Japan

Wood Products Prices

Dollar Exchange Rates of 25th

May

2022

Japan Yen 127.27

Reports From Japan

Private sector anticipates

improvement in business

environment

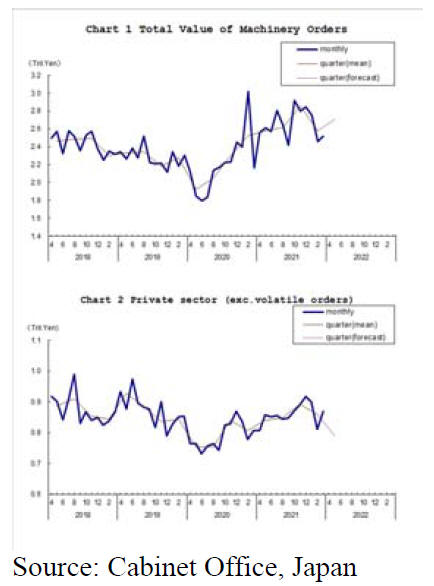

In March 2022 private-sector machinery orders by

domestic companies, an indicator of private sector

prospects, rose just over 7% from a month earlier

according to Cabinet Office data. The orders, which

exclude those for ships and from utility companies,

totalled around yen 870 billion.

This increase in machinery orders has been interpreted as

signaling the private sector anticipates an improvement in

the business environment. However, surging commodity

prices due to Russia's invasion of Ukraine will pull down

private consumption and is likely to slow a recovery from

the impact of the coronavirus pandemic.

See:

https://www.nippon.com/en/news/kd899810464173785088/japan's-march-machinery-orders-rise-7-1-on-month.html

Imported inflation 每 not what is needed

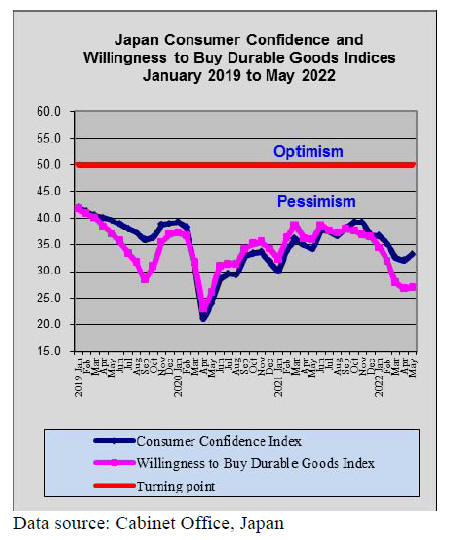

The consumer price index for April rose by 2.1% year-onyear,

the biggest increase in over 13 years excluding the

effects of the consumption tax hike. The Bank of Japan

(BOJ) Governor has forecast core consumer inflation will

remain around the Bank's 2% target for 12 months unless

energy prices drop sharply.

However, he anticipates that prices would not rise

"sustainably and stably" unless accompanied by wage

increases. This has been interpreted as indicating the

recent increase in (largely imported) inflation alone would

not lead to a tapering down of monetary stimulus.

Center for Economic Research - growth will

gradually

lose momentum

The Japan Center for Economic Research has said

heightened uncertainties linked to "tensions in

international relations and military conflicts" will continue

to undermine growth prospects.

Japan's economy shrank 0.2% quarter-on-quarter in the

January-March period, slightly less than expected. This

followed the slight increase in the final quarter of 2021.

The impact of covid-19 and the rising cost of imports with

energy prices surging along with the weakening yen has

pushed up import costs.

GDP forecasts by economists surveyed by the Japan

Center for Economic Research averaged an annualised

5.18% expansion in the second quarter of 2022 but they

anticipate growth will gradually lose momentum in the

following quarters. For fiscal 2022 growth of just over 2%

is expected.

See:

https://japantoday.com/category/business/japan-1st-quartergdp-shrank-as-omicron-wave-hit

and

https://japantoday.com/category/business/focus-japaneconomy-may-rebound-but-faces-headwind-amid-pricesurge

Opening the borders

It has been announced that entry rules for non-Japanese

will be eased from 1 June raising the entry limit to 20,000

people per day and exempting some from testing on arrival

and quarantine rules.

To be exempt from arrival testing and quarantine

procedures, countries and regions will be divided

into three groups depending on the Covid-19 situation in

their respective countries.

See:

https://www.mofa.go.jp/ca/fna/page4e_001053.html#title28

House builders to get relief from surging timber prices

The domestic media has reported a decision by the

Forestry Agency to provide incentives to companies which

use of domestic sawnwood. This follows the government's

ban on sawnwood imports from Russia. It is reported that

around yen 4 billion will be made available from the

government*s reserve fund.

It is understood the Agency will provide subsidies to cover

half of costs of domestic sawnwood transportation if the

distance is 100 kilometres or more. The agency will also

cover half of sawnwood storage costs and support

sawnwood consumption by house builders.

See:

https://www.nippon.com/en/news/yjj2022051600695/?cx_recs_click=true

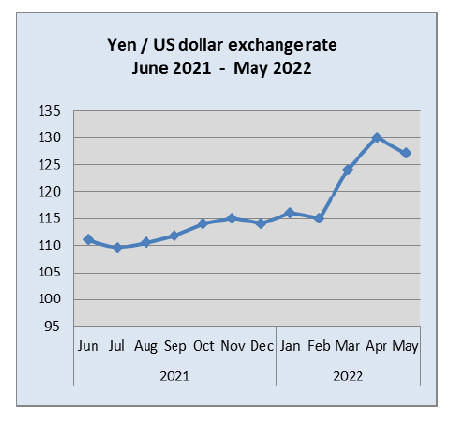

Increased perception of risk 每 yen

strenghens

Until the end of April the yen had been steadily weakening

against other major currencies driven mainly by the

widening interest rate gap between the Bank of Japan and

its counterparts. Investors are now concerned that the US

economy might tip into recession and this has, once again,

boosted the yen as a safe haven. The yen has strengthened

against the US dollar over the past two weeks.

Recent US housing date has been weak and the US

Federal Reserve has embarked on an aggressive rate-hike

cycle aimed at slowing the economy and containing

inflation. These moves have increased the perception of

risk.

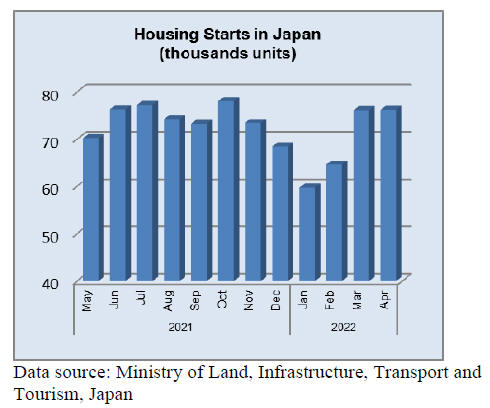

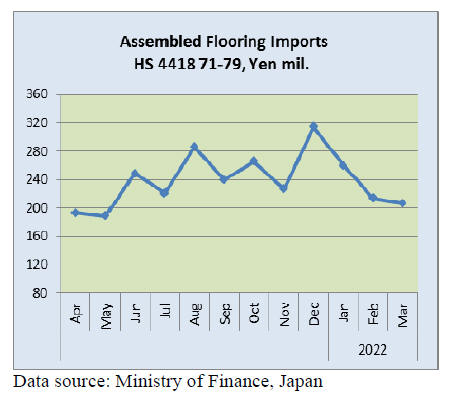

Assembled wooden flooring imports

The downward trend in the value of assembled wooden

flooring imports (HS441871-79) extended into March

marking the third consecutive decline. This is in contrast

to the steady rise in housing starts in the three months to

March.

Year on year, assembled wooden flooring imports were up

7% in March 2022 but the value of March imports was

down 3% from February 2022.The main category of

assembled flooring imported by Japan continues to be

HS441875 and this accounted for 61% of March 2022

imports with the main suppliers being China and Vietnam.

The value of imports of HS441873 and HS441879

together accounted for around 30% of the value of

assembled flooring imports in March.

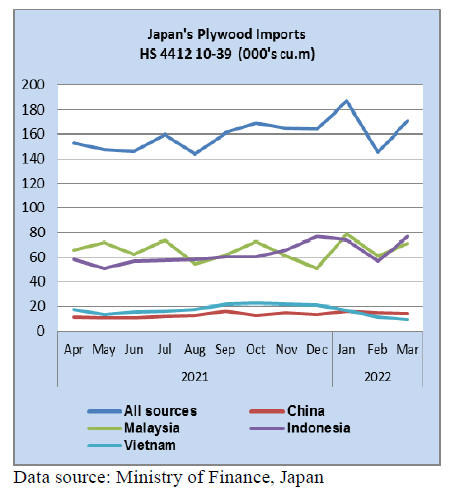

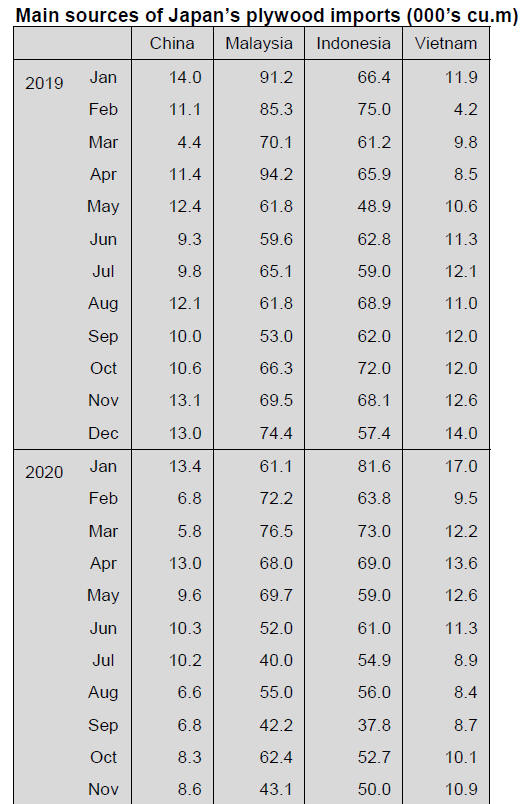

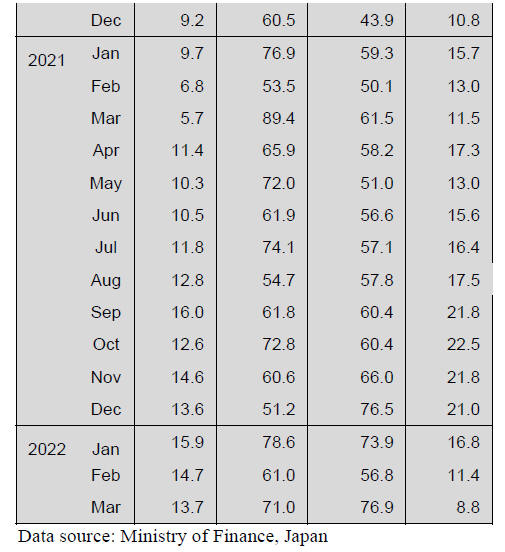

Plywood imports

The volume of plywood imports in March this year was up

18% from a month earlier, reversing the dip sen in

February. March 2022 import volumes were unchanged

from March 2021.

Malaysia and Indonesia were the main plywood shippers

to Japan and in March this year shipments from Indonesia

surged around 35% compared to the volumes imported in

February. Imports from Malaysia also rose from a month

earlier being up 16%.

The other two shippers of plywood to Japan, China

and

Vietnam each saw March shipments come in below those

in February. Shipments from China dipped 7% while

shipments from Vietnam were down 23% month on month

in March.

Of the various categories of plywood imported in March

2022 (as in other months) HS441231 was the most

common accounting for 90% of total plywood imports.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Forestry Agency*s business plan

The Forestry Agency announced supply volume from the

national forest. According to the plan, log sales would be

3,073,000 cbms, 6% more than last year and timber sales

would be 3,877,000 cbms, 5% more. This is the first time

in 30 years that log sales are over three million cbms since

1992.

Log sales have been about 2,600,000 cbms a year

since1993 but I increased to 2,824,000 cbms last year.

In 3,073,000 cbms of log sales, 1,971,000 cbms, 64% will

be system sales, which log buyers make contract with the

Forestry Agency for certain volume so buyers have stable

supply of logs as opposed to auction sales. A balance of

1,102 M cbms will be sold at auction markets.

The Forestry Agency is well aware that demand of logs

increased by wood shock so it increases sales volume but

in timber sales, if the buyer does not harvest timber, log

supply does not increase. The Forestry Agency plans to

sell timber ahead of schedule if log demand climbs. Rough

estimate of timber sales last year increased to 1,655,000

cbms, the largest in last ten years.

Other than logs and timber sales, plans of newly planting

areas will be 5,600 hectares, 4% more than last year.

Under brush clearing areas will be 22,200 hectares, 1%

less.

Newly build logging road will be 113 kilometers, 8%

less.

Logging road building has been decreasing for last three

years but the Agency plans to reinforcement and

improvement of existing roads.

Marutama developed birch plywood

Marutama Plywood Co., Ltd., Hokkaido announced that it

has succeeded trial product of thin plywood with birch so

it becomes possible to manufacture and supply floor base

with birch veneer for face and back.

Supply of thin plywood relies on import products and

Marutama tries to develop manufacturing with local wood.

Marutama started &birch project* to utilize unused local

species in Hokkaido.

Key to this project is how to accumulate birch logs stably.

It has been working together with local government

offices and log supply companies and finally succeeded to

have 200 cbms of birch logs a month with average

diameter of 24 cm. Birch log inventory has been steadily

increasing.

It installed veneer jointer. Birch thin plywood is 3 mm

thick with three 1 mm veneer. It plans to produce 5,000

sheets a month, which is used for base board of printed

plywood. At the same time, it has been manufacturing

floor base plywood of fir core with birch face and back of

12 mm thick 3x6. Thickness of birch veneer is 1.75 mm

and that of fir is 3.03 mm and three layers make 11.8 mm

plywood. Monthly production will be 15,000 sheets.

Hokkaido has abundant resource of hardwood but

utilization of many species has not developed yet like

birch, which is considered junk wood. Marutama targets to

utilise such unused species to make with100% Hokkaido

products.

Excellent performance of trading firms

Major trading firms closed their books in March and wood

products contributed largely particularly companies, which

are engaged in North American business by booming

housing market in the U.S.A.

Itochu Corporation registered 31.5 billion yen

profit from North American businesses, 2.17

times more than last term.

Sojitz Corporation registered 2.9 billion yen

profit by Sojitz Building Materials Corporation,

5.8 times more than last term.

Itochu has subsidiary companies in North

America such as CIPA, veneer manufacturer,

PWT, LVL manufacturer registered 22.6 billion

yen by active housing market in the U.S.A.

Itochu Kenzai and Daiken Industry are also partly

owned by Itochu and both companies made

record profit.

Sojitz Building Materials Corporation made

record high profit of 2.9 billion yen.

South Sea lumber and logs

Export prices of Indonesian mercusii pine lumber are

about US$950 per cbm C&F, US$40 lower than April.

Order balance is decreasing and confusion of

transportation by container shipment is gradually solved.

Then pine harvest will start in May so that lumber mills

want to have some orders. Market prices in Japan are

unchanged at 125,000 yen per cbm FOB.

There used to be price difference of 10,000-20,000 yen

between Chinese lumber and Indonesian lumber but a

difference has been narrowing as worldwide inflation of

wood prices. Chinese red pine lumber prices are

unchanged at US$1,030-1,050 per cbm C&F.

The manufacturers are busy to cope with active domestic

demand and Russian lumber prices stay up high so they do

not have to reduce the prices to have orders. Market prices

in Japan are about 130,000 yen per cbm FOB truck. There

is possibility that the prices would advance because of

weakening yen.

Rainy season is over in South East Asia but log production

has not increased because of shortage of workers. Log

prices of meranti regular in Sarawak, Malaysia are US$410

per cbm FOB.

An increase of the volume of imported fuel

There has been a lot of announcements of planning to start

an operation of biomass power plants. The output will be

huge with low cost and be sold to overseas.

Some huge biomass power plants consider using domestic

pellets instead of Northern American pellets. Most of huge

biomass power plants sign up long-term contracts for

importing Northern American pellets. It is predicted that

there will be a peak of the volume of imported fuel in a

few years so the government policy for renewable energy

will be very important to this situation.

According to Agency for Natural Resources and Energy,

there had been 30% of all biomass power plants in Japan,

which were under the FIT (Feed-in Tariff), in operation at

the end of last September. The FIT has been ten years by

July in this year and operations at huge biomass power

plants have been standing out in recent years. It takes over

five years to start an operation due to the environmental

assessments, agreements with local area, designs,

construction, tests and so on.

The number of authorized small biomass power plants

with its output is less than 2000kw, has increased 45 cases

in a year. It does not take a lot of fuel fee at one case

because the fuel consumption is small. However, there is a

problem of using the heat against stable operation.

There is a huge biomass power plant in Iwaki city,

Fukushima prefecture by Able Energy, which was

established by Kansai Electric Power Company,

Incorporated.

The output is 112,000kw and it started operation

since

April in this year. Abou 440,000 ton of imported pellet

will be consumed in a year. There will be several huge

biomass power plants in Japan in the future.

The volume of imported pellet and PKS has increased

since last year and it became 5,600,000 ton in a year.

Especially, the volume of imported pellet in 2021 was

3,116,523 ton, 53.7% more than the year of 2020. The

volume of pellet from Vietnam was the highest volume

and the pellet from Canada was the second. The volume of

imported pellet will be about 10,000,000 ton by 2024 or

2025.

There will be a big difference between the imported pellet

and the domestic pellet. One of reasons is that people

prefer using pellet instead of PKS because the prices of

pellet are fixed for 15 years to 18 years by long term

contracts.

A long-term contract includes not only unchangeable

prices but also exchange rates and freights but there is a

force majeure included when a sudden rise of exchange

rates or freights occurred.

The spot prices of pellet soared to US$ 300, FOB per ton,

in Europe due to an invasion in Ukraine by Russia.

There is large demand in Europe so the Northern America

supplies pellets to Europe mainly and also buy the pellets

in Asia for other areas so that is why the prices of pellet in

Asia have been increasing. There is a possibility that the

volume of imported pellets will be 10,000,000 ton in a

year and this situation seems to continue for several years.

The prices of biomass fuel

The invasion of Ukraine by Russia influenced the prices of

lumber and plywood in Japan but the prices of wood for

wooden biomass power plants are not as much increased

as lumber and plywood.

Some areas in Western Japan have high-priced biomass

fuel though. Since there is much demand for domestic

lumber cause by the wood shock last year and even the

low-quality lumber is used as building materials.

Therefore, it is difficult to buy fuels for biomass power

companies and buy wood chips to plants.

The unused wood materials cost around 7,000 每 7,500 yen

per ton, arrived at a plant in Southern Kyusyu. Some

biomass power plants showed their condition that they buy

the unused materials for 8,000 yen to get those for sure

and there is a time limit.

In Kansai area and Shikoku area, it is also difficult to buy

the unused materials and the prices are 7,500 每 8,000 yen.

If the materials include barks, the prices are cheaper.

There was a biomass power plant which stopped operating

in last autumn because lumber companies bought

muchmaterials and there were no materials available for

biomass power plants.

In Chugoku area, the prices are slightly cheaper than other

areas. It is 6,000 yen. In Tohoku area, it is less than 6,000

yen and in Northern Kanto, it is 5,500 每 7,000 yen. There

is a big difference between Western Japan and Northern

Japan. The prices in Western Japan are high and low in

Northern Japan.

It is basic to use the unused materials which were around

the plant within 50 km, so it is hard to buy the materials

from distant area. of income and reduce fixed costs for

continuing operations. There is also a rule that the prices

are fixed due to the FIT. There are some biomass power

plants that to find a new source.

|