|

Report from

Europe

Post-pandemic revival in EU joinery manufacturing

during 2021

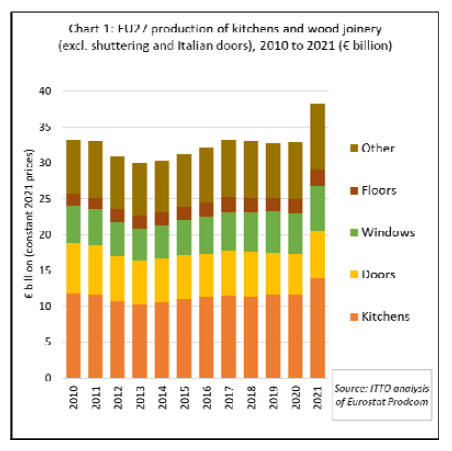

After the dislocation caused by the COVID-19 pandemic,

the performance of the EU27 wood joinery sector was

transformed in 2021. The main long-term trends in

previous years were a continuous increase in joinery

production in Germany offsetting a large decline in Italy

and wood's loss of share to other materials ¨C particularly

plastics - in windows and doors manufacturing.

However, 2021 saw a sharp revival in wood joinery

activity across the continent. Following three years of

stagnation, production value of wood joinery and related

products in the EU27 increased 16% to €38.22 billion in

2021. Last year, in value terms, total wood joinery activity

across the EU27 was at the highest since before the 2008

financial crises (Chart 1). This is the main conclusion to

be drawn from analysis of newly released Eurostat

PRODCOM data which provides a snapshot of the

production and consumption value of wood joinery

products in the EU27 in 2021.

In 2021, the impact in the COVID-19 recovery plans on

long-term economic and social ¡°resilience¡± was felt

particularly strongly in the joinery sector.

NextGenerationEU, the €750 billion ($888 billion)

economic recovery instrument rolled out across the EU

from 2021 in response to the pandemic, is explicitly linked

to the EU Green Deal, a radical project to cut EU

emissions by 55% compared to 1990 levels by 2030 on the

way to making the EU climate neutral by 2050.

37% of NextGenerationEU finance is earmarked for

achievement of European Green Deal objectives with

activities including a large program of building renovation

and support for the ¡°circular economy¡± and sustainable

investment. The projected costs of these Green Deal

measures are enormous, requiring an additional €82 billion

to €147 billion in spending every year until 2030, about

half a percentage point of the EU¡¯s GDP. Beyond 2030,

the additional investments are 1% to 2% of GDP, about

€4.6 trillion between 2031 and 2050.

Nowhere has the impact of these measures been greater

than in Italy. In fact the effect is so strong that the Eurostat

PRODCOM data for Italian door manufacturing in 2021 is

so high as to suggest it may be exaggerated. For this

reason it is not included in the EU-wide analysis (which it

would otherwise distort) and is considered separately

below.

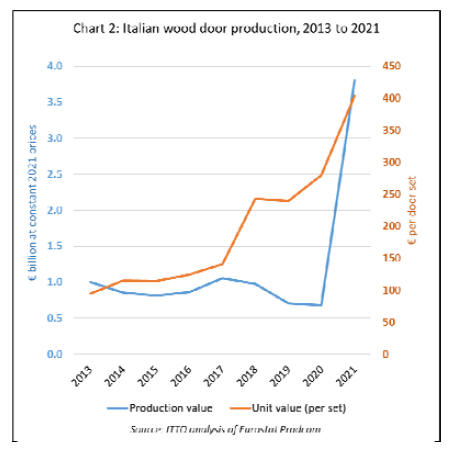

Eurostat reports fivefold increase in value of Italian

wood door production

According to Eurostat data the value of wood door

production in Italy increased nearly five fold from €680

million in 2020 to €3.8 billion in 2021 (Chart 2). If

accepted at face value, this would imply that Italy alone

accounted for around 40% of the total value of all wooden

doors manufactured in the EU last year. In terms of

quantity, Italy¡¯s production is recorded as increasing from

just 2.4 million door sets in 2020 to 9.4 million door sets

in 2021.

There is, possibly, a legitimate explanation for such a huge

increase in Italian wood door production.

A key feature of Italy¡¯s post-COVID support measures in

the construction sector, partly financed through

NextGenerationEU, was the so-called ¡°Superbonus¡±

scheme for building renovations.

This was originally introduced in May 2020 as part of

Italy¡¯s ¡®Relaunch Decree¡¯ adopted in the wake of the

pandemic. It aimed to boost the Italian economy by

providing incentives aimed at improving building energy

efficiency. The scheme allows homeowners to set 110% of

the costs building renovation against tax, effectively

allowing them to renovate at no cost. The scheme is due to

end in 2025.

Given that Italian door production was at a level of around

10 million units per year in 2013, before declining during

the long period of stagnation in Italy¡¯s joinery sector to

around 3 million units in 2019 before the pandemic, a

production figure of 9.4 million units last year is just about

conceivable.

This is particularly true when it is considered that

replacing old doors with new modern energy efficient

designs is probably one of the most immediately effective

measures to reduce energy consumption in the existing

housing stock. Indeed, this is the type of measure that led

the EU to praise Italy¡¯s Superbonus scheme for boosting

the decarbonisation of the building sector, which is

estimated to account for around 40% of energy use and

36% of CO2 emissions in Europe.

As of 31 July 2022, more than 220,000 renovation projects

with a total value of €40 billion had been accepted under

Italy¡¯s Superbonus scheme, according to data from the

Italian National Agency for New Technologies, Energy,

and Sustainable Economic Development (ENEA).

The scheme had a ¡°formidable positive impact¡± on the

Italian economy, according to the National Council of

Engineers (CNI). By the end of 2021, the subsidies

contributed to the generation of more than €12 billion in

Gross National Product (GDP) and the creation of 153,000

jobs, the association said in a study.

The Superbonus scheme, which likely lies behind the

sharp rise in Italian door production, therefore has had

some very positive effects. On the other hand, the

extremely rapid rise in unit costs of wood doors in Italy

last year hints at some potential problems due to such

large subsidies. The average unit cost of wood door

production in Italy last year was €404 per set, 70% more

than before the COVID crises.

A significant increase in the costs of door production can

be expected due to sharply rising costs of materials,

energy, and other business since the start of the pandemic.

However, the rise in the unit cost of doors in Italy is out of

line with other EU countries. Last year, the unit value of a

wood door produced in Italy was more than seven times

the average (€57 per set) of wood doors produced in other

EU countries.

This lends weight to comments by Prime Minister Mario

Draghi to the European Parliament in May this year when

he suggested that the Superbonus scheme had led to

market distortions. ¡°The cost of improving efficiency has

more than tripled due to the 110% scheme.

The prices of the investments needed to perform the

renovations have more than tripled because the 110%

eliminates the incentive to negotiate on price,¡± he

remarked.

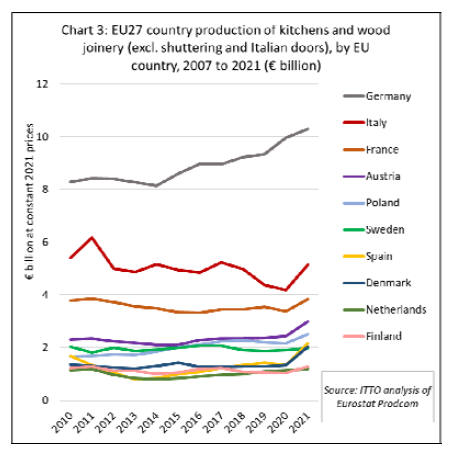

Slow but steady rise in German wood joinery sector

Last year¡¯s rise in the value of joinery manufacturing in

other EU countries, and in joinery sectors other than doors

in Italy, was less dramatic but still significant. (Chart 3).

The value of joinery production in Germany, which unlike

other leading joinery manufacturing countries in Europe

continued to grow in 2020, increased by 3% to €10.30

billion in 2021.

In all the other large joinery manufacturing countries there

was a sharp increase in joinery production value last year

following a decline in 2020. Gains were made in France

(+23% to €5.14 billion), Austria (+23% to €2.99 billion),

Poland (+16% to €2.51 billion), Sweden (+4% to €1.98

billion), Spain (+61% to €2.16 billion), Denmark (+53%

to €2.05 billion), and the Netherlands (+6% to €1.20

billion). Production value of all joinery products other than

doors in Italy increased 23% to €5.14 billion in 2021.

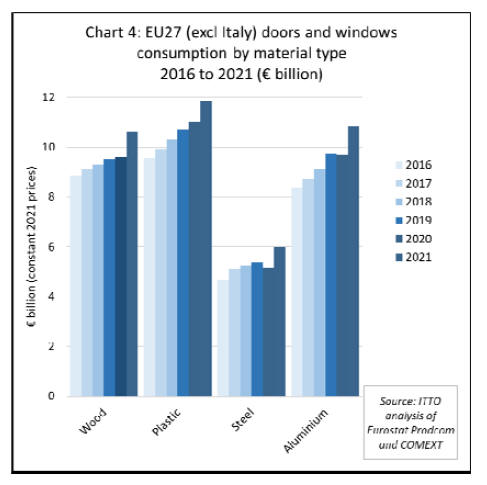

No sign of an increase in wood¡¯s share of the EU door and

windows sector.

While wood joinery activity increased significantly last

year across the EU, there is little evidence to suggest that

wood products increased their overall share of the EU

market for doors and windows. Eurostat PRODCOM data

provides comparable data on the total value of doors and

windows manufactured in the EU27 in wood, plastic, steel

and aluminium respectively. This shows that the value of

metal and plastic door and window production in the

EU27 increased alongside production of equivalent

products in wood (Chart 4).

The share of wood in the total value of EU27 door and

window production was 27% in 2021, the same proportion

as the previous year. The share of steel also remained the

same last year, at 15%. The share of aluminium marginally

increased, from 27% to 28%, while plastics share declined

slightly, from 31% to 30%.

The continuing rise in aluminium follows a longer-term

trend.

Aluminium has always remained the default windows

product in the commercial market but has enjoyed

considerable resurgence within the residential window and

door market. An important driver behind this has been

aluminium bi-fold and sliding doors as consumers demand

greater space and light within living areas. Another factor

is the demand for lower maintenance and greater strength

in light weight frames for high energy efficiency double

and triple glazed units.

A limitation of the PRODCOM data is that it does not

distinguish products made wholly in wood or metals from

those that are composites of both materials. The

development of wood-aluminium composite window

frames has been a key growth area in the EU27 in recent

years. These products combine the strength and efficiency

of aluminium with the thermal insulation and aesthetic

properties of wood.

EU market for wooden doors rebounded 12% last year

Eurostat PRODCOM data shows that the total value of

wood doors supplied to the EU27 (excluding Italy)

increased 12% to €6.50 billion in 2021 following a 1%

decline the previous year.

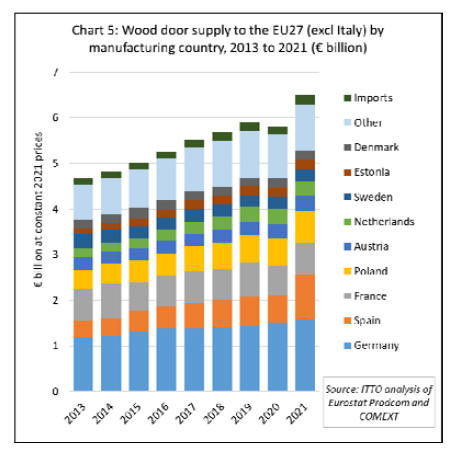

In 2021, 96.6% of the value of all new doors installed in

the EU27 were manufactured inside the single market,

only 3.4% were imported from outside (Chart 5).

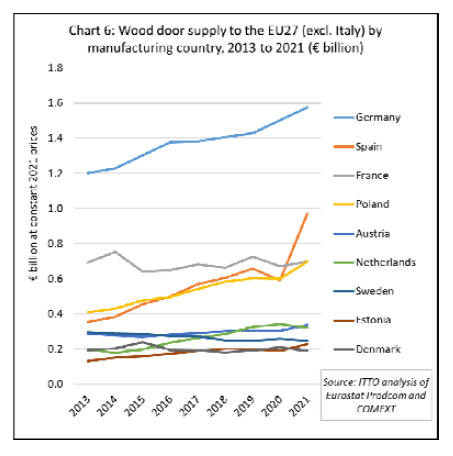

Although the trend was generally upwards, there was

variation in the performance of the wood door sector in

EU27 countries in 2021 (Chart 5). Production in Germany

increased 5% to €1.50 billion during the year, continuing

an uninterrupted rise since 2009. Production in Spain

rebounded very strongly, by 64% to €970 million in 2021

after a 10% fall in 2020.

Production in France also rebounded, but less strongly by

only around 4% to €700 million after an 8% decline in

2020. Elsewhere in 2021 there was a robust rise in wood

door production in Poland (+16% to €700 million), Austria

(+10% to €340 million), and Estonia (+20% to €230

million). Production fell in the Netherlands (-5% to €330

million), Sweden (-4% to €250 million) and Denmark (-

9% to €200 million). (Chart 6)

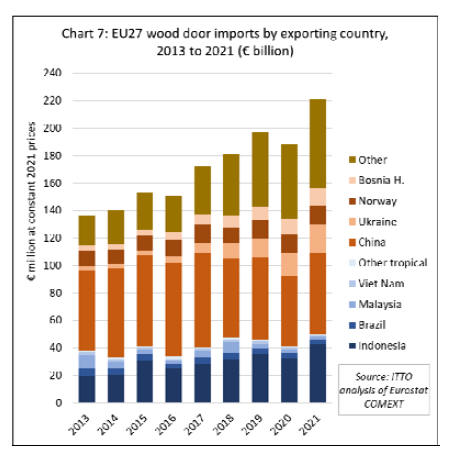

Following a 4% decline in 2020, wood door imports into

the EU27 increased by 17% to €221 million in 2021

(Chart 7).

Total EU27 wood door imports from the tropics were

€49.8 million in 2021, 21% more than in 2020. This

compares to a 16% increase in imports from temperate

countries to €172 million in 2021. The share of EU27

wood door imports sourced from tropical countries

increased slightly, from 21.9% in 2020 to 22.5% in 2021.

This redresses the loss of share during 2020 when tropical

suppliers were particularly hard hit by rising freight rates

and other supply problem in the early stages of the

pandemic.

In 2021, wooden door imports from Indonesia, by far the

largest tropical supplier, rebounded 31% to €42.5 million,

after falling 8% the previous year. Imports from Brazil

also rebounded, but by only 7% to €3.9 million after also

falling 8% the previous year. In 2021, EU27 imports of

wood doors fell sharply to negligible levels from Malaysia

(-30% to €1.8 million) and Vietnam (-49% to €0.8

million).

EU27 imports of wooden doors from China, still the

largest single external supplier, rebounded 19% to €59.6

million in 2021 after falling 14% the previous year.

Imports from Ukraine increased 24% to €20.2 million in

2021 building on a 22% increase the previous year.

EU27 wood door imports from the UK fell 14% to €12.0

million in 2021 owing to changing distribution networks

after the UK left the EU single market at the start of the

year.

The European wood door industry is now dominated by

products manufactured using engineered timber driven by

requirements to comply with higher energy efficiency

standards and efforts to provide customers with more

stable products and long-life time guarantees.

Another key trend is towards composite doors with a steelreinforced

uPVC outer frame with an inner frame

combining hardwood and other insulation material. These

products are designed to combine strength, security,

durability, high energy efficiency, with a strong aesthetic.

There may be a place for tropical hardwoods in the design

of these products with manufacturers looking to combine

high quality, consistent performance, regular availability,

and good environmental credentials with a competitive

price.

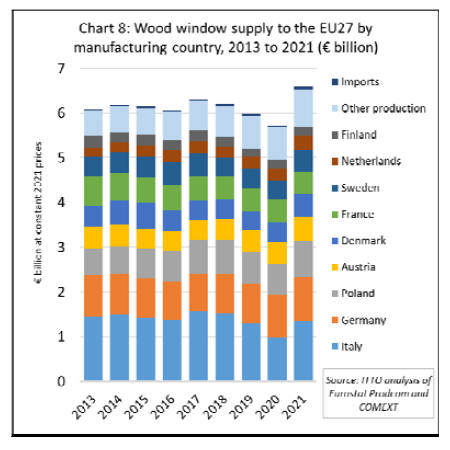

EU market for wood windows up 15% in 2021

The total value of wood windows supplied to the EU27

increased 15% to €6.59 billion in 2021 following a 4%

decline the previous year. This was the first annual

increase since 2017 in a market which had been effectively

static since before 2008 financial crises (Chart 8).

Supply of wood windows to the EU27 is overwhelmingly

dominated (over 99%) by domestic production which

increased 15% to €6.54 billion in 2021. The strongest

rebound was in Italy where the value of wood window

production increased 38% to €1.35 billion after a 25% fall

the previous year (although the scale of the rebound in the

Italian windows sector may, to some extent, be inflated for

the same reasons as in the Italian door sector).

Wood window production in Germany increased by 2% to

€980 million in 2021, continuing a rising trend ongoing

since 2018. Production in Poland increased 15% to €800

million after a 2% decline the previous year.

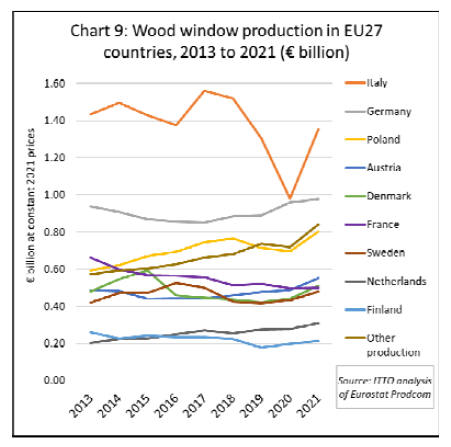

Gains were also made in all other leading wood window

manufacturing countries in 2021 including Austria (+13%

to €550 million), Denmark (+16% to €510 million),

France (+1% to €500 million), Sweden (+11% to €480

million), and the Netherlands (+11% to €310 million)

(Chart 9).

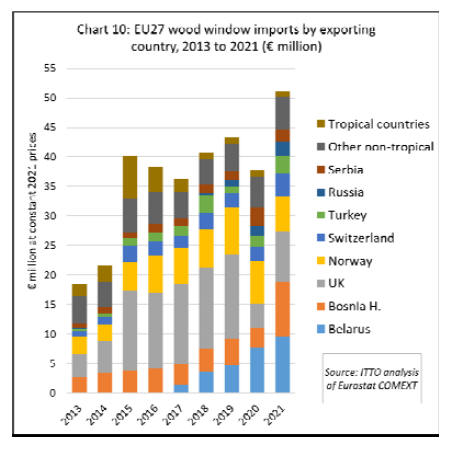

EU imports of wood windows from outside the EU

increased by 36% in 2021 to €51.2 million (Chart 10).

Imports from Belarus, the largest external supplier last

year, increased 26% to €9.7 million in 2021, continuing a

rising trend that started in 2017. Imports also increased

sharply from Bosnia (+170% to €9.1 million), and the UK

(+107% to €8.5 million). However imports from Norway

fell 16% to €6.1 million.

Only a tiny quantity of wood windows is imported into the

EU from tropical countries. After a spike in imports of €7

million in 2015, mainly from the Philippines, imports from

tropical countries fell to less than €1 million in 2019 and

remained at that level in 2020 and 2021.

While tropical countries are not significantly engaged in

the EU market for finished windows, this sector is of

interest as a source of demand for tropical wood material.

From this perspective, a notable long-term trend in the EU

window sector ¨C as in the door sector - is towards use of

engineered wood in place of solid timber. This is

particularly true of larger manufacturers producing fullyfactory

finished units that buy engineered timber by the

container load.

Increased use of engineered wood is closely associated

with efforts by window manufacturers to meet rising

technical and environmental standards, provide customers

with long lifetime performance guarantees and recover

market share from other materials.

Increased focus on energy efficiency means that tripleglazed

insulating window units with very low U-factors

are now more common than double-glazed units in

Europe. These units demand thicker, more stable and

durable profiles that in practice can only be delivered at

scale using engineered wood products or by combining

wood with aluminium and steel in composite products.

The quality and engineering of wood windows has

undergone a revolution in the EU in recent years so that

manufacturers are now able to deliver products with many

of the benefits previously reserved only for the best quality

tropical hardwood frames using softwoods and temperate

hardwoods.

Factory-finished timber windows are given a specialist

spray-coated paint finish for even and durable coverage

which might only need redoing once a decade. The

lifespan of factory-finished engineered softwood frames is

now claimed to be about 60 years, while thermally or

chemically modified temperate woods can achieve around

80 years.

Nevertheless, smaller independent joiners producing

bespoke products in low volumes still tend to rely on solid

timber purchased from importers and merchants to

manufacture window frames. Tropical woods such as

meranti, sapele and iroko continue to supply a high-end

niche in this market sector.

Sharply declining prospects for European wood

joinery sector in the third quarter

Joinery sector activity in the EU27 was still quite high in

the first half of 2022; the Eurostat manufacturing index for

joinery (excluding flooring) indicated activity during this

period at around 15% above the level prevailing in 2019

before the onset of the COVID pandemic. However,

prospects for the rest of this year have declined sharply in

the third quarter.

The S&P Global Eurozone Construction Total Activity

Index was below the no-change mark of 50.0 for the fourth

successive month in August and fell to 44.2 from 45.7 in

July. The latest figure signalled the fastest decline in

activity in the building sector since January 2021. The

three largest euro economies all posted steeper

contractions with Italy (41.2) seeing the fastest overall

decline, followed by Germany (42.6) and France (48.2)

respectively.

Broken down by sector, all three categories recorded faster

and similar rates of contraction. Civil engineering

registered the steepest decline, and housing the weakest,

although the latter still posted the fastest drop in activity

since May 2020.

Commenting on the latest results, Trevor Balchin,

Economics Director at S&P Global Market Intelligence,

said: "Construction companies in the eurozone endured a

deepening downturn in August, with seasonally adjusted

activity dropping the most than in any month since

January 2021.

¡°Whereas the previous period of decline reflected COVID-

19 restrictions, the latest downturn is being driven by a

darkening economic outlook amid high inflation and

uncertainty caused by the ongoing war in Ukraine. All

three of the largest euro economies recorded lower

activity, new orders, employment and purchasing in

August.

"There was further evidence that cost pressures may have

peaked but this failed to arrest weakening confidence in

the 12-month outlook, which in August was the worst

since the first COVID lockdown in spring 2020."

The increasingly negative outlook in the construction

sector reflects mounting problems in the wider European

economy. A recent article in the Economist commenting

on European prospects notes that ¡°Every single warning

light is flashing red. Russia¡¯s war on Ukraine, an uneven

recovery from the covid-19 pandemic and a drought across

much of the continent have conspired to create a severe

energy crunch, high inflation, supply disruptions¡ªand

enormous uncertainty about Europe¡¯s economic future.

Governments are rushing to try to help the most

vulnerable. Amid the nervous confusion, there is broad

agreement on one thing: a recession is coming¡±.

According to the Economist, quite how bad the downturn

turns out to be depends on how the energy shock plays

out, and how policymakers respond to it. At the end of

August, energy prices reached once-unimaginable heights:

more than €290 (US$291) per megawatt hour (mwh) for

benchmark gas to be delivered in the fourth quarter of the

year (the usual pre-pandemic price was around €30); and

more than €1,200 per mwh for daytime electricity for the

same quarter in Germany (up from around €60). Because

gas is the marginal fuel in most European electricity

markets, it sets the price for power more broadly.

With energy costs so high and the outlook uncertain, both

business and consumer confidence are declining sharply.

Concern is heightened by the fact that Europe will almost

certainly see the energy shock coincide with rising interest

rates. According to the Economist ¡°Having underestimated

price increases along with many other of the world¡¯s

central banks, the ECB [European central Bank] is now

determined to bring annual inflation back to its target of

2%, from the alarming 9.1% recorded in August.

Economists therefore expect the ECB to try to buttress its

inflation-fighting credentials with a substantial interestrate

rise in its next policy meeting on September 8th,

possibly lifting rates by three-quarters of a percentage

point¡±.

The Economist concludes ¡°all this suggests that the

European economy is certain to enter a recession, led by

Germany, Italy, and central and eastern Europe. Analysts

at JPMorgan Chase, a bank, expect annualised growth

rates of -2% for the euro area overall in the fourth quarter

of this year, -2.5% for France and Germany and -3% for

Italy¡±.

|