4.

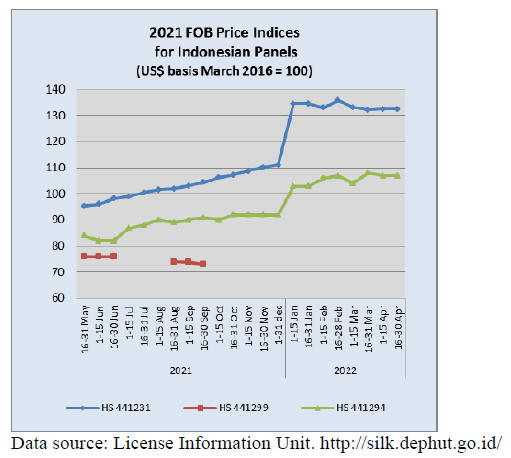

INDONESIA

Indonesia-UK to expand trade

At a meeting between Indonesian Foreign Minister Retno

Marsudi and British Minister of Foreign Affairs,

Commonwealth and Development, Elizabeth Truss, there

was agreement to strengthen bilaterally and multilaterally

cooperation.

To promote trade in wood products representatives from

the Ministry of Environment and Forestry together with

the Association of Indonesian Forest Concession Holders

(APHI) joined the Indonesian delegation in London to

discuss the issues related to the wood products trade.

The Indonesian side emphasised the urgency to expand the

understanding of UK consumers regarding aspects of

legality and sustainability to encourage more sales.

Currently the market for wood products in the UK is

estimated to be worth US$15 billion annually but

Indonesia’s share is only around 2%.

See:

https://forestinsights.id/2022/04/21/indonesia-inggrissepakat-perkuat-kemitraan-termasuk-perdagangan-produk-hasilhutan/

Promoting legal trade with China

Companies in the forestry and wood products sectors have

reached out to counterparts in China in an effort to jointly

promote markets for sustainable wood products. The

chairman of the Indonesian Forestry Community

Communication Forum (FKMPI), Indroyono Soesilo, said

both countries needed to eliminate trade in illegal timber.

This was the conclusion of an online forum ‘Promoting

Legal and Sustainable Timber Trade Between China and

Indonesia’.

This can be achieved as China is expected to introduce a

green procurement policy to increase the demand for

legally sourced and sustainable wood products.

Zhang Liyan, from China’s National Forest Product

Industry Association (CNFPIA) said Indonesia continues

to be a major wood product supplier to China.

See:

https://forestinsights.id/2022/04/15/indonesia-ajak-chinapromosikan-produk-kayu-lestari-tingkatkan-volumeperdagangan-kedua-negara/

Cracking down on carbon projects linked to illegal

forest operations

Indonesian Environment and Forestry Minister, Siti

Nurbaya, has identified a number of carbon projects

underway in the country's state forest areas that are or

could be associated with illegal forestry operations. The

Minister said this will be stopped and warnings and

sanctions are being imposed.

On the positive side the Minister mentioned a new carbon

offset deal with a major oil and gas company operating in

Sumatra’s Riau Province involving ecosystem restoration

in Central Kalimantan.

See:

https://foresthints.news/minister-cracks-down-even-harderon-carbon-projects-linked-to-illegal-forestry-operations/

Free trade deals could lead to shortages for domestic

manufacturers - Association

The Asean/Hong Kong free trade deal will encourage

exports but there is a risk that expanded trade could result

in higher prices and reduced supplies for domestic

furniture makers according to the chairman of the

Indonesian Furniture and Craft Industry Association

(HIMKI), Abdul Sobur.

He called on the government to discuss regulating what

categories of products can be exported because if the raw

material trade is not regulated the domestic furniture

industry will find it difficult to achieve the export value

target of US$5 billion by 2025.

See:

https://ekonomi.bisnis.com/read/20220420/257/1525091/perdagangan-bebas-asean-hong-kong-bahan-baku-kayu-berpotensiterbang-keluar-ancam-mebel-domestik

5.

MYANMAR

Challenges of power interruptions and

depreciation of

the Kyat

During the past two weeks news relating to energy and

foreign currency are hot topics. On 3 April the Myanmar

Central Bank issued a regulation requiring incoming

foreign currency to be converted to kyat. (see MIS Report

Volume 16 Number 7, 1-15 April 2022).

However, according to a directive issued by the Central

Bank on 26 April, exporters trading under China-

Myanmar and Thai-Myanmar border trade programmes no

longer need to compulsorily convert their export earnings

in foreign currencies into kyats within one working day.

However, it must be exchanged within three months.

Other changes were made exempting businesses operating

in economic zones approved foreign investors, embassies,

United Nations agencies and non-government

organisations.

In related news, Myanmar traders have welcomed the

move to allow private banks to offer renminbi (RMB)

accounts saying this will increase opportunities for border

trade. Four private banks in Myanmar have been allowed

to provide RMB accounts in order to facilitate the process

of payment in China-Myanmar border trade.

See:

https://elevenmyanmar.com/news/myanmar-relaxescurrency-conversion-order-for-traders-at-china-thailand-borders

Power outages plague manufacturers

In recent weeks Myanmar has been hit by a series of

power outages forcing industries to rely on alternative

power supplies such as generators which consume a

considerable amount of diesel. Power outages and soaring

fuel prices are driving up prices and increasing uncertainty

for the country’s businesses.

In order to maintain power supplies the authorities plan to

accelerate development of hydrocarbon and renewable

energy sources and are seeking to increase foreign

investment in the sector despite the threat of economic

sanctions.

According to the state run newspaper it has been proposed

including the Mee Lin Gyaing Project and a LNG power

plant and gas pipelines connecting with Yangon in the list

of projects in the China-Myanmar Economic Corridor

(CMEC).

See:

https://www.irrawaddy.com/news/burma/myanmarfactories-to-close-amid-planned-power-cuts.html

Information sources limited

The security situation is very uncertain as fighting

between the military and opposition forces has intensified

and this is making it increasingly difficult to get

information from the country. For an analysis of the

current situation:

See:https://www.japantimes.co.jp/news/2022/04/25/asiapacific/tom-andrews-myanmar-interview/

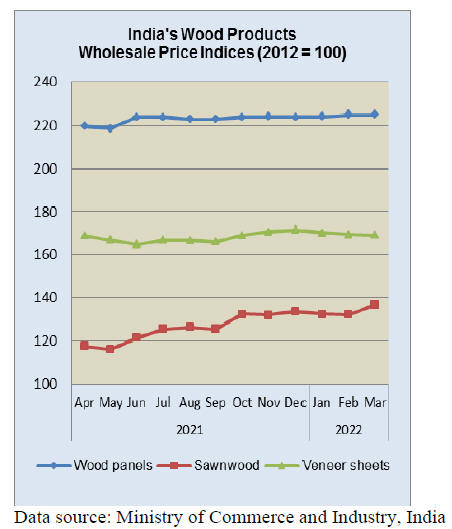

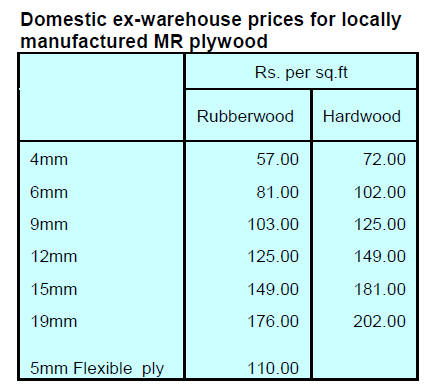

6. INDIA

Wholesale price

indices for March 2022

The Office of the Economic Adviser, Department for

Promotion of Industry and Internal Trade has published

wholesale price indices for March 2022. The index for

manufactured products increased to 141.6 in March 2022

from 138.4 for February 2022.

Out of the 22 manufactured products in the index, 18 saw

increases in prices while 3 groups saw declining prices in

March 2022 as compared to February 2022. The increase

in the overall index was mainly contributed by rises in

prices of basic metals, food products, chemical products

and textiles.

The annual rate of inflation was 14.55% in March 2022 as

compared to 7.89% in March 2021. Price inflation for

wood products and cork items over the past six months to

March 2022 was 5.76%, 5.49%, 5.32%, 4.11%, 4.55% and

4.65%.

See:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

India, a US$28-30 trillion-dollar economy by

2050

India’s GDP growth is one of the fastest in the world

according to the International Monetary Fund (IMF). The

IMF has projected a "fairly robust" growth of 8.2% for

India in 2022.

Speaking at the India economic conclave 2022 'The Great

Indian Democratic Dividend' Gautam Adani, founder and

chairman of the Adani Group said India's demographic

dividend will mean the country is on track to becoming a

US$28-30 trillion-dollar economy by 2050.

Adani said, "My optimism comes from my belief that no

nation in the world is as uniquely well placed as India to

capitalise on four major vectors that will accelerate

development.

These are the pull from India’s demographic dividend,

growth of the middle class, push from the accelerated

digital economy and the sustainability focused economy."

See:

https://economictimes.indiatimes.com/news/economy/indicators/india-to-be-a-30-trillion-economy-by-2050-gautamadani/articleshow/90985771.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Home sales surged in first quarter

According to a report from ProTiger.com home sales and

housing starts set a record high in the first quarter of this

year. Sales in the first quarter were the highest since the

Covid outbreak.

Markets included in the ProTiger report are Ahmedabad,

Bangalore, Chennai, Hyderabad, Kolkata, Mumbai

Metropolitan Region, Delhi-National Capital Region and

Pune.

Mumbai and Pune had the biggest share in housing sales,

with their combined share standing at 56% of overall

sales.

See:

https://economictimes.indiatimes.com/industry/services/property-/-cstruction/housing-sales-grew-by-7-y-o-y-jan-march-quarterwas-best-since-covid-outbreakreport/articleshow/90562277.cms?from=mdr

In related news, a UK-Singapore joint venture plans to

introduce Laminated Veneer Lumber (LVL) for housing

projects in India tosubstitute wood for conventional

building materials and help expand low-carbon

construction by substituting wood for steel and concrete.

See:

https://theprint.in/world/uk-singapore-joint-venture-tointroduce-engineered-timber-for-housing-in-india/921559/

Poplar log prices surging

Prices for poplar logs have reached an all time high much

to the delight of forest owners in Yamunanagar in the

Indian state of Haryana. This area is known for the clusters

of plywood and paper industries. It has been reported that

prices for poplar logs have reached a high of Rs 1,400 per

quintal (1 quintal = 100KG).

Plywood factories in Yamunanagar used to source most of

the poplar wood from a neighbouring state but supplies

have dropped. While the increased price for logs is good

news for suppliers the overall decline in log supplies has

meant mills have had to cut production.

Haryana Plywood Manufacturers’ Association Presiden,t

JK Bihani, claims that reduced supply was adversely

affecting the plywood industry in the district. Traders

report that prior to the Covid lockdown two lakh quintal of

poplar and eucalyptus logs was available every day but

now the supply has come down to about one lakh quintal

per day.

See:

https://www.tribuneindia.com/news/haryana/farmersupbeat-as-poplar-wood-rate-at-all-time-high-385836

Greenply shipments from Ikolo SEZ

A report from the Bank of Central African States (Beac)

says Gabon should experience increased wood production

in the second half as the Ikolo Special Economic Zone

(SEZ) becomes operational. The media in Gabon has

reported that Greenply (a major producer of wood panels

in India) has made early shipments of veneer to its

operations in India.

Greenply, along with the other companies operating in the

Ikolo SEZ, plan to create 750 to 1,250 jobs for Gabonese

by the end of 2023 and export between 300 and 400

containers of processed wood products every month,

See:

https://www.lenouveaugabon.com/fr/economie/2104-18352-bois-hausse-projetee-de-la-production-gabonaise-au-2etrimestre-2022-grace-a-la-zes-d-ikolo

7.

VIETNAM

Wood and wood product trade highlights

The Vietnam General Department of Customs has reported

wood and wood product (W&WP) exports in April 2022 at

an estimated at US$1.5 billion, up 7.3% compared to April

2021. In the first 4 months of 2022 exports of W&WPs

is estimated at US$5.48 billion, up 5% over the same

period in 2021.

Of the total exports of WPs in April 2022 have been

estimated at US$1.13 billion, up 6.4% compared to April

2021. In the first 4 months of 2022 WP exports were

worth US$4.14 billion, up 3% compared to the same

period in 2021.

Padauk wood imports in April 2022 are estimated at

19,200cu.m worth US$7.5 million, up 20.4% in volume

and 20% in value.

In the first 4 months of 2022 padauk wood imports were

estimated at 59,200 cu.m, worth US$24.7 million, down

6.5% in volume and 4% in value compared to the same

period in 2021.

Vietnam's exports of rattan, bamboo and other NTFPs in

March 2022 reached US$89.06 million, up 32% compared

to February 2022 and up 14% compared to March 2021.

W&WP exports has gained nearly US$4.0 billion in the

first quarter and optimistic with the target of US$16 billion.

According to the Import-Export Department of the

Ministry of Industry and Trade (MT) many wood product

export enterprises have orders until the end of the third

quarter of 2022. With this pace of growth the timber

industry's target of US$16 billion in 2022 can be achieved.

International demand for wood products and wooden

furniture continues to rise and businesses in the timber

industry, especially the furniture manufacturers have full

order books until the end of the third quarter or even the

end of 2022.

Vietnam's production and export activities are being

promoted by a series of agreements that are being

implemented such as EUFTA and CPTPP creating a

competitive advantage for enterprises.

As China is implementing a "Zero COVID" strategy

export production has been affected which also gives an

advantage to Vietnam.

However, the impact of the COVID-19 pandemic and the

war between Russia and Ukraine is causing businesses to

face a shortage of shipping opportunities, a lack of

containers, rising freight costs which is leading to

disruption of supply chains.

In the first quarter 2022 W&WP exports to the main trade

partners all grew except for China and Canada. The US

continues to be Vietnam's top export market for W&WPs

and in the first quarter was worth US$2.4 billion, up 4%

over the same period in 2021.

Exports to Japan were worth a further US$396 million, up

11%; to South Korea US$249 million, up 18% while to

China exports were worth US$353 million, down by 1%.

See:

http://asemconnectvietnam.gov.vn/default.aspx?ZID1=8&ID1=2&ID8=118638

In the first quarter of 2022, imports of wood raw

materials from Africa increased again

In early 2022 due to the limited supply of wood raw

materials from the US and the EU and the rapidly rising

prices, Vietnamese wood processing and trading

enterprises have been facing a serious problem.

In the face of these difficulties Vietnamese timber

importers intend to increase wood imports from African

suppliers while recognizing such imports come with

legality risks.

After consecutive declines in 2020 and 2021 imports of

wood raw materials from Africa increased again in the

first quarter of 2022 and were estimated at 300,000 cu.m

worth US$110 million, up 17% in volume and 21% in

value over the same period in 2021.

In the first two months of 2022 imports of wood raw

materials from Africa reached 187,450 cu.m worth

US$68.5 million, up 28% in volume and 31% in value

over the same period in 2021.

See:

https://goviet.org.vn/bai-viet/quy-i-2022-nhap-khau-gonguyen-lieu-tu-chau-phi-tang-tro-lai-9716

Acacia plantation development

In the last three decades Vietnam has been emerging as a

‘kingdom of the acacia tree’. The timber industry

development of Vietnam will not be a success without the

immense growth of acacia plantation. However, the use of

inappropriate varieties and improper seed propagation

technologies, unsustainable management techniques have

led to a poor perfomence acacia plantation busineses.

At present acacia plantations extend over 2.2 million

hectares accounting for about 60% of the total commercial

planted forest area in Vietnam.

Acacia mangium, acacia auriculiformis, acacia hybrid (a

hibrid of these two varities) and acacia crassicarpa grow

well on altitudes under 700 m above sea level.

These acacia species have an important role in regreening

baren lands and denuded hills, improving land

reclamation, helping erosion control and providing being

the main source of raw materials for the wood processing

industries. Acacia plantations have greatly contributed to

poverty alleviation for a large segment of Vietnamese

rural population.

Of the total wood and wood product export revenue of

US$14.8 million around half was manufactured from

acacia.

Neverthless, improper planning nd the extensive planting

on land with the wrong site conditions along with a too

short cutting cycle (4 – 6 years) along with other factors

has lowered potential and the efficiency of the entire

acacia value chain.

In many localities, farmers are still planting acacia on land

with inappropriate climatic and soil conditions (over 700

m above sea level, too steep slopes and high frequency of

storms. As a sesult, in certain areas, acacia plantations are

blamed for landslides and other negative impacts on the

environment. To address this situation the Ministry of

Science issued Standards on site requirements for acacia

mangium (TCVN 11366-1:2016), acacia auriculiformis

(TCVN 11366-3:2019).

In commercial plantation businesses seed source and

seedlings treatment are key factors that determine the

health, productivity and quality of plantation forests.

Improved seeds have contributed to increase the average

yearly yield of acacia plantations from 15 cu.m to over 20

cu.m per hectare.

The Ministry of Agriculture and Rural Development has

recognised many varieties of acacia for planting. However,

the number of varieties commonly used is still limited, the

transfer of new varieties remains slow and the life span of

using certain plus trees in nurseries for seed breeding is

too long leading to vigour.

Another factor affecting the yield and quality of acacia

plantations are the technical measures to intensify

plantation performance. Many farmers are still practicing

extensive plantation establishment, with extremely high

planting density (even 3,500 – 4,000 stems per hectare)

and without thinning. With such high density, trees are

often small in diameter, the vegetation under the plantation

canopy is unable to grow and reduced water penetration

accelerating erosion and landslides in high-slope locations.

South Africa - the largest supplier of padauk wood for

Vietnam

In the first 3 months of 2022 imports of padauk sawnwood

totalled 35,300 cu.m worth US$15.4 million, down 12% in

volume and 3% in value over the same period in 2021.

Imports of padauk logs amounted to 4,700 cu.m worth

US$1.8 million, up 13% in volume and 22% in value over

the same period in 2021.

The average price of imported padauk in the first 3

months

of 2022 was reported at US$429.0 per cu.m, up 16% over

the same period in 2021.

In particular the price of padauk logs imported from South

Africa increased by 1.4% compared to the same period in

2021 to US$274.7 per cu.m; from the Angola prices

increased by 13% to US$279.0 per cu.m; from Namibia

rose 12% to US$269.70 per cu.m and from Cameroon

US$404.50 per cu.m, up 8%.

In the first 3 months of 2022 imports of padauk from

Angola, Congo, Hong Kong and China declined against

the same period in 2021 while imports from South Africa,

Laos, Namibia, Cameroon and Gabon increased.

Imports of padauk from Angola reached 4,700 cu.m, worth

US$1.3 million, down 69% in volume and 65% in value

compared to the same period in 2021 and accounted for

12% of total imports in the first 3 months of 2022.

Imports of padauk from the Congo was 1,700 cu.m, worth

US$628,000, down 9.0% in volume and 18% in value

compared to the same period in 2021.

In contrast, padauk imports from South Africa increased

by 22% in volume and 23% in value over the same period

in 2021, reaching 15,500 cu.m, worth US$4.3 million,

accounting for 39% of total imports.

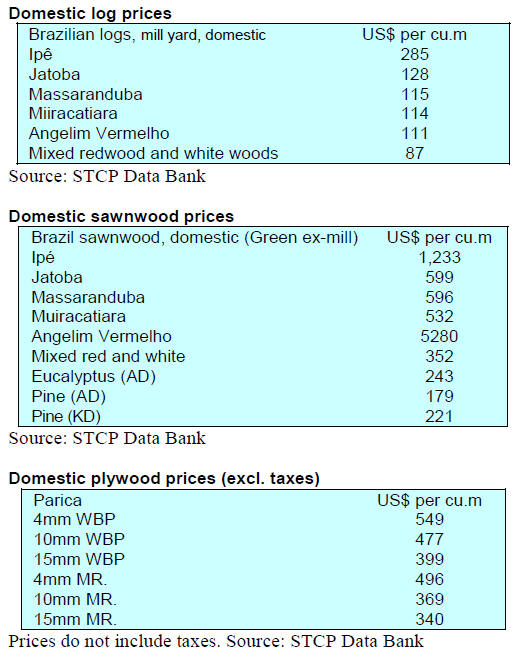

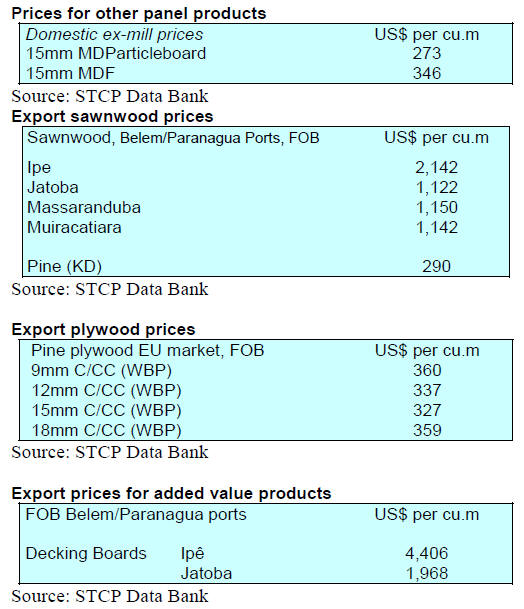

8. BRAZIL

Monitoring technology in the

Brazilian Amazon

The ‘Providence Project’ which began in 2016 led by the

Mamirauá Institute together with the Polytechnic

University of Catalonia (Spain) has promoted progress in

monitoring biodiversity in tropical forests. This has been

achieved through developing a technology that integrates

species recognition through audio and image techniques.

This technology is being applied in the Mamirauá

Sustainable Development Reserve to identify and track the

biodiversity in 1.1 million hectares of protected Amazon

forest.

‘Providence’ techniques also provide information on the

‘health’ of the forest through calculation of eco-acoustic

indices of biodiversity. This technique allowed automatic

real time identification of more species than any other

technology available. The impact of this technology will

be significant.

See:

https://www-mamiraua-orgbr.translate.goog/noticias/reserva-mamiraua-na-amazoniacentral-e-a-primeira-do-planeta-a-ser-monitorada-inteiramenteem-temporeal%20?_x_tr_sl=pt&_x_tr_tl=en&_x_tr_hl=en&_x_tr_pto=sc

Technology to support transparency of information

The Brazilian Institute for the Environment and

Renewable Natural Resources (IBAMA) have launched a

technology that supports transparency of information on

products from natural forests in Brazil.

The programme called ‘Analytical Panels of Timber

Management’ developed by the Federal Service of Data

Processing (SERPRO) will make public data on logging,

production, processing, commercialisation and transport of

forest products.

According to IBAMA sustainable production is one of the

most important public policies to combat illegal

deforestation. The information is obtained from the

processing and cross-referencing of data from several

integrated federal and state control systems. There are

three main categories, information on wood production,

timber processing and trade and transport of wood

products for export.

The system delivers details on authorisations granted by

environmental agencies and projects under analysis,

transactions of forest products in the national market and

export transactions.

The technology originated in 2020, with the creation of the

Sinaflor+ system (National System for the Control of the

Origin of Forest Products) which established the

obligation to adopt mechanisms for the traceability of

wood at origin.

See:

https://www-madeiratotal-com-br.translate.goog/governofederal-lanca-tecnologia-que-facilita-controle-e-fiscalizacao-daexploracao-da-madeira-nativabrasileira/?_x_tr_sl=pt&_x_tr_tl=en&_x_tr_hl=en&_x_tr_pto=sc&_x_tr_sch=http

Export update

In March 2022 Brazilian exports of wood-based products

(except pulp and paper) increased 30% in value compared

to March 2021, from US$326.9 million to US$424

million.

Pine sawnwood exports grew significantly( 51%) in value

between March 2021 (US$49 million) and March 2022

(US$73.9 million). In volume, exports increased 10% over

the same period, from 249,400 cu.m to 275,200 cu.m.

Tropical sawnwood exports increased 12% in volume,

from 38,700 cu.m in March 2021 to 43,400 cu.m in March

2022. In value, exports grew 19.5% from US$14.9 million

to US$17.8 million over the same period.

Pine plywood exports witnessed a 4% increase in value in

March 2022 compared to March 2021, from US$82.9

million to US$86.2 million. In volume, exports increased

3% over the same period, from 208,100 cu.m to 214,000

cu.m.

As for tropical plywood, exports declined in volume (-

4.6%) but increased in value by 14%, from 6,500 cu.m

(US$2.8 million) in March 2021 to 6,200 cu.m (US$2.2

million) in March 2022.

Wooden furniture exports fell from US$63.1 million in

March 2021 to US$57.4 million in March 2022, a 9%

drop.

First quarter 2022 exports

In the first quarter of 2022 there was an expansion in

exports of some categories of wood products compared to

the same period last year.

In the first quarter the volume of pine sawnwood increased

by 5% to 710,736 cu.m. Profiled softwood wood frame

exports jumped to 41,608 tonnes and pine plywood

exports grew 13% to 608,829 cu.m. According to ABIMCI

this export performance was the result of good stability

and moderate growth in some markets. In 2022 the

Brazilian timber industry sector expects better market

growth even in the face of the current crisis in Europe.

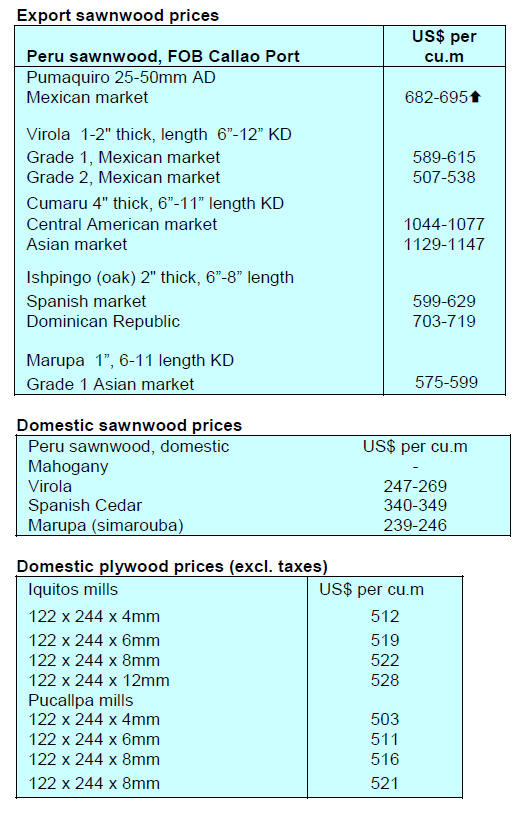

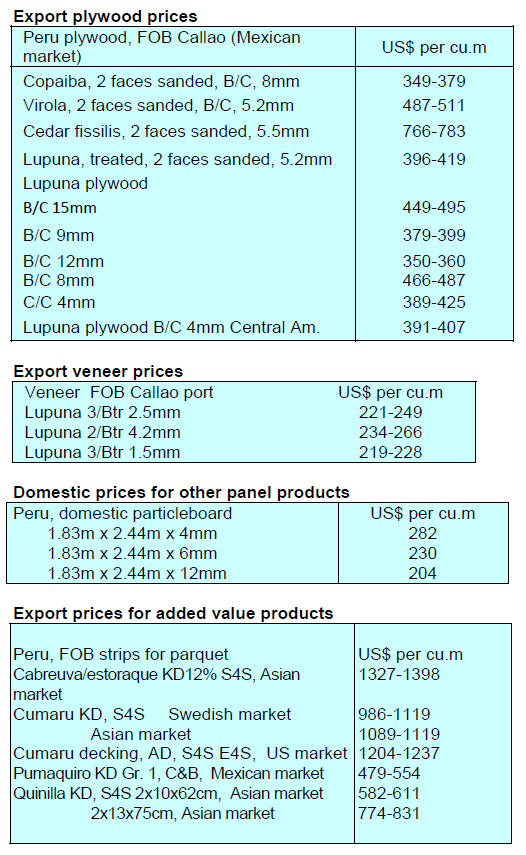

9. PERU

Good start to 2022 – exports rise

35%

The Management of the Services and Extractive Industries

Division of the Association of Exporters (ADEX) has

reported exports of wood products in the first 2 months of

the year totalled US$22.4 million, an almost 35% growth

compared to the same period of 2021. This increase is

explained by a stronger demand from countries such as

France, Dominican Republic and Belgium.

Despite the increase shipments of wood products barely

represented 0.7% of total non-traditional shipments, a

situation that does not coincide with the enormous

potential of the forestry sector.

Lucía Rodríguez Zunino from ADEX said “The

Amazonian forests represent 61% of the national territory

but this resource is not being well utilised, on the contrary

they are victims of deforestation”. He concluded that it is

essential that the revised process for forest concessions

allocation be implemented.

Despite reduced purchases China remains the main

buyer

With a 21% share of total export demand in the first two

months of 2022 China remains the main market for

Peruvian wood products followed by France, the

Dominican Republic and Belgium. Other buyers in the top

ten were Mexico, USA, Denmark, Vietnam, the

Netherlands and Germany.

In the first two months of 2022 semi-manufactured

products (US$13.6 million) were the largest and grew 28%

year on year representing 61% of total wood product

exports. The most outstanding items were: mouldings,

unassembled slats for flooring and other profiled wood.

With a 28% share, sawnwood (US$6.2 million) was the

second most exported product. In the first two months of

the year exports of sawnwood jumped over 50%.

Serfor and information exchange protocol

The National Forest and Wildlife Service (Serfor) and the

Regional Government of Loreto have signed a cooperation

protocol that will allow the exchange of geographic

information to ensure the sustainable management of

forest and wildlife resources in the department of Loreto.

The protocol was signed by the executive director of

Serfor, Hilario López Córdova and the Regional Manager

of Forestry and Wildlife Development of the Regional

Government of Loreto, Óscar Llapapasca Samaniego.

For nine months specialists from both institutions worked

to consolidate and harmonise the forest registry database

which will allow the sharing of information on the

effective management of the forest resources of the

department of Loretto.

During the signing ceremony a demonstration of the

spatial forest information system involving Serfors

GEOSERFOR platform and in the Spatial Data

Infrastructure (IDER) of the Forest Management of the

Loreto Region (GOREL).