US Dollar Exchange Rates of

10th

Jul

2022

China Yuan 6.7183

Report from China

Surge in log imports from Latvia and PNG

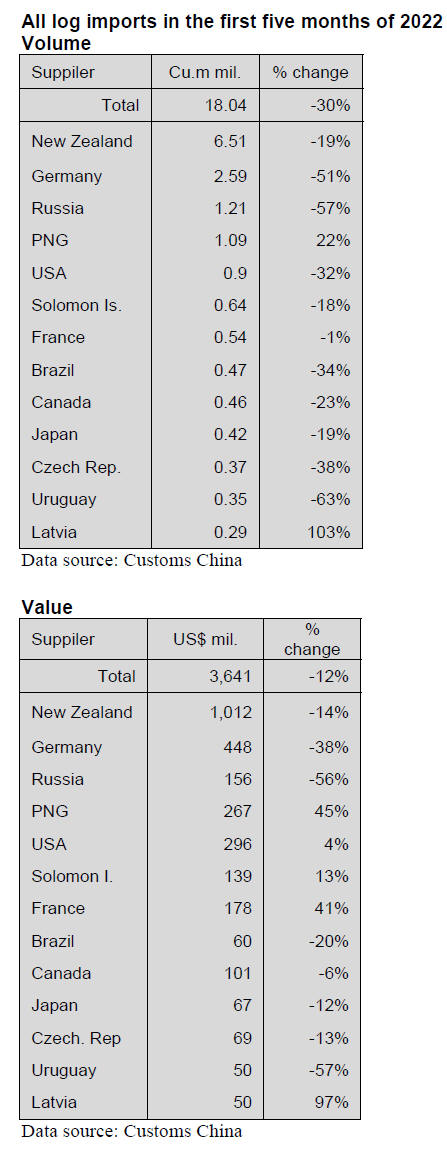

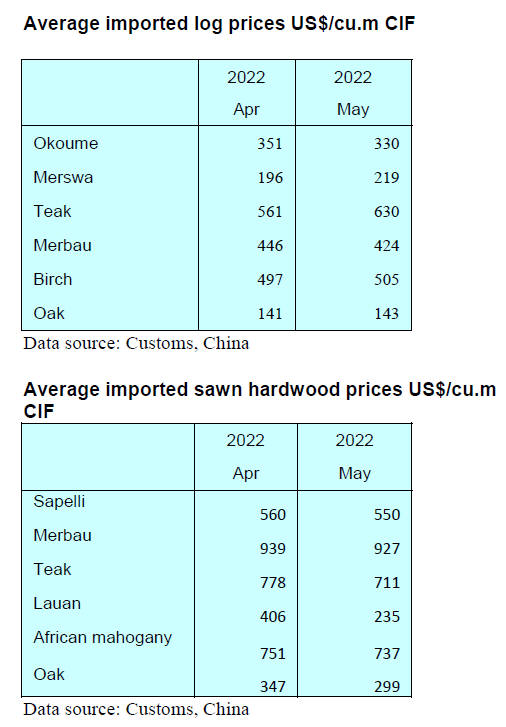

According to China Customs, log imports were 18.04

million cubic metres valued at US$3.641 billion, down

30% in volume and 12% in value in the first five months

of 2022.

However, log imports from Latvia doubled to 290,000

cubic metres and imports from PNG rose 22% to 1.09

million cubic metres.

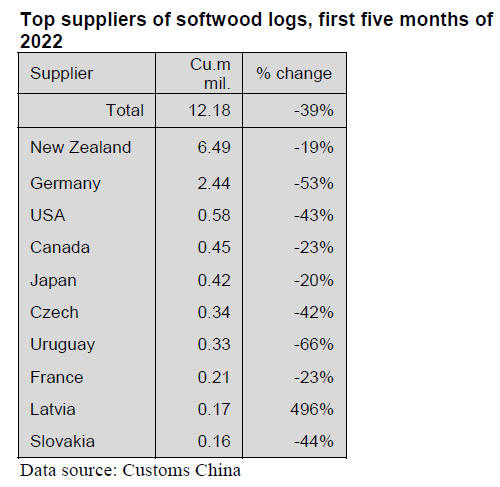

Softwood log imports

Softwood log imports fell 39% to 12.18 million cubic

metres valued at US$1.983 billion, down 28% in value

from the same period in 2021. However, China¡¯s softwood

log imports from Latvia alone surged almost 500% to

167,598 cubic metres. Imports from the other top suppliers

declined in the first five months of 2022.

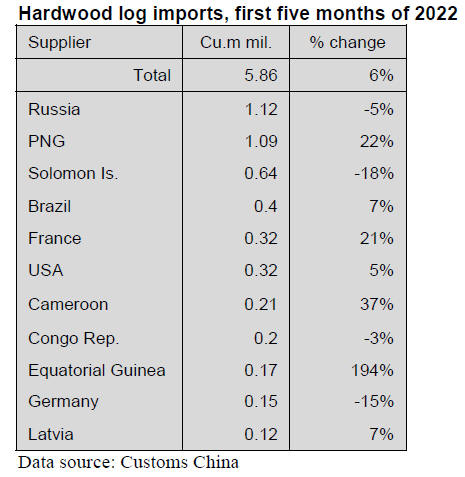

Hardwood log imports

Hardwood log imports rose 6% to 5.86 million cubic

metres in the first five months of 2022. Hardwood log

imports from Latvia grew 7% to 120,000 cubic metres.

China¡¯s hardwood log imports from Equatorial Guinea

surged 194% to 170,000 cubic metres, from PNG, France

and Cameroon imports rose 22%, 21% and 37% and from

Brazil and USA imports rose 7% and 5%.

However, China¡¯s hardwood log imports from Solomon Is.

and Germany fell 18% and 15% respectively and from

Russia and the Republic of Congo imports declined 5%

and 3% in the first five months of 2022.

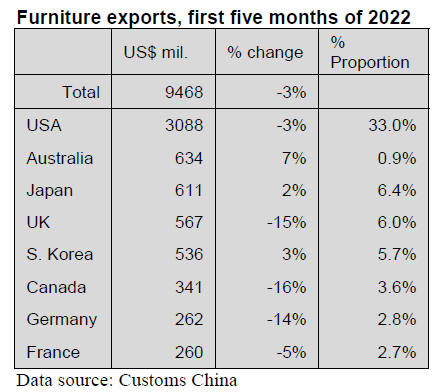

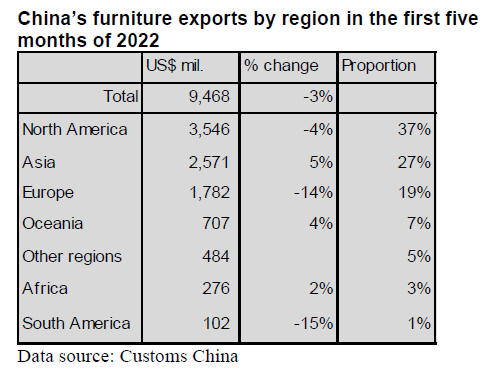

Decline in China¡¯s furniture exports

The value of China¡¯s furniture exports declined 3% to

US$9.468 billion in the first five months of 2022. The

USA still is the largest destination but exports fell 3% to

US$3.088 billion but still accounted for 33% of total

furniture exports.

Chinese furniture exports to Asia, Oceania and

African

increased 5%, 4% and 2% respectively but to North

America, Europe and South America exports declined.

Among the top markets for China¡¯s furniture exports sales

to Australia rose 7% to US$634 million, exports to Japan

and South Korea grew 2% and 3% respectively.

However, furniture exports to USA, UK and Canada fell

3%, 15% and 16% respectively and to Germany and

France exports dropped 14% and 5% respectively.

China¡¯s furniture exports to Peru, Brazil and Colombia fell

24%, 28% and 40% respectively.

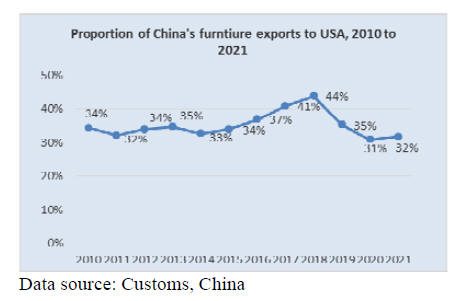

Decline in furniture exports to USA

According to China Customs data the proportion of

China¡¯s furniture exports to the USA has increased from

33% in 2014 to 44% in 2018 but declined from 44% in

2018 to 31% in 2020 due to the China-USA trade friction.

The proportion of China¡¯s furniture exports to the USA

was 32% in 2021 from 31% in 2020. China's furniture

exports are diversifying to more than 200 countries.

Rise in the number of wood product

enterprises

According to the National Bureau of Statistics the number

of registered wood products enterprises in China increased

between from 2017 and 2021 reaching 10,223 by the end

of 2021, a record high. By the end of April 2022 the

number of wood processing enterprises in China was

11,216, a big increase of 1,314 year-on-year. There are

more than 11,000 wood processing enterprises but the

number of enterprises with sales of more than RMB20

million is small and basically stable.

Drop in domestic log production

According to the National Bureau of Statistics the

domestic production of logs in 2021 was 98.88 mil. cubic

metres, down 4% over 2020.

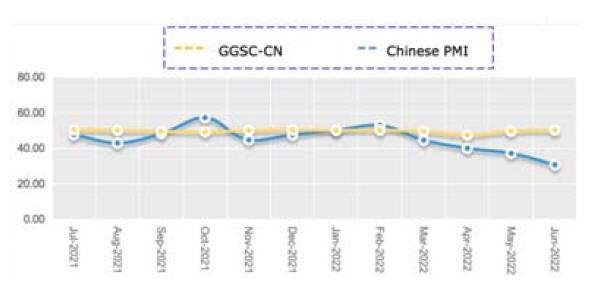

GGSC-CN Index Report (June 2022)

In June 2022 as the impact of the epidemic eased

industries began to recover. In June, China's PMI index

registered 50.2%, an increase of 0.6%s from the previous

month and back to above the critical value of

50% indicating an overall recovery of the economy.

Due to the rain season resource procurement activities by

the wood processing and manufacturing sectors dropped,

and the recovery of orders and production was not ideal.

The GGSC-CN comprehensive index for June registered

30.7% (53.3% for last June and 55.0% for June 2020) a

decrease of 6.4% from the previous month and has been

below the critical value of 50% for four months. See

below.

Challenges : Disrupted logistics

and high costs, some

products in short supply

Commodity of which the price has been increased :

Brazilian tauari , rubber, urea and composite raw

materials.

Commodity of which the price has been decreased :

Taun, oak, melamine.

June indices

In June 2022 two sub-indexes of GGSC-CN were flat and

three declined.

The production index registered 35.7%, the same

as the previous month and has been below the

critical value of 50% for three months

The new order index registered 21.4%, a decrease

from the previous month reflecting the ability of

enterprises to obtain orders is worse than the

previous month. The new export order index

reflecting international trade registered 28.6%, a

decline from the previous month.

The main raw material inventory index registered

28.6%, a decline from the previous month.

The employment index registered 35.7%, down

from the previous month.

The supplier delivery time index was 35.7%,

same as the previous month.

See:http://www.itto-ggsc.org/site/article_detail/id/241

|