|

Report from

North America

Strong jobs report is bad news for inflation

The economy added 263,000 jobs in November while the

country's unemployment rate was unchanged at 3.7%,

according to Labor Department figures. While the

November total was below the 2022 average monthly job

gain, it was more than the 200,000 economists surveyed

by Dow Jones expected.

While this is good news for workers, it’s less so for the

economy, underscoring that taming inflation is proving

more difficult and will require more time. Some experts

worry that the new data might make Federal Reserve Chair

Jerome Powell reconsider his suggestion that the pace of

rate increases might start to moderate as soon as the

December meeting.

Construction employment continued to trend up in

November gaining 20,000 jobs, in line with the average

monthly gain seen this year. Manufacturing gained 14,000

jobs, about half the 2022 monthly average. Retail trade,

however, lost 30,000 jobs with 3,000 cut from furniture

and home furnishings stores.

Furniture manufacturing sector contracts

Economic activity in the manufacturing sector contracted

in November for the first time since May 2020 after 29

consecutive months of growth, say the nation's supply

executives in the latest Manufacturing ISM Report On

Business.

Furniture and wood products industries reported some of

the worst contraction as 12 of the 18 industries surveyed

by ISM indicated contraction. “The U.S. manufacturing

sector dipped into contraction, with the Manufacturing

PMI at its lowest level since the coronavirus pandemic

recovery began,” said Timothy R. Fiore, Chair of the ISM

Manufacturing Business Survey Committee.”

With Business Survey Committee panelists reporting

softening new order rates over the previous six months,

the November composite index reading reflects

companies' preparing for future lower output.”

See:https://www.ismworld.org/supply-management-news-andreports/reports/ism-report-on-business/pmi/november/

Experts predict better affordability for 2023 US housing

The housing affordability crisis could be easing, according

to economists for real estate website Zillow.

Zillow’s economic research team predicts the following

for next year:

Despite mortgage rates doubling since 2019, affordability

will improve in 2023 as home values are expected to

remain relatively flat or even fall in some markets.

The Midwest will be a hot market. Prices have not risen

there as elsewhere and there is inventory to be had.

Zillow’s research shows mortgage costs are within reason

compared with incomes in Missouri, Kansas, Iowa, Ohio

and some areas of Illinois.

More family and even friends will be pooling resources to

make a purchase. In a survey from earlier this year, Zillow

found 18% of recent home buyers had purchased with a

friend or relative who wasn’t a spouse or partner.

More new construction will come from the rental market.

There is a glut of single-family housing in the wake of the

pandemic boom, but builders focused on multifamily units

are feeling more bullish. Construction starts for

multifamily have increased, up 8% in October since prepandemic

levels.

See:

https://www.furnituretoday.com/research-and-analysis/5-things-happening-in-the-housing-market-that-are-worthwatching-for-2023/

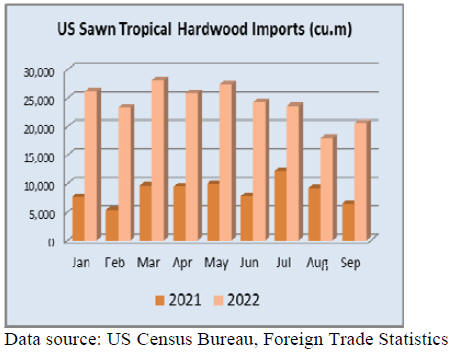

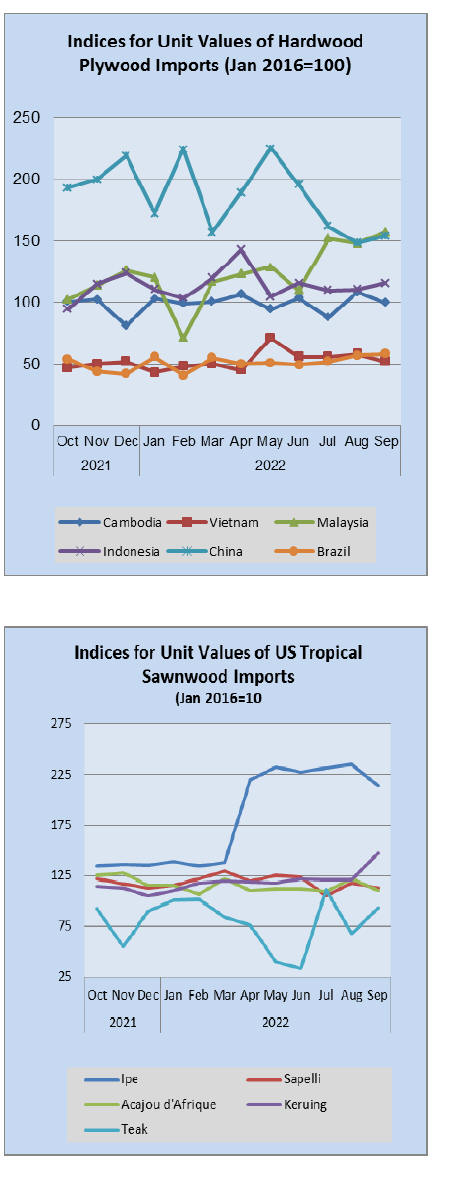

Tropical sawn hardwood imports level off

Imports of sawn tropical hardwood held level in October.

Imports fell less than 1% in October to 20,613 cubic

meters. Large gains in imports of Keruing (up 123%) and

Balsa (up 117%) offset lesser decreases in imports of

Sapelli (down 31%), Ipe (down 38%), and Mahogany

(down 63%).

Despite the monthly gain, imports of Balsa remain down

50% from 2021 year to date while most other woods are

up sharply.

Imports from Ecuador, Malaysia and Peru all saw strong

gains while imports from Cameroon, Indonesia and Congo

(Brazzaville) declined.

Canada’s imports of sawn tropical hardwood fell 21% in

October but were still 25% higher than the previous

October. Total Canadian imports of sawn tropical

hardwood are up 39% over last year through October.

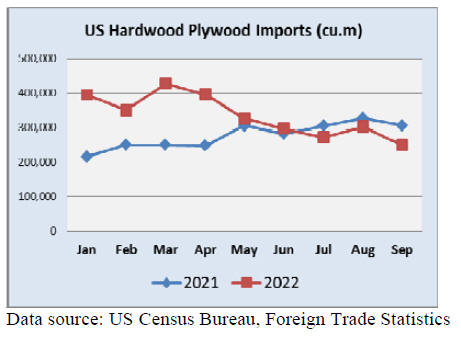

Hardwood plywood imports rebound

US imports of hardwood plywood rose 12% in October,

rebounding from a weak September. Even with the

improvement, the 280,533 cubic metres imported was 11%

below that of October 2021.

After a sharp decline in September, imports from Russia

rose more than 500% in October to their highest level

since Russia’s attack on Ukraine. Imports from Malaysia

more than quadrupled in October and were triple that of

October 2021. Total imports of hardwood plywood are up

18% over last year through October.

Veneer imports leapt in October

Imports of tropical hardwood veneer came back strong

from their annual September swoon, rising over 200% in

October over the previous month and more than doubling

the import dollars of October 2021.

Imports from Italy rose more than 15-fold as imports from

several other countries more than doubled. Imports from

Italy, by far the top U.S. trading partner, are up 22% for

the year so far, which is among the more modest gains by

a partner this year. Total imports year to date are up 53%

with imports from China, Ghana, and India all up in the

75% range.

Hardwood flooring imports advance while assembled flooring panel

imports lag

Imports of hardwood flooring rose by 33% in October to

outpace the previous October total by 22%. The rise was

driven by strong increases in imports from Brazil,

Indonesia and Malaysia. Imports from Malaysia were up

138% year to date over 2021 through October. Total

imports of hardwood flooring were up 11% over last year.

Imports of assembled flooring panels saw their weakest

month of the year in October, falling 22% from the

previous month to a level 3% below that of last October.

Imports from Thailand fell 55% to their lowest level in 17

months. Imports from Vietnam fell by a quarter and

imports from China fell 17%. Despite the poor showing,

total imports of assembled flooring panels were ahead of

2021 by 31% through October.

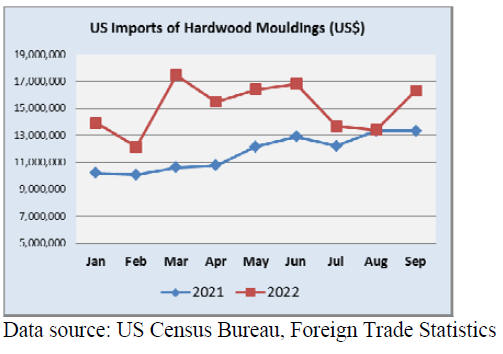

Moulding imports slump

US imports of hardwood mouldings fell 10% in October as

imports from China made a steep decline. Imports from

China dropped 53% in October to their lowest level since

April 2021. Imports from Brazil and Canada were both

down in the 10% range. Even with the declines’, imports

for the month were up 6% over October 2021 and were

ahead 26% year-to-date over 2021.

Wooden furniture imports tick upward

US imports of wooden furniture ended a four month slide

in October, rising 3% over the previous month. At

US$2.02 billion, October imports surpassed that of

October 2021 by 22%.

Imports from Canada and Malaysia both rose more than

10% over September totals while imports from India fell

9%. Total imports of wooden furniture were up 7% year to

year over 2021 through 0ctober.

Cabinet sales continue to drop monthly but outpace 2021

Cabinet sales dropped again in October according to

participating members in the Kitchen Cabinet

Manufacturers Association's monthly Trend of Business

Survey. Overall cabinet sales fell 6.7% in October

compared to September 2022. Custom sales were down

1.6%, semi-custom sales dropped 1.3%, and stock sales

decreased 11.4%. Compared to September, the estimated

cabinet quantity was down 8.6%.

Yet, 2022 sales remain strong compared to last year.

Cabinet sales were up 14.6% in October 2022 compared to

October 2021 figures, continuing the trend of year-overyear

sales growth for the industry. Custom sales were up

20.2%, semi-custom rose 24.5% and stock sales increased

6.9%. The estimated cabinet quantity decreased 2.6%

compared to last year at this time.

The Trend of Business Survey shows overall cabinet sales

for the first 10 months were up 17.3% when compared to

the same time period in 2021. Custom sales were up

16.4%, semi-custom sales increased 16.8% and stock sales

increased by 17.9%. The estimated cabinet quantity

decreased 0.8% according to the survey.

See:

https://kcma.org/insights/october-trend-business-report

Construction sawnwood prices at lowest since 2020

The continued slowdown in the US housing market has

taken its toll on softwood prices which fell to their lowest

level since June 2020 on 5 December. The essential

building commodity tumbled 9% in three days to a low of

US$382.80 per thousand board feet, below the US$400

level that has served as key resistance since 2013.

Prices are down 64% year-to-date. The weakness stems

largely from this year's deceleration seen in all facets of

the housing market, as soaring mortgage rates helped slow

down sales, rein in home price growth, and put a serious

dent in home builder confidence.

See:https://www.msn.com/en-us/money/realestate/lumber-fallsto-its-lowest-level-since-2020-as-us-housing-market-activitycontinues-to-slow/ar-AA14YzP5

Disclaimer: Though efforts have been made to ensure

prices are accurate, these are published as a guide only.

ITTO does not take responsibility for the accuracy of this

information.

The views and opinions expressed herein are those of

the correspondents and do not necessarily reflect those

of ITTO

|