4.

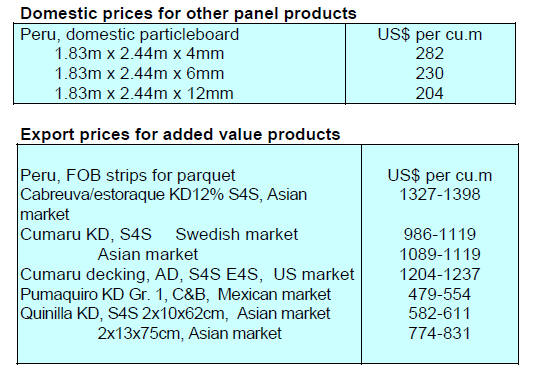

INDONESIA

Promotion to capture larger share of

German Market

Indonesia plans to initiate joint promotion with a number

of stakeholders as part of an effort to expand the market

share of Indonesian wood products in Germany. This was

announced by Arif Havas Oegroseno, Indonesia’

ambassador in Germany, when opening a dialogue

between Indonesian-German wood product business

players facilitated by the Embassy, “It is very important to

carry out a joint campaign to stimulate the German market

for Indonesian FLEGT-licensed products.”

Ambassador Havas also explained the cooperation

programme between Indonesia and the University of

Freiburg to study the market for industrial wood products

in Europe and how Indonesian products can help satisfy

the market demand.

Data from Indonesia’s Ministry of Environment and

Forestry shows that in 2021 the value of Indonesian wood

product exports to Germany reached US$171.1 million, an

increase of 23% from 2020. The main product exported

was furniture generating US$73.9 million in earnings

followed by wood panels (US$37.9 million).

Nils Olaf Petersen, Head of the Foreign Trade Department

at GD Holz, (German Wood Trade Assoc.) explained his

Association would support activities to promote

Indonesian wood products saying “The market is very

good and there is an increasing demand for wood products

in Germany”. Petersen also explained that the market

opportunities are widening with the cessation of timber

imports from Belarus and Russia due to the invasion of

Ulraine.

See:

https://forestinsights.id/2022/03/10/promosi-bersamaproduk-kayu-indonesia-untuk-rebut-pasar-jerman/

Opportunities in Europe, but furniture makers focus on

America

Although there are opportunities for greater furniture

exports to Europe most furniture makers in the country

focus on the US market where demand is predicted to

continue growing significantly until 2024 as US importers

reduce purchases from China.

Chairman of the Indonesian Furniture and Craft Industry

Association (HIMKI), Abdul Sobur, said there is a market

opportunity of up to US$24 billion left by China in the US

and that Indonesia still has the capacity for furniture

export growth, especially to the US, over the next three

years. HIMKI projects that furniture exports in 2024 could

reach US$5 billion.

Over the past year the value of furniture and craft exports

reached US$3.42 billion, up 26% year-on-year. As for this

year, the export value is targeted at US$3.69 billion.

See:

https://ekonomi.bisnis.com/read/20220316/257/1511494/adapeluang-di-eropa-pengusaha-furnitur-enggan-bergeser-dariamerika.

Carbon pricing promises business opportunities

According to the Executive Director of the Belantara

Foundation, Dolly Priatna, the carbon pricing scheme

developed by Indonesia can support achievement of the

country’s commitment to reduce greenhouse gas (GHG)

emissions and will be a business opportunity for Forest

Utilization Licensing Companies (PBPH) and

communities that manage forests.

See:

https://forestinsights.id/2022/03/18/indonesias-carbonpricing-scheme-promises-business-opportunities/

Minister urges shipping companies to open direct

international routes

The Minister of Transportation, Budi Karya Sumadi, has

urged ships owners and shipping companies to open direct

international routes to improve Indonesia's logistics

competitiveness. He made the request while attending the

inaugural launch of the shipping company PT Meratus

Indonesia-China shipping route in collaboration with the

operator of the Container Terminal of Tanjung Priok Port.

See:

https://en.antaranews.com/news/219941/minister-urgesshipping-companies-to-open-direct-international-routes

Forestry sector to contribute to reduction in carbon

emissions

The government, through the Ministry of Environment and

Forestry, has determined that the forestry sector and other

land use sectors could contribute to reducing carbon

emissions by 60% by 2030. The government has prepared

an operational plan to increase carbon absorption by the

forestry and other land use sectors as described in a

Decree of the Minister of Environment and Forestry

Number 168 of 2022.

In a press statement the Minister of Environment and

Forestry, Siti Nurbaya, indicated that with this legal basis

Indonesia will continue to meet climate control targets

especially reducing deforestation and forest degradation.

See:

https://en.antaranews.com/news/219893/forestry-sector-tocontribute-to-60

BMKG forecasts higher potential of forest, land fires in

2022

The Indonesian Meteorology, Climatology and

Geophysics Agency (BMKG) has warned of the potential

for forest and land fires to be greater in 2022. Acting

Deputy of Climatology at BMKG, Urip Haryoko, noted

that this year the dry season is expected to normal

compared to last year when there was unexpected rain

during the dry season. During a press conference Haryoko

commented that several hotspots were currently being

monitored such as in Aceh, Riau, South Sumatra, North

Sumatra, Bangka Belitung Islands and West Kalimantan.

See:

https://en.antaranews.com/news/220713/bmkg-forecastshigher-potential-of-forest-land-fires-in-2022

Indonesia has shown tremendous effort to reduce

deforestation - FAO

FAO Indonesia noted in a statement to welcome the

International Day of Forests that, despite all the priceless

ecological, economic, social and health benefits forests

provide, global deforestation continues at an alarming rate.

The world is losing 10 million hectares of forest a year –

more than half the size of Sulawesi – and land degradation

affects almost 2 billion hectares, an area larger than South

America.

Forest loss and degradation emit enormous quantities of

climate-warming gases and it is estimated that more than

eight percent of forest plants and five percent of forest

animals and birds are at “extremely considerable risk” of

extinction.

The statement says “the government of Indonesia has

shown tremendous effort to reduce deforestation. We need

to appreciate this effort by supporting the Indonesian

government to enforce the law to protect the forest and the

forest community as the fundamental aspects in managing

sustainable forest”.

Indonesia’s G-20 presidency also boosts Indonesia's

programme to achieve sustainable economic development

and the year 2045 targets to include sustainable

management of forests.

See:

https://www.fao.org/indonesia/news/detailevents/ru/c/1479558/

5.

MYANMAR

ASEAN Envoy -

little hope of breakthrough

Cambodian Foreign Minister Prak Sokhonn, the ASEAN

envoy, has met with Myanmar’s military rulers. Prak

Sokhonn’s trip comes amid frustration in ASEAN over

Min Aung Hlaing’s failure to honour the five-point

ASEAN “consensus” to end hostilities and start a peace

process that he agreed to last year at a summit in Jakarta.

Sokhonn said there is no sign of negotiations aimed at

achieving reconciliation and that many factions in the

conflict are not ready to talk”.

Speaking to the domestic press in Myanmar the envoy said

the Myanmar issue was complicated and would take a long

time to solve as the “stakeholders were not ready to

cooperate and still insist on fighting and eliminating one

another.”

Sokhonn became ASEAN’s special envoy for Myanmar

after Cambodia took the rotating ASEAN chair this year.

His appointment came after Cambodian Prime Minister

Hun Sen visited Myanmar to meet the coup leader in

January. That visit has been criticised for seeming to

legitimising the regime.

During discussions Myanmar made clear that the Five-

Point Consensus (proposed by ASEAN and supported by

USA, EU and Japan) must be led by Myanmar. Wunna

Maung Lwin, Foreign Minster said that the

implementation of the Five-Point Consensus must be a

‘Myanmar-owned’ and ‘Myanmar-led’ process. A press

statement from Myanmar’s Foreign Ministry said that the

special envoy’s first visit to Myanmar would pave the way

for confidence building and understanding to promote

cooperation in ASEAN.

See:

https://www.irrawaddy.com/news/burma/asean-envoy-seeslittle-hope-of-breakthrough-in-myanmar.html

GDP Growth 3.7% Expectation of Myanmar SAC

Myanmar’s State Administration Council (SAC) has

predicted 3.7% GDP growth in the next fiscal year

whereas the World Bank has predicted just 1%. The leader

of the SAC, Senior General Min Aung Hlaing, was also

quoted as saying that SAC would try to achieve the

objectives of the 5-Year National Plan which begins soon.

This news attracted a variety of views from the critics

inside and outside the country. The factors which will

influence growth prospects are first, the power supply

which is seriously disrupting manufacturing, the second

are external factors. Investment in the country is in decline

and the sanctions imposed are biting. The third factor

likely to undermine growth prospects is the nonfunctioning

banking system.

see -

https://thediplomat.com/2019/04/erin-murphy-on-the-stateof-myanmars-economy/

)

Thai firm takes over after Chevron, Total pull out

Thai energy company PTTEP has said it will take over the

running of Myanmar’s vital Yadana gas field following

the withdrawal of Chevron and Total Energies. PTTEP, a

unit of Thailand’s majority state-owned energy firm PTT,

will take control of operations from July.

The Yadana gas field in the Andaman Sea provides

electricity to Myanmar and Thailand, one of a number of

gas projects that Human Rights Watch says make up the

government’s largest source of foreign currency earnings

of around US$1 billion annually. The gas concession

accounts for roughly 50% of Myanmar’s gas demand and

around 11% of Thailand’s consumption.

See:

https://www.irrawaddy.com/news/burma/thai-firm-takesover-myanmar-gas-field-after-withdrawal-of-chevron-total.html

)

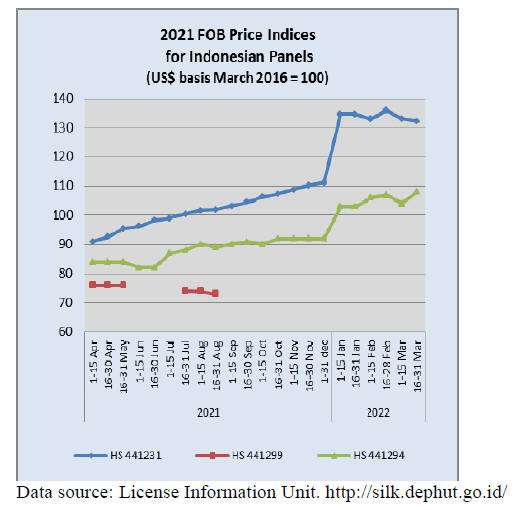

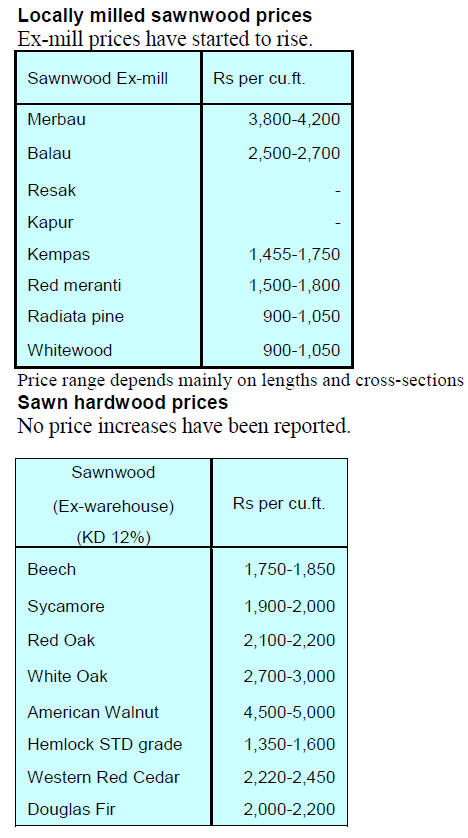

6. INDIA

Wholesale price

indices for February 2022

The Office of the Economic Adviser, Department for

Promotion of Industry and Internal Trade has published

wholesale price indices for February 2022.

The index for manufactured products rose to 138.4 in

February from 137.1 for January. Out of the 22 groups of

manufactured products in the index for 18 increased there

were price increases while 3 saw a drop in prices. The

increase in prices was for basic metals, textiles, paper and

paper products, chemical and chemical products.

The overall index for manufactured wood and wood

products has drooped from a high of 5.76% in October

2021 to 4.55% as of February 2022.

The annual rate of inflation was 13.1% in February 2022

compared to 4.83% in February 2021.

The high rate of inflation in February 2022 was primarily

due to rise in prices of mineral oils, basic metals,

chemicals and chemical products, crude petroleum and

natural gas, food articles and some non-food articles such

as plywood where the index titled slightly higher in

February.

See:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Log exports from Sabah welcomed

India importers of hardwood logs have welcomed the

decision of the Sabah State Government to resume log

exports. Currently, India import logs mainly from

Sarawak.

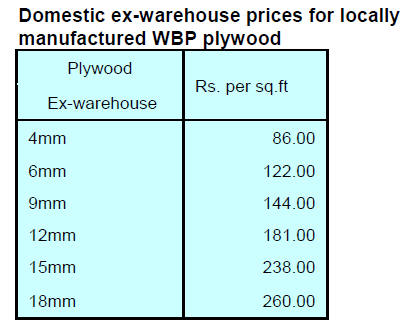

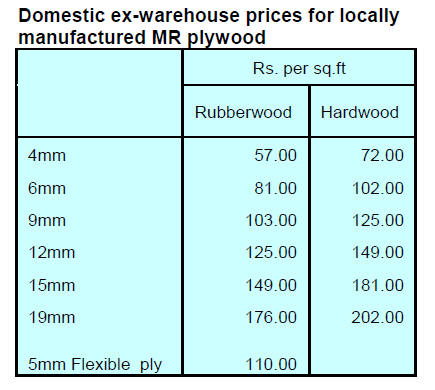

Shortage of domestic peeler logs

During a webinar organised by Plyreporter on 'Shortage of

Wood in North India', experts have clearly indicated that

by 2025, there will be a severe shortage of peeler logs in

North India.

It was pointed out that this situation presents a big

challenge for the industries located in Haryana, Punjab and

Uttar Pradesh. It is clear that due to the imbalance in

supply and demand of wood in North India, prices will

increase further and plywood prices are likely to increase

by at least 10-12% in the next few quarters.

See:

https://www.plyreporter.com/magazine-February-2022

7.

VIETNAM

High costs hit wood product manufacturers

The local media outlet, ‘Vietnamnews’ has reported that

rising input costs are eroding the profits of wood product

manufacturers putting them at risk. Additionally, sanctions

on Russia are likely to cause a decline in supplies of

timber raw materials from Russia. As timber supplies

become tighter, Vietnamese firms will have to compete

more fiercely in international markets especially for

timbers from the EU and the US.

According to VIFOREST Vietnam has been importing 5.5

– 6.5 million cubic metres of timber raw material every

year. Higher raw material prices coupled with mounting

transportation costs have added to import bills driving

down profitability.

Vietnamnews quotes Phan Văn Phước, director of Tân

Phước Co. Ltd., forecasting that the timber shortage

will last for some months. He said his firm had to raise

prices to remain operational and would not import

additional timber in the short term due to high costs.

Tran Quoc Manh, general director of Sai Gon Trading

Production Development JSC is more concerned about

fuel costs than timber prices. He said petrol prices had hit

up to VND27,000 (US$1.18) per litre exceeding

manufacturers’ capacity to absorb the rise. Accordingly,

manufacturers are reluctant to sign new contracts for fear

that petrol prices will continue to go up further.

“Many manufacturers of wood products have to stay idle

amid high fuel costs and freight rates. They are unwilling

to sign new contracts due to cost uncertainties,” he

explained.

Rising oil prices have pushed up freight rates bringing

transportation costs to a new high. Freight rates have

increased fivefold since the pandemic began and the

Russian invasion of Ukraine has made things worse.

The Chairman of Dong Nai Province’s Association

of Wood and Handicraft, Le Xuan Quan, has urged the

authorities to discuss with shipping lines how to stabilise

freight rates. He also called for close cooperation between

forest growers and timber-processing firms to develop

sustainable sources of timber for the industry to lower the

dependence on imported materials.

A spokesperson for General Import and Export Van Xuan

Corp. has suggested a data portal on timber to help

manufacturers monitor prices and supply to better manage

input costs and inventories.

See:

https://vietnamnews.vn/economy/1163524/highinput-costs-hit-wood-product-manufacturers.html

Imports from Russia fall

At a recent event hosted by VIFOREST to exchange

information on the possible impacts of Russia’s invasion

of Ukraine furniture manufactures discussed the search for

timbers to substitute for Russian birch. Locally produced

acacia and rubberwood higher quality were identified as

possible alternatives.

Vietnam's imports of wood raw materials from Russia in

2021 accounted for 130,220 cu.m or about 2% of total

wood raw imports. In January 2022 the volume of imports

of wood from Russia continued to drop to just 8,560 cu.m.

Over 90% of the timber imports from Russia in 2021 was

sawnwood with the balance being plywood, veneer and

other wood-based panels.

The top species Vietnam imports from Russia is birch

followed by pine, spruce and fir. In 2021, birch

sawnwoodr imported from Russia into Vietnam accounted

for 81% of the total sawnwood imports.

Wood and wood product trade highlights

According to statistics from the General Department of

Custom, Vietnam's wood and wood product (W&WP)

exports to South Korea in February 2022 reached

US$48,400, up 1% compared to February 2021.

Vietnam's office furniture exports in February 2022

reached US$20 million, down 26% compared to February

2021. In the first 2 months of 2022 exports of office

furniture were worth US$55 million, down 26% compared

to the same period in 2021.As wood product export

growth was positive in the first two months of 2022 many

firms are increasing capacity to meet current orders until

the end of the second.

Products from Vietnam are very competitive and exporters

benefit from the various free trade agreements signed.

Trade will get a boost as international arrivals are now

possible.

Vietnam's pine imports in February 2022 reached 50,300

cu.m, worth US$14.6 million, down 4% in volume and

4% in value compared to January 2022. Compared to

February 2021 they were down 57% in volume and 42%

in value.

US$20 billion in wood product exports in 2025

Vietnam is targeting US$20 billion in wood product

exports in 2025, an increase of more than US$9 billion

compared to the present. The goal is to develop a

sustainable and efficient wood processing industry

for 2021-2030 said the Deputy Prime Minister Lê Văn

Thành.

The total export value of wood and forest products is

targeted at US$25 billion by 2030. The value of wood

products for domestic consumption will reach US$5

billion in 2025 and over US$6 billion in 2030.

By 2030 the domestic wood processing industry

will become an important economic sector and will have

built a good reputation in domestic and export markets. To

achieve this it will be necessary to further develop

infrastructure and expand the scale of production. There

are plans for five forestry zones with high technology

applications to attract investment from wood processing

enterprises. The country will build an international

furniture exhibition centre and encourage research and

design centres.

Expanding forest cover

Thirty year ago due to over-exploitation and the war only

27% of the country was covered by forests however, by

2021 that had risen to 42% and the goal is to reach 45% by

2030.

The Ministry of Natural Resources and Environment has

called for the increasing application of science and

technology in the reforestation and the association of

forests with environmental services, ecotourism and

biodiversity conservation. The national reforestation

program includes the creation of a digital map of trees

aimed at improving the conservation efforts and the

forestry industry.

See:

https://www.plenglish.com/news/2022/03/21/vietnamreaffirms-will-to-expand-forest-coverage/

In related news, Deputy Prime Minister, Le van Thanh,

has approved a 10-year project to improve forest rangers’

capacity in management, protection and firefighting. The

project aims to reduce at least 10 to 15% of law violations

in the forestry sector compared to the 2015-20 period,

especially deforestation, illegal harvesting

and transportation and forest burning.

To realise the targets, personnel training is key. At least

50% of forest protection and firefighting forces must be

trained with professional skills and be equipped with

forest protection devices.

8. BRAZIL

Demand for timber from natural

forests increased

during pandemic

According to the Union of Wood Industries in the North of

Mato Grosso (Sindusmad), in 2020 the timber industry in

the region earned R$368 million due to firm demand and

rising prices. Since 2020 prices for some species doubled,

for example the price of cambará (Moquiniastrum

polymorphum) jumped from R$1,000 to R$2,000 per

cu.m. The pace of price increase was also driven by

demand in the construction sector which caused a rise in

construction materials which had a knock-on impact on

wood prices.

Brazilian system to help wood identification

The “Interactive Wood Identification Key” system created

by the Brazilian Forest Service forest products laboratory

(LPF/SFB) is a tool for species identification. The system

utilises an on-line database with details of 275 tropical

timber species ranging from the most commercialised to

some endangered species. Recently, several species that

share a common name were added. For instance the

number of species that are known commercially as ipê

(Handroanthus) has increased.

The LPF system contributes to combating the illegal

timber trade as timber identification is key to allowing

enforcement agents to curb environmental crimes. In 2021,

the system enabled employees working in the

environmental inspection division of the Federal Highway

Police (Polícia Rodoviária Federal - PRF) in the state of

Maranhão to identify 6,214 cu.m of suspect wood, some

50% more than what was seized the previous year. The

Federal Police are partnerin the “Interactive Timber

Identification Key” system for technical support.

The BioAmazônia Project and the Amazon Cooperation

Treaty Organization also collaborate to develop the

system.

Export update

In February 2022 Brazil’s exports of wood-based products

(except pulp and paper) increased 45% in value compared

to February 2021, from US$284.8 million to US$413.9

million.

Pine sawnwood exports grew significantly (49%) in value

between February 2021 (US$46.2 million) and February

2022 (US$68.9 million). In volume terms exports

increased around 7% over the same period, from 238.500

cu.m to 254.300 cu.m.

Tropical sawnwood exports in February increased slightly

(2%) in volume, from 30,100 cu.m in February 2021 to

31,800 cu.m in February 2022. In value, exports decreased

1.6% from US$12.6 million to US$12.4 million, over the

same period.

In February pine plywood exports experienced a 37%

increase in value compared to February 2021, from

US$66.3 million to US$90.5 million.

In volume terms pine plywood exports increased 18% over

the same period, from 194.500 cu.m to 229.700 cu.m.

As for tropical plywood, exports increased in volume

(13.5%) and in value (26%), from 5.200 cu.m (US$2.3

million) in February 2021 to 5.900 cu.m (US$2.9 million)

in February 2022.

Wooden furniture exports increased from US$55.1 million

in February 2021 to US$60.3 million in February 2022, an

almost 10% growth.

Online system to raise efficiency of timber exports

The Brazilian National Confederation of Industry (CNI)

has launched a Single Consent Platform for Brazil (Pau-

Brazil) developed by the Brazilian Institute for the

Environment and Renewable Natural Resources

(IBAMA).

This initiative was developed over three years and

provides for the registration of Brazilian biodiversitybased

products from the natural forest. The expectation is

that the digitisation of the procedure will provide

advantages in terms of processing time and costs as

paperwork is eliminated.

The system integrates IBAMA's CITES information with

the SINAFLOR (National System for the Control of

Origin of Forest Product) licenses process to create onestop

portal. Around 35,000 wood and non-wood products

from natural forests are exported throughout Brazil every

year. Most of these products are exported from the four

main ports in Pará, Paraná, Santa Catarina and Amazonas

through which more than 90% of the exported

biodiversity-based pass.

Brazilian furniture at Expo Dubai

The Brazilian furniture sector is participating in Expo

Dubai which began in February. The event attracts

professionals, companies and buyers from all over the

world related to the furniture industry.

27 Brazilian brands associated with the Brazilian Furniture

Sector Project have participated in Dubai Trade Mission

organized by the Brazilian Furniture Industry Association

(ABIMÓVEL) and the Brazilian Trade and Investment

Promotion Agency (Apex Brazil).

To promote business networking round-tables will be held

through a matchmaking process between Brazilian brands

and around 35 international buyers from the UAE and

other Middle Eastern countries.

The Middle East is one of the most relevant target markets

for the Brazilian furniture industry. Exports to Saudi

Arabia, the main destination for Brazilian furniture in the

Middle East, increased by 290% last year. The UAE, the

second largest destination, registered an over 80% increase

in furniture imports from Brazil in 2021.

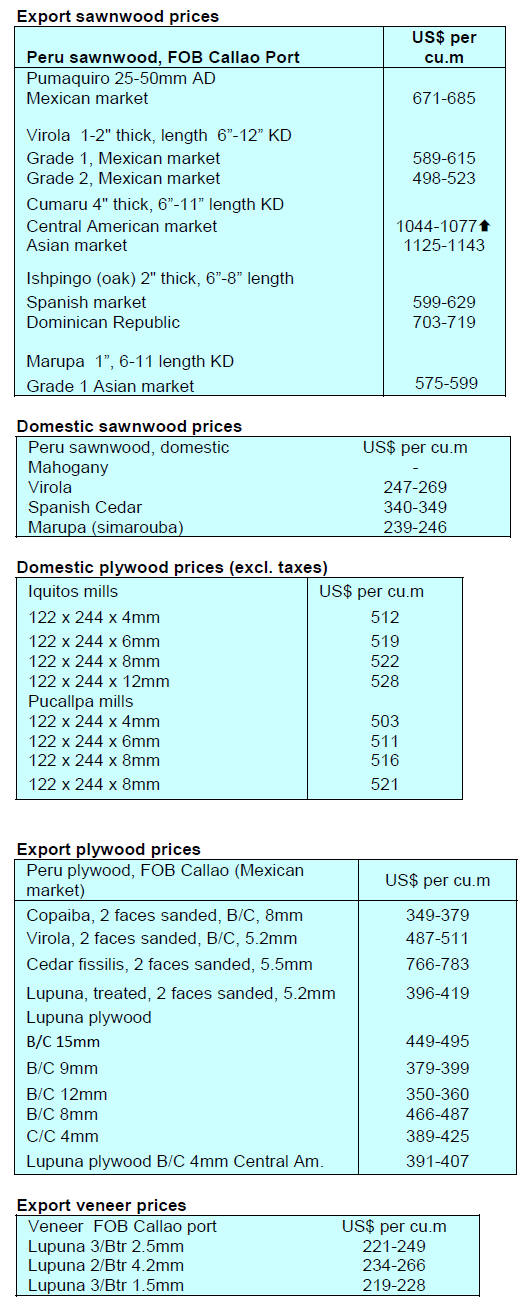

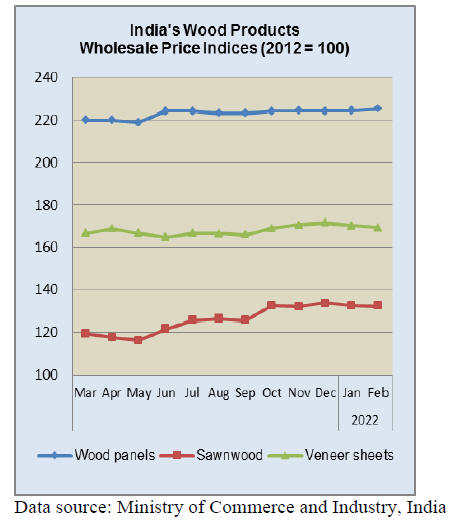

9. PERU

Sawnwood shipments rising

ADEX, the Association of Exporters, has reported the

value of sawnwood exported in January this year was

US$2.5 million, up 9% compared to the same month in

2021. There was strong demand in Mexico and the

Dominican Republic.

However, the January 2022 value was below that in 2020

(US$3.4 million) due to the high level of Chinese imports

(US$1.5 million) that accounted for 46 % of the total. In

January of this year the main export destination was

Mexico (US$0.7 million) a growth of 127% year on year,

the Dominican Republic (US$0.65 million), an increase of

91%.

Sawnwood was also shipped to Vietnam (US$0.55

million), China (US$0.23 million), Ecuador (US$0.12

million), the US (US$0.10 million) and smaller amounts to

Germany, Belgium and Spain. These last three

destinations are recent additions. With 26% of all wood

products sold abroad, sawn wood ranked second after

semi-manufactured products (US $5.9 million).

In addition, construction products were shipped (US$0.31

million); other manufactured products (US$0.29 million);

furniture and parts (US$0.18 million and plywood

(US$0.16 million).

According to figures from the ADEX Data Trade

Commercial Intelligence System, in 2021 (January-

December) shipments of sawn wood reached US$33.6

million, an increase of 35% compared to 2020 (US$24.9

million) and the highest in five years.

The largest buyer was China (US$10.7 million) with a

32% share and an increase of 5.4% year on year followed

by the Dominican Republic (US$8.7 million, up 75%,

Vietnam (US$4.8 million up 67%), Mexico (US$3.1

million, down 17% and Ecuador (US$2.4 million, up 89%.

Last year six new markets were added; Singapore,

Belgium, Martinique, Finland, New Caledonia and Puerto

Rico.

IMF – country faces uncertain economic outlook

A recent IMF report says Peru faces an uncertain outlook

after its strong recovery. The strong policy response in

2020 mitigated the worst impact of the pandemic and

created conditions for a rapid recovery. Firm international

demand, higher commodity prices and pent-up domestic

demand contributed to real GDP rising by 13.3% in 2021,

exceeding its pre-pandemic level in the third quarter of

2021. In addition formal employment fully recovered.

However, Peru is still suffering high social and economic

costs from the pandemic. Many lives were lost as Peru had

one of the highest death rates globally.

Real GDP remains below its pre-pandemic level and

labour force participation and employment has not fully

recovered and poverty increased in 2020 and is still above

pre-pandemic levels despite some improvement in 2021,

says the IMF. Overall says the IMF “the outlook is very

uncertain and downside risks prevail. Growth is expected

to slow to 3 percent in 2022 as external conditions tighten

and the policy stimulus is withdrawn”.

See:

https://www.imf.org/en/News/Articles/2022/03/07/mcs030722-peru-staff-concluding-statement-of-the-2022-article-iv-mission

National Forestry Fair - FENAFOR

Entrepreneurs and professionals in the forestry sector will

have the chance to visit the National Forestry Fair –

FENAFOR scheduled for 10-12 November 2022. This fair

features technology, raw material suppliers, accessories

and services for the forestry industry. The Fair will be held

in an exhibition centre in Lima.