US Dollar Exchange Rates of

10th

May

2022

China Yuan 6.7217

Report from China

Financial measures to support enterprises

The State Council decided measures are needed to support

micro, small and medium enterprises whose finances have

been disrupted by measures introduced to slow the spread

of covid-19.

The State Council called for immediate implementation of

the measures which include tax rebates, tax reductions and

fee reductions, delayed the payment of social insurance

premiums, help with logistics services all aimed at

encouraging enterprises to resume work and production.

Tax rebates and tax reduction are key measures to stabilise

the macroeconomic. It is estimated that RMB2.5 trillion of

tax reductions will be completed for the current financial

year. More than 20 tax support policies will be

implemented this year.

It is reported that financial and tax departments at all

levels are closely cooperating to speed up the progress of

tax refunds. As of 28 April 2022, a total of RMB625.6

billion had been refunded. According to the Ministry of

Finance it will advance the refund of tax credits for small

and medium-sized enterprises in May and will speed up

refunds for larger enterprises.

Large state-owned banks will increase small and micro

loans up to RMB1.6 trillion this year and the Ministry of

Finance is encouraging banks to strengthen proactive

services. For small, medium and micro enterprises and

individual industrial and commercial households loan

renewal and extension or adjustment of repayment

arrangements will be adopted. The State Council adopted

measures to "remove burdens" and "add vitality" to

enterprises.

See:

http://www.cinic.org.cn/xw/zcdt/1285307.html

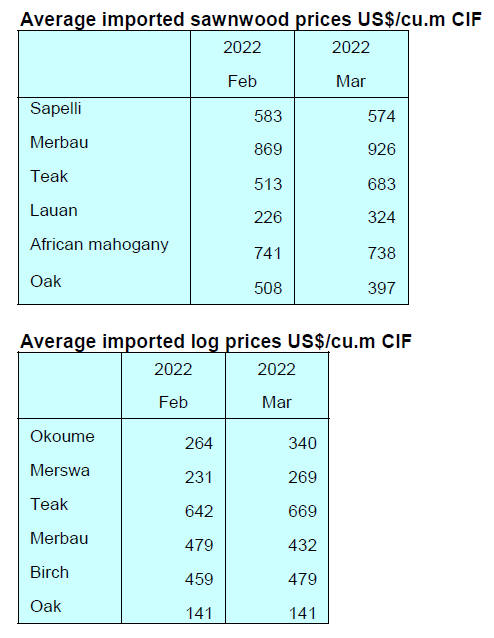

Slight decline in timber prices

It has been recently reported that timber prices have been

unstable and have been trending down by around RMB20

per cubic metre for radiata pine, hemlock, spruce and fir,

scots pine from Jiangsu Province; radiata pine and scotch

pine from Shandong Province; radiata pine in Hebei

Province and Tianjin Municipality; radiata pine, spruce

and fir, hemlock in Fujian Province.

Timber prices are closely related to activity in the

housing

sector. According to the National Bureau of Statistics

housing construction started on 298.38 million square

metres in the January-March period, down 17.5% year on

year.

The utilisation rates of downstream projects have been

relatively low as demand for all types of building materials

is still weak and sales of construction timbers are flat.

As the epidemic is brought under control production will

be resumed and market demand is expected to recover

driven by government initiatives but timber prices are

likely to fluctuate for some time to come.

Increase in OSB output

China's oriented strand board (OSB) sector has grown fast

as production by overseas mills has slowed and

international demand has expanded. China¡¯s OSB output

in 2021 surged 70% to 3.4 million cubic metres, a record

high. Of the total, output of faced OSB was 850, 000 cubic

metres.

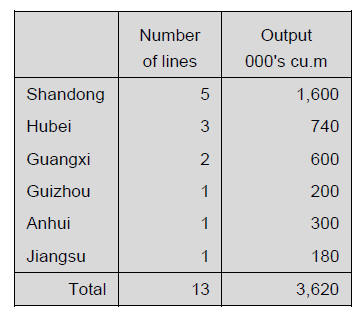

The capacity of China¡¯s OSB output in 2021 was 4.42

million cubic metres annually. An additional 13

continuous flat press production lines with a capacity of

3.62 million cubic metres per year have been brought on

stream.

In addition to the continuous flat press production

line

China also has some single-layer and multi-layer press

production lines to produce OSB. Most of these have a

production capacity of 10,000 to 50,000 cubic metres

annually with a maximum production capacity of 100,000

cubic metres per year and these mills are mainly in

Shandong, Jiangsu, He¡¯nan and Yun¡¯nan Provinces. 13

OSB continuous flat-pressing production lines are under

construction in 2022.

These OSB production lines will be completed and put

into operation during 2022-2024 period, and the national

production capacity of OSB will exceed 8.5 million cubic

metres annually.

OSB imports

According to China Customs OSB imports in 2021

totalled 182, 000 tonnes valued at US$86 million, down

9% in volume but up 14% in value year on year. The CIF

price for China¡¯s OSB imports in 2021 was US$475 per

tonne, up 26% year on year. China¡¯s OSB imports in 2021

were from Russia, (35%), Canada (19%), Germany (13%),

Brazil (12%), Thailand (9%) and Romania (7%).

Chinese analysts suggest the OSB market in China is in a

period of development as OSB is rapidly replacing other

wood panels. There are many OSB manufacturers in China

but most of them are small scale and inefficient such that

imported panels are deemed superior.

With the growth of the domestic OSB market imports will

rise but domestic investment in new production capacity

will also grow. The output of China¡¯s OSB increased year

on year by 31% in 2019, 43% in 2020 and 70% in 2021.

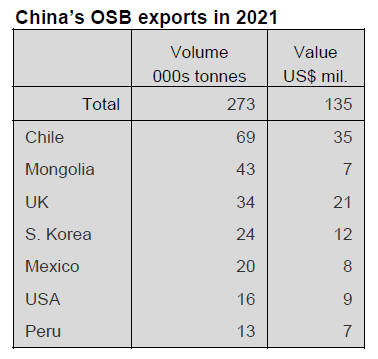

China¡¯s OSB exports in 2021 totalled 273,000 tonnes

valued at US$135 million, surging 224% in volume and

323% in value. The CIF price for China¡¯s OSB imports in

2021 was US$494 per tonne, up 30% year on year.

80% of China¡¯s OSB exports in 2021 were exported to

Chile (25%), Mongolia (16%), UK (12%), South Korea

(9%), Mexico (7%), USA(6%) and Peru (5%).

GGSC-CN Index Report (April 2022)

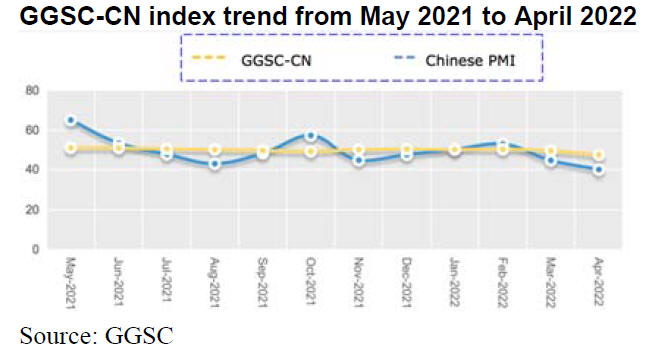

In April 2022 because of the spread of COVID-19 in many

places and the impact of the invasion of Ukraine the

logistics and employment potential of the manufacturing

sector have been seriously affected. Raw material prices

continue to rise and the output of the middle and upstream

industries has dropped significantly.

In April China's PMI index registered 47.4, a drop

of 2.1 points from the previous month marking the lowest

level since March 2020. Against this background

the timber manufacturing industries have been impacted,

order levels have fallen and difficult logistic operations

along with increased transport and freight charges are

damaging.

The GGSC-CN comprehensive index for April registered

40.0 (71.1 for last April and 60.4 for April 2020) a

decline of 4.6 points from the previous month and has

been below the critical value of 50 for two months. This

indicates that the operation of the forest products

enterprises represented in GGSC-CN index shrank from

last month. See Figure below.

Challenges

COVID-19 has repeatedly appeared, trans-province

transportation is disrupted and transportation costs are

high.

Freight rates have increased significantly.

Products in short supply

None.

Commodity for which prices have increased

Methanol, melamine, paraffin, waterproof agent and other

chemical raw materials.

Commodity for which prices have dropped

Miscellaneous firewood, eucalyptus firewood, pine

firewood, core board, eucalyptus logs, melamine, urea.

In the April 2022 GGSC-CN index three sub-indexes were

flat two declined. The production index registered 41.7, a

decrease of 8.3 points from the previous month. The new

order index registered 25.0, a decrease of 8.3 points from

the previous month reflecting the ability of enterprises to

obtain orders is worse than in March.

The new export order index reflecting international trade

registered 25.0 same as the previous month and has been

below the critical value of 50 for seven months indicating

that the flow of orders from overseas remains weak.

The main raw material inventory index registered 58.3

the same as the previous month. The employment index

registered 50.0 the same as the previous month. The

supplier delivery time index was 41.7 the same as the

previous month.

See:

http://www.itto-ggsc.org/site/article_detail/id/238

|