US Dollar Exchange Rates of

10th

Oct

2022

China Yuan 7.1545

Report from China

Vietnam imposes

anti-dumping duty on Chinese

furniture

On 30 September 2022 Vietnam's Ministry of Industry and

Trade issued Decision No. 1991 (1991/Q-BCT) to apply

provisional anti-dumping measures against some furniture

(table and chairs) originating in Malaysia and China. The

latest anti-dumping duties imposed ranged from 21.4% to

35.2%. The duty will become effective in mid-October.

The authorities in Vietnam said this was because of a

"significant" increase in the number of tables and chairs

imported from China which had hurt domestic production.

It has been reported that on 1 September 2021, Vietnam

launched an anti-dumping duty investigation against

imports of table and chair products from China and

Malaysia.

The survey pointed out that the volume of table and chair

products imported from China was significantly higher

than the domestic production and sales volume in Vietnam

which had a serious impact on the Vietnamese furniture

manufacturing industry. The HS code involved are shown

in the link below and there are some exceptions.

China is now Vietnam's main trading partner and a source

of key raw materials and equipment for its manufacturing

sector.

In the first nine months of this year bilateral

trade between

China and Vietnam stood at US$131.7 billion, of which

Vietnam imported products worth US$91.6 billion from

China. Vietnam's Ministry of Industry and Trade said it

would continue to collect information from relevant

parties to assess the impact of anti-dumping measures on

all parties.

Policies to stabilise foreign trade

In the first eight months of 2022 China's imports and

exports once again showed strong resilience but there is

increasing pressure to maintain steady growth and the

authorities found it necessary to introduce a new round of

policies to stabilise foreign trade to help enterprises.

The Chinese government has put forward policies and

measures to ensure production and the implementation of

contracts and further promote unimpeded trade. The

Ministry of Commerce will implement a new round of

foreign trade policies to ensure that this year's goal of

maintaining stability and improving foreign trade is

achieved including ensuring timely delivery of foreign

orders.

Given the current slowdown in external demand growth it

is important for companies to ensure that orders can be

produced, shipped and delivered on time.

In terms of production protection, the government

‘Policies and Measures’ clearly state that local

governments should strengthen the protection of export

enterprises in various aspects such as epidemic prevention,

energy use, labour use and logistics and give full support

when necessary to ensure timely delivery of foreign

orders.

In terms of protecting key enterprises, the Ministry of

Commerce has established a "white list" of foreign trade

enterprises proactively providing front-line services to

solve the practical difficulties of international foreign trade

enterprises. Customs clearance operations will be

conducted to support the new policies.

Support for cross-border e-commerce

In recent years cross-border e-commerce has developed

steadily and gradually become an important contributor to

trade flows. Growing and robust online consumer demand

in all countries offers growth opportunities for crossborder

e-commerce.

China's cross-border e-commerce import and export

volume was RMB1.62 trillion in 2020, up 26%. In 2021 it

was RMB1.92 trillion, an increase of 19% year on year. In

the first eight months of 2022 China's cross-border ecommerce

still showed very good growth.

To further support the role of cross-border e-commerce in

stabilising foreign trade, "Policies and Measures"

proposed, the introduction of additional support for crossborder

e-commerce offshore warehouse development

policy measures.

To support growth in cross-border e-commerce a second

phase of the Service Trade Innovation and Development

Guidance Fund will be launched to further stimulate social

capital and the existing funding channels such as the

special fund for foreign trade and economic development

will be coordinated and utilised to jointly support the

development of cross-border e-commerce, overseas

warehouses and other new forms of foreign trade.

Largest timber production base in Guangxi

Guangxi ranks first in China in the area of plantation

forests, the scale of national reserve forest establishment

and harvestable volumes and has become the largest

timber production base in China. Through construction of

a new land-sea corridor in the west the local government

will build a major forest product trading hub node.

Over the past ten years Guangxi has planted 200,000

hectares of trees annually and its timber output has

increased 7% annually. With about 5% of the country's

forest land, Guangxi has produced nearly half of the

country's domestic timber.

The total output value of the forestry sector increased from

RMB219 billion in 2012 to RMB849 billion in 2021 with

an average annual growth rate of 16% and the total output

value of the forestry industry jumped to the second place

in China.

Guangxi hosted the China-ASEAN Forest Exhibition and

the World Conference on Wood and Wood Products Trade

becoming an important node of the "double cycle" of

forestry, attracting timber trading enterprises from

Southeast Asian countries, Russia, Canada, New Zealand

and other countries.

China's first modern forest industry demonstration zones

have been built by the Guangxi Zhuang Autonomous

Region People's Government and the National Forestry

and Grassland Administration of China. Guangxi will

accelerate the development of green forestry industry and

take steps to expand ecological and environmental

protection, production of high-end furniture and home

furnishing, forest pulp and paper integration, forest

biomedicines.

Jiangsu Changshu wood product exports

Changshu City is located in the economic development

region of Yangtze River Delta in the south of Jiangsu

Province. The local enterprises exporting bamboo, wood

and grass products are mainly small-scale private

enterprises.

Among the many products sofas are the mainstay of

the

international trade. In order to promote the healthy

development of bamboo, wood and grass product exports

from Changshu region Changshu Customs promotes a

classification of wood product export enterprises matching

export support with the production management capacity.

Between January and August 2022 Changshou region

exported US$145 million of bamboo, wood and grass

products sold to more than 50 countries and regions.

See:

http://nanjing.customs.gov.cn/nanjing_customs/589276/589277/4596527/index.html

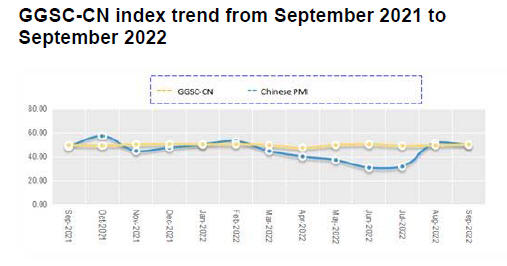

GGSC-CN Index Report (September 2022)

In September 2022 sporadic covd outbreaks and

subsequent lockdowns disrupted many industrial sectors

and private consumption. Multiple difficulties persist and

have been prolonged. China's macroeconomic growth is

still under great pressure.

This month China's PMI index registered 50.1%, a slight

increase from the previous month, The PMI was above the

critical value of 50% after two months indicating an

improvement in the economy. Overall, production in the

timber processing manufacturing industry increased,

orders and production are better than in the previous

month but export orders have decreased.

The GGSC-CN comprehensive index for September

registered 49.7% (48.2% for last September and 51.6% for

September 2020), a decline from the previous month and

below the critical value of 50%. It shows that the

operations of the forest products enterprises represented by

GGSC-CN index declined.

Challenges

Increasing costs

Declining quality of raw materials

Raw materials are out of stock

Need to find alternative sources

Products in short supply

Oak grade A, European oak grade AB, black walnut,

high-grade oak, high-grade oak, white birch.

Granules.

Commodity for which the price has increased

Hardware, metal, particleboard, urea, melamine,

paraffin, water repellent, glue. Merbau blanks, for the

floor parts, mpregnated wood grain paper.

Commodity of which the price has been decreased

Formaldehyde-free glue, core board, impregnated paper,

kraft paper, blank.

Panlongan, Diptera, Robinia locust, bean, oak, solid

rosewood, oak logs.

As for the GGSC-CN index, in September 2022 one subindex

of the GGSC-CN increased, one was flat and three

decreased.

The production index registered 50.0%, which was the

same as the previous month and remained at a critical

value. It shows that the production of enterprises

represented by GGSC CN is basically the same as the

previous month.

The new order index registered 54.1%, a decrease from the

previous month but, being above the critical value of 50%,

reflected the ability of enterprises to obtain orders is better

than the previous month. However among the new order

group the new export order index reflecting international

trade registered 39.47%, a bid decline from the previous

month.

The main raw material inventory index registered 45.8

showing that the raw material inventory of the forest

products enterprises has worsened from the previous

month.The employment index registered 45.8%, a drop

from the previous month. It shows that the employment of

the forest products enterprises is worse than the previous

month.

The supplier delivery time index was 47.9%, an increase

from the previous month. It indicates that the supply time

of raw material suppliers of the forest product enterprises

is still slow.

See:

http://www.itto-ggsc.org/site/article_detail/id/273

|