4.

INDONESIA

Expanding SVLK at the

global level

At the recent Forest Governance, Markets and Climate

(FGMC) Stakeholder Forum held in London the FLEGTVPA

cooperation between Indonesia and the UK was

strengthened.

The UK Government Minister in charge of International

Environment and Climate, Animal Welfare and Forests

expressed appreciation for the achievements by Indonesia

in improving forest governance. Purwadi Soeprihanto,

Secretary General of the Association of Indonesian Forest

Concession Holders, supports efforts to expand the

recognition and the acceptance of SVLK at a global level

saying "business to business cooperation needs to be

strengthened to promote the FLEGT VPA between

Indonesia, European Union and UK as well as to build

broad recognition of the Indonesian national standard at

the global level.

See:

https://industri.kontan.co.id/news/sistem-verifikasi-legalitaskayu-svlk-diperluas-ekspor-kayu-indonesia-makin-moncer

Low cost and efficient timber identification

Indonesia will develop a standardised system for wood

identification to support the promotion of sustainable

timber to the global market.

The Head of the Instrument Standardisation Agency in the

Ministry of Forestry, Ary Sudijanto, said that an accurate

and efficient species identification system and data centre

for easy and cheap identification and tracking of timber

will support verification and trade in sustainable timber.

This system could be the answer to the current situation

where customs officials and law enforcement officers have

difficulty to validate timber export documents.

A researcher from the National Research and Innovation

Agency (BRIN), Ratih Damayanti, revealed that to support

the development of a wood identification system Indonesia

has developed an Automatic Wood Identification

Application (AIKO-KLHK). She added “There are about

1,300 timbers that can be identified using AIKO-KLHK".

A portable device is currently being developed.

See:

https://forestinsights.id/2022/05/06/indonesia-kembangkanstandar-sistem-identifikasi-kayu-murah-dan-efisien-cegahperdagangan-ilegal/

Public/private promotion of Lightwood

The Ministry of Trade, through the Directorate General of

National Export Development and Fairventures

Worldwide signed a memorandum of understanding on the

development of lightwood especially sengon (Albizia sp)

and jabon (Anthochepalus sp). The MoU was signed by

the Director General of National Export Development,

Didi Sumedi and CEO of Fairventures Worldwide Megan

King. In addition to the MoU, the Ministry of Trade and

Fairventures Worldwide also signed a Technical

Arrangement (TA) to follow up on the MoU in detail.

Activities to be undertaken include educating consumers

about the benefits of lightwood, establishing a lightwood

innovation centre and conducting training on the use of

lightwood. In addition, the Ministry of Trade and

Fairventures Worldwide will also promote the Timber

Legality Verification System (SVLK) in Europe fostering

2000 sengon wood farmers with an area of 2000 ha of

sengon plantations and distribute two million sengon

seedlings.

See:

https://wartaekonomi.co.id/read410073/kemendag-tandatangani-mou-pengembangan-kayu-ringan-berkelanjutan

Social forestry aids economic recovery

Indonesia’s social forestry policy can deliver alternative

livelihood sources to rebuild the economy after the Covid-

19 pandemic as it will provide communities with access to

managed forests and assistance in marketing. This was

stated by Agus Justianto, Director General of Sustainable

Forest Management at the Ministry of Environment and

Forestry at the Asian Forest Cooperation Organization

Ministerial Meeting at the World Forestry Congress in

Seoul.

See:

http://agroindonesia.co.id/perhutanan-sosial-bantuindonesia-pulihkan-ekonomi-pasca-pandemi-covid-19/

Indonesia seeks ASEAN cooperation in peatland

management

Indonesia has invited countries in Southeast Asia to work

closely together for sustainable peatland management in

support of economic growth and maintainance of

ecological balance. Indonesian Ambassador to the

Republic of Korea, Gandi Sulistyanto, said that tropical

peatland in Southeast Asia provides many benefits for the

region from providing timber and non-timber forest

products, water reserves and helping in flood control.

Ambassador Gandi said the Indonesian government is

strongly committed to managing peat ecosystems by

building a monitoring and control system for forest and

land fires.

A document outlining a sustainable peat management

strategy has been released which can serve as a guide for

ASEAN countries. Vong Sok, Head of the Environment

Division and Assistant Director of the Sustainable

Development Director at the ASEAN Socio-Cultural

Community said that a project for implementing

sustainable peat management is currently being piloted in

countries in the Mekong Delta.

See:

https://republika.co.id/berita/rbfn70383/ri-undang-negaranegaradunia-untuk-bantu-pengelolaan-gambut-lewat-itpc

EconomicgGrowth in the first quarter

Statistics Indonesia reported a 5.01% year on year growth

in the first-quarter attributed to recovering economic

activities post Covid-19 pandemic. Statistic Indonesia

Head, Margo Yuwono, also mentioned the growth was

built on a very low baseline. In the same quarter of 2021

economic growth was minus 0.7%.

See:

https://en.tempo.co/read/1589865/statistics-indonesiabreaks-down-5-01-percent-economic-growth-in-q1

5.

MYANMAR

Export registrations revoked -

timber companies

included

According to the Ministry of Commerce over 300 exporter

registrations have been revoked for the failure to abide by

the Central Bank regulations on foreign currency

exchange.

The Central Bank issued a rule that foreign currency

export earnings must be deposited in a domestic bank

account within a defined time from the export date.

Export earnings for exports to Asian countries must be

credited within 45 days of the export date and export

earnings from exports to other countries must be deposited

to the bank account within 90 days of the export date.

According to a 6 May statement from the Ministry of

Commerce and the Central Bank the government will take

action against exporters who do not follow the amended

laws. Their export certificates will be suspended until the

earnings are banked as required.

In addition to the 346 companies who had their export

licenses revoked in 2021, this year, as of 27 April, 177

exporters have also had their licenses revoked for noncompliance

with the banking regulation.

It is learnt that about 40 timber manufacturers are among

the companies effected. Some complain they were

wrongly placed om the list of companies whose export

credentials should be revoked.

See:

https://www.mizzima.com/article/companies-have-exportlicences-suspended-not-following-banking-rules

)

Energy companies withdrawing

ENEOS from Japan, Petronas from Malaysia and PTTEP

from Thailand announced their withdrawal from the

Myanmar energy sector.

ENEOS Holdings said it will withdraw from a gas project

in Myanmar days after its Thai and Malaysian partners

announced they would pull out. ENEOS is the latest

energy giant to retreat from the Southeast Asian country.

Malaysia's Petronas and Thailand's oil and gas

conglomerate PTTEP also announced their withdrawal.

Companies from France, the UK and Norway have left the

country.

See:

https://www.hd.eneos.co.jp/english/newsrelease/upload_pdf/20220502_01_02_0960492.pdf

Solar projects cancelled

Myanmar’s administration has cancelled tenders invited

by the previous government for 26 solar power projects

and blacklisted the companies for breaching tender

regulations. In May 2020, the government of the day

invited bids for the construction of 29 ground-mounted

solar projects capable of generating a total of 1 gigawatt of

power under a 20-year build, operate and own contract.

Chinese companies and their consortia won the bids to

build 28 out of the 29 plants according to a release by the

Ministry of Electricity and Energy in September

2020. However, only three solar projects are currently

being implemented and the local media report Chinese

firms have delayed the other projects.

See:

https://www.irrawaddy.com/news/burma/myanmar-juntacancels-chinese-backed-solar-power-projects.html

Myanmar to resume issuing tourist visas

Myanmar announced on 12 May that it will resume issuing

visas for visitors in an effort to help the tourism industry

devastated by the coronavirus pandemic and the political

situation.

Tourism is an important source of revenue for most

Southeast Asian nations and over the past six months most

have reopened and gradually dropped testing

requirements. Myanmar hosted 4.36 million visitor

arrivals in 2019 before the pandemic but the number fell to

903,000 in 2020 the latest year for which official statistics

are available.

See:

https://www.thestar.com.my/aseanplus/aseanplusnews/2022/05/13/myanmar-to-resume-issuing-tourist-e-visasstarting-on-sunday-may-15

6.

INDIA

Rising costs impacting housing sector

An ‘Impact Assessment Survey’ reported in a press release

from the Confederation of Real Estate Developers'

Associations of India (Credai) says almost 40% of

developers have expressed concern that it is becoming

difficult to sustain their business owing to the rise in input

costs. 46% of developers foresee a delay in delivery

timelines of ongoing projects and 76% of developers will

only be able to continue for another six months if they

cannot find ways to bring down costs.

The survey also reports that the majority of respondents

predicted that the impact of rising input costs will add

around 10% in the price of properties. Credai points out

that while the rise in prices has been an ongoing issue for

the past two years the current situation, which has resulted

in prices of some of the raw materials skyrocketing by

over 110%, has made it impossible for developers.

Around two thirds of respondents said they will be forced

to temporarily stop procurement and shut construction

sites if raw material prices do not correct and if they

cannot find immediate relief from the ongoing situation.

As the second largest employer in the country any

slowdown or stoppage would directly impact the labour

force and the security of allied industries.

Credai’s President, Harsh Vardhan Patodia, said “For the

last one year, developers have been able to absorb the rise

in the cost of construction to steer the industry’s growth

post the pandemic. However, with thin margins this will

eventually have to be passed on to the buyers which may

not augur well for the industry’s growth momentum. As

the apex body for the real estate in the industry Credai

have been in dialogue with concerned ministries to seek

their intervention to avoid any delay in the delivery of

projects for homebuyers, help kickstart delayed projects

and save jobs.

Our recommendations included measures such as setting

fixed prices for raw materials, providing GST input credit

on these materials, incentivising or subsidising customers

through stamp duty discounts or waivers and reducing

interest rates“.

See:

https://www.credai.org/media/view-details/268

High domestic transport and shipping cost defeating

exporters

The impact on Indian exporters from rising sea freight

charges and container shortages is worse for those

companies in the east as goods have to be transported by

road to Mumbai, Visakhapatnam or Cochin to find

shipping opportunities. From Kolkata Port goods are

shipped either to Colombo or Singapore for transshipment.

It is generally agreed by businesses and the government

that this issue is unlikely to be resolved for several more

months.

One exporter has, according to the report in the Times of

India, said transport cost per container adds around Rs.1

lakh and then are other charges such as for warehousing,

loading and unloading, which add up to another

Rs.30,000-40,000 per container. What is worse is that few

shipping lines are taking consignments from Kolkata to

Chittagong countries, resulting in Indian exporters losing

out to competitors.

See:

https://timesofindia.indiatimes.com/business/indiabusiness/exporters-in-east-go-to-west-indianports/articleshow/87748529.cms

Federation seeks policy change to release potential in

agroforestry sector

Plyreporter has highlighted a presentation ‘Small Policy

Shift – Big National Change’ prepared by the Federation

of Indian Plywood and Panel Industry (FIPPI) which was

sent to the government. This offers suggestions on how the

industry can support the ambition for an Atmanirbhar

Bharat (self-reliant India).

A letter written by the Federation President, Sajjan

Bhajanka, requested intervention in affecting a policy

change with potential for immense national impact

through self-sufficiency in production of agro-forestry

wood and development of wood based industry in India.

The FIPPI has said at present wood produced from

farmlands is classified as forest products requiring

regulatory clearances which it says discourages farmers

from growing trees. FIPPI proposed shifting agro-forestry

from forestry to the agriculture sector to release all the

economic benefits given agriculture to the farmers

engaged in agroforestry.

They also propose the removal of licensing requirements

for wood-based units and all other industries that primarily

use ‘farm wood’ as raw materials.

See:

https://www.plyreporter.com/article/92931/pmsintervention-needed-by-fippi-due-to-changes-affecting-policy

7.

VIETNAM

Exports of wood and wood products to rise in 2022

According to the General Department of Customs exports

of wood and wood products (W&WP) in April 2022 are

estimated at US$1.5 billion, up by 7.3% compared to April

of 2021.

Exports of wood products alone in April of 2022 are

estimated at US$1.13 billion, up by 6.4% compared to

April of 2021.

In the first 4 months of 2022 there were 5 product groups

with export values over US$1 billion including wood and

wood products according to the Ministry of Agriculture

and Rural Development.

The Vietnam Wood and Forest Products Association has

indicated the focus of exports is on high value-added items

such as wooden chair frames, living and dining room

furniture and bedroom furniture reflecting Vietnam's

manufacturers strengths.

The timber industries still face many difficulties such as

the prolonged Covid-19infections and control measures

which disrupted the flow of of workers and the Russian

invasion of Ukraine. These issues have pushed up energy

and fuel costs and impaced production costs.

In particular the price of wood raw materials continues to

rise but businesses had to maintain production to meet

orders.

With the positive results achieved in the first months of

2022 it is forecast that Vietnam's exports of wood and

wood products in the first half of 2022 will increase by

around 5-8% compared to the same period of 2021.

See:

http://www.asemconnectvietnam.gov.vn/default.aspx?ZID1=8&ID1=2&ID8=119356

CORRECTION

In the previous report from Vietnam it was stated that “of the total wood

and wood product export revenue of US$14.8 million around half was

manufactured from acacia”. It should read US$14.8 billion.

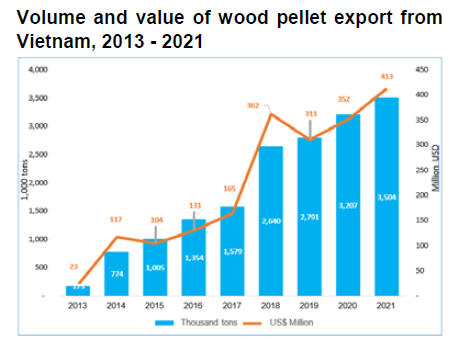

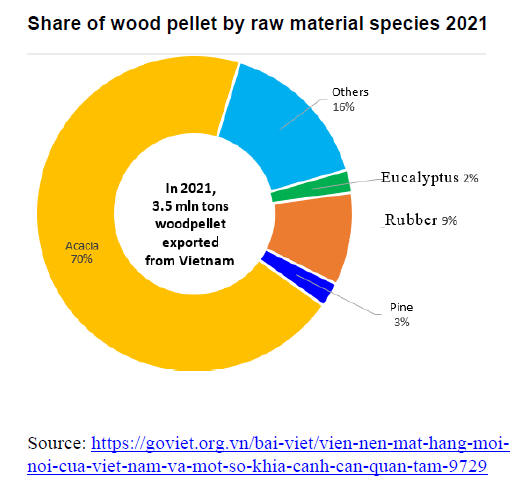

Vietnam becoming major wood pellet exporter

Wood pellets are an emerging export commodity in

Vietnam. The production and export of this wood product

has expanded rapidly over the past 5 years and Vietnam

has become the second largest exporter of wood pellets in

the world after the US with exports of over 3 million

tonnes per year worth around US$400 million. Japan and

South Korea are Vietnam’s largest wood pellet markets.

Exports to these two markets account for over 95% of the

total export from Vietnam.

Vietnam’s wood pellet exports 2013 – 2021

Vietnam's wood pellet exports are rising. In 2021 the

export volume reached 3.5 million tonnes, worth US$413

million. Exports have been growing at between 10-20%

annually.

At present the volume and value of wood pellet

exports to

Japan and South Korea are almost the same. In 2021 the

export to Japan and South Korea accounted for 43.8% and

56% of total wood pellet exported by Vietnam in volume

and 48.5% and 51% in value, respectively.

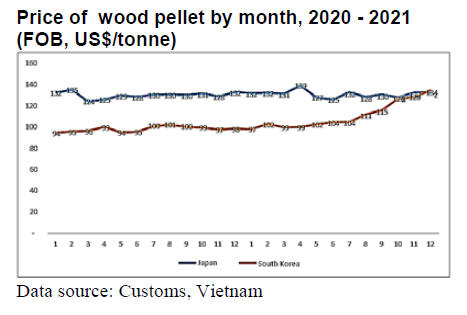

Wood pellet price

The price of wood pellets exported to Japan is more stable

than the export price to S. Korea. However, the price

growth rate in the Korean market is faster than the growth

rate in Japan. In particular, in the first months of 2020 the

price of wood pellets exported to S. Korea stood at about

70% of that exported to Japan. However, at the end of the

fourth quarter of 2021 the difference in prices in these two

markets narrowed.

In the first months of 2022 the price of wood pellet

exported to Korea increased sharply (US$150-160/tonne)

while the price in Japanese market ranged between

US$140 - 145 per tonne. The difference in price growth in

these two markets is mainly due to differences in the

duration and term of contracts signed by the Vietnamese

enterprises.

Size of export companies

The number of companies directly involved in wood pellet

export is relatively small and has not changed much in

recent years. In 2021 83 companies were involved in wood

pellet export, just 9 companies more than in 2020 and 6

companies added in 2019.

In 2021 of the 83 companies directly involved in exporting

wood pellets 8 companies have export volumes over

100,000 tonnes per company.

The annual export volume of these 8 companies accounted

for nearly two-thirds (67%) of the total exports. Of these 8

exporters there are 3 companies with export volume of

400,000 tonnes or more including 1 company with a large

export volume (714,000 tonnes, equivalent to 20% of the

total Vietnam’s wood pellet export in the year).

Information on the export size of the enterprise reveals the

following observations:

In general, the number of wood pellet exporters is quite

small (less than 100 companies) partly due to limited direct

access to overseas markets;

Wood pellet export remains mostly with some 15 largescale

producers and exporters;

The small and micro companies represent a large

number of exporters but of small volumes.

The number of companies engaged in wood pellet

export business (83 companies) is not corresponding to the

number of the producers (over 300 actors).

Raw material sourcing

Wood raw material input for pellet production, is usually

residues from harvesting plantations and mill residues. At

present Vietnam’s wood pellet production relies on 2 types

of raw material inputs:

Wood pellet as a byproduct of sawmilling and furnituremanufacturing

factories

This type of wood pellet is produced mainly in the South-

Eastern provinces, including Binh Duong, Dong Nai, Ho

Chi Minh City which represents the major hub of

Vietnam’s wood industry. Producers in this area are using

imported raw material.

Wood pellet produced by using branches, tops of

plantation wood and other small-sized wood

Vietnam's plantation area and farm forests are

concentrated mainly in the Northern and Central regions

of the country. Wood pellet factories distributed in these

localities rely on raw material collected during plantation

harvesting and a smaller volume of residues from local

wood processing plants.

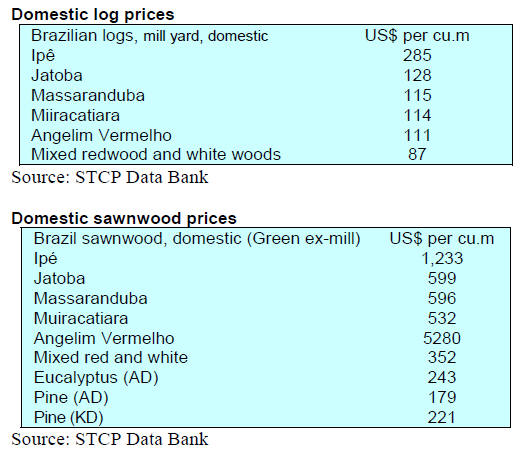

8. BRAZIL

Concession in the northern region of

Brazil

The Brazilian Forest Service (SFB) has published details

of the forest concessions available in the Amana National

Forest in Pará State. Concessionaires will be permitted to

harvest timber and non-wood forest products under

sustainable forest management plans.

The concessions comprises three forest management units

totaling 229,300 hectares with an estimated annual cut of

120,000 cu.m of logs for an annual fee of around R$4,1

million. The concession notice was posted for public

consultation during two public hearings.

It should be noted that between 2019 and 2021

concessions in federal forests delivered R$73.3 million in

fees and produced 787,850 cu.m of roundwood which

corresponded to 47% of forest production in federal

concessions since 2010.

Technology and innovation in the Brazilian Amazon

Technology is being used in Brazil to increase

productivity, generate jobs, strengthen biomes and

ecosystems and simultaneously build wealth and

sustainability. These technologies are innovative, capable

of securing the forest and support local communities.

The Brazilian programme AMAZ, coordinated by the

Institute for Conservation and Sustainable Development of

the Amazon (IDESAM), selected several companies to

receive an initial investment of R$200,000 each with the

possibility of reinvesting another R$400,00 per year at end

of the process.

Altogether the companies in the north of the country in the

states of Acre, Amazonas, Mato Grosso, Pará, Rondônia

and Roraima have the potential to guarantee more than one

million hectares of preserved forests and absorb more than

700,000 tons of carbon annually.

The businesses that participate in AMAZ have very

diverse areas delivering direct and indirect support for

conservation of the Brazilian Amazon forest such as

implementation of agroforestry production; forest

recovery; manufacture of food supplements produced with

ingredients predominantly from Amazonian communities,

reduction of negative environmental impacts through

production chains with the participation of local

communities and promoting tourism through visits in

Brazilian Conservation Units.

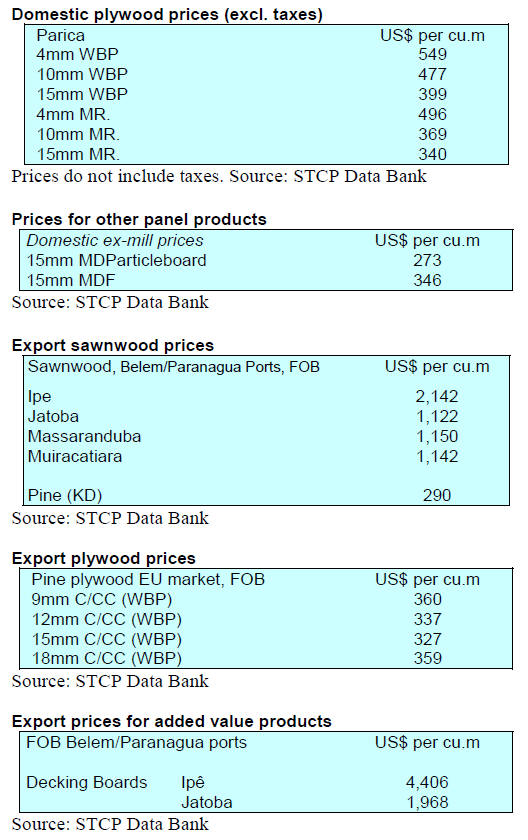

Furniture sector exports grow

The Brazilian furniture sector started the year 2022 with a

high level of exports. In January exports of furniture

totalled R$275.6 million, an increase of 27% in relation to

the first month of the previous year. Timber products led

exports (87%) and traded R$238.6 million according to

data from IEMI, ABIMÓVEL and Apex-Brazil.

The main destinations for furniture exports were the

United States (the main market) accounting for 36% of

exports followed by the United Kingdom at 11%. Exports

to the UK increased by 79% compared to December 2021

and by 30% over the past 12 months. Significant growth

was seen in the value of furniture exports to the

Netherlands.

After the positive great export performance in 2021 the

furniture market started 2022 on a good note optimism

according to the Bento Gonçalves Furniture Industry

Union (Sindmóveis). The main companies in the furniture

cluster in Bento Gonçalves and nearby regions (one of the

largest furniture clusters in the Southern Brazil) traded

more than US$14.2 million in the first quarter of this year,

a13% increase compared to the same period in 2021.

In the first quarter of 2022 the three main buyers of

furniture “made in Bento Gonçalves” were the United

States, Chile and Uruguay. The fastest growth among the

top ten export markets was in the United Kingdom (an

increase of 95% compared to the same period last year).

9. PERU

Jump in particleboard imports from

Brazil

Peruvian particleboard (PB) imports exceeded US$50

million in the first quarter of 2022 growing 78% in March

2022 and this drove first quarter 2022 year on year growth

to almost 40%,

Ecuador was, once again, the main supplier of PB with

shipments of US$18.1 million which represented an

increase of 24.5% year on year. Spain was the second

supplier at US$13 million, an increase of 25.2% compared

to the US$16.5 million shipped Q1 2021.

Shippers in Brazil achieved strong export growth of 66%

and were the third largest supplier of PB in the first quarter

of 2022 at US$11.4 million.

Peru commits to promote the use of sustainable wood

Peru, through the National Forestry and Wildlife Service

(SERFOR), participated in the XV World Forestry

Congress where it supported the declaration to promote

the sustainable production of wood that will conserve

forests, provide added value and mitigate climate change.

This declaration seeks to promote technical exchange,

experiences and learning in order to promote innovations

in sustainable forest management and value chains. It also

seeks to increase the use of sustainable wood-based

solutions within the Nationally Determined Contributions

by 2030.

In related news, during the 17th United Nations Forum on

Forests SERFOR General Manager, German Jaimes,

affirmed that Peru is committed to promoting sustainable

forest management to achieve the Global Forest Goals and

the implementation of the United Nations Strategic Plan

for Forests.

IMF - policy response in 2020 helped mitigate impact of

the pandemic

In cooperation with Peruvian officials the International

Monetary Fund completed a consultation on the state of

the economy at the end of April 2022.

A statement from the IMF says “Economic activity in Peru

rebounded strongly in 2021 from its deepest downturn in

decades.

The strong policy response in 2020 helped mitigate the

impact of the pandemic and created the conditions for a

rapid recovery. Progress in the vaccination campaign

allowed a gradual lifting of Covid-19 mobility restrictions.

Real GDP rose 13.3% in 2021, supported by robust

external demand, favorable terms of trade, and pent-up

domestic demand. Real GDP surpassed its pre-pandemic

level but remains below its pre-pandemic trend”.

See:

https://www.imf.org/en/News/Articles/2022/05/02/pr22138-imf-executive-board-concludes-2022-article-iv-consultationwith-peru