|

Report from

North America

Tropical hardwood imports slide, Canadian imports

plummet

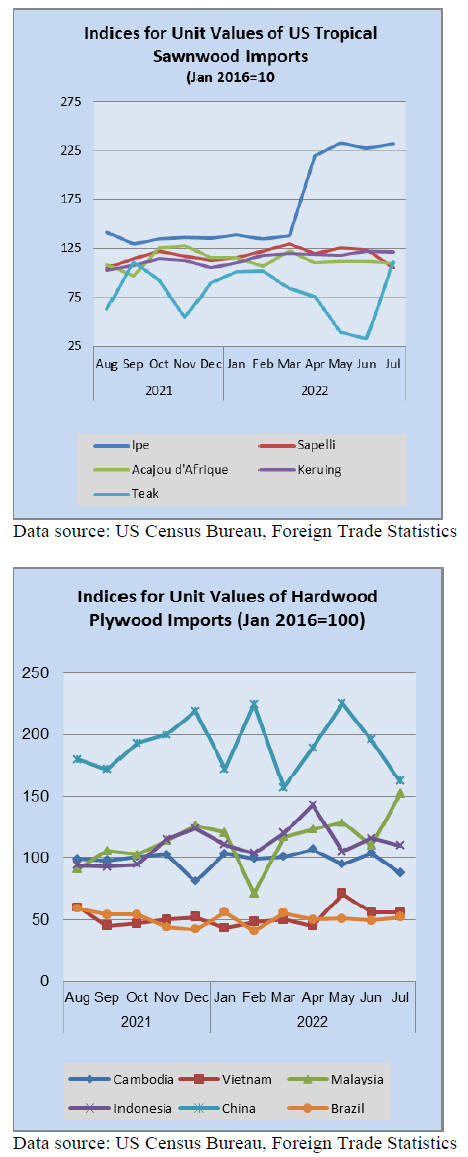

Imports of sawn tropical hardwood fell for a second

straight month. The 23,608 cubic metres imported in July

was down 3% from the previous month. Imports of Ipe

fell 15% to their lowest level of the year while imports of

Cedro and Balsa also hit a yearly low by falling 79% and

40% respectively.

Gainers included Iroko imports, which more than

quadrupled in July to their highest level of the year, and

Sapelli imports, which also had their best month of the

year after rising 63%. Imports of most woods remain up

sharply for the year so far, however imports of Aningre

and Balsa are both down more than 50% year to date.

Imports from Cameroon and Peru both more than doubled

in July while imports from Malaysia surged by 70%.

Imports from Indonesia dropped by 46% to their lowest

total of the year while imports from Cote d¡¯Ivoire tumbled

69%.

After five months of solid growth, Canada¡¯s imports of

sawn tropical hardwood plunged by 52% in July. At

US$1.24 million, imports were 10.8% lower than the

previous July. Imports of Sapelli fell by 38%, imports of

Mahogany dropped 72%, and after smashing an all-time

record for Iroko imports in June, absolutely zero Iroko was

imported into Canada in July. Despite the tumble, total

imports remain ahead of last year by 33% through July.

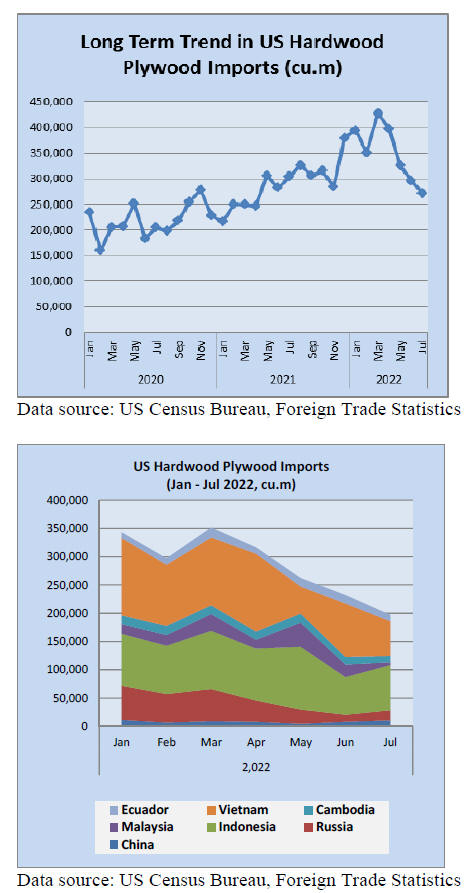

Hardwood plywood imports down again

Imports of hardwood plywood fell for a fourth straight

month, declining by 8% in July. The 271,697 cubic metres

imported was the lowest volume month since April 2021

and was 10.5% less than the previous July.

Imports from Malaysia fell 78% in June to their lowest

level since November 2017, while imports from

Cambodia, Vietnam, and Ecuador also retreated by more

than 10%.

Imports from Russia rebounded somewhat in July rising

44% from the previous month, but they were still only

one-third of the volume compared with last July. Despite

the continued slide, total imports are up 33% over last year

through July.

Veneer imports see best month in three years

US imports of tropical hardwood veneer jumped 18% by

volume in July for their strongest month since July 2019.

Imports from Ghana more than doubled, imports from

China and Cote d¡¯Ivoire more than tripled, and imports

from India rose more than sixfold, bouncing back from a

very poor June.

Weak import figures from Italy (down 23% from June and

45% from the previous July) tempered some of the

growth. Year to date, tropical hardwood veneer imports

from Italy are only 4% better than last year while overall

imports are up 32%.

Hardwood flooring imports improve

Imports of hardwood flooring rose 6% by volume in July,

not quite returning to their May peak, but still a hearty

22% higher than the previous July. Imports from Brazil

fueled the gain, rising 29% in July. The gains from Brazil

more than made up from declines in imports from

Indonesia and China as well as a sharp 51% drop in

imports from Malaysia. Overall imports of hardwood

flooring are up 16% over 2021 year to date.

Imports of assembled flooring panels were down 14% in

July. Imports from Indonesia fell by 40%, imports from

Brazil fell by 33%, and imports from Canada fell 18%.

Imports from China rose 14% in July but were still 41%

less than that of the previous July. Overall imports of

assembled flooring panels this year are up 46% over 2021

through July.

Moulding imports dip

Imports of hardwood moulding dropped by 19% by

volume in July even though imports from Canada, the top

supplier, went up. Despite the 12% bump in imports from

Canada and a 64% increase in imports from Brazil, large

declines in imports from emerging suppliers like

Indonesia, Vietnam and Mexico dragged down the

monthly total. Imports from China also fell by 41%.

However, imports have been strong all year as July¡¯s

imports still manage to beat July 2021 imports by 10.2%

and total imports are up 34% year to date.

Wooden furniture imports cool

Imports of wooden furniture fell for a second consecutive

month in July. At US$2.1 billion, July imports were down

10% from June and were 4.8% less than that of the

previous July. Imports from Indonesia, Malaysia and

Vietnam all saw declines of more than 10%. Imports from

India were the only riser, gaining 10%. Despite the

pullback, wooden furniture imports remain up 8% over

2021 through July.

Exports of sawn hardwood expanded in first half of

2022

In January-June, U.S. exports of hardwood lumber

expanded to 1.9 million cubic metres, a 12% increase over

the same period last year. The value of exports jumped

21% to US$1.3 billion. In first half of 2022, the average

price of hardwood lumber expanded 8% to US$679 per

m3, according to Lesprom Analytics.

In June, the average price for exported hardwood lumber

edged down 0.9% compared to the previous month at

US$690 per m3, according to Lesprom. This is 4.9% more

than a year ago when it was US$657.

Tropical sawnwood exports increased 10% in volume,

from 41,200 m3 in July 2021 to 45,500 m3 in July 2022.

In value, exports grew 35% from US$15 million to

US$20.3 million over the same period. As for tropical

plywood, the volume of exports fell around 20% and in

value by 10% from 7,300 m3 (US$4.2 million) in July

2021 to 5,900 m3 (US$3.8 million) in July 2022. The

exported value for wooden furniture value fell from

US$71.7 million in July 2021 to US$58.1 million in July

2022, a 19% decline.

See:

https://www.woodworkingnetwork.com/news/woodworkingindustry-news/us-exports-hardwood-lumber-expand-12-firsthalf-2022

Lumber prices decline to new 2022 low

Prices for softwood lumber in the US fell to a new 2022

low heading into September, according to Markets Insider.

The essential building commodity fell as much as 4% the

last week of August to US$465 per thousand board feet,

decisively below the low seen in early August of US$470.

The price decline may be seen by some as a positive sign,

but Goldman Sachs believes that is also indicative of a

housing market slowdown that may last longer than

expected.

See:

https://markets.businessinsider.com/news/commodities/lumberprices-new-low-housing-market-warning-mortgage-ratesgoldman-2022-8

|