4.

INDONESIA

Indonesia publishes FLEGT study

The Indonesian government has published a study on the

implementation of forest law enforcement, governance,

and trade (FLEGT) as part of efforts to support the

eradication of illegal logging and boost legal timber trade.

This study provides an overview of market acceptance,

recognition, perception, and incentives, particularly the

European market for FLEGT-licensed timber said the

Director General of Sustainable Forest Management, Agus

Justianto. The study is an important milestone in

understanding global policies related to product legality

and forest sustainability in forest products trade, he added.

The study provides an overview of developments in

producing countries besides Indonesia on developing,

negotiating and implementing FLEGT VPA, especially in

consumer country policies.

The study was carried out by a team from the University

of Freiburg in Germany and the Sebijak Institute of Gajah

Mada University with financial support from the

Indonesian Embassy for the Federal Republic of Germany

and the United Kingdom government.

See:

https://en.antaranews.com/news/251497/indonesiapublishes-flegt-study-to-support-legal-timber-trade

and

https://nasional.kontan.co.id/news/kajian-implementasi-flegtdan-implikasi-kebijakan-global-legalitas-kayu-dirilis

Encouraging equality in forest management

certification

Silverius Oscar Unggul, Deputy Chairman of the

Indonesian Chamber of Commerce and Industry (Kadin)

for Environment and Forestry, said Indonesia hopes that

the members of the Forest Stewardship Council (FSC) can

agree on Motion 37/2021 to provide equality to forestry

business actors in the world in sustainable forest

development at all business scales.

FSC discussed Motion 37/2021 at the General Assembly

in Bali, 9-14 October 2022 and one of the important points

in this motion is the change in the cut-off date – the

deadline for authorised natural forest conversion into

forest plantations - from November 1994 to December 31,

2020.

The November 1994 cut-off date, said Silverius Oscar, has

so far been considered an obstacle in the application of

FSC certification for plantation forests in Indonesia.

He also said that business actors in Indonesia of various

scales, from large scale to the community scale, deserve

the opportunity to participate in the FSC certification

scheme so that they can enter markets that require FSC

certification.

See:

https://forestinsights.id/2022/09/27/indonesia-dorongkesetaraan-dalam-sertifikasi-pengelolaan-hutan/

and

https://ekonomi.bisnis.com/read/20220930/9/1583012/kadinaphi-dorong-kesetaraan-dalam-sertifikasi-pengelolaan-hutanlestari

Indonesia/UK VPA – should benefit environment and

communities

The Indonesian House of Representatives has approved

the Ratification of the Voluntary Partnership Agreement

between the Indonesian Government and the United

Kingdom. This was stated in a Working Meeting between

the Ministry of Environment and Forestry, Ministry of

Trade, Ministry of Law and Human Rights and Ministry of

Foreign Affairs.

Regarding the ratification, Commission VI member Deddy

Yevri Hanteru Sitorus, emphasised that the ratification

should be of special concern to the Ministry of

Environment and Forestry because, even though the

FLEGT-VPA has a large economic impact, it is still

necessary to pay attention to its effect on the existing

forests. Deddy said that he hopes the FLEGT-VPA will

not only stimulate the economy but also take into

consideration the environment and benefits for

communities.

See:

https://www.dpr.go.id/berita/detail/id/41060/t/javascript;

Export benchmark prices for October wood products

The government released the Export Benchmark Price

(HPE) for wood products for October 2022. This was

stated in the Decree of the Minister of Trade Number 1372

of 2022 which was issued on September 30, 2022.

In a press statement it was explained that in October there

is a change in the HPE for wood sheet products for

packing boxes from plantation forests and chipwood.

The press release says "In wood products, there is a

change in HPE, namely wooden sheet products for

packing boxes from plantation forests which increased by

US$50 from the previous month to US$900 /cu.m. The

HPE for chipwood products also increased to US$95/cu.m.

The following are the HPE for wood products which are

valid in October 2022.

Veneers

Natural Forest Veneer US$850/cu.m; Plantation Forest

Veneer US$550/cu.m; Wooden Sheet US$900/cu.m

Chipwood

Chipwood in the form of particles US$90/tone; Chipwood

US$95/tonne

Processed Wood

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1000 mm2 to

4000 mm2 (ex 4407.11.00 to ex 4407.99.90

Meranti (Shorea sp) US$900/cu.m

Merbau (Intsia sp) US$1.100/cu.m

Rimba Campuran (Mixed tropical wood) US$850/cu.m

Eboni US$3.200/cu.m

Teak US$1.500/cu.m

Pine and Gmelina US$700/cu.m

Acacia sp US$70/cu.m

Sengon (Paraserienthes falcataria) US$450/cu.m

Rubberwood US$300/cu.m

Balsa (Ochroma sp) Eucalyptus, US$600/cu.m

Sungkai (Peronema canescens) US$350/cu.m

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth from

merbau wood (Intsia sp) with a cross-sectional area of

more than 4000 mm2 to 10000 mm2 (ex 4407.29.91 and

ex 4407.29.92): US$1,200/cu.m

See:

https://forestinsights.id/2022/10/02/harga-patokan-eksporhpe-produk-kayu-periode-bulan-oktober-ada-kenaikan-untuksejumlah-produk/

Multi-business scheme will not negatively impact

forests

The Ministry of Environment and Forestry (KLHK) has

asserted that the multi-business forestry permit scheme

will not have a negative impact on the condition of forests

in Indonesia.

Agus Justianto, DG of Sustainable Forest Management in

the Ministry said during a “Multi-business - Obstacles and

Solutions” workshop "We can control every permit

because if they cannot fulfill their obligations, the permit

can be revoked. This is one mechanism to keep this

programme running."

The shift from a wood-oriented to a landscape ecosystemoriented

approach to utilise non-forest products through a

forestry multi-business permit scheme requires permit

owners to protect the forestry and land use to avoid

increasing new greenhouse gas emissions.

Agus said the ministry will closely monitor existing

schemes, including regulations. Once entrepreneurs are

granted a permit they will be required to make a business

plan in accordance with the ministry's regulations. After

that the business owners will have to report their annual

work plan which will be monitored and evaluated by the

government, specifically in terms of the management of

forest diversification to prevent damage to forests.

See:

https://en.antaranews.com/news/252385/multi-businessscheme-will-not-affect-forests-negatively-ministry

Indonesia releases document on forestry management

policies

The LHK Ministry has released the report “State of

Indonesia's Forests (SOIFO) 2022”. This is a compilation

of government policies for managing the forestry and

environment sector in 2021–2022. LHK Minister Siti

Nurbaya Bakar said the document also contains all of the

government’s efforts to achieve the Forestry and Other

Land Use (FOLU) Net Sink 2030 target.

Indonesia believes that the FOLU sector can play an

important role in mitigating and adapting to climate

change as well as realising Indonesia’s nationally

determined contribution (NDC) document targets. Hence,

Indonesia is implementing three strategies to achieve the

FOLU Net Sink 2030, namely, sustainable forest

management, environmental governance and carbon

governance.

See:

https://en.antaranews.com/news/253621/indonesia-releasesdocument-on-forestry-management-policies

and

https://www.jpnn.com/news/klhk-meluncrkan-soifo-2022-dokumentasi-kebijakan-mengelola-hutan-lingkungan

5.

MYANMAR

Manufacturing

output drops further

According to the latest data from S&P Global, Myanmar's

manufacturing sector output contracted for the fifth

consecutive month in September. Weak demand because

of rising prices and the weakness of the kyat were to

blame. As business activity declined firms cut back on

purchasing of raw materials.

See:

https://www.pmi.spglobal.com/Public/Home/PressRelease/027cb5a25ef54341aaba4218d609910b

Toyota-Myanmar back in business

Toyota Motor Corp. has begun assembling autos in

Myanmar after a more than year-long delay following the

military takeover in February 2021. The factory in the

Thilawa Special Economic Zone, outside the country´s

biggest city, Yangon, is owned by Toyota and its trading

arm, Toyota Tsusho. Toyota is among more than 100

Japanese and other foreign companies with investments in

Thilawa.

See:

https://www.dailymail.co.uk/wires/ap/article-11307247/Toyota-begins-making-cars-Myanmar-delaycoup.html

Import restrictions and currency woes boosts border

trade

Capital flight and a drop in foreign investment, aid and

remittances have resulted in a foreign currency shortage

and in an effort to balance trade the authorities imposed

import limits.

The World Bank’s Myanmar Economic Monitor says that

over 80% of tariff lines now require import licences, up

from 35% last year. New requirements have been imposed

on consumer products, raw materials, intermediate goods

and machinery. The most common items in the border

trade are diesel and petrol.

See:

https://www.frontiermyanmar.net/en/junta-trade-policiesspark-a-smuggling-revival-at-thai-border/

6.

INDIA

Wholesale price indices

The Office of the Economic Adviser, Department for

Promotion of Industry and Internal Trade has published

wholesale price indices for August 2022.

The annual rate of inflation based on the Wholesale Price

Index was 12.41% in August 2022 compared to August

2021. Inflation in August 2022 was primarily because of

the rise in prices of mineral oils, food products, crude

petroleum and natural gas, basic metals, chemical products

and electricity.

The index for manufacturing increased in August to 143.2

from 143.1 for July 2022. Out of 22 NIC two-digit groups

for Manufactured Products, 12 groups have witnessed an

increase in prices while 10 groups have witnessed a

decrease in price.

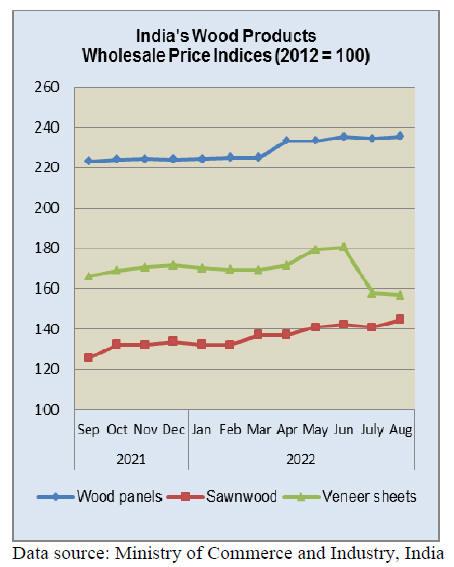

The indices for wood panels and sawnwood increased

while the index for veneers fell adding to the decline seen

in July. The explanation for the decline in veener prices is

most likely the weaker demand for veneer in China which

has added considerable volumes becoming available.

Some of the groups that witnessed a decrease in prices

were food products, basic metals, textiles, wood and of

products of wood and cork, rubber and plastics products,

electrical equipment, chemical and chemical products.

See:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Rupee at historic low

India could emerge as one of the strongest economies with

7% growth rate in fiscal 2023 according to the Economic

Advisory Council to the Prime Minister. The World Bank

projected 6.5% growth rate for the Indian economy for

2022-23, a drop of one percent from its June 2022

projections, citing the deteriorating international

environment.

What may derail growth prospects is currency volatility.

The Indian rupee fell to a historic low of 82.33 against the

US dollar in early October but not as badly has been seen

for some other currencies.

India to benefit from Global Gateway scheme

India is likely to benefit from the Euro 300 billion fund

announced by the European Union (EU) under its Global

Gateway scheme.

The EU website says “The Global Gateway will deliver

sustainable and high-quality projects, taking into account

the needs of partner countries and ensuring lasting benefits

for local communities.

This will allow EU’s partners to develop their societies

and economies but also create opportunities for the EU

Member States’ private sector to invest and remain

competitive, whilst ensuring the highest environmental

and labour standards, as well as sound financial

management. The Global Gateway is the EU’s

contribution to narrow the global investment gap

worldwide”.

See:

https://ec.europa.eu/info/strategy/priorities-2019-2024/stronger-europe-world/global-gateway_en

Lack of import regulations a risk for timber sector says

Forest Trends

Forest Trends has recently released a report “Turbulent

times for India’s timber trade”. This report. says Forest

Trends. “focuses on recent changes in India’s international

timber trade, especially over the 2019–2021 period, and

the implications (of identified changes) for India’s

sourcing of illegally harvested or traded timber.

The paper provides an update of Forest Trends’ 2020

report India’s Wooden Furniture and Wooden Handicrafts:

Risk of Trade in Illegally Harvested Wood (Norman &

Canby 2020). The findings of the 2020 Forest Trends

report as regards to the long-term timber illegality risk

profile of India’s timber trade remain valid”.

The report continues “Although the illegality risk level of

India’s timber imports has been lower over the 2019–2021

period than the preceding years, this is almost certainly

due to COVID and therefore short-term.

In the absence of timber import regulations the pre-

COVID risk levels will probably be reestablished when

India’s domestic demand picks up this is projected to rise

fast through the 2020s”.

See:

https://www.forest-trends.org/wpcontent/uploads/2022/09/India-TTA-Report-Final.pdf

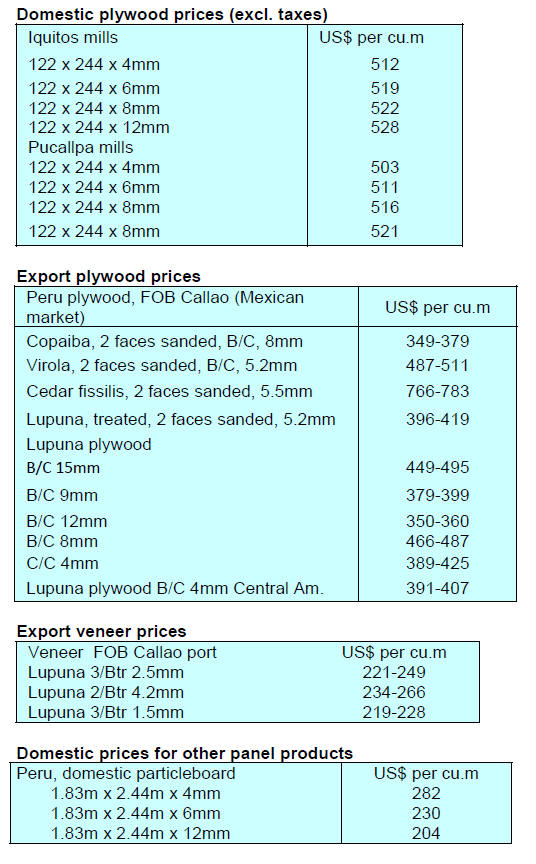

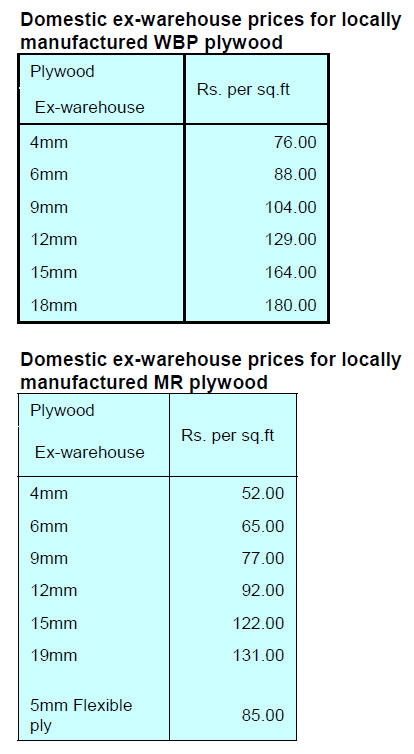

Plywood

Please note plywood prices are now shown below free of

local taxes.

7.

VIETNAM

Wood and Wood Product

(W&WP) trade highlights

Vietnam's exports of W&WP to South Korea in September

2022 are estimated at US$65.4 million, up 32% compared

to September 2021.

In the first 9 months of 2022 exports of wood and wood

products to the Korean market are estimated at US$742

million, up 14% over the same period in 2021.

In September 2022 exports of bedroom furniture reached

US$150 million, up over 200% compared to September

2021. In the first 9 months of 2022 exports of bedroom

furniture are estimated at US$1.8 billion, up 14% over the

same period in 2021.

Vietnam's imports of doussie in September 2022 reached

36,900 cu.m, worth US$15.3 million, down 8% in volume

and 9% in value compared to August 2022. Compared to

September 2021 imports increased by 95% in volume and

121% in value.

In the first 9 months of 2022 doussie imports reached

264,600 cu.m, worth US$105.3 million, up 25% in volume

and 33% in value compared to same period in 2021.

Imports of raw wood from CPTPP markets have declined

for 10 consecutive months compared to the same period

last year. In August 2022 imports reached 62,850 cu.m,

worth US$22.72 million, up 2% in volume and 1.5% in

value compared to July 2022. Imports were down 8% in

volume but up 20% in value compared to August 2021.

In the first 8 months of 2022 imports of raw wood from

CPTPP markets reached 416,860 cu.m, worth US$148.11

million, down 40% in volume and 18% in value over the

same period in 2021.

Vietnam Wood Trade Fair 2022

The 2022 Vietnam International Woodworking Industry

Fair (Vietnam Wood 2022) will be held in Ho Chi Minh

City from October 18-21, to promote technological

transformation of Vietnam’s wood processing industry.

The show will be both virtual and face-to-face and the

event will be held alongside the Vietnam International

Furniture Accessories, Hardware and Tools (Furnitec

2022) exhibition.

Vietnam Wood 2022 will gather 250 exhibitors from 24

countries and territories. Canada, France, Germany and

Russia are expected to run pavilions at the fair, which

showcases the global value chain of the woodworking

industry.

A series of seminars will be organised within the

framework of the event in which speakers will share their

expertise in the field of technology transformation,

automation trends for the industry, smart solutions for the

wood industry in the digital era and wood material

application in interior design, according to the event’s

organisers.

See:

https://en.vietnamplus.vn/tags/Vietnam-Wood-2022.vnp

Wood pellets

In 2021 wood pellets exports from Vietnam amounted to

3.5 million tonness worth US$413 million. Wood pellet

exports are expected to increase sharply. In the first 6

months of 2022 exports reached nearly 2.4 million tonnes

worth US$354 million. If the pace of growth is maintained

exports for the year may reach US$700 million. Wood

pellets are, projected to enter the group of agricultural and

forest products with an export earnig of over US$1 billion.

Domestic plantations, mostly of fast-growing acacia which

are extensive in Vietnam, are the most important source of

material for wood pellet production. This raw material

includes small diameter wood, branches, tops along with

residues from sawmills, veneer factories, chipping mills

with low quality chips that cannot be otherwise used.

Wood residues are abundant in the Northern region where

many sawmills and wood-based panel factories are in

operation. In the Central coastal areas the raw materials

for wood pellet production is mostly branches, tops, reject

chips and certain volume of solid wood.

Information shared by some companies which are

producing and exporting wood pellet shows that raw

materials for wood pellet from domestically grown

plantations account for over 75% of the total supply.

Shavings, sawdust, crushed chips from imported wood are

also one of the most important inputs for wood pellet

production. This source contributes over 20% of the total

supply of raw wood for the wood pellet industry.

Shavings, sawdust and crushed woodchips are waste and

residues from sawmills and woodworking factories

distributed at major wood industry clusters.

Due to the high cost of transportation domestically grown

wood is often uncompetitive with residues from imported

timbers. Vietnam has over 300 wood pellet production

facilities with about 70-80% concentrated in the central

and northeast of the Northern Region, the Central coastal

with extensive plantations and the Southern region with

highly developed wood processing centres.

8. BRAZIL

Forest+ Amazon

Project for conservation and recovery

Small producers and rural property owners from the nine

states in the Legal Amazon are eligible to benefit from the

Amazon Project, the “Forest+ Conservation” modality.

Selected participants will receive financial incentives for

conservation efforts. This project is a partnership between

the Ministry of Environment (MMA) and the United

Nations Development Program (UNDP).

The selection criteria include beneficiaries with no

environmental violations and that have natural vegetation

protected beyond the minimum required by law.

In addition, candidates need to have the Rural

Environmental Registry (Cadastro Ambiental Rural -

CAR) validated by the competent agency as well as

showing compliance with the other criteria set out in the

public call notice.

Project also aims to identify institutions that work with

natural vegetation recovery projects in the Amazon and

that have the potential to work as partners of the “Forest+

Amazon” Project.

See:

https://www.gov.br/pt-br/noticias/noticias/meioambiente/09/projeto-floresta-amazonia-recebe-inscricoes-namodalidade-conservacao-e-tem-chamada-aberta-para-amodalidade-recuperacao

Exports and sustainable harvesting in the State of

Acre

A study showed that all timber companies in the State of

Acre, one of the main tropical timber producing states in

the Amazon, have permits to operate and are thus legal

entities.

The analyses were carried out by the Logging Monitoring

System (Simex - Sistema de Monitoramento da

Exploração Madeireira) Network formed by four

environmental institutions: the Amazon Institute of People

and the Environment (IMAZON), the Institute for

Conservation and Sustainable Development of the

Amazon (IDESAM), the Institute of Agricultural and

Forest Management and Certification (IMAFLORA) and

the “Centro de Vida” Institute (ICV).

Simex analyses were carried out between August 2020 and

July 2021 and recently released data show that, out of the

total of 10,886 hectares of forest in the State of Acre, 94%

of harvesting was on private properties and that there was

no illegal exploitation in restricted areas such as Protected

Conservation Areas or Indigenous Lands.

In August 2022 companies in Acre State exported wood

products valued at US$4.56 million and wood product

imports to the State were valued at US$439,000.

According to the Ministry of Industry, Foreign Trade and

Services the accumulated trade balance for the period

January to August 2022 exceeded that in the same period

in 2021 by 30.2%, totaling US$42.95 million Source: G1

Acre (October 2022).

See:

https://g1.globo.com/ac/acre/noticia/2022/10/01/extracaode-madeira-no-ac-se-concentra-em-areas-privadas-e-esta-100percent-autorizada-aponta-estudo.ghtml

Timber exports from Pará State increase

In Pará State between January and August 2022 the

international trade in wood products registered an increase

of 97% in value (US$273.9 million) and 19.5% in volume

(189,000 tonnes) according to the Association of Timber

Industries Exporters of Pará State (AIMEX).

The United States remains the main destination for wood

products from Pará State followed by France, the

Netherlands, Denmark and Belgium. However, exports in

August dropped to just US$20 million, the worst since

January this year.

AIMEX suggested exchange rate volatility impacted sales,

in addition measures to combat inflation in consumer

countries, the regular lockdowns China and the invasion of

Ukraine by Russia were to blame for the decline in

exports.

See:

https://ver-o-fato.com.br/para-exportacao-de-madeiraaumenta-195-em-volume-e-97-no-faturamento-em-2022/

Export update - corrected

In August 2022 the value of Brazilian exports of woodbased

products (except pulp and paper) declined 2.0%

compared to August 2021 from US$412.6 million to

US$404.6 million.

Pine sawnwood exports grew 8.3% in value between

August 2021 (US$69 million) and August 2022 (US$74.7

million). In volume, exports dropped slightly over the

same period from 255,300 cu.m to 254,200 cu.m.

Tropical sawnwood exports increased 1% in volume, from

35,300 cu.m in August 2021 to 35,700 cu.m in August

2022 and in value exports grew 25% from US$13.0

million to US$16.2 million, over the same period.

Pine plywood exports saw a massive 54% decline in value

in August 2022 compared to August 2021, from US$108.8

million to US$50.5 million. In volume, exports also

dropped 35% over the same period, from 195,900 cu.m to

127,100 cu.m.

As for tropical plywood, the volume of exports also fell

(44%) and in value (34%), from 9,200 cu.m (US$5.6

million) in August 2021 to 5,200 cu.m (US$3.7 million) in

August 2022.

As for wooden furniture exported values fell from

US$66.4 million in August 2021 to US$60.9 million in

August 2022, an 8% drop year on year.

9. PERU

International Wood Fair

From 10-12 November the International Machinery,

Equipment and Services for the Wood and Furniture

Industry Fair – FENAFOR will be held. FENAFOR is the

only international fair in Peru for machinery, supplies,

accessories and services for the forestry, wood and

furniture industries and has been held since 2006.

To date, the organisers report that the Fair will have the

participation of an interesting number of foreign

companies and that the international invitations exceeded

all expectations.

During the event there will be technical presentations by

Peruvian and foreign specialists. Among the topics to be

discussed will be how to take advantage of low-impact

harvesting with a good level of transformation to added

value products.

Private sector initiatives in forest ecosystems

protection acknowledged

The Reforestamos and AIDER associations conducted the

second ‘Los Bóscares Peru’ in September which promotes

the recognition of business practices that support forest

sustainability in the country.

Publicly available information from 169 companies in the

country was analysed from which initiatives by four

companies were selected for assessment. The initiatives of

the finalist companies were evaluated by a jury made up of

the Ministry of the Environment (MINAM), the National

Forestry and Wildlife Service (SERFOR) and two experts

in the forestry sector of Peru.

The winning companies in each of the categories were:

Forests and Climate Change

ISA REP, for its “Jaguar Connection Program in

Alto Huayabamba and Biored Ucayali”.

Forest Conservation

BBVA-BBVA Foundation for its initiative

“Inventory of large Amazonian trees in the Las

Piedras river basin, Madre de Dios”.

Research and Innovation in Forests

Bosques Amazónicos (BAM), for its "State-ofthe-

Art Forest Genetic Improvement Program."

The award ceremony was held virtually so as to connect

with audiences from different sectors of society interested

in learning about the work carried out by companies to

improve their relationship with Peru's forests.

Andean countries fight against illegal logging

With the aim of promoting discussions on illegal logging

in member states of the Andean sub-region the Peruvian

Andean parliamentarian, Juan Carlos Ramírez, presented

the draft regulatory framework for the fight against illegal

logging and trade of wood in the Amazonian forests of the

Andean region.

It is expected that this draft if adopted will improve

coordination between the forestry authorities of the

Andean Parliament countries and will achieve timely

access to information and exchange of experiences.

The Regulatory Framework for the fight against illegal

logging will be reviewed and debated by the Andean

parliamentarians who are members of the Fourth

Commission, which will convene experts in the field to

receive their contributions. Subsequently, the law will go

to the plenary session of the Andean Parliament where it

will be debated further.