US Dollar Exchange Rates of

10th

Mar

2022

China Yuan 6.3177

Report from China

Decline in 2021 sawnwood imports

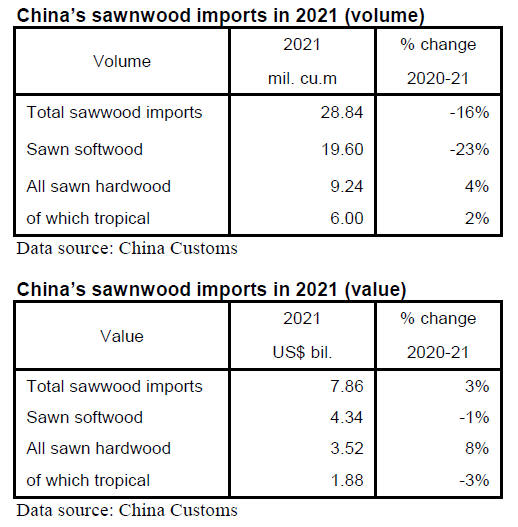

According to data from China¡¯s Customs 2021 sawnwood

imports totalled 28.84 million cubic metres valued at

US$7.86 billion, a year on year decrease of 16% in

volume but an increase of 3% in value on 2020.

Of total sawnwood imports, sawn softwood imports fell

23% to 19.60 million cubic metres accounting for 68% of

the national total. Sawn hardwood imports rose 4% to 9.24

million cubic metres in 2021. China¡¯s sawn hardwood

imports from the top sources; Thailand, Russia, the

Philippines, Romania and Germany rose 6%, 28%, 98%,

18% and 20% respectively in 2021.

Of total sawn hardwood imports tropical sawn hardwood

imports were 6 million cubic metres valued at US$1.88

billion, a year on year increase of 2% in volume but a drop

3% in value and accounted for about 21% of total imports,

up 2% on 2020.

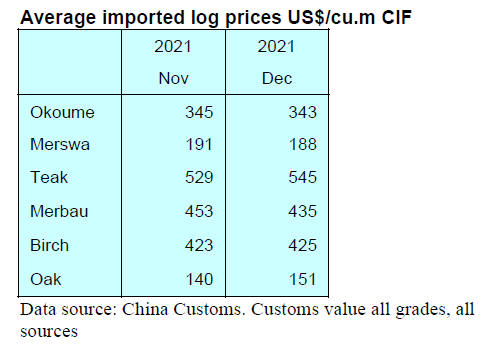

Rise in average prices for sawnwood

The average price for imported sawnwood in 2021 was

US$272 per cubic metre, a year on year rise of 20%. The

average price for imported sawn softwood was US$221

per cubic metre, up 25% year on year. The average price

for imported sawn hardwoods was US$381 per cubic

metre, a year on year increase of 5%. The average price

for imported tropical sawn hardwood was US$314 per

cubic metre, up 2% year on year.

Surge in sawnwood imports from the

Philippines

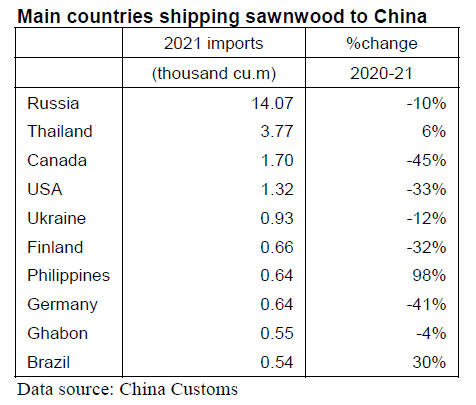

Russia was the main sawnwood supplier to China in 2021

but sawnwood imports from Russia fell 10% to 14.07

million cubic metres and accounted for 49% of the

national total.

The Philippines was a sawnwood supplier to China in

2021 and sawnwood imports surged 98% to 640,000 cubic

metres. In contrast, sawnwood imports from Thailand and

Brazil rose 6% and 30% to 3.77 million cubic metres and

540,000 million cubic metres respectively in 2021.

China¡¯s sawnwood imports from Canada, USA, Finland

and Germany declined 45%, 33%, 32% and 41%

respectively in 2021 which was the main reason for the

decline in the total China¡¯s sawnwood imports in 2021.

Rise in China¡¯s sawn softwood imports from Brazil and

New Zealand

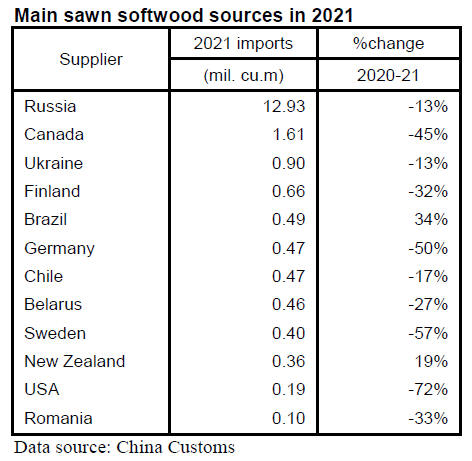

According to Customs data sawnwood imports from

Russia and Canada, the two main source countries of

China¡¯s dropped 13% and 45% respectively in 2021. The

volume of sawn softwood imports from Russia accounted

for 66% of the national total in 2021 which has been the

case for 7 consecutive years. The market share of China¡¯s

sawn softwood imports from Canada has declined steadily

since 2014 and was just 8% of total imports in 2021.

Decline in sawn hardwood imports from USA

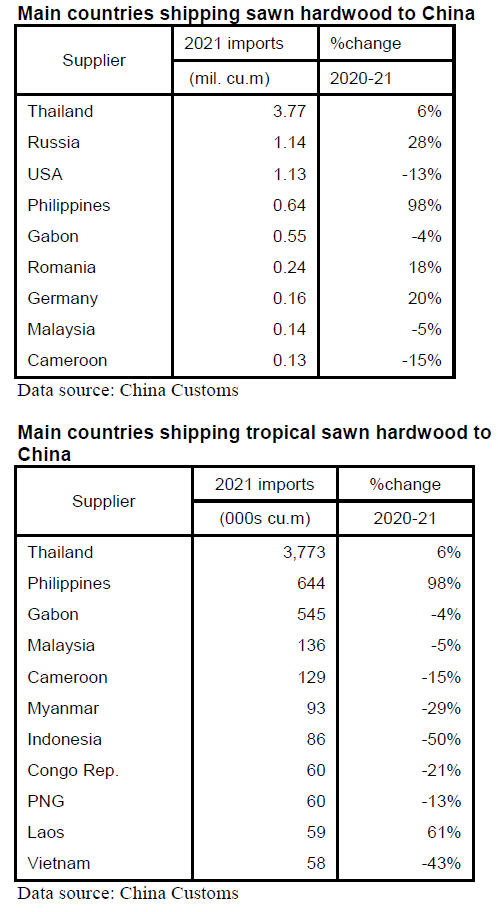

Thailand, Russia and USA still are the main sources for

China¡¯s sawn hardwood imports in 2021 accounting for

41%, 12.3% and 12.2% respectively in 2021.

China¡¯s sawn hardwood imports from Thailand and Russia

rose 6% and 28% to 3.77 million cubic metres and 1.14

million cubic metres respectively. However, sawn

hardwood imports from USA declined 13% in 2021.

In addition, China¡¯s sawn hardwood log imports from the

Philippines, Romania and Germany grew 98%, 18% and

20% respectively.

China¡¯s tropical sawn hardwood imports

China¡¯s tropical sawn hardwood imports in 2021 were 6

million cubic metres valued at US$1.88 billion, a year on

year increase of 2% in volume but drop 3% in value and

accounted for about 21% of the national total, up 2% on

2020 levels. Thailand still is the main source of tropical

sawn hardwood for China and 2021 tropical sawn

hardwood imports from Thailand totalled 3.773 million

cubic metres valued at US$1.017 billion, a year on year

increase of 6% in volume and 7% in value in 2021.

Thailand¡¯s share of tropical sawn hardwood imports by

China rose to 63% in 2021 from 54% in 2020. The

increase in China¡¯s tropical sawn hardwood imports from

Thailand contributed to the growth in total 2021 imports.

|