US Dollar Exchange Rates of

10th

Apr

2022

China Yuan 6.3784

Report from China

Manufacturing output drops sharply

Manufacturers in China have seen output drop at its fastest

pace in two years as the economic impact of Russia¡¯s

invasion of Ukraine and new covid lockdowns bite. This

slowdown is likely to impact regional economies which

rely on trade with China.

To reduce the economic impact of covid restrictions the

government is adjusting its approach to reduce the time

that activities will be restricted suggesting there has been

some loosening of the Zero covid strategy.

The first round of large-scale covid testing was conducted

in Shuyang County of Jiangsu Province and many woodbased

panel manufacturers have ceased production.

Production of wood-based panels in Hebei, Jiangsu and

Shandong Provinces is now limited and it is difficult to

transport finished products or secure raw materials.

Adding to these challenges are the rising prices for fuel

and raw materials. However, wood-based panel

manufacturers in Linyi City, Shandong Province have said

although there is no great impact on production for now

many roads are closed which is a challenge.

Manufacturers revealed that transport costs from Guangxi

to Shanghai rose from RMB270-280 to RMB420 per

tonne. They also revealed that the price of raw materials is

still rising, for example the price for veneer rose from

RMB1,220-1,240 per cubic metre to RMB,1300 per cubic

metre recently.

In addition, demand is relatively weak and order levels are

lower this year. With weak demand it is difficult to raise

prices to off-set increased production costs.

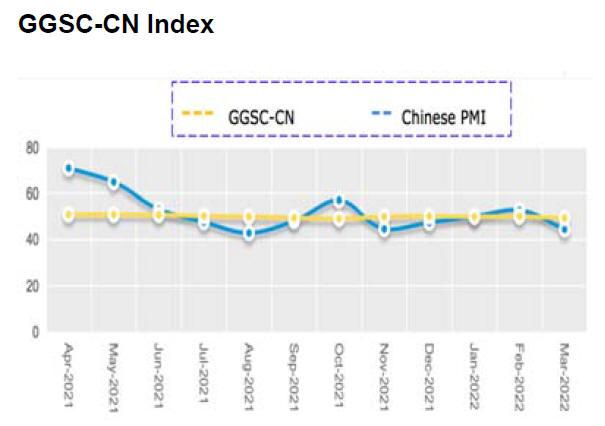

GGSC-CN Index Report (March 2022)

In March 2022, as a result of covid control measures and

the impact of Russia¡¯s invasion of Ukraine, there has been

a marked impact on output. Production inputs are difficult

to secure, costs are rising and demand is weakening. The

overall economic growth rate has slowed.

In March China's PMI registered 49.5%, down from the

previous month and below the critical 50 mark indicating

that the macro economy has slowed. The development of

timber production and manufacturing industry also

showed a declining trend.

The new order index for most enterprises was lower than

the previous month and export orders dropped

significantly.

The GGSC-CN index for March registered 44.6% (71.9%

for last March and 70.7% for March 2020) and

was below the critical value of 50 indicating the operations

of the enterprises represented by GGSC-CN

index shrank from a month earlier.

Challenges: Covid infections have

reappeared, cross

province transport is disrupted and transportation cost

have increased.

Products in short supply: None.

Commodity of which the price has been increased:

methanol, melamine, paraffin, waterproof agent and other

chemical raw materials.

Commodity of which the price has been decreased:

eucalyptus firewood, pine firewood, melamine and urea.

Overview

In March 2022 two sub-indices of GGSC-CN increased

and three decreased.

The production index registered 50.0%,

a decrease from the previous month. The new

order index registered 33.3%, sharply down on

the previous month reflecting the inability of

enterprises to obtain orders.

The new export order index reflecting

international trade registered 25.0%, a decline

from the previous month indicating that orders

from abroad this month have fallen.

The main raw material inventory index

registered 58.3%, an increase from the previous

month. The employment index registered 50.0%,

an increase from the previous month.

The supplier delivery time index

was 41.7%, a drop from the previous month.

See:http://www.itto-ggsc.org/site/article_detail/id/237

Forest development plan 2021-2025

China aims to establish a modern forest and grass industry

system by 2025 with the total output value expected to

reach RMB9 trillion from RMB8.1 trillion in 2020. This

was included in the Forestry and Grassland Development

Plan (2021-2025) released by the State Forestry and

Grassland Administration.

China also strives to establish itself as a leading

country in

the international trade of forest and grasslnd products with

an annual import and export value hitting US$195 billion

by 2025 from US$152.8 in 2020.

The output of wood-based panels is expected to be stable

at around 300 million cubic metres, the output of flooring

at around 800 million square metres and the output of

wooden furniture at RMB800 billion by 2025.

More than 2 million hectares of national reserve forests

will be cultivated and upgraded by 2025. There will also

be a rise of 20 million cubic metres in annual stocking

volumes in national reserve forests. More than 8 million

cubic metres of stocking will be of rare tree species.

See:

http://www.forestry.gov.cn/main/304/20220221/110605840479828.html

China¡¯s bamboo industry

More than 500 Bamboo species grow in China being

distributed in 16 provinces or regions such as Fujian,

Jiangxi, Zhejiang where there are 7 million hectares of

bamboo forests.

At present, bamboo products are widely used in

construction, packaging, furniture, decoration and textils.

The bamboo industry plays an important role insupporting

rural economic growth and boosting incomes. In some

bamboo producing areas, such as Anji County, Huzhou

City in Zhejiang Province and Luzhou City in Sichuan

Province the bamboo industry has become a pillar of the

local economy.

The State Forestry and Grass Administration, the National

Development and Reform Commission and other

departments prepared a plan "Opinions on Accelerating

the Innovative Development of Bamboo Industry". This

was put forward to vigorously protect and cultivate highquality

bamboo resources, build a modern bamboo

industry system and create a beautiful rural bamboo

landscape.

See:

http://www.forestry.gov.cn/main/304/20220221/110605840479828.html

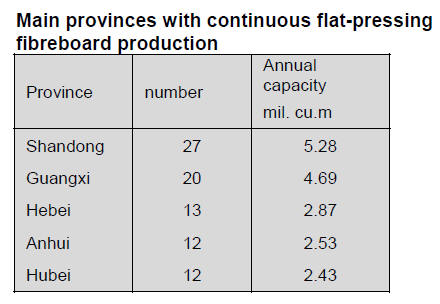

Rise in the fibreboard production capacity

Fourteen fibreboard production units were put into

operation nationwide in 2021 with an annual production

capacity of 3.36 million cubic metres. China's 376

fibreboard manufacturers had 425 fibreboard production

lines by the end of 2021 distributed in 24 provinces and

municipalities. The number of enterprises and production

lines in China's fibreboard industry declined while the

total production capacity and average single-line

production capacity increased as a whole.

About 33 fibreboard production lines were shut down,

dismantled or suspended operations in 2021 removing

around 4.56 million cubic metres capacity.

China had 142 continuous flat-pressing fibreboard

production lines by the end of 2021 with a total production

capacity of 30.37 million cubic metres per year accounting

for 57% of the national total fibreboard production

capacity, which distribute in 18 provinces and regions.

Eight production lines are expected to come on line

in

2022 with a production capacity of 1.93 million cubic

metres. The mills are in Eastern China such as Shandong,

Jiangsu, Anhui and Jiangxi Provinces as well as the

Guangxi Zhuang Autonomous Region of Southern China.

No fibreboard production lines are under construction in

North, Central, Southwest, Northwest or Northeast areas.

Of the new lines 7 are continuous flat-pressing production

lines adding an extra capacity of 1.78 million cubic metres

per year.

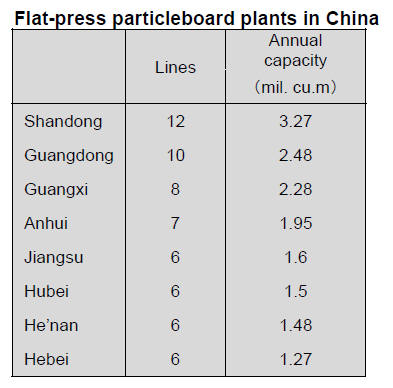

Rise in particleboard production capacity

13 particle board production lines were put into operation

in China in 2021 adding a further production capacity of

2.76 million cubic metres. China's 312 particleboard

production enterprises had 331 particleboard production

lines by the end of 2021.

|