US Dollar Exchange Rates of

25th

Apr

2022

China Yuan 6.6085

Report from China

Supply chain pressure increases

The spread of COVID-19 and urban lockdowns have had a

huge impact on the global timber supply chain for a long

time and have led to soaring freight rates and rising timber

prices. Although freight rates have risen the impact on

wood supplies has been equally impacted by disruption of

transport from the ports and the difficulty faced by

overseas raw material suppliers in securing containers.

Shanghai City is under lockdown which has resulted in

serious cargo accumulation at the port. Shanghai Port is

one of the important container ports in China and 20% of

exports pass through the port. Cargo volumes are now

exceeding port capacity and trucks with containers are

backing up on highways and vessels arriving for cargo are

being delayed at sea. If the outbreak in Shanghai continues

China could face a logistics crisis.

Global shipping companies and exporters in the eastern

provinces of Jiangsu, Zhejiang, Anhui and Shanghai are

turning to Ningbo Port in Zhejiang some three hours from

Shanghai, to avoid the congestion at Shanghai Port.

First quarter 2022 housing trend

The National Bureau of Statistics has reported national

real estate development and sales for January to March

2022 saying there was a 0.7% year on year increase in

sales.

The overall construction area increased 1.0% and the

area

of residential construction increased 1.1% however, the

completed housing area was down 11.5%. In March, the

real estate development climate index stood at 96 after a

slight improvement in February.

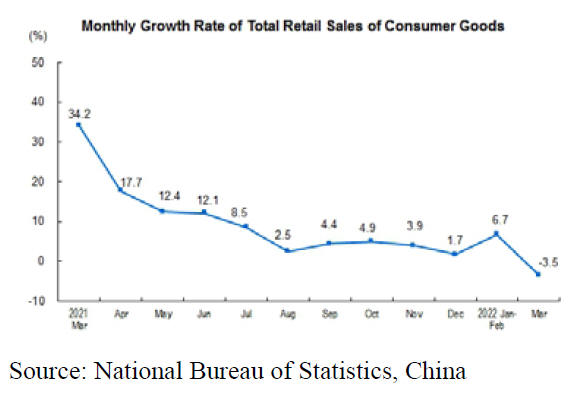

Retail sales up slightly in the first quarter

In the first quarter retail sales of social consumer goods

increased of 3.3% year on year. Sales of consumer goods

(other than automobiles) increased 3.6%. Excluding price

factors, retail sales of consumer goods in the first quarter

actually increased by 1.3 percent year-on-year. In March

retail sales of consumer goods dropped 3.5% year on year.

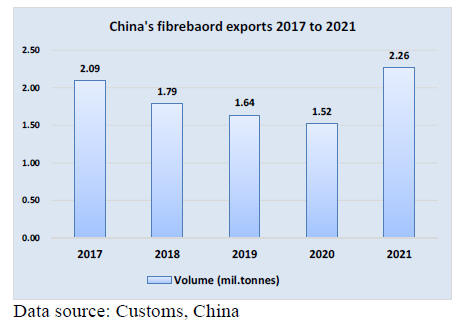

Surge in fibreboard exports in 2021

According to China Customs exports have been

dominating China¡¯s fibreboard trade in recent years. The

volume of China¡¯s fibreboard exports fell to 1.52 million

tonnes in 2020 from 2.09 million tonnes in 2017 however,

exports surged 49% to 2.26 million tonnes year on year in

2021.

In 2021 China¡¯s fibreboard exports totalled 2.26

million

tonnes valued at US$1.2 billion a year on year increase of

49% in volume and 45% in value. The average CIF price

for China¡¯s fibreboard exports fell 3% to US$532 per

tonne.

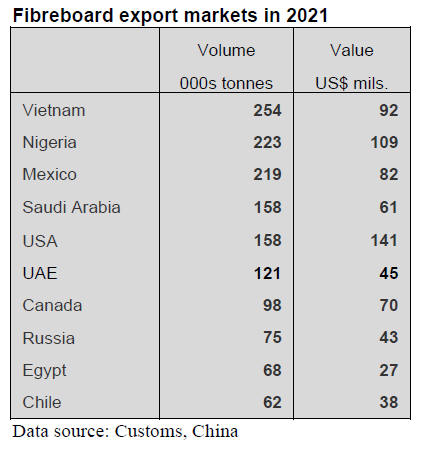

China¡¯s fibreboard export markets are diverse and the

volume of fibreboard exports to the top 10 destinations

accounted for only 63% of the total in 2021. The top 3

countries in terms of fibreboard export volumes in 2021

were Vietnam, Nigeria and Mexico. China¡¯s fibreboard

exports in 2021 to Vietnam and Mexico surged but to

Nigeria fell 15%.

The USA was ranked fifth in terms of China¡¯s fibreboard

exports volume in 2021, previously it was ranked number

one.

The average CIF price for China¡¯s fibreboard exports to

Vietnam among the top 10 destination countries was

lowest at US$362 per tonne in 2021, down 14% year on

year. The average CIF price for China¡¯s fibreboard exports

to Mexico fell 26% year on year.

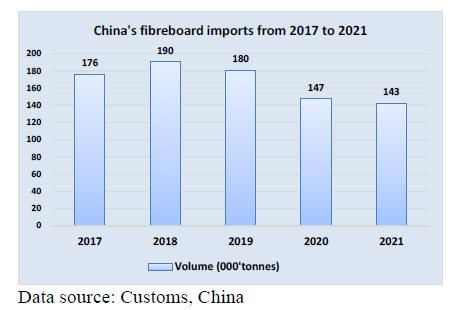

Decline in fibreboard imports in 2021

According to China Customs, fibreboard imports rose 8%

in 2018 but have been falling since that date.

China¡¯s fibreboard imports totalled 143,000 tonnes

valued

at US$132 million, down 3% in volume but up 23% in

value year on year in 2021. The average CIF price for

China¡¯s fibreboard imports rose 27% to US$928 per tonne.

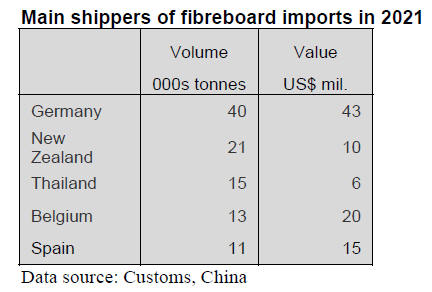

The main suppliers of fibreboard imports in 2021 were

Germany, New Zealand, Thailand, Belgium and Spain.

The volume of China¡¯s fibreboard imports from Germany,

Thailand, Belgium and Spain rose 59%, 35%, 41% and

79%, however from New Zealand they fell 35% year on

year.

Steady rise in particleboard exports in 2021

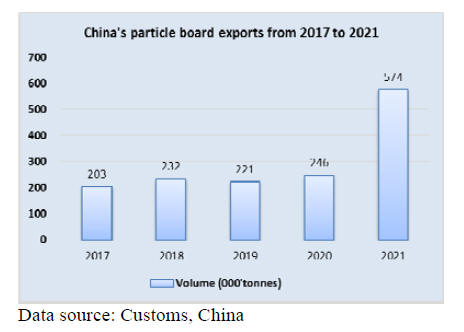

According to China Customs data China¡¯s particleboard

exports from 2017 to 2021 have been rising except for a

decline of 4% in 2019. The capacity of China¡¯s domestic

particleboard industry has increased in recent.

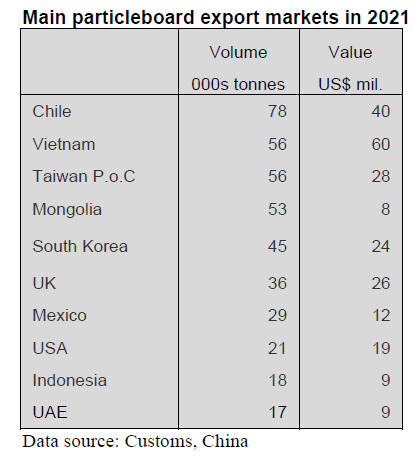

In 2021 China¡¯s particleboard exports totaled

574,000

tonnes valued at US$429 million, surging 134% in volume

and 162% in value year on year. The average CIF price for

China¡¯s particleboard rose 12% to US$747 per tonne year

on year. Chile, Vietnam and Taiwan P.o.C were the top 3

markets in 2021. Demand in most of the top markets rose

in 2021 except for Mongolia and the UAE .

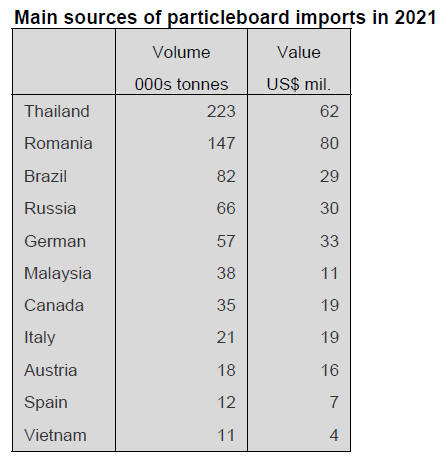

Decline in particleboard imports in 2021

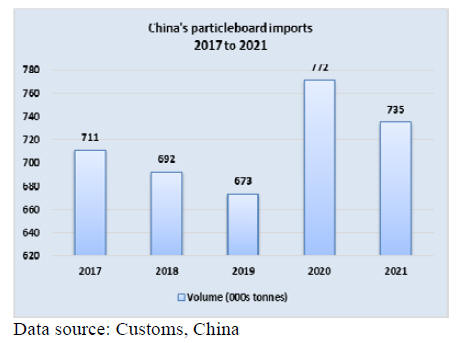

China¡¯s particleboard imports have been very volatile. The

volume of China¡¯s particleboard imports in 2021 totalled

735,000 tonnes valued at US$323 million, down 5% in

volume but up 25% in value. The average CIF price for

China¡¯s particleboard imports rose 32% to US$439 per

tonne in 2021.

The main suppliers of China¡¯s particleboard imports

in

2021 were Thailand (30%), Romania (20%) and Brazil

(11%). These three countries accounted for 61% of total

imports in 2021.

|