Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Jul

2022

Japan Yen 136.7

Reports From Japan

7th covid wave rewriting

infection records

Health authorities across Japan are reporting record high

cases of coronavirus with each day bringing a new record.

The daily count hit a new high in 17 of Japan's 47

prefectures in mid July. The number of COVID-19

patients recuperating at home across Japan reached a

record high of 612,023 on 20 July, double that from a

week earlier. Infections continue to spread due to the

highly contagious BA.5 sub-variant.

Lower economic growth forecast 每 Buiness sentiment

dips

Uncertainty over the direction of the global economy,

blamed on Russia*s invasion of Ukraine and China*s strict

Covid-19 lockdown, has prompted the Japanese

government to lower its economic growth forecast for

fiscal 2022 to about 2%. This was based on forecasts from

the Bank of Japan (BoJ) that lowered growth expectations

because of weakness in private consumption.

See

https://www.businesstimes.com.sg/governmenteconomy/japan-to-cut-this-fiscal-years-economic-growthforecast-nikkei

Ultra-low rate policy maintained

The BoJ has maintained its ultra-low rate policy to support

economic recovery. This is in contrast to the trend of

monetary tightening as other countries report record

inflation.

In its Quarterly Outlook Report after its July meeting the

BoJ raised its core consumer inflation forecast to 2.3% for

fiscal 2022, up from its earlier 1.9%. This takes account of

the surging energy and raw materials costs as well as the

effect of a weak yen which pushes up import costs.

See:

https://mainichi.jp/english/articles/20220721/p2g/00m/0bu/030000c

In related news, the BoJ raised inflation forecast but

maintained its ultra-low interest rate policy saying the

economy is still fragile. This came at around the same time

the European Central Bank signaled an increase in interest

rates to tackle soaring inflation. Rising fuel and

commodity costs have lifted inflation in Japan above its

2% target but the BoJ is no rush to withdraw stimulus

saying in its quarterly report ※We must be vigilant to

financial and currency market moves, as well as their

impact on the economy and prices.§

See:

https://www.boj.or.jp/en/mopo/outlook/gor2207b.pdf

Weak yen improving Japan*s competitive advantage

even against China based companies

The yen/dollar exchange rate has jumped from 103 to 135

in less than two years and the July US interest rate hike

will drive the yen even lower.

The exchange rate of the yen against the Chinese renminbi

is creating a situation in which Japanese corporations are

becoming increasingly price competitive even against

companies based in China.

See:

https://www.etftrends.com/model-portfolio-channel/japansyen-weakness-has-changed-the-competitive-landscape/

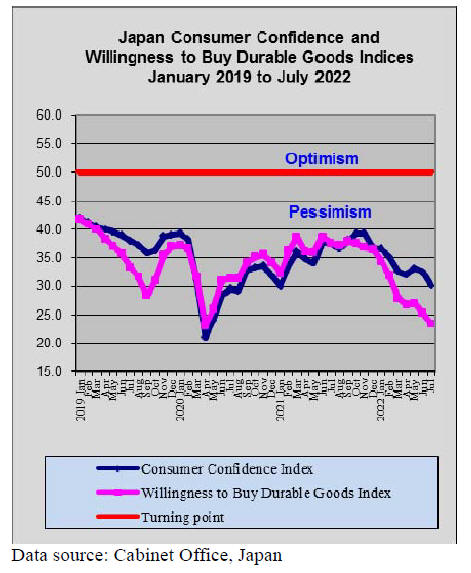

Willingness to buy durable goods at all time

low

Households in Japan contine to feel the pressure of rising

prices and this, along with the surging rate of covid

infections across the country has caused confidence to

collapse. The index for willingness to buy durable goods,

such as furniture, in June was at an all time low.

Timber prices soaring 每 another &wood shock*

Prices for plywood and sawnwood have risen 10 to 20% in

the last three months and this is feeding into the price of

new homes. Sawn softwood for construction is in short

supply and some in the industry are calling this another

&wood shock*.

The first wood shock was in the early 1990s, the second in

2000 when logging was restricted in Indonesia. The third

is considered to be last year*s sawnwood price surge, the

result of a rapid recovery in US housing demand.

According to the BoJ*s corporate goods price index wood

product prices rose over 40% year on year in June.

In the face of the rising timber prices there are moves to

raise house prices in Japan. In January, Daito Trust

Construction raised the price of its homes by 2%. A

spokesperson from Sumitomo Forestry is quoted as saying

※this is a difficult situation and we are reviewing home

prices as necessary.§

Attention has turned to domestic timber resources.

Currently, planted forests account for 40% of the country*s

total forests but, according to the Forestry Agency, there is

no efficient supply chain in place for the processing and

distribution of large volumes of domestic wood.

Small and micro-forestry operators account for 90% of the

domestic harvesting and processing industry in Japan and

the number of workers in the sector continues to decline.

The distribution issues need to be addressed in order for

greater use of domestic timber.

See:

https://asianews.network/japanese-lumber-prices-soaringagain/

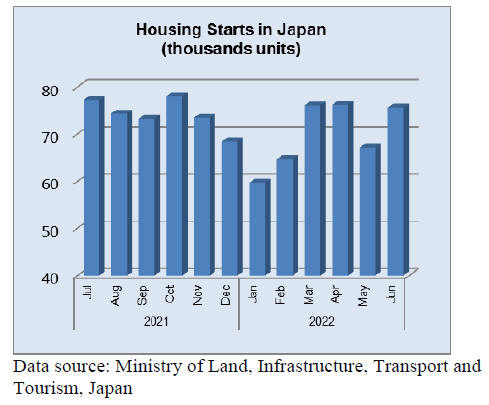

June housing starts were up around 12% compared to

May. The dip in starts in May was because of the long

May holidays. June 2022 stsrts were little changed from

June 2021.

Import update

Assembled wooden flooring imports

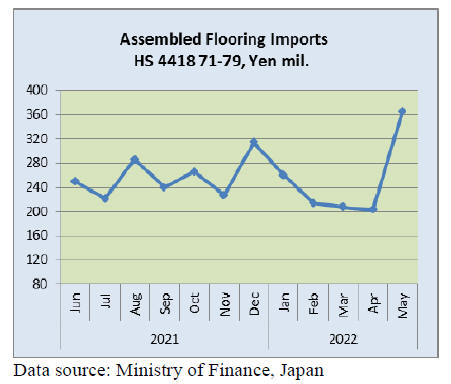

For three months since the beginning of the year the value

in yen of Japan*s imports of assembled wooden flooring

(HS441871-79) was declining. The decline ended in May

when the value of imports shot up, almost doubling. Part

of the explanation for this is that the yen has steadily

weakened against the dollar and the Chinese yuan.

China is a major shipper of assembled flooring to Japan.

However, the exchange rate is only part of the answer, it

seems that in May importers anticipated further yen

weakness and stocked up early.

Year on year, assembled wooden flooring imports in May

2022 were up around 90% and month on month the value

of imports rose 80%.

The main category of assembled flooring imported by

Japan continues to be HS441875 and this accounted for

60% of May 2022 imports with the main suppliers being

China and Vietnam.

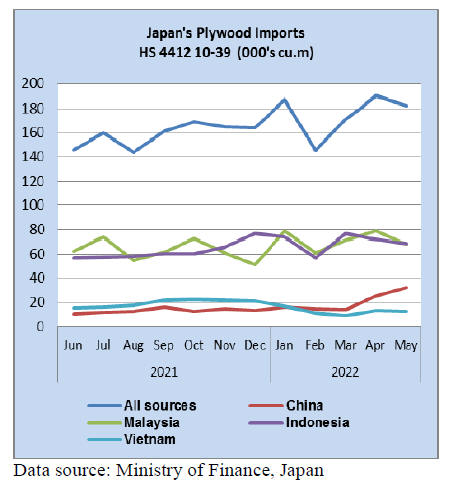

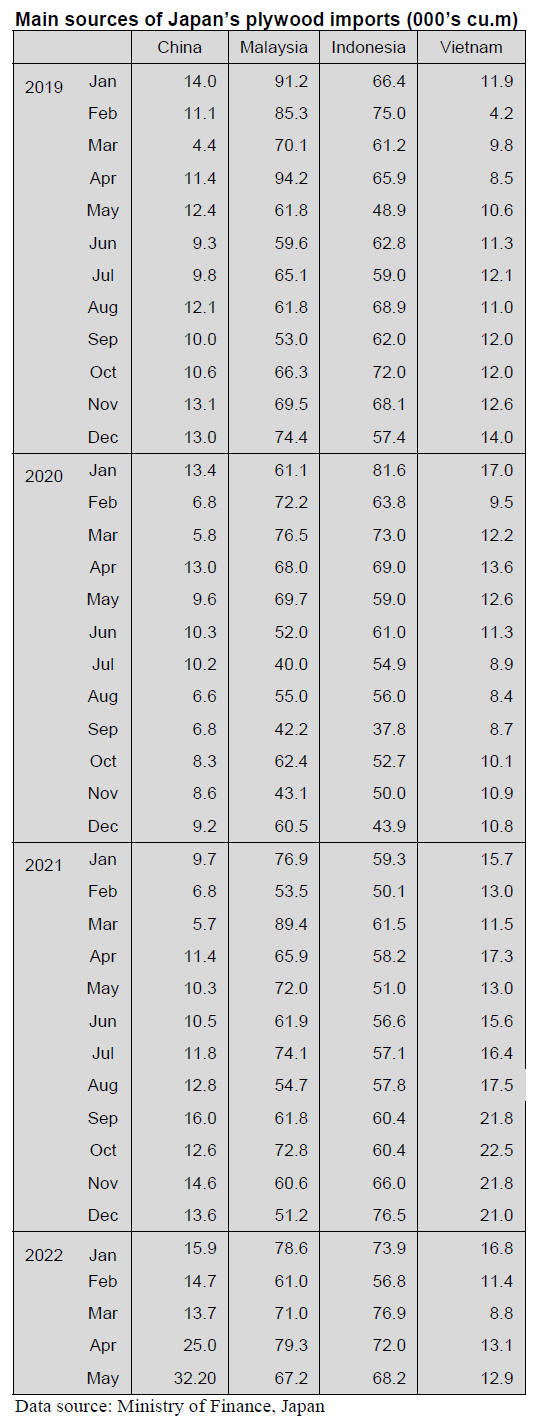

Plywood imports

The main news in April was the doubling of plywood

imports from China. At 25,000 cu.m April shipments were

at a level not seen since 2014/15 and in May the volume of

plywood shipments from China increased further. Year on

year the volume of May plywood imports from China rose

by a factor of 3 to 32,200 cu.m and month on month

imports from China jumped by almost 30%.

Malaysia and Indonesia remain the main plywood shippers

to Japan but in May this year shipments from both

suppliers declined. Of the various categories of plywood

imported in May 2022 (as in other months) HS441231 was

the most common accounting for almost 90% of total

plywood import volumes.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Imported lumber inventory at Tokyo

Imported lumber inventory at Tokyo at the end of June is

192,000 cbms, 8.5% more than May. It is the highest

volume in this year and it is 2.1 times of May, 2021.

Shipment volume is 67,000 cbms, same volume in

previous month and receiving volume is 83,000 cbms,

36.1% more than previous month. The received volume is

16,000 cbms more than shipment.

New contracts and demand are decreasing so it would take

time for balancing the inventory. The inventory of North

American lumber is 54,000 cbms, 8% increased from last

month. European lumber is 59,000 cbms, 3.5% increased

from last month. Russian lumber is 41,000 cbms, 24.2%

increased from last month. Chinese and other lumber are

30,000 cbms, 3.4% more than previous month.

Wooden boards are 9,000 cbms and it is same volume in

May. Compare to June, 2021, the inventory of North

American lumber doubled in volume.

European lumber is 2.6 times more. Russian lumber is 2.3

times more. North American and European lumber are 1.6

times from the volume of June, 2020.

Receiving volume of North American lumber in June is

21,000 cbms, 90.9% more than May. European lumber is

21,000 cbms, 16.7% more than previous month. Russian

lumber is 22,000 cbms, 100% more than previous month.

One of reasons is that the North American lumber, which

was supposed to arrive in Japan in July, arrived in June by

two bulk ships. It was 13,000 cbms.

The other reason is that a large amount of Russian lumber,

which were contracted in the past, arrived in Japan. Since

the lockdown in China is lifted, a lot of European lumber

piled up in China arrived in Japan. The receiving volume

in July will be 14,000 cbms, 33.3% less than June. Russian

lumber will be 13,000 cbms, 40.9% less than June.

European lumber will be 16,000 cbms, 23.8% less than

June.

Receiving volume of North American lumber in January

to June, 2022 is 112,000 cbms, 13.1% more than same

periods of 2021 and shipment volume is 116,000 cbms,

24.7% more than same periods in 2021. The shipment

exceeded 3.6% of receiving. The inventory decreased

2,000 cbms from December, 2021.

European lumber in January to June, 2022 is 132,000

cbms, 46.7% increased from same periods in last year and

shipment volume is 119,000 cbms, 40% more than same

periods in 2021.

The inventory is 14,000 cbms more than December, 2021.

Russian lumber in January to June, 2021 is 98,000 cbms,

14% more than same periods in 2021 and shipment

volume is 85,000 cbms, 16.4% more than same periods in

2021.

Receiving is 15.3% more than shipment. The inventory is

13,000 cbms more than December, 2021. Total receiving

volume in July will be 59,000 cbms, 28.9% less than June.

The inventory at the end of July will be 187,000 cbms.

However, the inventory might be 190,000 cbms if the

shipment volume would be 2,000 cbms.

Forestry Agency changes hiring policy

The Forestry Agency starts accepting female and foreign

workers for forestry work. It plans to secure more workers

for replantation and nurturing young trees. Number of

forestry business ompany continues declining and majority

is small, petty companies.

Harvest has been increasing but only 30% of logged off

areas are replanted with workers of replanting and

nurturing have been steeply decreasing and it is urgent

matter to secure such workers. Presupposition is to provide

working condition and safety other industries are

providing and to improve stability of workers, it should

offer weekly holidays, monthly salary, providing social

insurance and give fair evaluation to ability.

Stability of newly hired workers after seven years is less

than 50% and labor hazard is more than ten times of other

industries so establishing safety measure is also urgent

matter. Main points are to hire female, aged and

handicapped workers plus to hire foreign workers.

Now in technical learning, foreign workers are allowed to

work only one year but in other industries like farming and

fishing. Foreign workers are allowed for three years so the

Forestry Agency is trying to change the system.

Domestic logs

Demand and supply of domestic logs are not lively. The

prices are still high but not as high as last year.Cypress

logs cost 40,000 每 50,000 yen delivered per cbm in last

year but they are now under 30,000 yen delivered per cbm.

Cedar logs cost 30,000 yen delivered per cbm in last year

and they are under 20,000 yen delivered per cbm in this

year. It was a very short rainy season in this year so there

are enough logs.

On the other hand, a movement of domestic lumber was

slow in June so demand for logs is not so active. 3 meter

cypress logs for posts are around 25,000 yen delivered per

cbm and 4 meter cypress logs for sill are around 24,000

yen delivered per cbm. The lowest price is under 20,000

yen in some areas.

3 meter cedar logs for posts are 16,000 每 17,000 yen

delivered per cbm in main producing districts. There are

20,000 yen in other areas.

Requests for cedar logs are stronger than 3 m

cypress logs.

3.65 每 4 m cedar logs are not really in demand and the

prices are 13,000 每 14,000 yen delivered per cbm.

There is no hope for the prices decreasing like before the

wood shock because some plywood companies could not

buy Russian veneers. However, logging companies are

ready to continue harvesting the trees so the future prices

are unpredictable.

Chinese softwood plywood

The volume of Chinese softwood plywood has been

increasing. It was 19,000 cbms in May and it was 60.3%

more than April. This was because of a shortage of

domestic plywood. However, a shortage of domestic

plywood is now solved slightly and there are less orders

for Chinese softwood plywood recently.

One of reasons is the quality of Chinese softwood

plywood. Sometimes there are uneven thickness or holes

on plywood. Since Japanese companies do not order new

plywood, Chinese companies started cutting the prices. It

was 2,300 yen delivered per sheet at the peak and now it is

1,950 yen delivered per sheet. The price of domestic

softwood plywood for 12mm thickness 3 x 6 is stable at

2,000 yen.

South Sea lumber

Lumber demand for steel and shipbuilding is active but

there is not enough imported lumber so inquiries on

domestic made lumber is active.

Market prices of laminated free board continue climbing.

Export prices of Indonesian mercusii pine lumber are

US$950 per CBM C&F and Chinese red pine lumber are

US$1,020-1,050 per cbm C&F, both are unchanged from

June but the market prices in Japan are being pushed up

with weak yen so mercusii pine lumber prices are 138,000

yen per cbm FOB truck and Chinese red pine lumber

prices are 143,000 yen, both are 5,000 yen up.

Mercusii pine log supply in Indonesia is steady and lumber

production is active particularly high grade but Japanese

demand concentrates in lower grade products. products

only so new purchase is going slow.

|