Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Aug

2022

Japan Yen 135.4

Reports From Japan

Economy revived in second

quarter

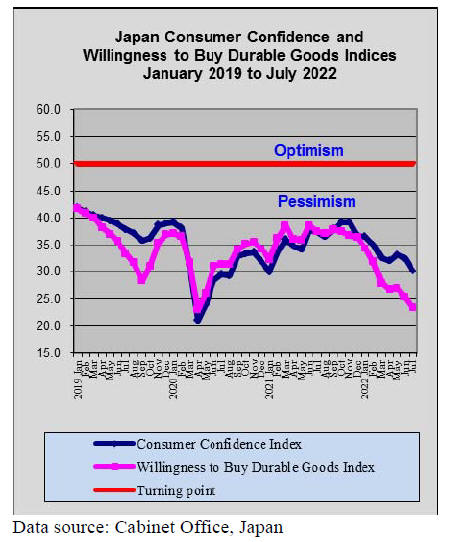

Japan's economy made a come-back in the second quarter

2022 after the contraction in the previous quarter. This

was due to an upswing in consumer spending, especially

in the services sector, which no longer has to apply strict

protection rules. There is concern, however, that consumer

spending in the current quarter may slip.

The government is encouraging prefectural authorities to

implement measures to contain the latest corona variant

that has sent infections to record levels. There are no plans

for nationwide control measures. The seventh wave of the

BA.5 variant has pushed new cases in Japan to over

200,000 per day putting pressure on medical services and

disrupting commercial operations.

See:

https://www.reuters.com/world/asia-pacific/japan-free-uplocal-officials-battle-new-covid-variant-kyodo-2022-07-29/

and

https://www.reuters.com/markets/asia/japans-economy-likelyrebounded-q2-with-unleashing-consumers-2022-08-05/

Another record minimum-wage hike

A government panel has proposed raising the average

minimum wage for fiscal 2022 by a record ¥30 per hour or

more as the experiences accelerating inflation. In

discussions there was little agreement between the panel

and employers on by how much the increase should be.

The unions have been calling for a substantial rise as the

cost of living is rising while the private sector, which is

facing surging costs, has stressed the need for careful

consideration.

In related news, a Kyodo News survey showed that 42%

of major companies in Japan expect the economy to slow

over the next 12 months as they struggle with surging

commodity costs and the yen's weakness.

See:

https://japantoday.com/category/business/japan-gov't-panelto-propose-another-record-minimum-wage-hike

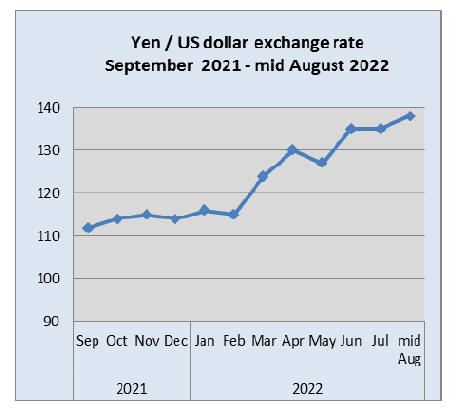

A rise in US rates could drive yen lower

The yen surged to a two-month high against the US dollar

recently as investors reassessed US inflation risk,

recession fears and intensifying market volatility.

In mid-July, the yen dropped to ¥139 against the dollar as

hedge funds and other investors guessed that US rates

would continue to rise while the Bank of Japan remained

locked into its ultra-loose policy. The risk for the Yen is

that interest rates in the US could increase again in

September.

Japan ¨C No. 1 covid hotspot

Japan has become the world¡¯s No.1 COVID-19 hot spot

according to international statistics. Most infected people

now only develop mild symptoms but still the health care

system is overwhelmed. As yet the government has not

imposed any restrictions on businesses or peoples¡¯

movements but the impact on consumption will be felt in

the coming months.

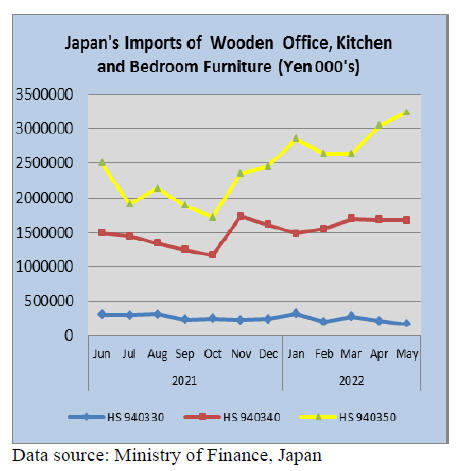

Furniture imports

Imports of wooden bedroom furniture just keep rising in

contrast to the value of imports of wooden office and

wooden kitchen furniture which have remained at around

the same level as in the first quarter of the past four years.

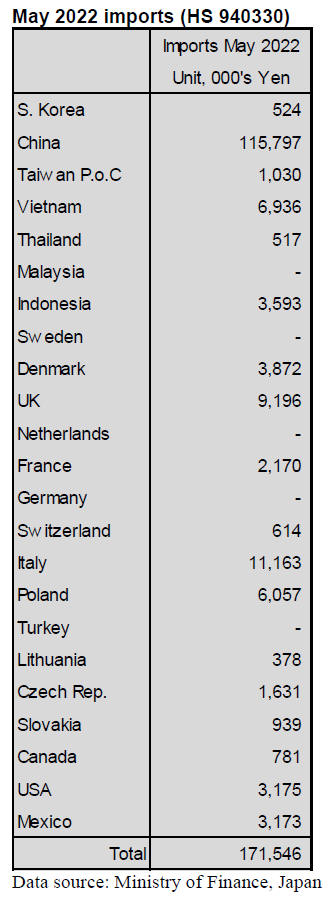

May office furniture imports (HS 940330)

May imports of wooden office furniture (HS940330)

declined over 50% year on year and were down over 20%

compared the value of April imports.

As in previous months the top shipper of wooden

office

furniture in May 2022 was China accounting for 67% of

total wooden furniture imports.

Two relative newcomers to the wooden office furniture

trade with Japan in May were the UK and Italy, each of

which accounted for between 5-6% of all May shipments.

Poland is a regular shipper of wooden office furniture to

Japan but in May the value of shipments dropped sharply.

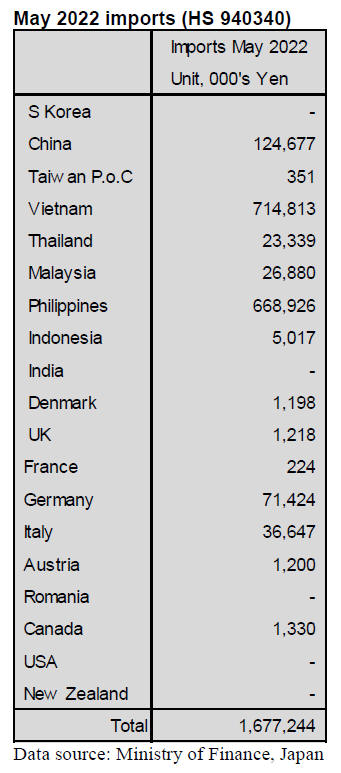

May kitchen furniture imports (HS 940340)

Year on year May 2022 shipments of wooden kitchen

furniture (HS940340) rose over 30% but compared to

April there was little growth. The two major shippers of

wooden kitchen furniture to Japan are the Philippines and

Vietnam and manufacturers in these two countries account

for over 80% of all imports of this category of product.

With a further 7-10% of shipments comimg from China

there is little room for other manufacturers.

Shippers in Malaysia and Thailand have a small market

share but this has not improved in the face of tough

competition from the two main shippers.

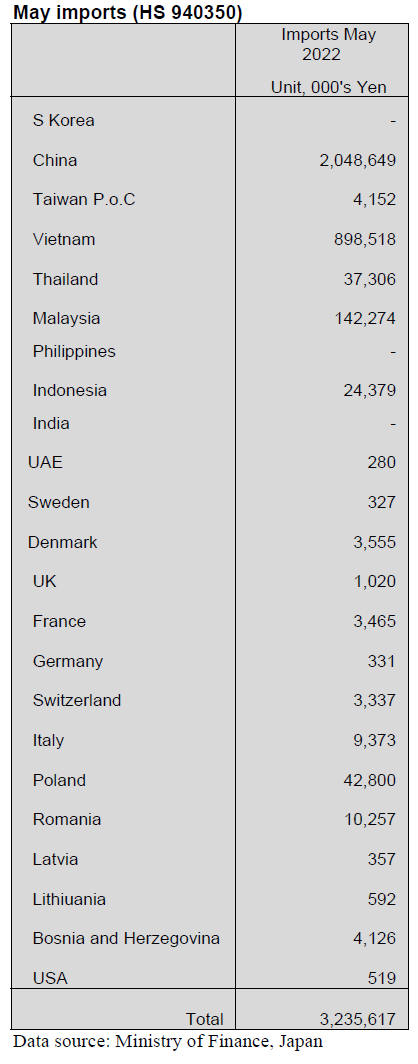

May bedroom furniture imports (HS 940350)

And the upward trend in the value of imports of wooden

bedroom furniture (HS940350) continues. May saw

another rise in the year on year value of imports and

compared to April there was a 6% increase in the value of

imports.

Imports from shippers in China, the main supplier, rose

but arrivals in May from Vietnam dropped close to 10%.

China remains the main supplier of wooden bedroom

furniture to Japan with a share of imports at just over 60%.

Vietnam shippers had a 28% of imports in May. The other

shippers of note in May were Malaysia, Thailand and

Poland. For the first time this year May shipments from

Romania were sharply higher.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Reports from the JLR will resume at the end of August.

The Obon festival (also known as Bon festival) falls in

August and most businesses close. This is an annual

Japanese holiday which commemorates and remembers

deceased ancestors. It¡¯s a tradion for workers to return to

their home townd as to celebrate the festival with relatives.

|