Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Apr

2022

Japan Yen 125.9

Reports From Japan

Covid

rebounding

Just two months after the sixth wave coronavirus

infections are rebounding in Japan. New infections had

been gradually declining for several weeks after the

January emergency measures. The lifting of restrictions in

late March and the start of the new school and business

year in April resulted in the spread of the highly

transmissible BA.2 omicron sub- variant.

Sanctions expanded

The Japanese government has been gradually expanding

the scope of its sanctions on Russia since late February

when Russia launched its invasion of Ukraine and has

been in step with G7 countries in imposing sanctions.

Japan will phase out coal imports from Russia.

Businesses anticipate a worsen business environment

The recent Bank of Japan (BoJ) Tankan survey of

Japanese business confidence reported a worsening of

confidence for the first time in nearly two years as

companies were impacted by supply disruptions, surging

raw material costs and weakening domestic consumption.

The survey found companies anticipate a worsening of the

business environment in the second quarter.

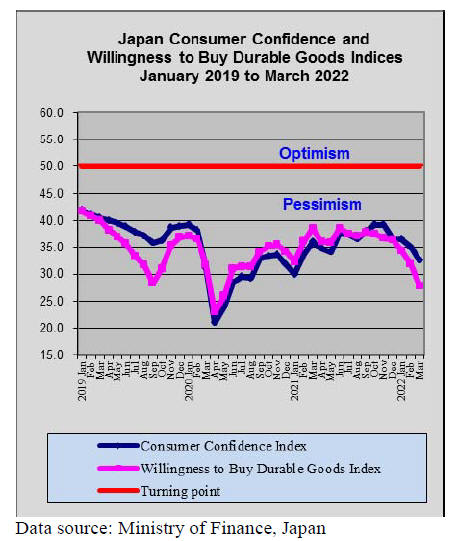

Analysts expect the BoJ to cut its growth forecast for the

current year beginning in April and raise projections for

consumer inflation. Rising fuel and food prices blamed on

the Russian invasion of Ukraine and the rapidly

weakening yen/dollar exchange rate has driven down

consumer confidence.

See:

https://www.japantimes.co.jp/news/2022/04/01/business/tankanfirst-quarter/

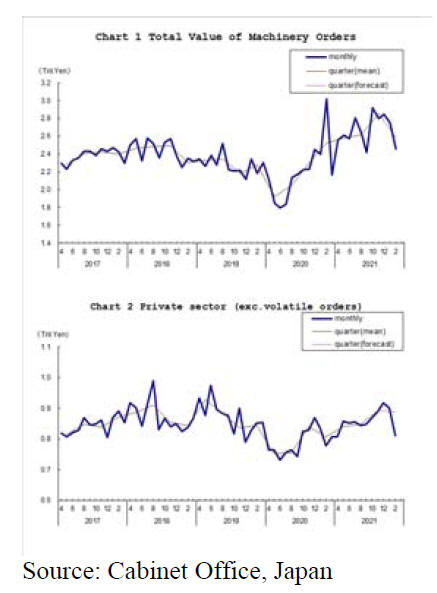

Slow down in investments

The latest survey of business machinery orders, a highly

volatile leading indicator of capital spending in the coming

six to nine months, fell more than expected in February

following the drop in January.

Businesses in Japan are cutting back on investments as

profits are squeezed by the rising costs of energy and raw

materials. However, Compared with a year earlier core

orders grew 4% in February.

Steepest decline in consumer confidence in

two years

The March consumer confidence index released by the

Cabinet Office dropped in March and was the steepest rate

of decline in almost two years. The decline was put down

to the growing concerns on price rises and the impact of

Russia¡¯s invasion of Ukraine and how the cost of living

will likely increase.

The Cabinet Office lowered its projections of sentiment

for the third consecutive month saying consumer

confidence has been "weakening further."

See:

https://mainichi.jp/english/articles/20220408/p2g/00m/0bu/063000c

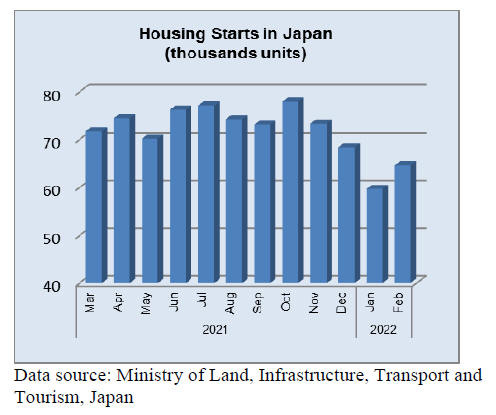

Vacant homes exceeding home seekers - should

home

loan tax relief be extended?

For Japanese seeking home loans the mortgage tax relief

system is a big advantage. Recent revisions to the overall

tax structure in Japan did not change the scale of tax relief

on home loans.

However, some analysts have raised concern that the

current structure may be ineffective and unfair.

According to the Ministry of Internal Affairs and

Communications' Housing and Land Survey in 1968 the

number of homes in Japan exceeded the number of

households to live in them. In 2018 there were about 54

million households and about 62.4 million homes. Some

are asking whether further mortgage tax breaks and

homebuilding promotion are really needed.

The government intends to extend tax relief for people

who renovate their homes. The current home renovation

tax relief will end this year but it appears it will be

extended to the end of 2023. The aim of the scheme is to

encourage sales and renovation of second hand homes as

the number of vacant properties continues to rise.

See:

https://mainichi.jp/english/articles/20220121/p2a/00m/0bu/008000c

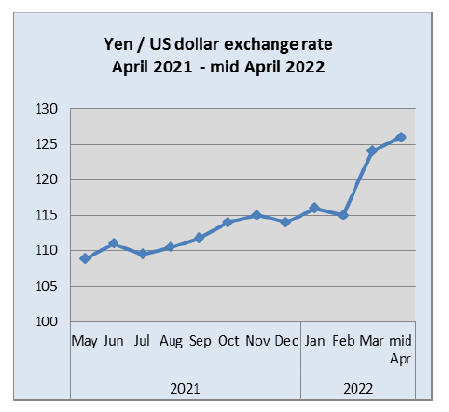

Yen at record low

The Japanese currency fell more than 5% against the US

dollar in March despite the being seen traditionally as a

safe-haven currency in times of crisis. There was a further

decline in exchange rate in early April when the yen was

at 126 to the US dollar.

One reason for the yen¡¯s weakness is the view that

the

Bank of Japan will resist tightening monetary policy in

contrast to other major economies. The yen weakened

against the US dollar the most of any major currency

except the ruble during the first quarter of 2022.

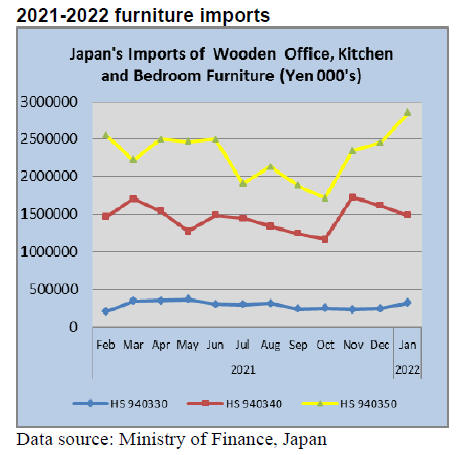

January office furniture imports (HS 940330)

The top shipper of wooden office furniture in January

2022 was China and it increased its share of imports by

Japan to 83%, up from the 75% in December 2021. The

other main suppliers in January were the US (5%. Down

from a month earlier) and Poland (2%, also down from a

month earlier.

Year on year the value of imports of wooden office

furniture (HS940330) rose a massive 42% in January 2022

continuing the upward trend seen at the end of last year.

Month on month the value of wooden office furniture

imports rose 29%. Clesarly importers were anticipating an

upswing in demad in Japan as the covid infection rates had

started to decline.

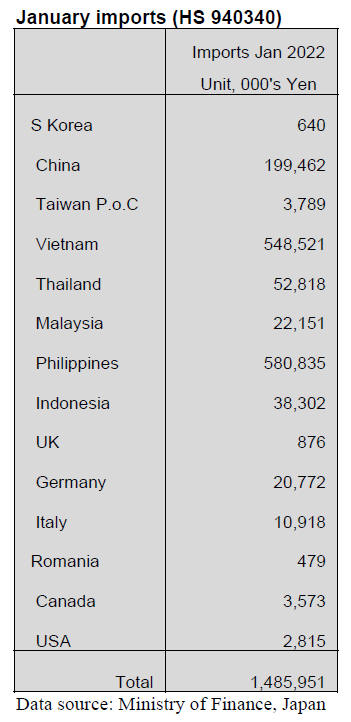

January kitchen furniture imports (HS 940340)

Following a very sharp rise in the value of wooden kitchen

furniture in November 2021 there was a 6% downward

correction in December and this downward correction

extended into January 2022. After the rise in wooden

kitchen furniture from the Philippines in December there

was a downward correction of 39% in January.

On the other hand the other two main suppliers, Vietnam

and China, saw their share of imports rise in January.

Imports from Vietnam rose 36% and imports from China

were up 13%. Year on year January 2022 the value of

wooden kitchen furniture imports rose 10% but were down

8% compared to a month earlier.

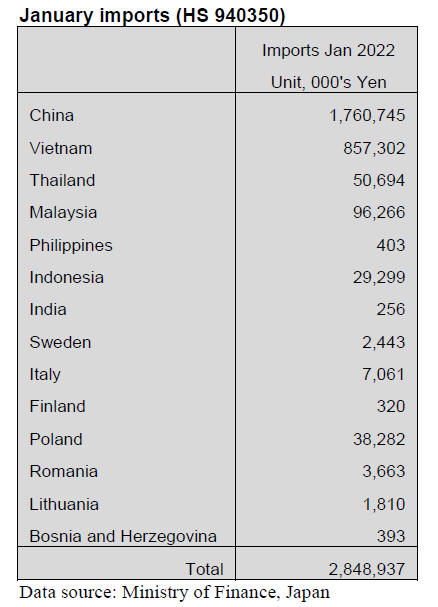

Janauary bedroom furniture imports (HS

940350)

The top suppliers of wooden bedroom furniture in January

2022 were China (61%) and Vietnam (30%). The value of

shipments from both countries was over 20% higher than

in December 2021. In January 2022 shipments of wooden

bedroom furniture from Malaysia fell by around 30% but

arivals from Poland were higher in January compared to a

month earlier. Year on year, January 2022 imports were

8% higher and month on month January imports were 16%

higher.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Impact of export ban of Russian veneer

The Russian government announced to stop exporting

Russian made veneer and wood chip on March 10. This is

a big blow to the Japanese softwood plywood

manufacturers and they are hurriedly look for the

substitution but it seems a long shot to find immediate

substitution with sizable volume.

If they try to use domestic cedar logs to manufacture

veneer it would push log prices further up when log supply

has been tight in competition with sawmills and laminated

lumber mills. They normally carry about a month

inventory of Russian veneer but because of confusion of

shipping, the supply of veneer has been tight since last

year and the inventory on hand will be gone by the end of

this month.

By disruption of Russian veneer supply total plywood

production would drop by about 20% or 20-30,000 cbms a

month. The shipment has been exceeding the production

and the inventory of softwood plywood at the end of

January was only 77,000 cbms, only 0.3 month so if the

production decreases 20 -30,000 cbms a month, supply of

softwood plywood would get worse.

Annual import of Russian larch veneer is about 250,00

cbms. It is equivalent to one million sheets of 12 mm thick

3x6 plywood. It is volume more than one large plywood

mill.

Substituting supply with South Sea hardwood plywood has

been low because of log shortage in producing regions and

volume of Chinese plywood is limited. Structural

particleboard and MDF have no extra supply volume since

regular customers¡¯ requirement is full. OSB supply from

the U.S.A. and Europe has no surplus volume for Japan

with active demand.

There is no extra capacity to produce and dry veneer by

domestic manufacturers to replace imported veneer even if

log supply is secured so it is unavoidable to see decrease

supply of plywood.

The largest plywood manufacturing group, Seihoku

consumes about 18,000 cbms of Russian larch veneer,

which are used for face and back of structural plywood

together with North American Douglas fir and domestic

larch. Now that supply of Russian veneer stops, Seihoku

proposes customers 100% domestic cedar plywood.

Keytec, LVL manufacturer, uses Russian veneer for high

strength structural LVL for both residential and

nonresidential buildings. Demand of 140 E LVL has been

established and it can be manufactured with North

American Douglas fir, New Zealand radiate pine and

domestic larch. It is consulting with the customers to use

substituting materials.

Candidates of substituting species are North American

Douglas fir, New Zealand Radiata pine, Australian and

Brazilian eucalyptus and domestic larch.

Russian veneer production by Japanese investment

There are two major companies which manufacture veneer

in Russia. One is Terneiles, Plastan, Primorski Krai, which

is Sumitomo Trading¡¯s joint venture company. Another is

RFP in Khabarovsk Krai, which is capital participation by

the Iida Group Holdings.

Both produce larch veneer about 440,000 cbms a year out

of which 275,000 cbms has been shipped for Japan and

other volume is exported to Korea and China. Despite

export ban of veneer for Japan by the Russian government

both are determined to continue full production of veneer

and plan to export more for Korea and China.

Weak yen pushes import cost

Trend of depreciation of the yen continues. The yen rate to

the dollar in early March was 115 yen then it dropped

down to 125 yen now. This is negative factor to push the

cost of imported products while it helps promote export

business.

Distributors are reluctant to commit future contracts as

they are surely higher in cost in the yen compared to what

they are holding in inventory.

Second quarter contracts for North American Douglas

fir

and hemlock square are concluded in February but

negotiations on SPF lumber and Douglas fir taruki

continue. Some suppliers of Douglas fir taruki settled a

tUS$915-920 per cbm C&F,US $90 drop from previous

prices.

When this offer was made, the exchange rate was 115 yen

per dollar and import cost would be almost 112,00 yen per

cbm FOB truck port yard, 7,000 yen lower than previous

contract cost but with exchange rate of 120 yen the cost

would be about 117,000 yen. Unless the suppliers reduce

the prices more than US$70 the yen cost would not drop.

When the North American lumber market is booming, it

does not make sense for the suppliers to reduce export

prices.

Canadian SPF lumber¡¯s proposed prices are US$1,450 -

1,500 per MBM C&F,US $250-300 higher than previous

prices. At the beginning of the negotiation, the yen¡¯s

exchange rate was 115 yen per dollar. Imported cost

would be 117,000-121,000 yen per cbm FOB truck port

yard, 21,000-25,000 yen up, which is steep increase equals

to the wood shock prices but with exchange rate of 120

yen, the cost would be 122,000-126,000 yen, increase of

26,000-30,000 yen, 5,000 yen more than 115 yen rate.

Imported lumber inventory at the Tokyo harbor at the end

of February was high with 175,000 cbms. Since future

import cost would be higher by weak yen only measure

the dealers have is to hold the inventory.

Plywood

Japanese manufacturers are cautious of an effect on

domestic softwood plywood in Japan by an invasion of

Ukraine by Russia. There will be no imported veneer from

Russia after April.

Some plywood manufacturers say that they could produce

plywood even though they did not have enough inventory

since last half of the year so the affect will not be a long

time at this time.

On the other hand, some other manufacturers are worried

about production would be reduced by 20%. Precutting

manufacturers have still orders from housing companies to

work in April, so there is a possibility to be a shortage of

plywood.

There is another problem of cost for raw materials. It is

difficult to buy enough logs in Japan. The imported

Douglas fir logs are still high-priced and supply volume is

very limited.

Russia banned exporting veneer to Japan, so it affects

plywood prices in Japan. The price of oil and natural

gas are soaring by an invasion of Ukraine by Russia.

Glue and distribution cost will also increase.

The price of imported South Sea hardwood plywood is

unable to decrease because of the selling prices for foreign

countries are high and a weak yen pushes landed cost.

All kinds of South Sea hardwood plywood are not enough

in Japan.

However, trading companies say that it is hard to order

specific kind of plywood because there are not enough

labor and logs for local manufacturers. Therefore, some

plywood manufacturers in South East Asia say that they

understand about a weak yen but they cannot stop raising

their prices due to a price increase of cost.

A price hike of domestic softwood plywood

Plywood manufacturers in Eastern and Western Japan

decided to raise the price of plywood after April 1. The

price of 12mm of 3 x 6 will be 1,800 yen (per sheet) and

this is 100 yen up from March. It is going to be 90,000 yen

as per cbm and this is 5,000 yen up from March.

The plywood manufacturers need to raise the prices

because of a price hike of domestic and imported logs and

glue. They are concerned about raising the prices again by

prohibited exporting veneer from Russia and soared

natural resources.

24mm of 3 x 6 costs 3,600 yen and this is 200 yen more

than the previous month. 28mm of 3 x 6 costs 4,200 yen

and this is 250 yen more than the previous month.

The prices of logs have been increasing in Japan. Cedar

logs for plywood in Tohoku area is 15,000 yen to 17,000

yen (per cbm). It is 2,000 yen higher than last month.

Larch logs cost 27,000 yen (per cbm). The prices continue

rising definitely in the future. In Western Japan, cedar logs

for plywood are 15,000 yen (per cbm). The price hike will

happen because the exporting to China is very active.

Demand in Japan is firm while production cost is

increasing. Precutting manufacturers still have orders from

units built for sale companies so they are busy in March

and April.

A wholesalers says that it is hard to buy a large amount of

plywood because there will be very lively at construction

of wooden structures after April. An invasion of Ukraine

by Russia will cause a bad influence to domestic plywood.

There is not a big influence by banned exporting veneer

from Russia yet.

However, Japanese larch is very high cost and a tight

supply of Douglas fir so the price hike will occur after

April. Some glue companies in Japan had already asked

the plywood manufacturers about their price hike due to

the prices of oil and natural gas increasing.

|