|

1.

CENTRAL AND WEST AFRICA

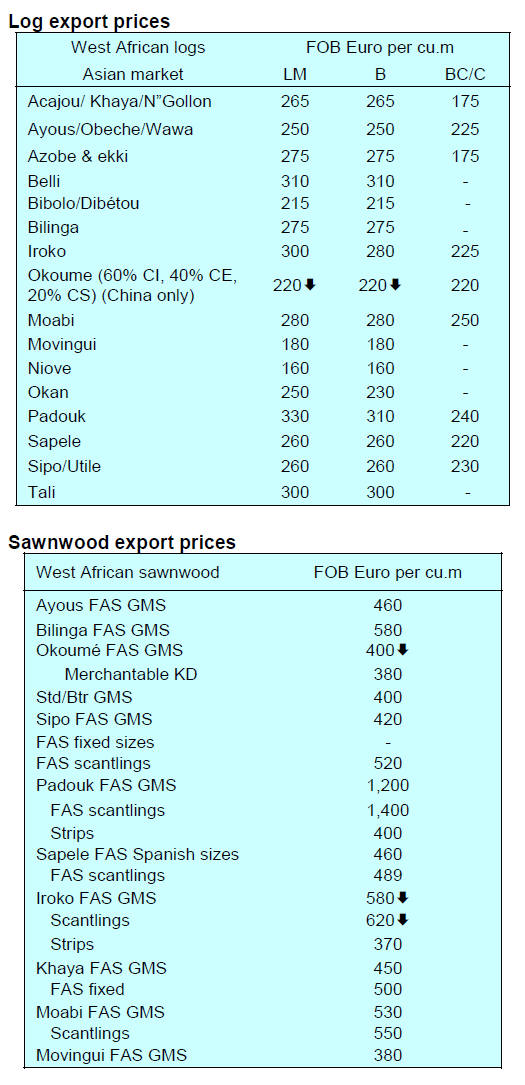

Demand in China slows

The economic slowdown in China is impacting trade and

producers report a noticeable drop in orders for okoume

and some redwoods. It is reported that interest in

ovangkol, belli and okan is steady but species such as

dabema are not attracting interest at present.

With fewer shipments to China the container availability

has improved and it is no longer necessary to pay

premiums to obtain containers.

The container shortage appears to be easing and prices

have been dropping. Drewry. an independent maritime

research consultancy firm, has said “In the first eight

months of the year manufacturers based in China, which

account for over 96% of global container output, produced

close to half a million teu, which was up almost 64% year

on year and 35% up on the corresponding period in 2020.

Drewry expects output for the full year to total at least

900,000 teu, up from just below 560,000 teu in 2021.

See:

https://www.joc.com/maritime-news/containerlines/drewry-projects-adequate-ocean-container-availabilitythrough-mid-2023_20220906.html

As mills cut back on milling for the Chinese market and

even the Middle East markets demand in the Philippines is

said to be holding up. Demand in the EU and UK is also

reported as steady so far. News is circulating that stocks of

azobe are high in the Netherlands and that some timber

shipments were diverted from Antwerp to Amsterdam.

Police commader warns on unauthorised road checks

Lenouveaugabon recently carried a story on

‘unauthorised’ road blocks in Gabon. Following numerous

complaints of cases of corruption the Commander-in-

Chief of the National Police Force, Serge Hervé Ngoma,

issued a warning to police officers saying "all police

officers are reminded that untimely roadside checks are

prohibited throughout the national territory ".

He added, any police officer ignoring this instruction will

be immediately presented before an extraordinary council

which will rule on his dismissal.

See:

https://www.lenouveaugabon.com/fr/securite-justice/0809-18887-forces-de-police-les-controles-routiers-interdits-sur-letendue-du-territoire-gabonais

October and November brings heavy rain to the CAR but

there are reports that the weather has deteriorated already.

In Cameroon operators are preparing for the bad wether

expected towards year end. When the weather allows

forest managers undertake marking trees and taking GPS

readings to input information into their operation maps.

Correction

Under the headline ‘Harvesting and trucking conditions good’ in

the previous report export species from the DRC were

mentioned. The text should have said the Central African

Republic not the DRC.

2.

GHANA

Added value product exports register growth

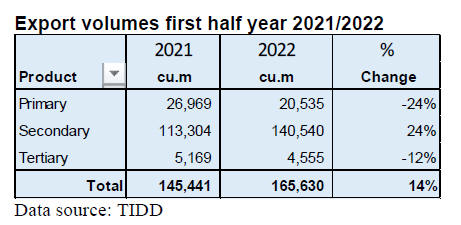

According to export data from the Timber Industry

Development Division (TIDD) of the Forestry

Commission 10 products totalling 165,630 cu.m were

exported during the period January to June 2022. Of this

volume Primary, Secondary and Tertiary Products

accounted for 12% (20,535cu.m), 85% (140,540cu.m) and

3% (4,555cu.m) respectively.The export volume for the

first half of 2021 was 145,441 cu.m.

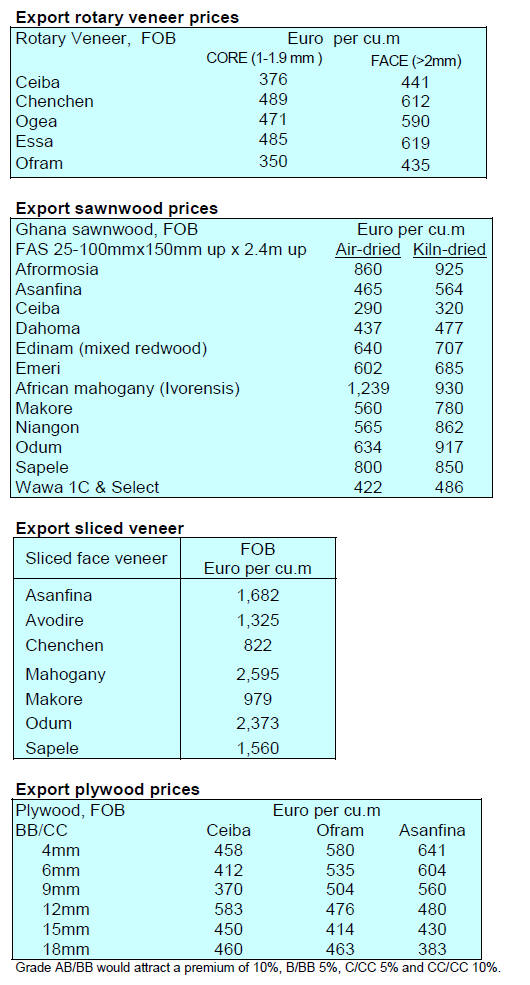

The following tables show product volumes and values for

2022 compared to 2021.

Secondary Wood Product (SWP) amounted to 140,540

cu.m in the first half of 2022 as against 113,304 cu.m in

2021, a growth of 24% while primary and trtiary export

volumes declined (-24% and -12%).

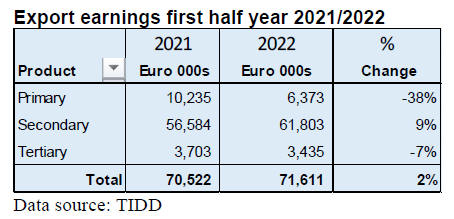

The table beow shows export earnings for primary,

secondary and tertiary products. Exports of SWP

registered a 9% growth while the others dipped.

For the period under review primary product exports,

mainly billets, accounted for 12% (20,535cu.m) and

earned Euro 6.37 million, around 9% of total exports.

Earnings for primary products dropped compared to a year

earlier.

Exports of SWPs for the period comprised sawnwood,

plywood, veneer, boules and briquettes. These, altogether,

contributed 140,540 cu.m, representing 85% of total

exports during the first half of 2022. The corresponding

earnings were Euro 61.80 million or 86% of total export

receipts.

These figures also showed increases of 9% and 244% in

value and volume respectively, compared to the SWP

export contribution of Euro 56.58 mllion (80%) and

113,304 cu.m (78%) registered from the period of January

to June 2021.

Ghana to boost country’s teak industry

Samuel Abu Jinapor, Minister of Lands and Natural

Resources (MLNR), has said Ghana is seeking to explore

and develop new strategies and initiatives to boost its teak

production so as to become a leading teak producing

country.

The Minister made the statement when Ghana hosted the

4th World Teak Conference (WTC) which called on

participating countries to facilitate the availability of

superior planting materials to private companies and local

communities to improve the planted teak forest.

The meeting also called on governments to commit more

resources to research and development to advance the

sustainable management of the planted teak forest.

A total 273 delegates attended the conference from 28

countries across five continents on the theme: 'Global

Teak Market: Challenges and Opportunities for Emerging

Markets and Developing Economies'. The biennial event

was organised by the International Teak Network

(TEAKNET), in collaboration with Forestry Commission

of Ghana with support from the International Tropical

Timber Organisation (ITTO) and other international

organisations.

Ghana has an estimated 200,000 ha. of teak plantations.

Approximate 5.2 million out of 26 million tree seedlings

distributed during the 2022 ‘Green Ghana Day’ initiative

were teak seedlings. Plantations are developed to enhance

transparency, efficiency and legality in timber traded from

Ghana.

Teak is a leading species for the production of air- and

kiln-dried sawnwood, billets, sliced veneer and plywood

for the country’s major markets.

See:

https://thebftonline.com/2022/09/07/ghana-targets-numberone-spot-in-global-teak-production/

Bank and Chamber of Commerce to support SMEs

The new Development Bank Ghana (DBG), in partnership

with the Ghana National Chamber of Commerce and

Industry (GNCCI), is undertaking the first phase of a

capacity-building workshop targeting 1,000 SMEs

throughout the country. This initiative forms part of

DBG’s commitment to foster strong partnerships to build

capacity for SMEs, with 100 workers or less which

struggle to secure finance.

The initiative is designed to build knowledge on the

various business areas that will enhance SMEs ability to

access funding from DBG’s partner financial institutions

(PFIs) as well as build sustainable businesses. The Bank

aims to lend US$600 million to small businesses over the

next one to two years.

The DBG partnership is timely as most woodcraft artisans

need funding to boost their businesses and begin

exporting.

See:

https://www.myjoyonline.com/development-bank-ghanagncci-undertake-capacity-building-workshop-for-1000-smes/

3. MALAYSIA

MTIB

DG optimistic on prospects for furniture industry

Malaysia’s wood product exports rose year on year around

14% in the first six months of this year helped by the

reopening of the economy post-pandemic. MTIB Director

General, Kamaruzaman Othman, said he is cautiously

optimistic on prospects for the furniture industry this year

but he remains cautious of challenges such as raw material

availability and the worker shortage faced by the industry.

See:

https//www.thesundaily.my/home/malaysia-s-timberexports-in-first-half-2022-climb-to-rm132b-KA9662279

Third consecutive interest rate increase

Bank Negara Malaysia (the central bank) has raised the

overnight policy rate to 2.5% in line with expectations for

further normalisation of monetary policy as the country’s

economic growth and inflation gain momentum. This is

the third consecutive increase this year and was in line

with expectations.

|