Japan

Wood Products Prices

Dollar Exchange Rates of 12th

Dec

2022

Japan Yen 136.7

Reports From Japan

High level uncertainty for medium to long term

growth prospects

In December, sentiment among the major Japanese

manufacturers rose for the first time in four months and in

the service sector optimism was growing as companies

began to see signs of consumers spending again. But there

were concerns in both sectors that there is a high level

uncertainty for medium to long term prospects. This

uncertainty stems from the up and down recovery from the

pandemic in Japan, the slowdown in China which could

get worse as covid retrictions are eased and infections

spread and the risk of a global downturn.

Rising prices and weak consumer spending – slow growth anticipated

Kanako Tanaka and Fumiko Kuribayashi have

summarised the main findings of a recent Asahi Shimbun

survey of 100 major companies as follows:

-

More than half of leading companies believe the

economy has stalled or is slowly contracting

because of rising prices and sluggish consumer

spending.

-

46% of companies in the latest survey

viewed the

economy as flat, up by 9% from the previous

survey.

-

7% said the economy is slowly shrinking.

-

53% gave a pessimistic assessments of the

economy compared with 38% in the spring

survey.

-

The number of companies that feel the economy

is slowly expanding fell to 46 out of 100 from 59

in the previous survey.

-

No company assessed the economy as on a steady

growth path.

Asked to provide the main concerns for the

economy:

-

59 companies cited rising prices of crude oil

and

raw materials

-

34 companies said flagging consumer spending

was a big concern. This was more than double the

figure in the previous survey.

-

20 companies mentioned the weakened yen.

See:

https://www.asahi.com/ajw/articles/14785900

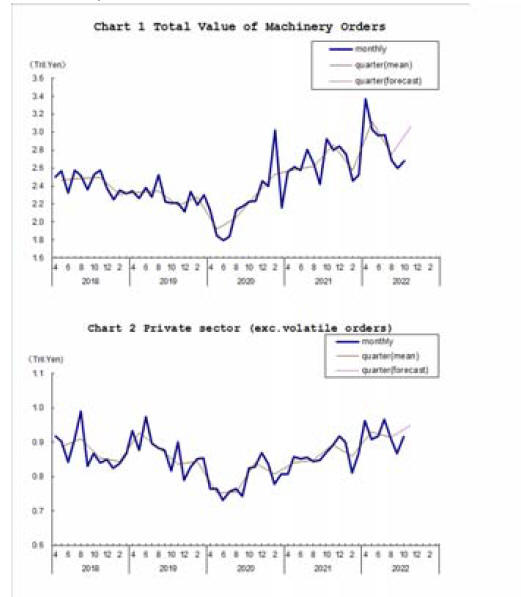

Rise in key indicator of capital spending

Private-sector machinery orders, excluding volatile ones

for ships and those from electric power companies,

increased a seasonally adjusted by 5.4% in October.

This was better than the 2.6% rise expected by economists

polled by Reuters. Compared with a year earlier core

orders, a highly volatile data series regarded as a leading

indicator of capital spending in the coming six to nine

months, rose.

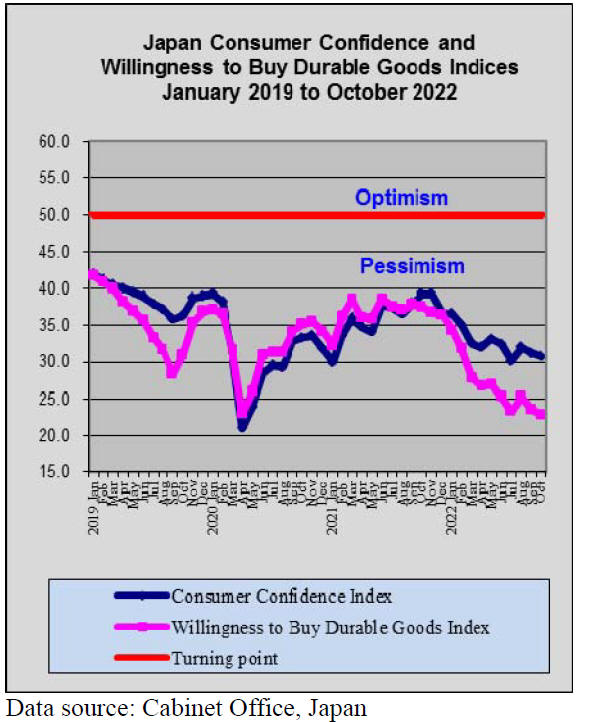

Consumer sentiment weighed down by price increases

The latest consumer sentiment survey in November

showed that consumers were even less optimistic than in

the previous month. This follows three consecutive

months of declines. In assessing the survey officials say

consumer sentiment is being weighed down by recent

price increases for daily necessities. They also say an

increase in the number of coronavirus cases may also be a

factor. More than 60% of survey respondents said they

think prices will be at least 5% higher in twelve months.

On the basis of the survey the Cabinet Office revised

downward its assessment of consumer sentiment for the

second month, describing it as "weakening." That word

was used for the first time since October 2019.

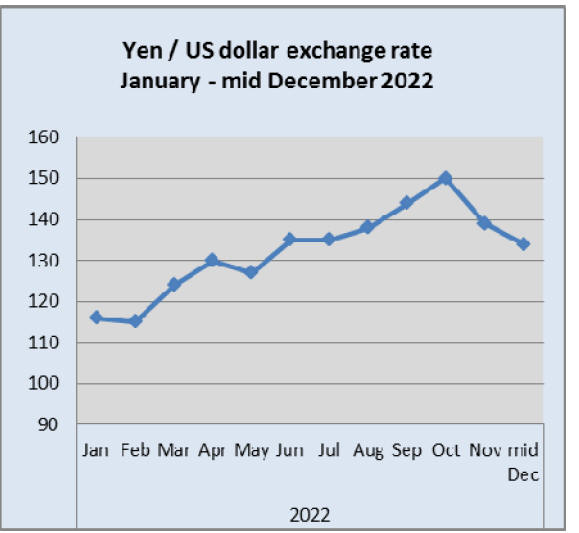

Yen strengthens

US inflation figures for November showed that annualised

rates fell from 7.7% to 7.1%, the lowest level in almost a

year. Better than expected inflation numbers drove

expectations about the future path of US interest rate

hikes.

The US$/Yen exchange rate moved after the release of US

inflation data with the yen strengthening to around 134 to

the dollar, the strongest it has been all month.

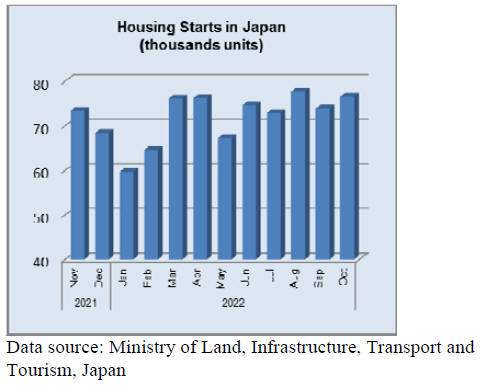

Concerns raised on availability construction

workers

ResearchAndMarkets.com has released its ‘Japan

Construction Industry Report 2022’ which says demand is

expected to grow by 5.0% to reach around US$245 billion

in 2022. However, the report notes challenges from rising

material costs and inflation which have put pressure on the

construction sector. Additionally, the construction sector

has raised concerns on the availability of skilled labourers.

As the country deals with the shrinking workforce foreign

workers are expected to play a significant role over the

next three to four years in driving construction activities

and market growth in Japan.

See:

https://www.researchandmarkets.com/reports/5025237/japanconstruction-

market-growth-trends-covid#src-pos-3

Import update

Furniture imports

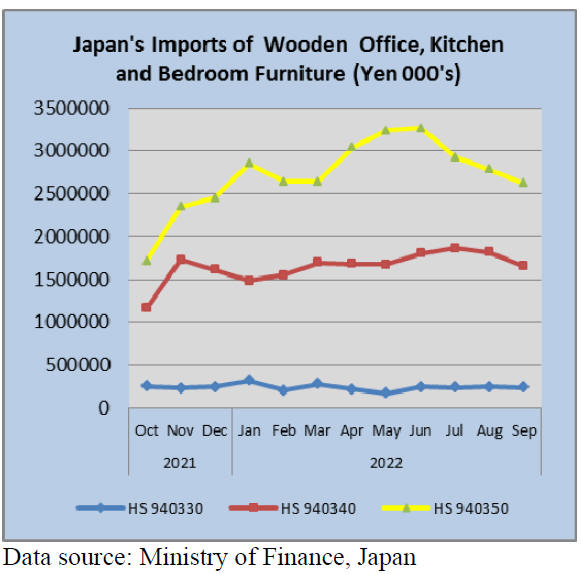

The weak yen, unprecedented inflation and the risng cost

of everyday necessities has undermined consumer

sentiment and the first to suffer are purchases of

discretionary items such as furniture. Since mid-year there

has been a downward trend in the value of furniture

imports mirroring traders’ assessment of consumer

demand.

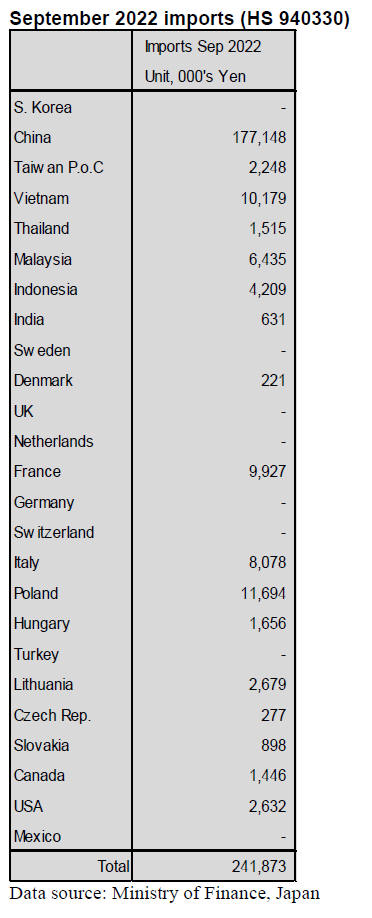

September wooden office furniture imports

(HS940330)

For shippers of wooden office furniture, China, Poland,

Vietnam and Malaysia accounted for around 85% of

September exports to Japan. September shipments from

Malaysia were far above that in August.

Shipments from China were down slightly but despite this

China alone accounted for over 70% of wooden office

furniture shipmemts.

Compared to the previous month and to September 2021

the value of imports of wooden office furniture were

largely unchanged.

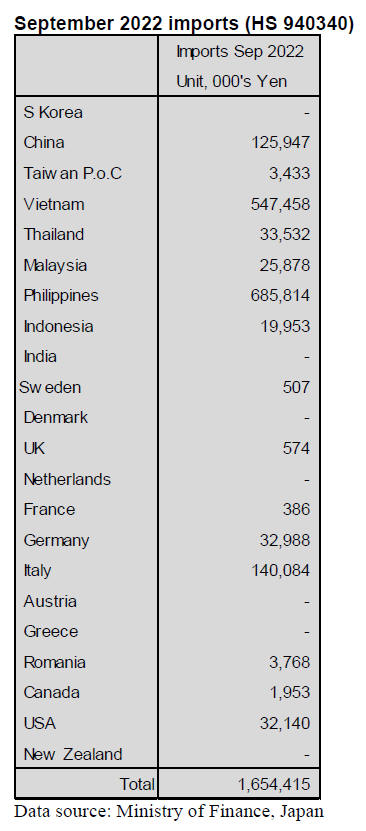

September 2022 kitchen furniture imports (HS 940340)

As was the case for most of 2022, four suppliers accounted

for most of the value of Japan’s imports of wooden

kitchen furniture.

The top four shippers are the Philippines and Vietnam

along with Italy and China. In September this year the

value of shipments from both the Philippines and Vietnam

were down from August but shippers in Italy and China

saw gains in September.

The value of September 2022 imports of kitchen office

furniture were over 30% up on September 2021 but

compared to August this year there was a drop of nearly

10%.

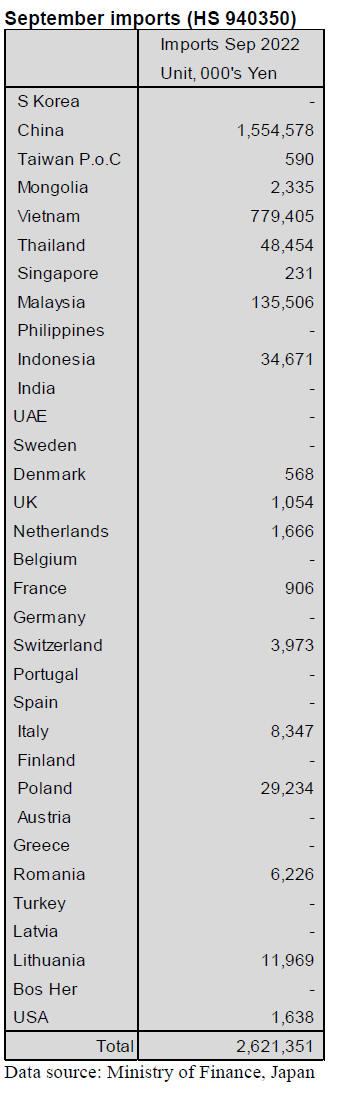

September wooden bedroom furniture imports (HS

940350)

September marked the third consecutive decline in the

value of Japan’s imports of wooden bedroom furniture

(HS940350).

Despite this September 2022 imports were around 40%

higher than in September 2021 and the weak yen exchange

rate may be part of the reason for the surge in the value of

imports. Compared to the value of August imports there

was a 6% decline in September.

In September this year the top suppliers of wooden

bedroom furniture were China, Vietnam, Malaysia and

Thailand. These four shippers accounted for over 90% of

the value of September shipments into Japan.

The value of imports of wooden bedroom furniture from

China were down about 10% in September, imports from

Vietnam were down slightly but imports from both

Malaysia and Thailaind rose month on month.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Price hikes of adhesive

Several manufacturers which produce adhesive will raise

the prices in December in this year. Oshika Corporation

raises over 10% of the current prices on adhesive product

for industrial use and constructions. MGC Woodchem

Corporation raises 20 – 40 % up in next month. Those

price hikes would influence production costs of plywood

and laminated lumber.

Oshika’s price hike is the 4th times in this year

and MGC

Woodchem’s price hike is the 2nd times in this year.

Log auction fairs in Okayama prefecture

There was a domestic log fair held at Tsuyama Sogo

Mokuzai Ichiba in Tsuyama, Okayama prefecture. The

market was lively and active. 3m cypress log was 21,500

yen. This is a sign of recovery in log markets. There were

2,200 cbms of logs offered at the fair. 3m cypress log was

16,000 yen at the fair held on 16th, September. The prices

at this time are 1,500 yen higher than the previous fair

held on 28th, October. 4m cypress log is 19,000 yen from

14,000 yen.

There were enough cypress logs at the northern part of

Okayama prefecture stimulated by the wood shock. Then

the prices dropped by oversupply. The cypress logs at

lumber plants had enough logs. In other areas, there had

been damages by a typhoon and there was a shortage of

logs. The lumber plants had many inquiries and the prices

rose. Other reasons are that movement of lumber was good

and log quality is better harvested in colder temperature.

There was a competition of good quality log from forests

under private ownership on the same day at a different

place. There were 6,300 cbms logs for the competition.

37% of 6,300 cbms was cedar logs and 60% was cypress

logs. 3m cypress log was 30,000 – 40,000 yen and 4m

cedar log was 35,000 – 40,000 yen. These are over 5,000

yen higher than previous time. 6m cedar log was 30,000 –

35,000 yen.

Log markets in Tohoku region

There is an atmosphere of an increase in log prices at

domestic log markets in Tohoku region. In Miyagi

prefecture, 4m cedar log is 14,000 – 15,000 yen, delivered

per cbm and this is 1,000 yen higher than previous month.

Cedar logs were unpopular until recently and the prices of

cedar logs kept falling.

However, it changed. 3m cedar log for posts is around

16,000 yen in Miyagi prefecture. 3.65m cedar log is

around 17,500 yen in Akita prefecture.

Movement of larch logs stays same and also the prices are

the same. 4m larch log for lumber is around 25,000 yen.

There is no recovery of demand for plywood. Hardwood

logs and red pine logs are not enough volume at the

markets because the temperatures were high in this year

and there might be damages on the logs. Oak and chestnut

logs cost high and oak log was 70,000 yen at the market.

A model house made of lumber

Aqurahome Corporation opened a model house which is a

five-story-building and wooden building. This is the first

model house with timber framework method in Japan. The

model house is not a base-isolated structure and it is an

aseismatic structure without special metal tools.

This model house is a prototype of the company and it

does not take a lot of cost to build. Size of posts is 210 mm

squares and of beams is 210 x 310.

Three gypsum plasterboards are used at the 1st floor and

are fire resistance for two hours. 60 mm LVL are used at

the 2nd floor to 5th floor. This LVL is resistant to fire for

an hour. The company will apply the certification for this.

There will be stores on the 1st floor, rental offices on the

2nd floor, rental houses on the 3rd floor and an owner’s

house on the 4th and 5th floors. Aqurahome will set up an

office on the 2nd floor after the show house finishes.

It will reduce Co2 generated during constructions of

wooden buildings. About 105 ton of Co2 will be reduced

and this is half volume of Co2 which is generated during

reinforced-concrete constructions and steel constructions.

Carbon storage is 84 ton converted into Co2.

Plywood

Movement of domestic softwood plywood started

improving since early November but not strong enough to

push the prices up yet so that plywood mills continue

production curtailment.

In October, movement of Chinese imported plywood

slowed down after some of Chinese plywood failed to

meet JAS standard then some domestic mill had fire,

which stopped the production. Both incidents did not help

stopping weak market. Chinese plywood was

supplemental supply for domestic supply and it was

expected to decline once domestic supply satisfies the

market. Fire was one of Seihoku group’s plant and other

Seihoku plants covered the supply shortage.

With increase of non-residential buildings and delayed

construction, the plywood demand is recovering so that the

manufacturers’ plywood inventory is expected to decline

at the end of November but usual demand pickup in

December seems remote now so the manufacturers plan to

continue production curtailment.

Prices of imported South Sea hardwood plywood

continues stay up high. With increased inventory and

advancing depreciation of the yen, the importers are

unable to place new orders. Some completed receiving all

the order files.

Normally the market prices decline when orders decrease

to promote sales but South Sea manufacturers adamantly

stick to high export prices as fixed cost increases when the

production declines. Then it is rainy season now and log

supply gets tight so there is no reason that the suppliers

need to reduce the sales prices.

Export prices of standard plywood of 24 mm 3x6 are

US$1,500 per cbm C&F. 3.7 mm is $1,250 and 5.2 mm is

US$1,200. With exchange rate of 140 yen dollar, 2.4 mm

and 3.7 mm may meet market prices in Japan. The prices

in Japan are 970 yen per sheet on 2.5 mm, 1,300 yen on 4

mm and 1,450 yen on 5.5 mm. 12 mm 3x6 concrete

forming panel for coating prices are US$850 per cbm C&F

and structural panel prices are US$780.

The weak yen

An effect of the weak yen for imported plywood markets

is not as big as lumber markets. A number of new

purchases for plywood is declining like a lumber’s

situation but the future’s price of imported South Sea

plywood in South East Asia are very high and the futures

price of lumber in Canada or Europe are not. Japanese

buyers concern about the import cost due to the weak yen

so they hesitate to buy future plywood.

Volume of imported plywood in September, 2022 was

201,117 cbms, 15% less than September, 2021. It was for

the first time in 16 months to decrease. There were delays

for loading plywood in the past and the plywood arrived

Japan with a large volume until August so some trading

companies did not purchase new plywood. This is why the

volume of imported plywood in September decreased. The

decrease will continue until December in this year and the

inventory volume will be around 170,000 cbms.

It is hard for the trading companies to buy new plywood

because the futures price of plywood in overseas are high

and also the weak yen will be the problem for them. In

Japan, imported South Sea plywood for coated plywood

for concrete forming of 3 x 6 of 12mm costs 2,400 yen,

delivered per sheet. Forming plywood with 3 x 6 of 12mm

costs 2,200 yen, delivered per sheet. Structural plywood

with 3 x 6 of 12mm costs 2,300 yen, delivered per sheet.

In overseas, the futures price of coated plywood for

concrete forming costs US$850, C&F per cbm. Uncoated

forming plywood with 3 x 6 of 12mm costs $760, C&F

per cbm. Structural plywood costs US$780, C&F per cbm.

Import cost would be 2,600 yen, FOB per sheet for coated

plywood for concrete forming, 2,330 yen, FOB per sheet

for uncoated forming plywood and 2,390 yen, FOB per

sheet for structural plywood. The import costs are

calculated with exchange rate of 147 yen per dollar.

To trade in futures, the trading companies need to think

carefully about lowering US$100 per cbm in overseas

export prices or raising 200 yen per sheet in Japan.

However, it is a rainy season in South Asia and it is

difficult to request sellers to lower the prices. Also, there

are too much inventory of plywood in Japan so it is unable

to raise the market prices.

There are two opinions about coated plywood for concrete

forming and uncoated forming plywood. These two kinds

of plywood have less inventory than standard plywood.

One of the opinions is that it will be able to raise 200 yen

up if supply and demand are balanced. Another opinion is

to buy plywood in Japan until a shortage occurs at

domestic markets. For standard plywood, it will take much

time to balance supply and demand due to overstocking. |