Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Oct

2022

Japan Yen 145.7

Reports From Japan

BoJ quarterly

report surprisingly optimistic

A Bank of Japan (BoJ) quarterly report found that most of

Japan’s regional economies are picking up ‘moderately’

with some firms considering raising wages. This is

essential if household incomes can grow to compensate for

rising living costs. The BoJ raised its assessment for one

of the country’s nine regions and left its view unchanged

for the remaining eight.

A private research firm, Teikoku Databan, has reported

that prices of about 6,700 food and beverage products will

rise in October as manufacturers are faced with rising

material costs and a weaker yen.

The firm says prices of 20,665 items have been or will be

raised this year including those that have been raised

multiple times. The average increase is 14%. October will

be the peak month for price increases this year but with

rising prices of electricity, gas and food periodic waves of

price increases could occur in 2023 and onwards.

See:

https://www.boj.or.jp/en/research/brp/rer/data/rer221006.pdf

and

https://www3.nhk.or.jp/nhkworld/en/news/20221002_08/

Forecast that inflation will be short lived questioned

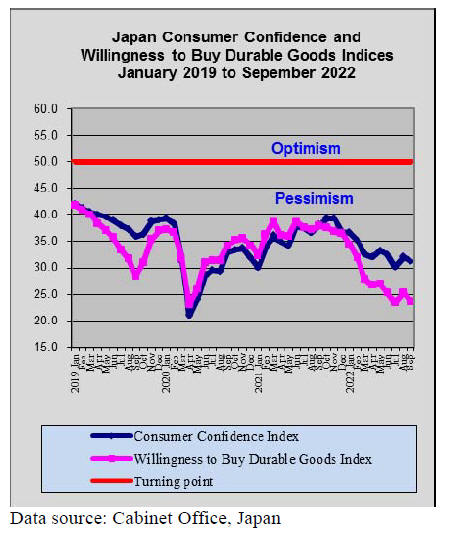

Core consumer prices in Tokyo, a leading indicator of

nationwide inflation, rose 2.8% year on year in September,

exceeding the BoJ's 2% target for a fourth straight month.

The data reinforced market expectations that nationwide

core consumer inflation will approach 3% in the coming

months and may cast doubt on the BoJ view that recent

cost-push price increases will prove temporary.

The Prime Minister has urged companies to aim for

pay

increases that keep pace with inflation during wage

negotiations next spring. The government aims to expand

subsidies for small and medium sized companies on

condition that they raise pay. The Russian invasion of

Ukraine has pushed up energy, raw material and grain

prices which have driven inflation.

Machinery orders – a major decline

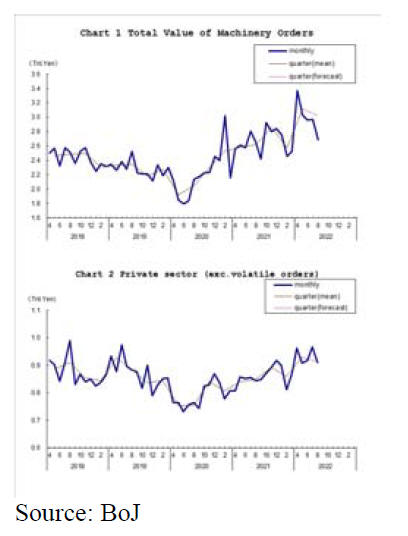

Machinery orders placed with major manufacturers (an

indicator of corporate sentiment) marked the biggest

single-month fall in six months in August due to the global

economic slowdown and a sharply weaker yen that pushed

up import costs. This does not bode well for corporate

spending.

The total value of machinery orders received by 280

manufacturers operating in Japan fell by 9.5% in August

from the previous month on a seasonally adjusted basis.

Private-sector machinery orders, excluding volatile ones

for ships and those from electric power companies,

decreased a seasonally adjusted by 5.8% in August.

See:

https://www.esri.cao.go.jp/en/stat/juchu/2022/2208juchue.html

Bankruptcies rise

The number of private sector bankruptcies in Japan rose

6.9% year on year between April and September, the first

increase in three years. The biggest challenge, it seems, is

that companies are having a hard time repaying the loans

they received from the government in response to the

COVID-19 pandemic.

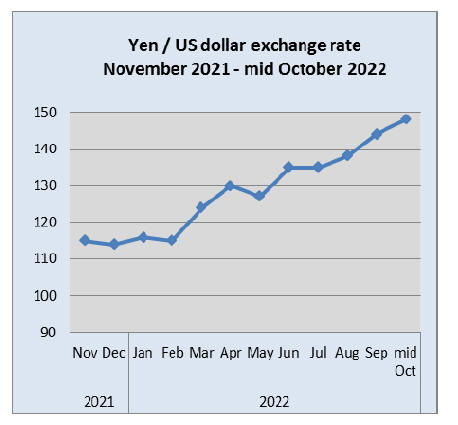

Yen titling to 150 to the dollar

Throughout Asia currencies are falling to record lows not

seen since the 1997 financial crisis. These changes have

unnerved businesses and policymakers who remember

how depreciation caused a collapse of Asian currencies.

To minimise the risk of a repeat policymakers and central

banks are trying to stabilise their currencies. The State

Bank of Vietnam raised interest rates last month as the

dong had fallen for nine straight days to a 29-year low.

The same day Vietnam raised interest rates, Japan, where

the yen has dropped around 25% against the dollar this

year, intervened in an attempt to strengthen its

currency for the first time since 1998.

In China, where the renminbi is trading near 14-year lows,

the central bank has taken a series of measures to slow the

currency’s depreciation.

The yen touched a low of 148.86 versus the dollar Friday,

the weakest level since August 1990, before ending the

session at 148.67.

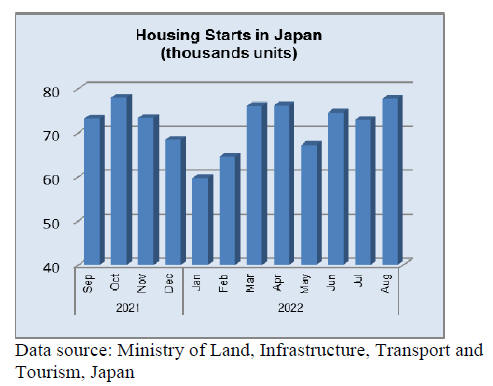

The real estate sector in Japan is enjoying a boom

at

present as the weak yen and foreign interest in the

Japanese housing market has come together to drive

demand.

With a yen that has fallen 25% against the US dollar,

Japan’s traditional attraction for foreign real estate

investors could grow.

House prices in urban areas are getting close to the highs

seen 25 years ago. Japan hasn’t enjoyed its current rates of

growth since prices began to inflate in the 1980s. But

questions remain, could this lead to another housing

bubble?

Furniture imports

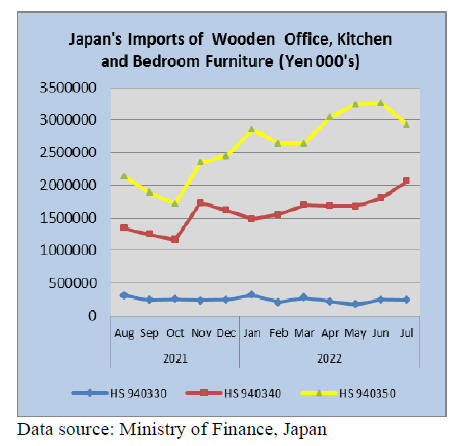

After three consecutive months of increasesthere was a

correction in the value of wooden bedroom furniture

imports in July. The value of July wooden kitchen

furniture imports added to the gains made in June but, the

value of wooden office furniture imports was flat.

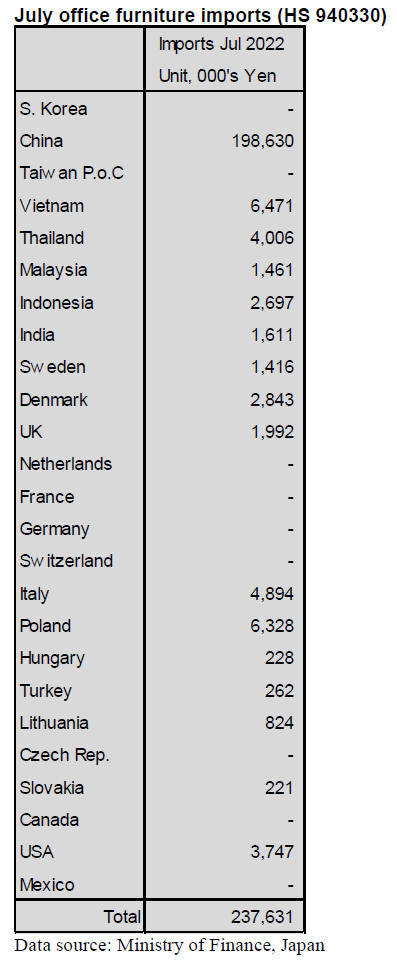

In July the value of shipments of wooden office

furniture

(HS940330) from China accounted for over 80% of all

wooden office furniture imports.

The other two shippers of note, Vietnam and Poland,

barely contributed 3% each to July arrivals. Year on year,

July 2022 wooden furniture imports were down around

20% while compared to a month earlier there was little

change in the value of imports.

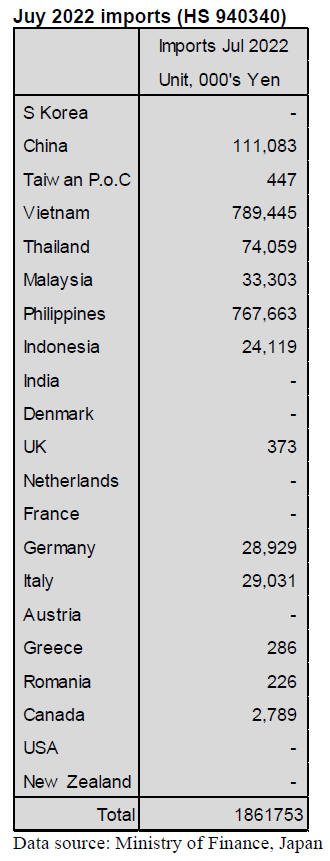

July kitchen furniture imports (HS 940340)

For two consecutive months the value of Japan’s imports

of wooden kitchen furniture (HS940340) have risen.

Month on month, July imports were 14% above over the

previous month and the rise in the value of July 2022

imports was a staggering 42% compared to July 2021.

The Philippines and Vietnam compete for the top spot in

wooden kitchen furniture deliveries to Japan and in July

each accounted for just over 40% of all imports of

HS940340.

The remaining 20% of the value of imports was taken up

by China (6%, a drop from the previous month) and

Thailand (3%, also a decline from the previous month).

Indonesia and Malaysia saw July shipments to Japan

increase over the previous month.

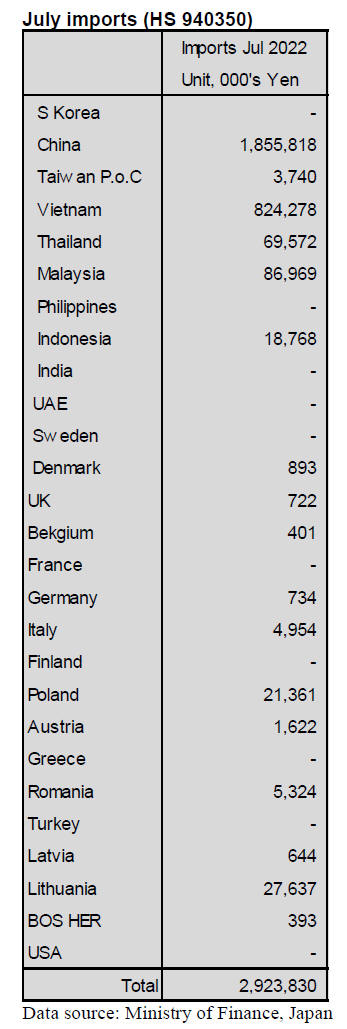

July bedroom furniture imports (HS 940350)

After three monts of steady increases the value of July

imports of wooden bedroom furniture (HS940350) tipped

lower by around 10%. Since October 2021 Japan’s imports

of wooden bedroom furniture have been on an upward

trend. Despite the downturn, year on year, the value of

July imports were over 50% higher than in July 2021.

As in previous monts most of the imports of wooden

bedroom furniture in July were from China which

accounted for just over 60% of all imports of this category

of furniture but this was down compared to the previous

month. Shippers in Vietnam saw there share of July import

values rise and accounted for 28% of july imports.

The other tow shippers in the top five were Malaysia and

Thailand. Shipments of wooden bedroom furniture from

Indonsia fell sharply in July.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Cedar logs for China

The weak yen and a fall in freight caused a high

competitiveness of exporting cedar logs to China. A

purchase price of logs is around 10,500 yen, at port per

cbm and this is 100 yen more than last month. A selling

price is USUS$130, C&F per cbm and this is US$10 lower

than last month. However, a payment is in yen so Japanese

companies receive profit. There is an increase in exporting

logs to China because the prices are lower than NZ logs,

which are around US$150, C&F per cbm.

A peak of the prices was US$160, C&F per cbm in March

and the prices started decreasing. On the other hand, the

freight kept increasing until summer. The freight was

US$80,000 to load 2,500 cbms for a ship at the beginning

of this year and the freight increased US$100,000 –

110,000, 2,500 cbms for a ship in August.

The yen started to fall from 115 yen to 144 yen against the

dollar since spring. It is a good opportunity to sell in yen.

The selling prices is US$30 lower than the peak and is

18,720 yen, C&F per cbm. It was 18,400 yen, C&F per

cbm at the peak. The freight dropped suddenly. It is

around US$90,000 recently.

Some reasons are slow economies in the world and

confusions at ports have been solved. If a cbm were

US$36 of the freight US$90,000, it would be 5,184 yen. It

would be nearly 700 yen drop from the peak even though

it was the weak yen. The log prices are increasing.

Demand of cedar logs for lumber and plywood is low but

for biomass fuel, it is lively and the prices are high to

export overseas.

There are 180,000 – 190,000 cbms of cedar log inventory

at ports around Shanghai, China. Once the volume

declined to 160,000 cbms after the lockdown lifted in June

but the volume is growing again because exporting cedar

fences to the U.S.A. is slow.

A NZ log costs around US$150 and a European log costs

around €170. The prices increased slightly. The Chinese

government would work out a monetary policy to grow

economy active. Usually, China imports logs from Japan

at the end of the year through the Chines New Year’s

holiday, so it is important to watch carefully how the

Chinese government would do.

A budget request in 2023

The Ministry of Agriculture, Forestry and Fisheries

announced about its budget request in 2023 to the Ministry

of Finance, Japan on 30th, August.

The budget request is 350.6 billion yen, 17.8% more than

last year to promote supplying domestic logs or lumber

stably and sustainably and to reforesting.

The budget request for public works projects is 231.6

billion yen, 17.4% more than last year and for non-public

works projects is 119 billion yen, 18.4% more than last

year.

The goals are to grow agriculture, forestry and fisheries

business and to succeed local traditions of rural districts to

next generation. There is a big theme to achieve carbon

neutrality. There are several plans such as strengthen in

supply and use of domestic lumber, training people for

forestry business, develop distribution business and

introduce high quality machines and so on. By doing these

plans, the volume of supply and use of domestic logs or

lumber will expand to 42,000,000 cbms by 2030 from

31,000,000 cbms in the year of 2020.

The Ministry of Agriculture, Forestry and Fisheries

will

support introduction of more trucks to transport log and

lumber. Another support is to supply CLT stably with low

costs by standardizing measures of CLT and promote

wooden high rise buildings in populated regions.

Plywood

A movement of domestic softwood plywood is dull after

the prices settled down. A shortage of long plywood is

solved in Western Japan and plywood companies have

enough inventory. Plywood companies start to adjust

production.

An inventory of plywood manufacturers at the end of

August was 111,495 cbms, 11.9% more than July. This

inventory was less than the inventory in May, 2020, which

was 178,998 cbms. A shipment was 223,652 cbms, 11.0%

less than the previous month. This was a low-level

volume. Some plywood companies reduce producing

plywood and will watch the situation carefully. This is a

different situation from usual years.

Trading companies reduce orders for South Sea plywood

due to the increased arrivals and overstocking at ports

since the 2Q. The volume of Malaysian plywood fell

below the previous year’s volume since May. The volume

of Indonesian plywood exceeded the previous year’s result

for 13 months continuously. The inventory is still too

much. Suppliers in South East Asia lowered the prices by

around USUS$40, C&F per cbm, but the import yen costs

are high due to the weak yen. It is difficult to raise the

prices to sell in Japan so it is difficult to place new orders.

The prices of plywood for concrete forming 12mm, 3 x 6

are USUS$860, C&F per cbm in South East Asia and this

is stabilized. The import cost is 2,560 yen, FOB per cbm

as the dollar is 143 yen. This is over 100 yen increasing

from last month. The prices in Japan are 2,400 yen,

delivered per sheet and it is 100 yen higher than the

previous month.

Imported lumber inventory at Tokyo

The inventory of imported lumber at Tokyo port at the end

of August is 210,000 cbms, 7.1% more than the previous

month. This is straight two months increasing. Dull

shipment and steady arrivals of Russian and European

lumber are the reasons of this much inventory.

The volume of lumber from North America is 49,000

cbms, 1,000 cmbs more, from Europe is 67,000 cbms,

6,000 cbms more, from Russia is 52,000 cbms, 6,000

cbms more and from China or other countries are 23,000

cbms, 1,000 cbms more than last month.

Since European lumber arrived to Japan with excess

volume during May, 2021 to March, 2022, which are

eleven months, the volume of 16,000 cbms at the end of

April, 2021 rose to 59,000 cbms at the end of March,

2022. Once the volume declined in April and May, 2022

but it started to rise in June.

Then, the volume at the end of June was 61,000 cbms.

This was for the first time to be high-level volume since

September, 2019.

This situation also occurs on Russian lumber. The volume

in September, 2021 was 19,000 cbms and the volume at

the end of March, 2022 was 37,000 cbms. The volume

decreased in April and May, 2022 and started increasing in

June. The volume at the end of August was very high-level

for the first time in two years.

The prices of imported lumber in overseas were very high

at the 3Q in last year and started to decline until the 1Q in

this year. An invasion in Ukraine by Russia influenced

people to buy a lot of Russian lumber. Then the prices

overseas rose again. As a result, Russian lumber kept

arriving to Japan and the volume of lumber grew. A

movement of lumber in Japan has been dull and a

shipment in July and August was only 59,000 cbms.

The volume in September in this year will be 56,000

cbms, 24.3% less than September, 2021 and in October

will be 50,000 cbms, 26.5% less than October, 2021.

The shipment in September in this year will be 62,000

cbms, 3.1% less than the same month in last year and in

October will be 61,000 cbms, 10.3% less than the same

month in last year. However, it will be difficult to reduce

the inventory in a short time. It will take some time for the

inventory to drop down to proper level of 150,000 cbms or

less.

|