Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Jul

2022

Japan Yen 137.43

Reports From Japan

Ruling coalition maintains its

hold on power

As expected the ruling coalition in Japan won the majority

of seats in the recent upper house election. This was a

success for Prime Minister Kishida but the victory was

overshadowed by the shooting at a rally of former Prime

Minister, Shinzo Abe.

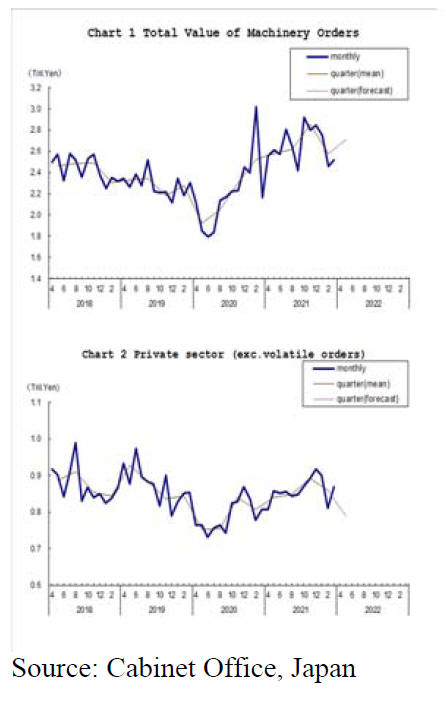

Machinery orders fall

The total value of machinery orders received by 280

manufacturers operating in Japan increased by 2.5% in

March from the previous month on a seasonally adjusted

basis.

In the January-March period it declined by 9.7% compared

with the previous quarter.

Private-sector machinery orders, excluding volatile ones

for ships and those from electric power companies,

increased a seasonally adjusted by 7.1% in March but

declined by 3.6% in the first quarter.

In the April-June quarter the value of machinery orders

was forecast to increase by 5.2% but private-sector orders,

excluding volatile ones, were forecast to drop.

The Cabinet Office that compiles the machinery order

report said companies still show an appetite for investment

but added it is necessary to pay attention to downside risks

such as high raw material costs amid Russia's war in

Ukraine.

Core machinery orders measures the change in the

total

value of new orders placed with machine manufacturers,

excluding ships and utilities. It is a key indicator of

investment and a leading indicator of manufacturing

production.

See:

https://www.esri.cao.go.jp/en/stat/juchu/2022/2203juchue.html

and

https://mainichi.jp/english/articles/20220711/p2g/00m/0bu/026000c

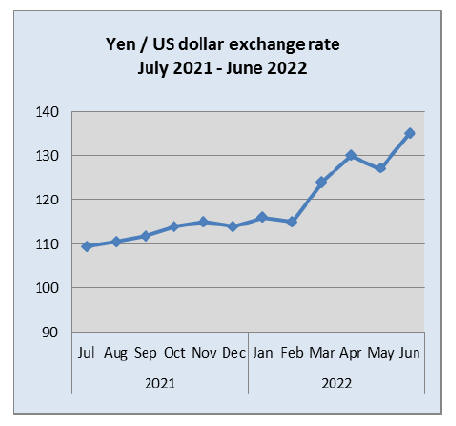

Yen at lowest since 1998

The yen fell to as low as 137.27 against the US dollar, its

lowest level since September 1998, after the Governor of

the BoJ stated that the Bank will not hesitate to take

additional easing measures if necessary. The yen¡¯s decline

was also because of the improved US job data for June and

this fueled speculation that the US Federal Reserve may

raise interest rates further.

See:

https://mainichi.jp/english/articles/20220711/p2g/00m/0bu/047000c

Japanese commentators are suggesting the Bank of Japan

(BoJ) is getting to the point where it may have to change

policy direction as central bankers around the world

tighten monetary policy to rein in high inflation.The BoJ

has sought to remain loose monetary policy but the

economy has been stuck in a low growth, deflationary

environment for many years which has prompted the BoJ

to maintain pump money into the economy.

See:

https://www.cnbc.com/2022/07/07/japan-could-be-about-tosurprise-markets-with-monetary-policy.html

Double digit price increases

Households in Japan are reeling from surging prices as the

rise in BtoB wholesale prices, which rose 9% in June, are

being passed to consumers.

Prices for petroleum and coal products jumped 22%, while

those for iron and steel gained 27%. Wood and sawnwood

prices surged over 40% in June, a relief from the almost

60% rise in May. Electricity, gas and water prices which

move in tandem with energy prices rose 28% in June.

Weak yen attracts foreighn buyers to housing

market

The weak yen has attracted Hong Kong investors to the

Japanese real estate market, especially for on Tokyo¡¯s

waterfront and studio apartments in smaller cities where

rental income can be good.

International property agents sales as the yen fell and

expectations for an end to anti-Covid border controls have

spurred interest.

Prices of new condominiums in Tokyo rose above the

record set in 1990 but even with the gains apartments in

Tokyo remain cheaper per square metre than those in

London, New York and especially Hong Kong.

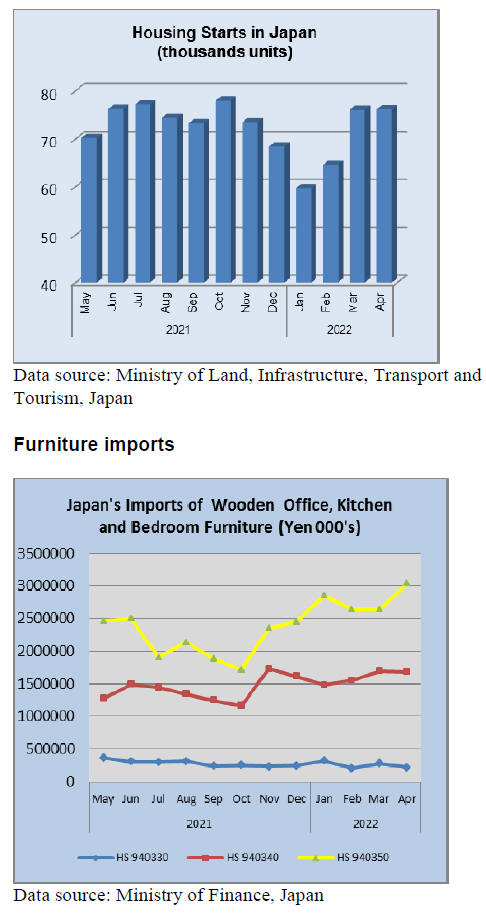

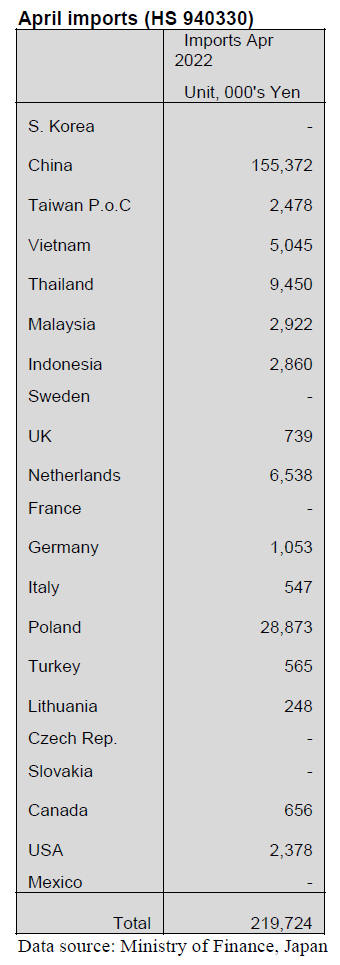

April office furniture imports (HS 940330)

There was a sharp drop in the value of wooden office

furniture (HS940330) imports in April. Compared to a

month earlier imports were down 22% and year on year

April 2022 imports dropped 38%.

The biggest decline was in imports from China which

were down around 35% and imports from Italy dropped

steeply.

On the other hand imports from Poland were up by a

factor of three. Shippers in Thailand and Malaysia also did

better in April compared to a month earlier.

As in previous months the top shipper of wooden office

furniture in April 2022 was China accounting for 70% of

total wooden furniture imports (85% in March). The only

other shipper of note in April was Poland which accounted

for about 13% of total imports.

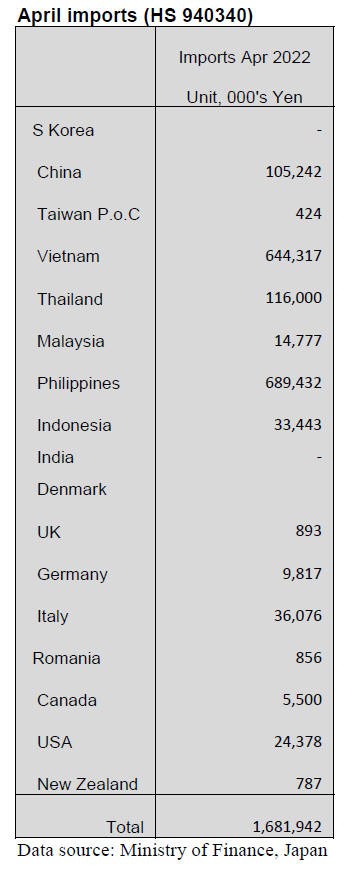

April kitchen furniture imports (HS 940340)

Shippers of wooden kitchen furniture (HS940340) in

Vietnam did well in April. Shipments from Vietnam were

up over 30% compared to a month earlier. Shipments from

Thailand dropped by half in April.

Year on year April 2022 shipments were up around 10%

but compared to March there was little growth. There were

two major shippers of wooden kitchen furniture in April,

the Philippines and Vietnam and manufacturers in these

two countries have a commanding position in imports of

wooden kitchen furniture each accounting for around 40%

of all wooden kitchen furniture imports.

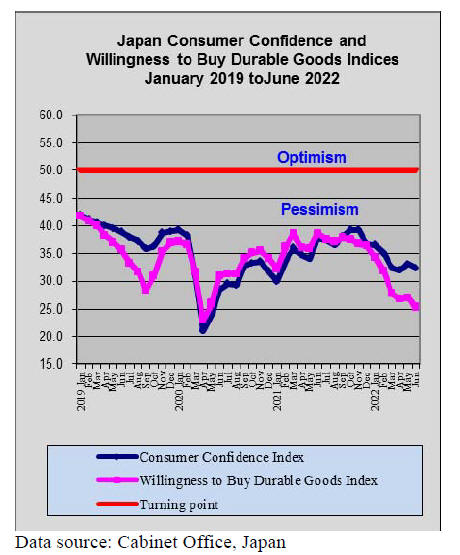

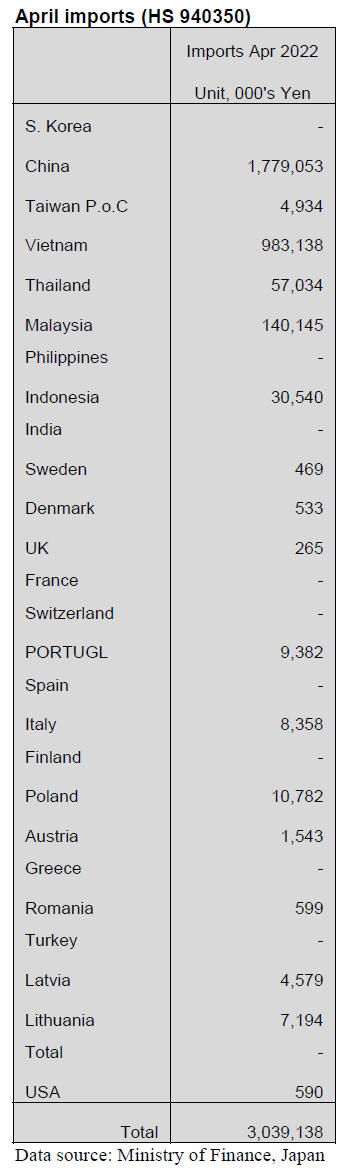

March bedroom furniture imports (HS 940350)

Except for the slight dip in the value of imports in

February this year Japan¡¯s imports of wooden bedroom

furniture (HS940350) continue to rise. Compared to

March imports there was a 15% rise in April and year on

year April 2022 imports were up 22%.

The driver of the continued rise in the value of wooden

bedroom furniture is difficult to identify. Consumer

sentiment and willingness to buy durable goods was

dropped in the first quarter and showed no sign of

recovery in the second quarter and in April the yen

exchange rate had begun to weaken pushing up the price

of imports but despite this imports of bedroom furniture

steadily rose.

One possible explanation is that domsectic manufacturing

has fallen creating the need for increased imports to

sustain demand.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Demand and supply of logs in 2021

The Ministry of Agriculture, Forestry and Fisheries

announced a result of demand and supply volume of logs

in 2021.Logs for lumber, plywood and chips were

26,085,000 cbms, 10.8% more than 2020¡¯s.

Domestic logs were 21,847,000 cbms, 9.9% more than

2020 and imported logs were 4,238,000 cbms, 15.5%

more than the previous year. The domestic logs were

83.8% of the total volume and it was0.6 point decreasing

from 2020 but it has been keeping a level of 80% for five

years.

The volume was around 26,000,000 cbms in 2016 ¨C 2019

and it was under 24,000,000 cbms in 2020. It was decline

for the first time in ten years. The volume of imported

lumber decreased at the beginning of 2021 and then the

demand was shift to the domestic lumber so the volume of

domestic logs increased to 26,000,000 cbms. The domestic

logs for lumber were 12,860,000 cbms, 10.7% more than

last year and for plywood was 4,660,000 cbms, 11.1%

more than last year.

The volume of softwood logs exceeded the volume of

2019 but the volume of hardwood logs did not.

Cedar logs for every category increased and it was

12,920,000 cbms, 10.8% increased from 2020.

Cypress logs for lumber and plywood increased but for

chips, it did not. The total volume was 3,080,000 cbms,

13.1% increased from 2020. Fir and whitewood volume

was 1,200,000 cbms, 28.3% more than 2020 due to

increase for plywood use. Larch volume was 1,990,000

cbms, 1% less than 2020 even though larch lumber

volume increased.

The volume of red pine and black pine was 530,000 cbms,

7.2% less than 2020 because the volume of lumber and

chips decreased. For imported logs, the volume of North

American logs was 3,450,000 cbms, 21.3% more than

2020. The volume of lumber and plywood increased a lot.

The volume of lumber exceeded 3,000,000 cbms for the

first time in three years.

Economic sanctions on Russia

The Ministry of Economy, Trade and Industry added

economic sanctions on the list of banned export to Russia.

Veneers, wooden containers, lumber, corks, machines and

machine parts were not allowed to export to Russia as of

17 June.

These economic sanctions followed the U.S.A. and

Europe¡¯s sanctions. New additions are veneers for

decorative boards and plywood, wooden barrels, buckets

which will be banned exporting. Lumber and corks for

machines will be also banned. Japan used to export

veneers for decorative plywood to Taiwan, South Korea

and Indonesia before but not to Russia.

There are no Russian lumber companies would not be able

to produce for Japan if they could not get machine parts

when they do maintenance.

Improved plywood for crating

Honda Lumber Co., Ltd. and Meiwa Corporation started

selling improved plywood for crating at Kitakyusyu City

in June. It took about a year to improve the plywood. The

plywood is water-repellent and fungicide. The companies

changed a glue company to reduce the cost and the glue is

better and stronger than before.

Mold and inundation have been a problem at distribution

business due to COVID-19. They are exposed to weather

in long time. The companies would expand selling the new

plywood not only in Japan but also in overseas. Size is

1,230x2,440 mm and yearly volume would be 600 cbms.

Domestic logs and lumber

Demand of domestic lumber is stalling since early June

and sales are slowing. 105 mm square is still moving but

120 mm square has no demand.

Meantime, log production is active and sawmills continue

full production despite dull movement of lumber.

Since balance of supply and demand is collapsing, prices

of structural items are getting weaker all over Japan.

3 meter KD cedar 105 mm square prices are 100,000-

110,000 yen per cbm FOB yard so far but in Tokyo

market, there are 90,000 yen level of prices are seen so

further slide is likely. 3 meter KD cedar 30x105 mm stud

prices are holding at 90,000-100,000 yen.

Standard cedar lumber prices are much steadier than

structural lumber. Substituting demand of Russian lumber

after the Ukraine war broke out is now totally simmered

down since Russian lumber continues coming in.

Log production continues steady even after rainy season

started in June and log inventory of sawmills is plenty

now. Plywood mills¡¯ log demand is satisfied. Market log

prices are softening with ample inventory. Cypress log

prices are particularly weak.

|