Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Nov

2022

Japan Yen 138.80

Reports From Japan

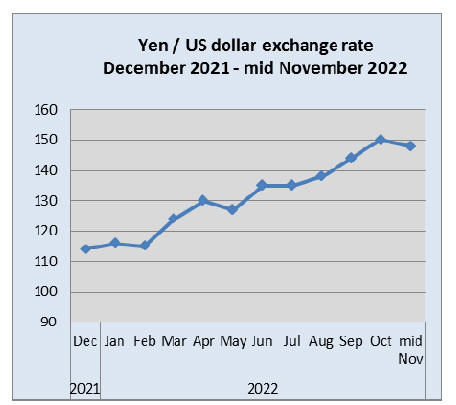

Trying to beat

global market forces

The Japanese authorities had spent over US$40 billion on

currency intervention up to the end of October, one of the

largest amounts in 30 years in an effort to support the yen

in currency markets.

To address the impact of inflation the government

announced a massive stimulus package but the Bank of

Japan is pinning all its hopes on companies raising wages

to drive what is called good inflation (as opposed to the

current imported inflation) and a slowdown in interest rate

increases in the US. Many economists, however, are

skeptical that the package will effectively boost the

economy.

See:

https://www.asahi.com/ajw/articles/14757593

and

https://www.ft.com/content/f9aca1c2-50c6-4040-8322-6ddfacda6cd6

Sentiment among manufacturers at new low

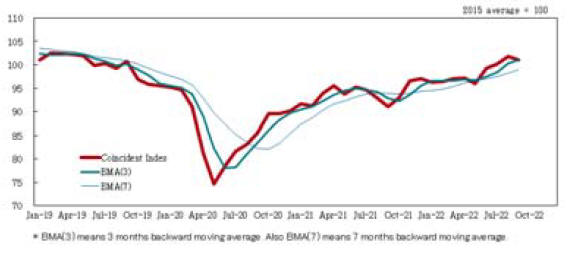

Sentiment among Japanese manufacturers dropped to a

new low in early November but in the services sector the

mood improved. This, according to analysts of the recent

Reuters poll, highlights the unevenness of Japan's

economic recovery.

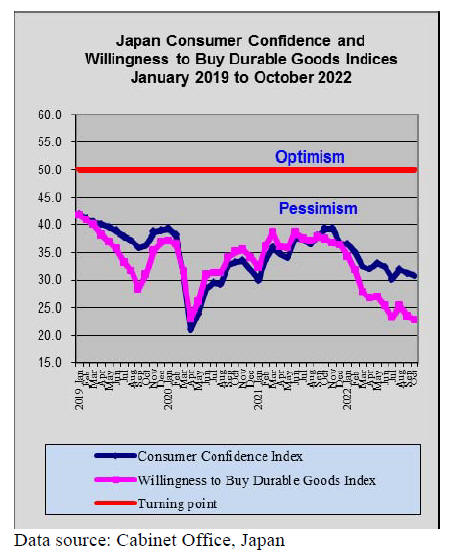

Inflation set to dampen household spending

The Ministry of Internal Affairs and Communications has

reported Japan's household spending in September

increased from a year earlier, rising for the fourth month in

a row as people spent more money following the removal

of coronavirus restrictions.

The question is whether the improvement in household

spending will be sustained given that inflation rose to 3%

in September, the first time in over 30 years and this will

dampen spending. At the same time, real wages fell 1.3%

from a year earlier in September marking the sixth

consecutive month they dropped.

Falling real wages may herald a further cooling of

consumer sentiment in the coming months and a bleak

outlook for consumption which accounts for more than

half of Japan's gross domestic product.

See:

https://mainichi.jp/english/articles/20221108/p2g/00m/0bu/003000c

and

https://www.marketpulse.com/20221108/yen-yawns-ashousehold-spending-rises/

Stagnant wage growth plus inflation a toxic mix

Over the past 30 years global average wages have risen,

the exception being Japan, where wages have remained

relatively flat. Minimum hourly wages in most European

countries range from 1,500 to almost 2,300 yen while in

Japan they are below 1,000 yen in most cases.

With the rapidly depreciated yen exchange rate the

purchasing power of 1,000 yen has fallen over 20% in the

past month.

See:

https://unseenjapan.com/working-in-japan-weak-yen/

Lower pace of US inflation lifts yen

Japan appears to be facing an extended period of low

growth and a weak yen as the U.S. Federal Reserve

continues its aggressive monetary tightening amid soaring

inflation.

The yen rose against the dollar mid November after US

inflation data showed a decline in the pace of increase.

The US Consumer Price Index rose by 7.7% in October

compared to a year earlier, the first time in eight months

that the figure was below 8%.

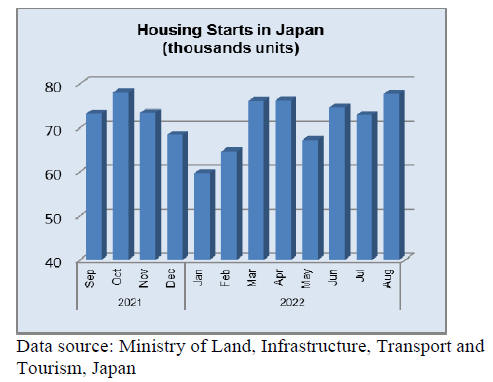

When interst rates rise home loan burden will

jump

The outstanding value of home loans continues to rise and

at the end of June stood at around US$1.5 trillion. In

contrast asset value of houses remains stagnant. Most

borrowers in Japan opt for variable-rate mortgages. A rise

of 0.1% in loan rates would increase the cumulative

outstanding interest by about 110 billion yen.

Import update

Furniture imports

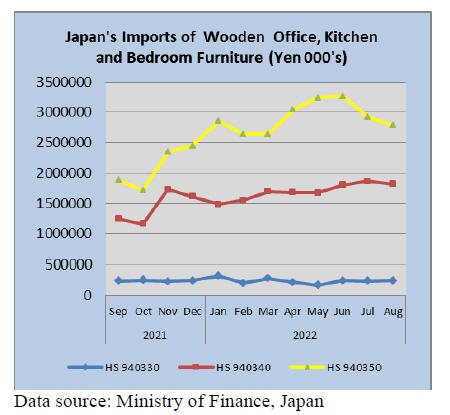

August import values were steady and with the yen

exchange rate at around 135 to the US dollar there was

little impact on imports. In the final quarter of the year the

sharp depreciation of the yen against all major currencies

pushed up the cost of imports and this is likely to be

reflected in the trend of wooden furniture imports.

The value of August imports of HS 940330 from China

were up slightly on July as was the value of imports from

both Vietnam and Poland. Year on year, August 2022

wooden furniture imports were down by 23% marking two

straight months of decline. When compared to the value of

July imports there was little change in August.

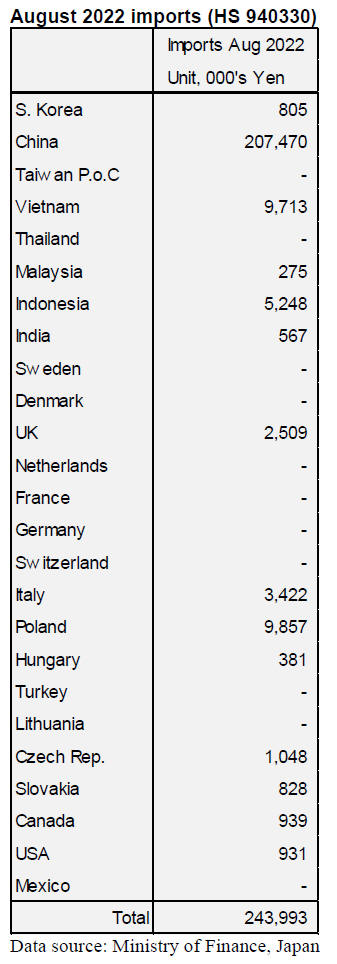

August office furniture imports (HS 940330)

Over 85% of Japan’s imports of wooden office furniture

(HS940330) in August originated in China. A further 4%

of the value of wooden office furniture came from each of

Vietnam and Poland. The only other significant shipper in

August was Indonesia.

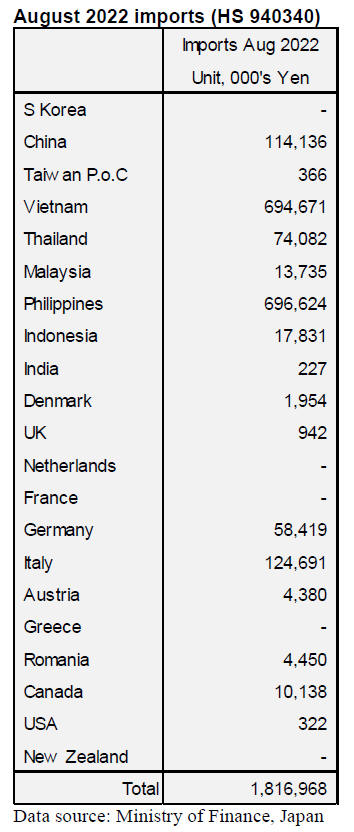

August kitchen furniture imports (HS 940340)

The Philippines and Vietnam each accounted for over 35%

of Japan’s August imports of wooden kitchen furniture

(HS 940340). The other main shippers in August were

China and Italy, each accounting for a further 5% of the

value of imports. Compared to a month earlier the value of

imports from all the main suppliers was almost the same

as in July.

After two consecutive monthly increases the total value of

HS 940340 imports there was a correction in August when

a 12% drop against the value of July imports was reported.

However, year on year August 2022 imports were up 35%.

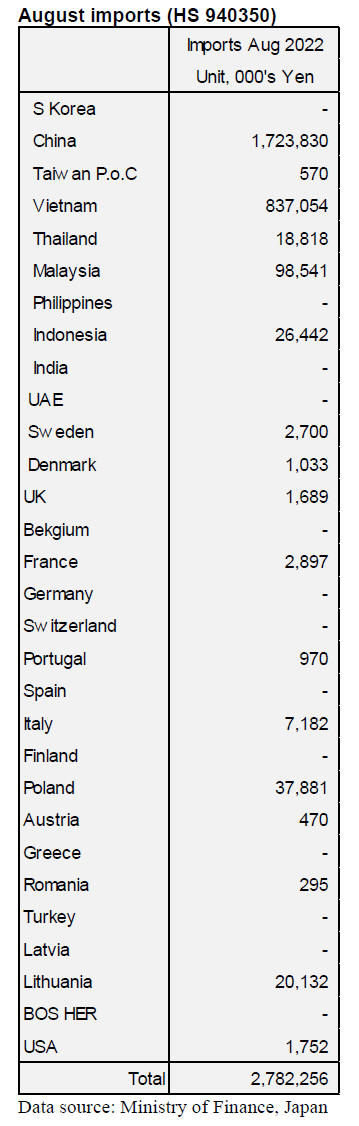

August bedroom furniture imports (HS 940350)

The downward correction in the value of imports of

wooden bedroom furniture (HS 940350) reported for July

extended into August when there was a further 5%

decline. Year on year the value of August 2022 imports

were up 30%.

Most of the imports of wooden bedroom furniture during

the year were from China which, in August 61% of the

value of imports followed by Vietnam at 30% and just 3%

from Malaysia which saw an increase in the value of

shipments in August.

The other shippers of note in August were Indonesia and

Poland both of which saw advances. On the other hand, a

significant shipper in July, Thailand, saw a sharp drop in

August shipments.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Block by FSC

The FSC (Forest Stewardship Council) released

information about removal of An Viet Phat Energy Co.,

Ltd., which is a major wooden pellet manufacturing

company in Vietnam, from the FSC member.

The reason is that the company had mendacious labeling

on purpose. CoC (Chain of Custody) of the company is

cancelled and the company is not able to reapply for the

certification for next three and a half years. In recent

years, volume of pellet from Vietnam has been increasing

in Japan and some of pellet would be from An Viet Phat

Energy.

According to the FSC, the company foisted off raw materials

as certified and sold the produces as FSC products to the

clients. There were forged documents used. There was an

investigation to the company, which sells raw materials, and

there was no fact about cutting down trees at authorized

forest by the FSC and selling authorized raw materials to An

Viet Phat Energy. The investigation was during January

through December, 2020.

The punishment is very severe and is called ‘Block’. The

‘Block’ became effective in April, 2020. Companies, which

had removed or suspended from FSC, could apply to other

certification authorities but the ‘Block’ was made to avoid

this. Announcing the ‘Block’ of An Viet Phat Energy by the

FSC, clients know that all products of this company are

mendacious labeling and unauthorized. There have been no

influences in Japan so far. There will be a final report of

this problem at the end of 2022 and there might be a

change in import wooden pellets.

Sattsuru to expand production

Sattsuru Plywood Co., Ltd. in Hokkaido completed

maintenance on a line of producing plywood and will

expand production. Total amount of product will be 2,500

cbms in a month including production at Shiranuka plant.

A business plan of the company will be finished by June,

2025. The company stopped operations at the head plant

and closed down the plant. Then the company moved

product lines to Shiranuka and Koitoi plants.

The Koitoi plant got the JAS (Japanese Agricultural

Standards) certification in April and started the operation

in May. The Koitoi plant produces 300 cbms in a month.

A total production of Shiranuka and Koitoi plants are

2,200 cbms in a month. Koitoi plant is able to produce

large plywood such as 3 x 8, 4 x 8 and 4 x 6.

Shiranuka plant is able to produce 3 x 6 and 3 x 7. A goal

of this company is to expand production by using veneers

or unfinished lumber such as platforms because there are

less South Sea logs. According to the company, there are

much inquiries about basswood plywood and this

company is the only company producing plywood made of

porous wood. It intends to promote sales of products made

of local Hokkaido species.

A new circular material

LIXIL Corporation in Tokyo prefecture developed

producing a circular material born from the combination

of plastic waste and wood waste. A name of this new

material is ‘revia’. It was difficult to recycle plastic waste

before but the company succeeded to recycle by

pulverizing and molding plastics in combination with

wood waste. The company will start selling the first revia

product called ‘revia pave’ in January, 2023.

The new product will be used as a paving material for

sidewalks, plazas, parks and building exteriors. A goal of

sales is 100 billion yen by 2030. In Japan, plastic packages

are collected and recycled in every where but there are still

several kinds of materials which are difficult to recycle.

Normally, the plastics are filled in ground or burnt but this

new material ‘revia’ is manufactured by plastic waste from

households or undertakings and wood waste from

buildings. Utilizing plastic and wood waste to create one

ton of revia that would have otherwise been incinerated

after use can result in 82% reduction in CO2 emissions.

It used to be difficult to recycle plastic waste because a

melting point was all different in every kind of plastics.

However, pulverizing and molding several kinds of plastic

all together made a success. Now, it is able to recycle

almost all kinds of plastic waste.

Log market in Northeast Japan

Domestic cedar log market in Northeast Japan is

weakened. There had been enough logs in summer in this

year and movement of domestic lumber is not good in

autumn. Therefore, the inventory at lumber manufactories

and plywood plants is very high and some stored logs are

damaged by insects. The prices of larch logs stay in the

same level. The prices of 3.65m cedar log of good quality

are 17,500 yen, delivered per cbm, and this is over 1,000

yen down from last month. Other size is around 16,000

yen.

Plywood plants start to adjust production due to

weakening demand. In Iwate and Miyagi prefectures, 4m

cedar log is around 13,000 yen, delivered per cbm, and

this is about 1,000 yen lower than previous month.

Other size logs suitable to recover post are 16,000 yen,

delivered per cbm.

In winter season, costs for crude oil and electricity rise

steeply and the companies have to increase the product

sales prices or decrease the procurement of materials.

4 m larch log is around 25,000 yen, delivered per cbm, and

this is stable. There are still inquiries for larch logs but

plywood plants demand calmed down for buying larch

logs so there is no price move. It is lifted restriction for

cutting down red pine logs in October so red pine logs

started shipping to the markets. On the other hand, there

are not enough hardwood logs and cypress logs.

There is a delay at cutting down trees because cedar is

more popular than hardwood trees and cypress trees. The

prices of hardwood trees are high and there is a shortage of

logs for woodchips. Forecast for the prices of cedar logs

will be improved if number of logs which were cut down

in autumn to winter will be at the markets. Actually, there

are already logs which are cut down in autumn and the

prices are good as log quality is stable compared to

summer harvested logs.

Plywood

Movements of domestic softwood plywood have not

recovered yet. Many companies settle accounts in September

and do not get plywood so much in September. However,

there are not much inquiries in October so some plywood

manufacturers started reducing production. Since a Chinese

plywood manufacturer, Jiangsu Benbenmao New Material

Co., Ltd. got suspended on JAS (Japanese Agricultural

Standers) certifications, inquiries for domestic plywood

seemed to grow.

However, it did not actually and the shipment is not good.

Orders to precutting plants are not many orders even

though shipment is not bad so far. The precutting plants

still have a lot of inventory so they are not able to buy new

stock.

There are a few new orders to South Sea plywood due to

the full inventory in Japan and the weak yen. It is a rainy

season in South Asia and there are not enough logs now.

The prices of 3 x 6 of 12mm of coated form plywood are

US$850, C&F per cbm, of form plywood are US$760,

C&F per cbm and of structural plywood areUS $780, C&F

per cbm. This is stabilized. The import costs are 2,632

yen, FOB per sheet for coated concrete forming plywood,

2,357 yen, FOB per sheet for raw form and 2,418 yen,

FOB per sheet for structural plywood.

The selling prices in Japan are 2,400 yen, delivered per

sheet for coated concrete forming plywood and 2,200 yen,

delivered per sheet uncoated form and structural plywood.

|