Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Apr

2022

Japan Yen 129.9

Reports From Japan

Rising raw material prices and

currency depreciation a

risk to economy

The government has upgraded its economic assessment for

the first time in four months citing a recovery in private

consumption as the effects of the coronavirus pandemic

wane. The recovery has been driven by more spending on

travel and dining out.

The Cabinet report says:

¡°Concerning short-term prospects, the economy is

expected to show movements of picking up supported by

the effects of the policies and improvement in overseas

economies while taking all possible measures against

infectious diseases and economic and social activities

move toward normalisation. However, full attention

should be given to the further increase in downside risks

due to rising raw material prices and fluctuations in the

financial and capital markets and supply-side constraints

while the uncertainties surrounding the state of affairs of

Ukraine. Also attention should be given to the effects of

the Novel Coronavirus.¡±

See:

https://www5.cao.go.jp/keizai3/getsurei-e/2022apr.html

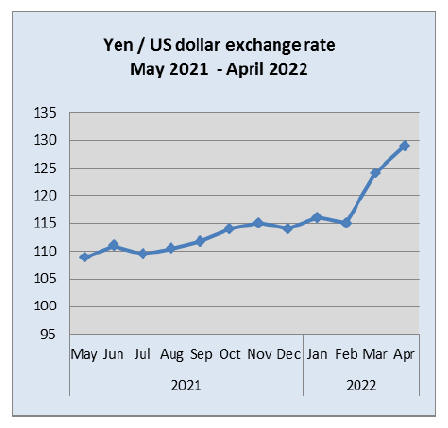

In related news, Ranil Salgado the head of the IMF

mission in Japan, has said the yen's rapid recent

weakening against the US dollar could interrupt recovery

of the Japanese economy as the cost of imports are rising

which is undermining consumer spending.

The yen's drop to a 20-year low against the dollar at the

end of April is closely related to the Bank of Japan's

decision to maintain the monetary easing policy when

central banks in other major economies are tightening.

A weaker yen typically serves as a boon to Japanese

exporters as Japan-made products become more

competitively priced overseas but now, with the cost of

imports especially energy sources rising, consumers have

seen sharp increases in daily goods. Japan¡¯s consumer

price index, excluding volatile fresh food, rose almost 1%

March from a year earlier, the fastest increase in over two

years.

Shunichi Suzuki, the Minister for Economy and Finance

said the rapidly weakening yen could cause problems for

Japan's economy and the media have speculated that, for

the first time in over 20 years, the government may try and

slow the rate of depreciation.

See:

https://japantoday.com/category/business/imf-says-yen'srapid-slide-may-hamper-japan's-post-pandemic-recovery

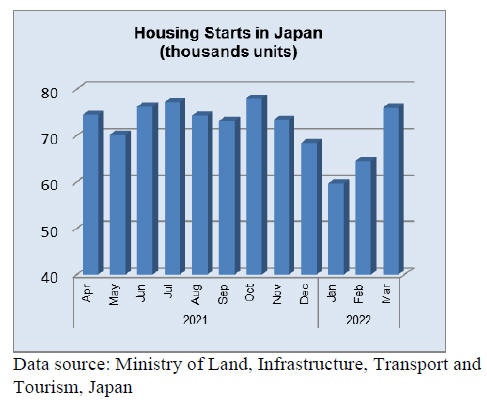

Firm housing starts

Housing starts unexpectedly rose by 6% year-on-year in

March 2022 exceeding expectations. The March rise

builds on the increase seen a month earlier.

A statistical survey of housing starts for 2021 from the

Ministry of Land, Infrastructure, Transport and

Tourism (MLIT) shows the number of new housing starts

in 2021 was 865,909, up 6.6% from the previous year, the

first increase in three years. The floor area of new housing

also increased for the first time in three years. By category

of homes it was reported that the number of custom home

starts increased for the first time in three years.

See:

https://www.rethinktokyo.com/news/2022/04/29/japan-newhousing-starts-increase-first-time-three-years/1651198823

A direct online real estate purchase service launched

In Japan the real estate market is fragmented and

homeowners wishing to sell face many challenges such as

difficulty in determining the value of a property, high

agent fees and a process to conclude a sale which could

take over 6 months. These issues discourage existing home

sales which in Japan are around 15% compared to the 80%

typically seen in the US and the UK. To help home sellers

a Tokyo ¡®proptech¡¯ startup offers a direct online real estate

purchase service.

See:https://techcrunch.com/2022/04/27/proptech-startupsumutasu-raises-10m-series-b-to-digitize-japans-real-estatemarket/

Energy-saving measures in the building sector

Japan has revised the Law on ¡®Improvement of Energy

Consumption Performance of Buildings to Contribute to

the Realisation of a Decarbonised Society¡¯. The revision

specifies energy-saving measures in the building sector in

order to achieve carbon neutrality by 2050 and a 46%

reduction in greenhouse gas emissions by 2030 compared

to 2013 levels.

To promote energy-saving renovations a low-interest loan

programme for residential properties will be established by

the Japan Housing Finance Agency.

Sawnwood prices at record highs

Sawnwood prices have reached record highs in Japan

since economic sanctions were imposed on Russia and this

will push up the cost of new homes. Russia accounted for

around 80% of Japan¡¯s imports of veneer for plywood

production and about 20% of Japan¡¯s imports of roof

timbers came from Russia.

The Bank of Japan¡¯s report on the corporate goods price

index for March, released on April 12, showed sawnwood

prices jumped nearly 60% recently.

See:

https://www.asahi.com/ajw/articles/14601984

Yen tumbles to 130 to the US dollar

For the first time since April 2002 the yen fell to 130

against the dollar on 28 April after the Bank of Japan

(BoJ) maintained its ultra-easy monetary policy at its latest

board meeting. This decision is in sharp contrast to the US

Federal Reserve that has raised interest rates.

At the two-day policy meeting at the end of April the BoJ

said it will purchase Japanese government bonds from

financial institutions to support the economy still

recovering from the impact of COVID-19.

Import update

The Ministry of Finance has not released import data for

either wooden doors (HS448120) or wooden windows

(HS441810).

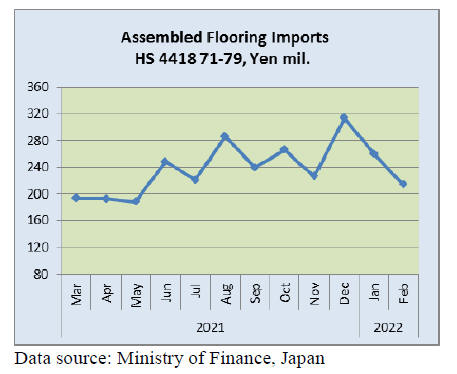

Assembled wooden flooring imports

There was a serious downward correction in the value of

Japan¡¯s imports of assembled flooring (HS441871-79) in

February. There had been a steady upward trend in the

import value between May to December 2021. Year on

year, assembled wooden flooring imports were up 5% in

February 2022 but the February figure was down by 18%

compared to January 2022.

The main category of assembled flooring imported by

Japan continues to be HS441875, accounting for around

70% of January 2022 imports with the main suppliers

being China, Vietnam and Malaysia. The second ranked

category in terms of value of imports was HS441879

shipped mainly from China, Thailand and Vietnam.

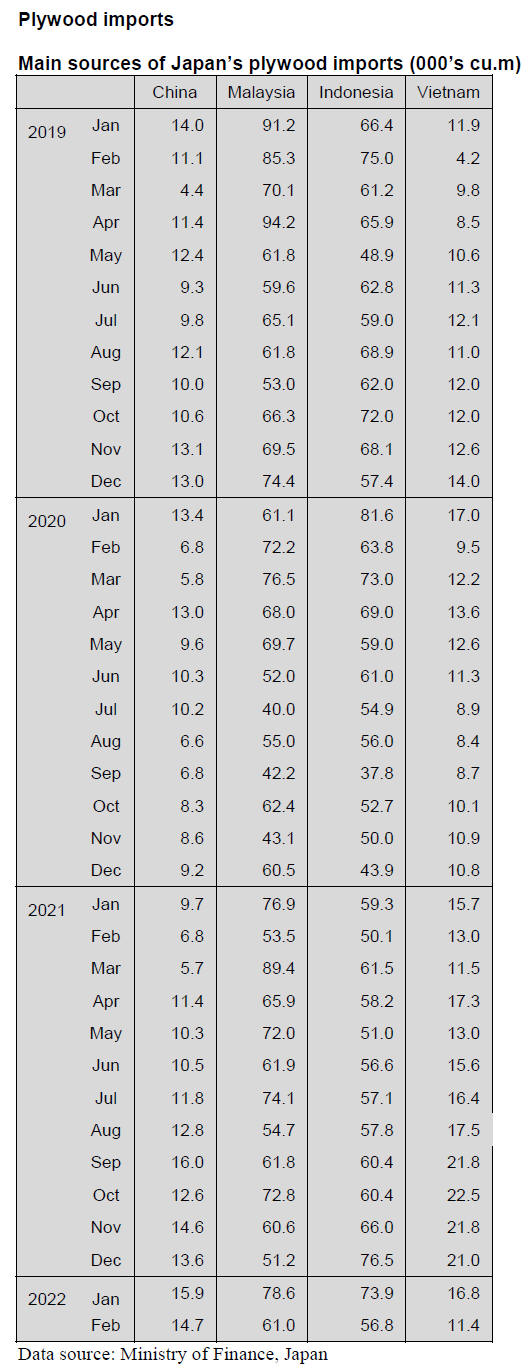

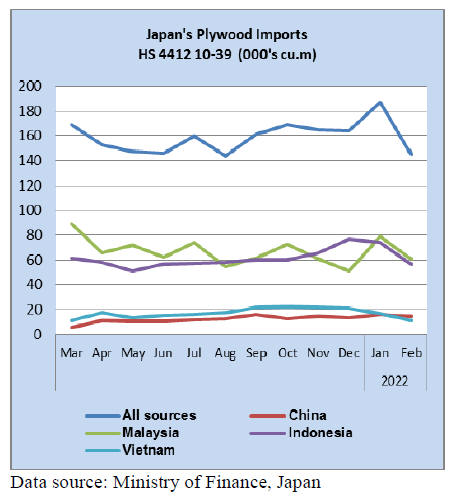

HS441231 was the most common accounting for 88% of

total plywood imports.

Malaysia and Indonesia were the main plywood

shippers

to Japan and in February 2022 shipments from Malaysia

rose year on year but were below the volume imported in

January. A similar pattern was seen for plywood imports

from Indonesia and China. It was only shippers in

Vietnam that managed year on year and month on month

increases in February 2022.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Items of sanctions by the government

The Japanese government announced items of additional

sanctions to Russia on April 12. Russia banned export of

wood chip, veneer and logs for retaliation to the sanctions

by the unfriendly Western countries. Log export is banned

since beginning of this year so there is no influence.

According to the Forestry Agency, actual imported result

in 2 021 is 36,000 cbms of logs (900 million yen in value),

80,000 tonnes of wood chip (1.3 billion yen) and 244,000

cbms of veneer (8.5 billion yen).

Market share of wood chip is 1%, of veneer is 82%. As

raw materials to manufacture plywood in Japan, it takes

2% share. Larch veneer is used for face and back of

plywood and LVL because of the strength so plywood

mills in Japan need to find substitution in a hurry to

replace Russian supply.

February plywood supply

Total plywood supply in January was under 500,000 cbms.

Monthly volume of less than 500 M cbms is for the first

time in six months. This is because of the volume of

imported plywood was under 200,000 cbms. The volume

of domestic production and shipment in Japan are

balanced and the inventory at manufacturers is minimum.

The volume of imported plywood from Malaysia and

Indonesia both decreased. One of major plywood

manufacturers in Malaysia stopped taking new orders in

last November and put priority on orders which were

delayed for shipping. Manufacturers in Indonesia hurried

shipping order balances to Japan in February, 2022 after a

rush of shipping products to other countries completed

during October, 2021 to January, 2022. The volume of

Chinese plywood was influenced by a Chinese New

Year¡¯s holiday.

It is hard to predict the volume of imported plywood after

March. There are not enough logs and labors in Malaysia

and Indonesia so there will be less plywood supply for

Japan. The prices of logs in both countries are increasing

every month.

There is not enough imported plywood at markets in

Japan. People are careful to buy import plywood because

the prices are high in Malaysia and Indonesia and a sudden

weak yen hit against the dollar at the end of March.

The production of domestic softwood plywood exceeded

shipment a little bit. The production of domestic softwood

plywood is 78,300 cbms, 1,300 cbms more than last

month.

Manufacturers¡¯ inventory level is 0.3 month and this is

same inventory level as January. Usually, it is the time to

build up inventory in February to April by the

manufacturers but still there are not enough inventory due

to a shortage of logs and a delay of delivery. February had

only eighteen working days and it affected lower

production.

It is important to see the balance of demand, product and

supply in April because Russian veneer was prohibited

exporting to Japan at the begging of March. This takes

considerable part of domestic plywood and lack of

imported veneer would reduce total plywood production.

South Sea logs and lumber

Supply of South Sea hardwood logs is low even after rainy

season is over in producing regions. Demand for South

Sea hardwood logs in Japan is way down after all the

plywood mills stopped using tropical hardwood logs and

only demand is for lumber of truck body.

Production of trucks is slowing by shortage of

semiconductor then in March some major truck

manufacturer lost certificate on engine by illegal

procedures so truck production would decrease in coming

months so demand for truck body lumber would also

decline.

Supply and demand of tropical hardwood lumber

manufactured in China are balancing. Dealers in Japan

have ample inventory of free board but some place orders

hurriedly as weak yen would push the import cost. In

China, severe measure is taken to stop spreading COVID

19 like lockdown of communities and transportation is

being disrupted.

Wood use for public buildings

Wood use promotion office by the Ministry of Agriculture,

Forestry and Fisheries announced actual wood use by the

public buildings in 2020. Total of 154 units of buildings

lower than three stories were built, out of which 132 units

are wooden building. Percentage of wooden building is

85.7%. This is two straight years with more than 85%.

As number of unit, total is almost doubled to 2019 but

floor space per unit is smaller than 2019 so total floor

space is 13,861 square meters, only 1.2% up from 2019.

Wood use for interior is 220 units, 66.7% more, first

increase in four years. Total volume of wood is 5,286

cbms, 1.6% less because of many small size buildings.

This is two straight year¡¯s of over 5,000 cbms of wood

use. 3,790 cbms of wood used is domestic wood. Units

with large floor space are roadside stations, where local

products are sold for visitors.

This is managed by the Ministry of Land, Infrastructure,

Transport and Tourism. One has floor space of 1,144

square meters and another has 515 square meters. Other

small units are bicycle storage and interior passage of Diet

building. Also explosive warehouse for the Defense

Ministry was built with wood for three consecutive years.

The Forestry Agency and The Ministry of Land,

Infrastructure, Transport and Tourism inspected on 22

non-wood buildings if any can be built with wood. Only

six units can be built with wood.

|