|

Report from

North America

Imports set records in March

US imports of tropical hardwood, hardwood plywood and

related wood products rose to record levels in March.

While record dollar figures may be due partly to inflation

import volume records were set for both sawn tropical

hardwood and hardwood plywood.

Wooden furniture imports shattered their previous all-time

high while imports of assembled floor panels and

mouldings saw their highest values since well before the

pandemic.

Tropical hardwood imports rise to a record high

US imports of sawn tropical hardwood rose by 21% in

March to their highest level in more than 10 years. The

28,129 cubic metres imported in March marked the fourth

straight month above the 20,000 cunbic metres.

Total imports through the first quarter of 2022 were more

than three times that of Q1 of 2021. Most of the increase

for the month came in the category of ¡°other tropical¡±

woods which would appear to include woods counted as

jatoba until this year. Official Jatoba imports are down

96% through the first quarter most likely due to

reclassification rather than a marked change in trade

volume. Imports of mahogany rose 13% in March and are

up 103% year to date while imports of padauk rose 77%

and are ahead 20% year to date.

Imports from Brazil and Indonesia were very strong

throughout the first quarter of 2022. Imports from Brazil

rose 34% in March and are up more than 10-fold year to

date. Imports from Indonesia gained 87% in March and

are up more than 15-fold year to date.

Imports from nearly all trading partner nations are up more

than 10% through the first quarter with the exception of

Ecuador. Imports from Ecuador rose 6% in March but are

down 57% for the first quarter.

Canada¡¯s imports of sawn tropical hardwood rose 10% in

March. The rise was driven by a 37% increase in imports

from Cameroon and an 89% increase in imports from the

US. Imports from Cameroon, Canada¡¯s leading supplier,

are up 120% for the first quarter over 2021.

Imports from Brazil fell 75% in March and are down 37%

so far this year. Total imports are up 38% through the first

quarter.

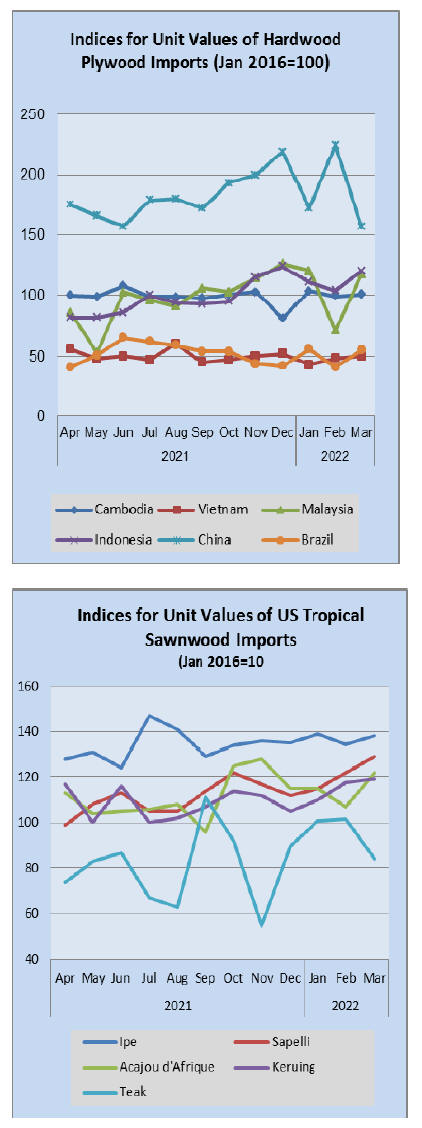

Hardwood plywood imports soar to record level

Monthly US imports of hardwood plywood rose above the

400,000 cubic metre level for the first time ever in March.

Imports rose 22% for the month and are up 64% year to

date versus 2021. Imports from Russia have yet to see a

drop-off as a result of the Ukraine invasion. Imports from

Russia gained 13% in March and are up 16% through the

first quarter.

Imports from all major trading partner nations were up

more than 10% in the first quarter with Vietnam leading

the way. Imports from Vietnam rose 11% in March were

up 157% through the first quarter. Imports from Malaysia

rose 61% in March and were up through the first quarter

by 118%.

Veneer imports rebound

US imports of tropical hardwood veneer rebounded from a

slow February, rising 76% in March.

Imports from Italy rose more than 7-fold in March while

imports from China and India more than doubled. Imports

from Cameroon fell by 24% in March but still managed to

surpass last year¡¯s pace by 70% through the first quarter.

Overall imports of tropical hardwood veneer are up 68%

so far this year, with imports from Italy and India both

more than doubling last year¡¯s first quarter totals.

Hardwood flooring imports surge

US imports of hardwood flooring moved higher in March,

rising 36% to mark the strongest month since November

2018. Imports from Brazil rose 74% in March and are up

24% over 2021 through the first quarter.

Imports from Malaysia are ahead 44% through the quarter

after more than tripling in March over the previous month.

Despite falling in March, imports from China and

Indonesia remained well ahead of 2021 totals through the

first quarter. Total imports are up 13% year to date.

Imports of assembled flooring panels rose 14% in March

to fall just short of the record dollar amount set in January.

Total imports are up 86% through the first quarter as

imports from most major trading nations are up strongly.

Imports from Vietnam jumped 49% in March and are

ahead 72% year to date, and imports from Canada are up

35% for the month and 29% year to date. Imports from

Thailand cooled 31% in March but are up 10-fold through

the first quarter and lead all other nations. Imports from

China fell 44% in March and are down 4% through the

first quarter.

Moulding imports set post-pandemic high

US imports of hardwood mouldings leapt 43% in March to

reach their highest level in nearly five years.

Imports from Brazil more than doubled in March and are

up 44% over 2021 through the first quarter of the year.

Imports from Malaysia nearly tripled in March and are up

30% year to date.

Imports from Canada remain solid, growing 44% in March

and up 49% year to date. Imports from China fell 7% in

March but are up 23% year to date. Total imports of

hardwood moulding are ahead 41% over 2021 through the

first quarter.

Wooden furniture imports set record at over US$2.4

billion

US imports of wooden furniture moved back into record

territory in March, rising 27% to reach their highest level

for a single month. The US$2.437 billion imported in

March was 19% higher than last March.

Imports from Mexico, Indonesia, and India all rose sharply

and are well ahead of last year¡¯s totals through the first

quarter of the year. Imports from Vietnam, which have

been falling over the last few months, rebounded rising

45% in March, but are still trailing 2021 imports by 7%

through the first quarter. Imports from China fell 3% in

March but are up 11% year to date. Total imports of

wooden furniture are ahead by 10% through March.

Economy dipped in first quarter

The nation's gross domestic product -- the broadest

measure of economic activity -- declined at an annualised

rate of 1.4% between January and March according to the

"advance" estimate released by the Bureau of Economic

Analysis.

This was an abrupt reversal of the prior year's strong

growth and the 6.9% growth pace recorded in the final

quarter of last year, and the worst performance since the

pandemic recession in the second quarter of 2020.

The decrease in real GDP reflected decreases in private

inventory investment, exports, federal government

spending, and state and local government spending, while

imports, which are a subtraction in the calculation of GDP,

increased.

Personal consumption expenditures (PCE), nonresidential

fixed investment, and residential fixed investment

increased.

See:

https://www.bea.gov/news/2022/gross-domestic-productfirst-quarter-2022-advance-estimate

|