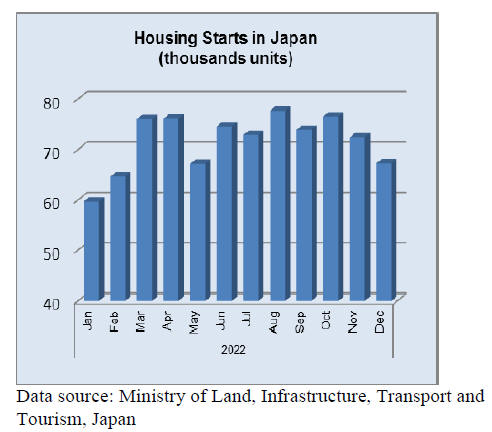

Housing starts and 2022 total

Total starts in 2022 is 859,529 units, 0.4% more than

2021’s result. This is straight two years exceeding the

previous year’s result. However, owner’s unit decreases

over 10% from 2021’s result. This result is the worst units

in the past. Level of 850,000 units is very low level in past

10 years but to compare the result of 2020, it is 5.7%

increased.

Owner’s unit in 2022 is 253,287 units, 11.3% less than

2021’s result. It did not exceed 261,000 units in 2020. In

2014, it was under 300,000 units and it was over 280,000

units in almost every year after that except 2020.

Total starts of rental and unit built for sale are good in

2022. Rental is 345,080 units, 7.4% more than the

previous year. This result is close to 2019’s result when it

was before the COVID-19.

Then rental units in 2020 decreased to 306,000 units, due

to the COVID-19. In 2021, rental units increased about

15,000 units from 2020 and in 2022, it increased about

24,000 units from 2021.

Condo is 108,198 units, 6.8% increased from 2021. Unit

built for sale is 145,992 units, 3.5% increased from 2021.

Units of condo increased for the first time in three years.

Unit built for sale increased for two years continuously.

However, unit built for sale is getting slow so total starts

in November and December, 2022 did not exceed the

same months in 2021.

Forest environment tax

According to The Ministry of Agriculture, Forestry and

Fisheries, 29 municipalities around urban areas and 13

municipalities around mountain areas make efficient use

of forest environment tax and work together.

A questionnaire survey about the use of forest

environment tax was held during September to December,

2022. 1594 municipalities of 1741 municipalities

answered the questionnaire. About 30% of people are keen

to use the forest environment tax.

They work together to maintenance forest, to recommend

using lumber, to educate about wood, forest and lumber to

children and to have events related to forest.

Phytosanitary Certificate

Japan Lumber Importers’ Association recommends

Japanese importers to get Phytosanitary Certificates from

exporters four months earlier because the new rule for

importing logs and other products will start on 5th August,

2023.

Some countries have not responded to this new rule so

Japanese importers have concerns about they might not be

able to import logs.

|