4.

INDONESIA

Wood product exports to Europe can

be increased

The Indonesian Ambassador for Belgium, Luxembourg

and the European Union Andri Hadi said there are

opportunities to increase wood product exports to the EU

as the EU plans to implement a Deforestation-Free Supply

Chain (DFSC) policy. Indonesia has a wood legality

certificate which has now been reframed into a wood

sustainability certificate and with more vigorous

promotion Indonesian products can capture a greaetr share

of the EU market he said.

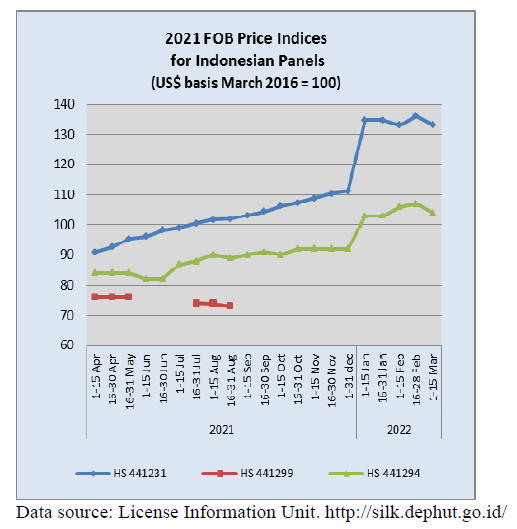

Indonesia's export performance for wood products has

been continuing to show improvement since the FLEGT

VPA was established with the EU and products such as

wood parquet, furniture, paper and plywood exports have

expanded.

One such product that should be promoted is wood fuel

(chips and pellets) as many EU countries want to expand

biofuel consumption.

Janauary export earning encouraging

Chairman of the Communication Forum of Indonesian

Forestry Society (FKMPI), Indroyono Soesilo, revealed

that the performance of the forestry sector was positive in

early 2022.

Total exports of wood products in January 2022 amounted

to US$1.23 billion, up 28% compared to January 2021. In

January 2022 exports of wood products to the EU and the

UK recorded an increase of 30%.

SME flooring exports to India

The Ministry of Trade, via the Surabaya Export Center

programme facilitated the export of wood flooring

products to India from an SME.

Director General of National Export Development at the

Ministry of Trade, Didi Sumedi, said this was a good

achievement as the SME has only been in operation for

three years.

Data from Statistics Indonesia shows that in 2021

Indonesia's exports of wood flooring products (HS

441871-79) amounted to US$117.86 million, an increase

of 39% compared to the previous year. Over the past five

years the trend of Indonesian wood flooring exports to the

world has shown an average decline of 4% annually.

See:https://www.jawapos.com/ekonomi/02/03/2022/kemendagfasilitasi-pengusaha-umkm-ekspor-lantai-kayu-ke-india/

Encouraging furniture and lifestyle products trade

The Ministry of Trade, through the Directorate General of

National Export Development, launched the Aku Siap

Expor (ASE 2) programme to encourage production and

trade in furniture and lifestyle products.

According to the Director General of National Export

Development, Didi Sumedi, the first ASE was welcomed

by exporters which encouraged the Ministry to launch the

second programme, ASE 2. The scope of this programme

is expanded and directed at home decoration products,

furniture and lifestyle products. The new programme will

provide assistance to 50 businesses.

The one year programme will offer workshops, simulation

practices, assignments, business meetings, private

mentoring, local market orientation missions and

participation in domestic and foreign exhibitions.

See:

https://voi.id/ekonomi/138531/dukung-produk-furniturindonesia-mendunia-kemendag-luncurkan-program-ase-2-0

New Forest’s Tropical Asia Forest Fund 2 (TAFF2)

The Asian Development Bank (ADB), in a press release,

announced the signing of a US$15 million equity

investment in the New Forest’s Tropical Asia Forest Fund

2 (TAFF2) L.P. to support sustainable forestry practices in

Southeast Asia and reduce logging in natural tropical

forests by helping sustainably managed plantation

companies to scale up their operations. The investment

comprises US$5 million from ADB’s ordinary capital

resources and US$10 million from the Australian Climate

Finance Partnership (ACFP) trust fund.

Opportunities for support will be sought in Cambodia,

Indonesia, the Lao People’s Democratic Republic,

Malaysia, Thailand, and Vietnam.

The press release says “Investment in sustainable forestry

is limited in developing countries due to market, political

and natural resource risks,” according to the ADB Private

Sector Investment Funds and Special Initiatives Director,

Janette Hall.

She continued, “ADB’s investment will enable best

practice forestry companies that currently lack access to

growth capital to engage in commercial, sustainable

forestry.

See:

https://www.adb.org/news/adb-invests-tropical-asia-forestfund-2-promote-sustainable-forestry-enhance-biodiversity

5.

MYANMAR

Teak exports

contine – even to countries with

sanctions

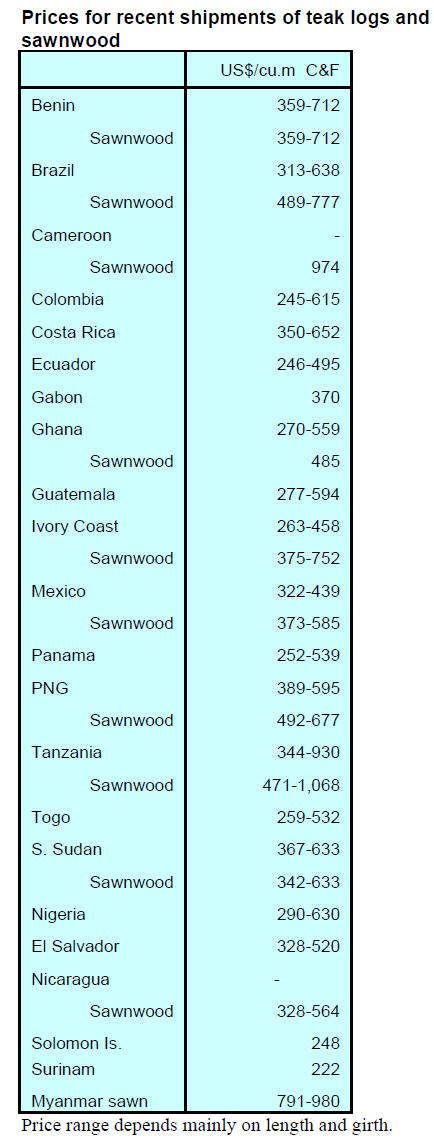

In a media release Forest Trends (FT) has said it recently

found that timber exports from Myanmar worth more than

US$190 million were reported and much of this went to

countries whose governments have applied trade sanctions

potentially exposing companies importing from Myanmar

to penalties.

Forest Trends reports timber exports valued at US$37

million were shipped to countries with sanctions and

US$154 million shipped to China, India, Thailand and

other countries which have not sanctioned MTE.

FT notes “most markets have decreased their imports of

timber from Myanmar since the coup, but others,

including countries with sanctions have increased imports

relative to 2020.

In the US, where almost all imports were in the form of

sawn teak for the luxury yacht market, the number of

companies importing from Myanmar dropped by twothirds

to only 5 importers, yet total trade still increased

slightly.

Five EU Member States, Austria, Belgium, France, the

Netherlands and Poland also showed substantial increases

in imports.

China, which has not imposed sanctions on Myanmar, also

increased imports by 35%. All findings are likely an

underestimate as not all countries have reported trade for

the entirety of 2021”.

See:

https://www.forest-trends.org/pressroom/despite-sanctionson-myanmar-the-us-uk-and-eu-imported-more-than-36-millionin-timber-since-the-coup-exposing-traders-to-risk-ofprosecution/

and

https://thediplomat.com/2022/03/myanmar-timber-exportscontinue-despite-western-sanctions-report/

Can teak purchased before sanctions be exported?

According to Myanmar exporters wishing to ship to the

EU they have to process logs for which payment was

made to MTE before 21 April 2021 and for the US, before

21 June 2021. Exporters have indicated that buyers in the

US and EU are very strict on this condition. Because of

this condition the price for teak logs held by private

stockists has increased by about 30%.

Myanmar exporters also expressed their understanding

that the products from the logs for which the payment had

been settled before the respective dates are exempted from

the sanctions. Such assumptions were shared with buyers

who have been accordingly advised by their legal

consultants.

See:

https://www.forest-trends.org/pressroom/despite-sanctionson-myanmar-the-us-uk-and-eu-imported-more-than-36-millionin-timber-since-the-coup-exposing-traders-to-risk-ofprosecution/)

Value of trade falls

The value of Myanmar trade has declined by over US$765

million over the past five months of the current 2021-2022

fiscal year when compared to the same period of the

previous year according to the figures released by the

Ministry of Commerce.

From 1 October 2021 to 18 February 2022 the total trade

value was US$11.958 billion while in the same period in

the last fiscal it was US$12.724 billion. Myanmar exports

agricultural products, animal products, marine products,

mineral products, forest products, finished industrial goods

(CMP) and other goods. When it comes to imports the

country mainly imports capital goods, raw materials for

businesses and consumer products.

See:

https://elevenmyanmar.com/news/myanmars-trade-valuefalls-over-765m-in-five-months-compared-to-same-period-ofprevious-fiscal

)

Baht and kyat for direct payment at border

Central Bank (CB) of Myanmar issued notification dated 3

March on the use of Thai baht and Myanmar kyat for

direct payment at Myanmar-Thai border. The Central

Bank stated that this is an effort to facilitate bilateral trade

and to promote the use of the local currency.

According to the objectives of Asean financial integration

initiative the Central Bank of Myanmar is allowed the use

of Thai baht and Myanmar kyat for direct payment at the

Myanmar-Thai border.

In related news, the Bank issued a notification in

December 2021 on the use of the Chinese yuan and

Myanmar kyat for direct payment at Myanmar-China

border.

See:

https://elevenmyanmar.com/news/central-bank-ofmyanmarthe-use-of-thai-baht-and-myanmar-kyat-for-directpayment-at-myanmar-thai)

Myanmar considers digital currency

A spokesman for the State Administration Council says

the government plans to establish a digital currency to

support domestic payments and boost the economy within

the year and is assessing how to move forward.

See:

https://www.mizzima.com/article/myanmar-junta-lookingintroduce-digital-currency

6. INDIA

Life beginning to

return to normal

India’s daily coronavirus infections rose by less than

10,000 per day in early March, a level last seen in late

December 2021 before the rapid spread of the Omicron

variant, according to the Union Health Ministry.

Nearly two years after India went into lockdown to slow

the spread of COVID-19 students are heading back to

school across the vast country, a sign of normal life

resuming as infection rates fall. Similar signs of normal

are everywhere, roads and trains are packed as people

travel to work.

See:

https://www.aljazeera.com/gallery/2022/3/2/photos-indianormal-life-two-years-covid-lockdowns

Cost of imports set to rise

India’s economy lost momentum in the last quarter of

2021 with growth slowing from previous two quarters and

the prospects are bleak as it is likely that energy costs and

the cost of other imports will rise because of the global

reaction to Russia’s invasion of Ukraine.

Gross domestic product rose 5.4% year-on-year in the

October-December period and below the 8.5% growth in

July-September and 20.3% April-June quarters.

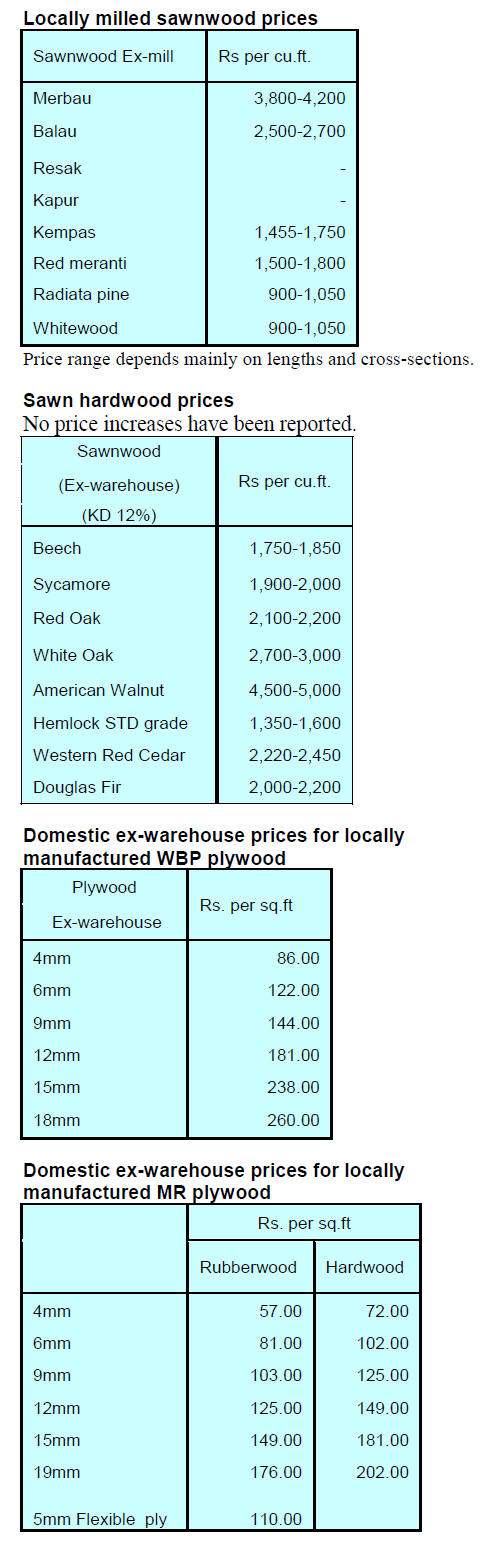

Growing demand for imported particleboard

The Indian trade magazine Plyreporter has said currently

there is a huge demand for woodbased particleboard in the

Indian market due to firm demand from furniture makers.

To satisfy production requirements manufacturers have

turned to imports especially as container freight rates have

eased making imports from regional producers viable.

Despite having more than 60 particleboard manufacturing

plants in the country quality furniture makers in India are

still keen to utilse imported particleboard.

Green affordable housing

Recently, an outreach programme to create awareness for

green affordable housing was launched. In 2017 the Indian

Prime Minister and the Presidents of the European Council

and European Commission adopted a joint declaration on

a ‘Partnership for Smart and Sustainable

Urbanisation‘. This partnership supports smart and

sustainable cities, promotes investments in sustainable

urbanisation, climate action and disaster risk reduction.

See:

https://ec.europa.eu/regional_policy/en/policy/cooperation/international/india/

7.

VIETNAM

Trade highlights

In 2021 Vietnam’s wood and wood products (W&WP)

exports to Russia totaled at US$7.3 million (mostly

wooden furniture) and imports were valued at US$55

million (mainly birch and pine sawnwood, veneer and

plywood). Vietnam is in need of Russian birch veneer as

the face for plywood for furniture manufacturing. As a top

wood supplier of the world the Russia – Ukraine conflicts

threatens to disrupt the supply of wood raw materials for

Vietnamese wood industries.

Exports of W&WPs to the Japanese market in February

2022 were valued at US$109 million, up 31% compared to

February 2021. In the first two months of 2022 W&WP

exports to Japan reached US$262 million, up 22% over the

same period in 2021.

Exports of living and dining-room furniture in February

2022 are estimated at US$230 million, up 13% compared

to February 2021. In the first 2 months of 2022 the exports

of these two wooden commodities are estimated at

US$552 million, showing an increase of 8.8% over the

same period in 2021.

Imports of W&WPs in February 2022 reached US$240

million, down 4% in value compared to January 2022 but

compared to February 2021 W&WP imports increased by

25% in value.

In February 2022 exports of rattan, bamboo and other

NTFPs reached US$70 million, down 35% compared to

January 2022 but up 38% compared to February 2021.

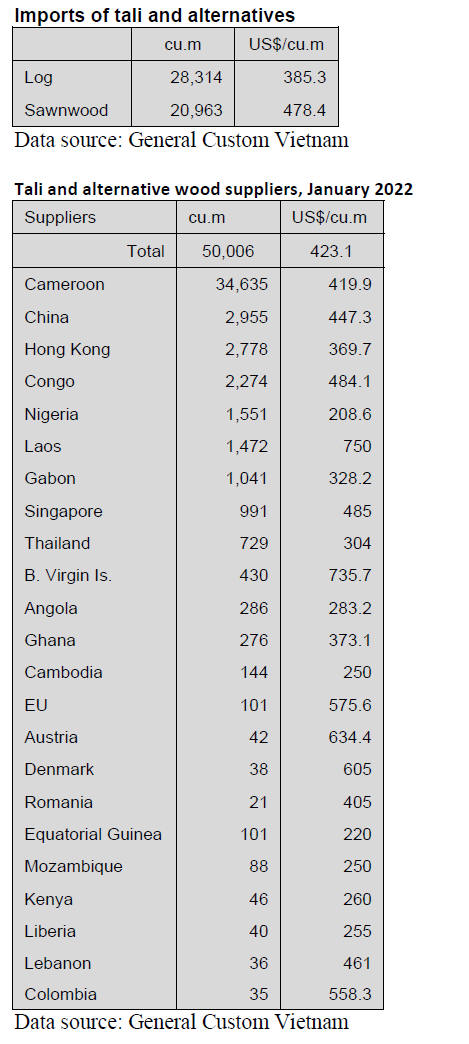

Vietnam's import of tali wood in February 2022 has been

reported at 47,900 cu.m, worth US$20.3 million, down 4%

in volume and 4% in value compared to January 2022.

However, compared to February 2021 imports of tali

increased by 14.5% in volume and 19% in value.

Sanctions on Russia to adversely impact timber

industries

The Russia’s invasion of Ukraine along with the sanctions

imposed on Russia by the United States the EU and others

will have a big impact on the global wood processing and

export industries.

Assessing the risks and identifying solutions relating to

mechanisms and policies to help wood enterprises reduce

the negative the impact from the conflict took centre stage

at an online seminar held in early March by the Vietnam

Timber and Forest Product Association (VIETFOREST)

in co-ordination with the General Department of Forestry

and the Ministry of Agriculture and Rural Development

(MARD).

Vo Quang Ha, General Director of Tan Vinh Cuu Joint

Stock Company, said,”Birch supplies from Russia must be

balanced but we can still have it whether we depend on

Chinese sources or buy it directly. He noted prices have

started to rise.

Phan Thi Thu Trang, Head of An Lac Wood Import-

Export Department, said, "Wood materials from Ukraine

in the past year have sharply increased but the war in

Ukraine will result in price increases”.

According to Vu Hai Bang, Chairman of the Board of

Directors of Woodsland Company, the shortage of wood

supply from Russia may create new demands for

alternative types of imports from Eastern European

countries. It is possible that Vietnamese wood sourced

from planted forests can become one of the alternative

sources of timber therefore it can be viewed as necessary

to devise policies aimed at supporting businesses in

ensuring this supply.

"Fortunately, Vietnamese businesses that have locally

grown wood and relatively stable prices over the years

have not had to pay for shipping. Therefore, the MARD

should have support policies to help wood processing

enterprises maintain the domestic wood supply,"

emphasised Bang.

Bui Chinh Nghia, Deputy Head of the General Department

of Forestry said that it is impossible to predict how long

the conflict will last and how serious the ultimate impact

of it will be. Due to this it can be viewed as necessary to

adopt timely mechanisms and policies aimed at helping

timber businesses reduce the negative impacts thereby

contributing to the wood industry's sustainable

development in the future.

According to Nghia, it remains essential to have a specific

assessment and be increasingly proactive to get the best

adaptations for the local wood and forest product

processing industry.

The General Department of Forestry and the MARD is

ready to review all opinions then produce a joint report

featuring specific proposals and recommendations

regarding adaptation to the emerging supply issues.

See:https://english.vov.vn/en/economy/russia-ukraine-conflictadversely-impacts-vietnamese-wood-industry-post929346.vov

Rising exports of wood chips to Japan

Exports of W&WPs from Vietnam to Japan in February

2022 reached US$109 million, up 31% compared to

January 2021.

W&WP exports to Japan surged due to the increased

export of woodchips which is also the main wood product

exported from Vietnam to Japan with a 35% share of the

total exports to Japan.

In addition to woodchips Vietnam exports wooden

furniture to Japan. The export of wooden furniture to the

Japanese market dropped in January 2022 as a result of the

pandemic.

Japan has become one of the world's largest renewable

energy markets and Vietnam’s exports of wood pellets to

Japan are expected to rise significantly in the coming

years.

Imports of tali and alternative such as ironwood

Vietnam's imports of tali and alternatives in February were

estimated at 47,900 cu.m worth US$20.3 million, down

4% in volume and 4% in value compared to January.

The wide variation in prices US$255 – 750 per cu.m

is

explained by market preference. The price of tropical hard

wood from Laos can be 3 - 4 times higher than of African

timbers. Vietnamese hardwood are even more expensive

than that of Laos having a much sought after beautiful

texture.

Trees in the tropical forests of Vietnam grow slowly than

in Africa and even in mainly because of site conditions

(rocky site, severe climate conditions with long dry season

- quite cool winter and heavy rainy season).

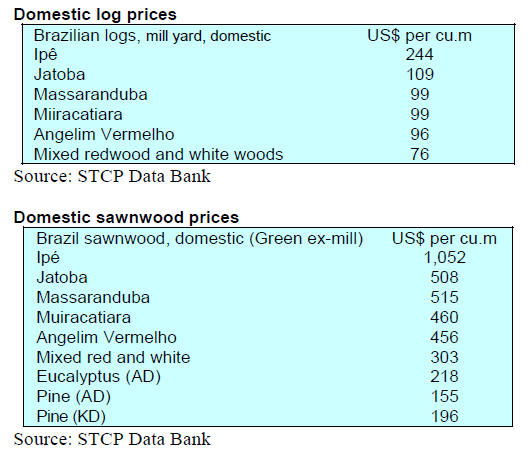

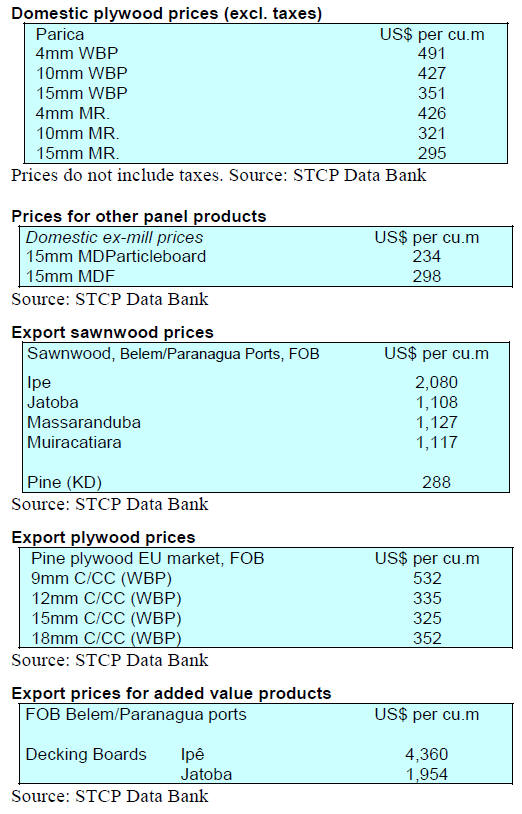

8. BRAZIL

SMEs guarantee legality and

traceability

Strong domestic demand for home renovations associated

with the price increase in civil construction inputs such as

steel and iron caused a rise in prices which carried over to

the timber market. According to the Timber Industry

Union of Northern Mato Grosso State (Sindusmad) prices

for some timbers doubled. Itauba (Mezilaurus itauba) for

example increased from R$2,500 per cu.m to R$5,000 per

cu.m.

In 2021 the 44 municipalities in the Northern Mato Grosso

state which leads the Brazilian timber production from

natural forests through sustainable forest management

produced 35,400 logs with a volume of approximately 4.2

million cubic metres.

A large part of the expanded domestic market can only be

accessed by producers who guarantee the entire product

traceability process but this is difficult for SMEs. A study

carried out by the Getulio Vargas Foundation pointed out

that the difficulties in having a sound tracking system for

SMEs could be addressed through a consortium of

companies operating a “joint supply system” to meet the

demands of buyers.

In related news, there are government programmes to

strengthen management in SMEs. One example is the

School Furniture Regionalisation Programme (Programa

de Regionalização de Mobiliário Escolar - Promove)

implemented by the state of Amazonas which provides for

the purchase of products from cooperatives and furniture

associations that use raw material from companies with

sustainable forest management plans.

Forest concession bidding process explained

The Brazilian Forest Service (SFB), the Brazilian

Development Bank (BNDES) and the Investment

Partnerships Program (Programa de Parcerias de

Investimentos - PPI) will, in the first half of March 2022

hold a round of meetings with potential investors for the

Concession of the National Forests (Floresta Nacional –

FLONA) of the South region: FLONA de Irati, FLONA de

Chapecó and Tres Barras’ FLONA de Três Barras.

The meeting with potential investors aimed to clarify

doubts about the concessions and the bidding process

related to the public notice for concession in the National

Forests of the FLONAs. The forest concessions initiative

aims to ensure the management of planted forests and the

restoration and conservation of FLONAs through publicprivate

partnerships.

The FLONAs are located in the municipalities of Chapeco,

Guatambu and Tres Barras in the state of Santa Catarina

and in the municipalities of Fernandes Pinheiro and

Teixeira Soares in the state of Parana. The new forest

concession model allows the commercial use of planted

forests and their recovery through silviculture with native

timber species or forest restoration with the original

vegetation of the Atlantic Forest.

Furniture exports a record in 2021

Brazilian furniture exports grew 51% in 2021 reaching

US$1 billion compared to the US$679 million in 2020.

Furniture exports from Rio Grande do Sul, one of the

largest furniture manufacturing clusters in Brazil,

increased by 64% year on year totalling almost US$293

million according to Furniture Industry Association of Rio

Grande do Sul (Movergs). This was the best export

performance since 1997.

The ten largest buyers of furniture produced in Rio Grande

do Sul state were the United States, Chile, Peru, Uruguay,

the United Kingdom, Paraguay, Colombia, Bolivia,

Panama and Puerto Rico, representing 81% of total

exports with one third of the total export going to Chile

and the USA.

One of the opportunities for furniture exporting companies

wanting to assess new markets are international fairs. The

joint FIMMA (International Fair of Suppliers of the Wood

and Furniture Production Chain) and Brazil Movelsul

(furniture fair in Latin America) is scheduled for mid-

March 2022 in Bento Gonçalves.

FIMMA is focused on exhibitors of machinery, production

inputs, services and accessories and Brazil Movelsul

brings together furniture, design and decoration

companies.

Acre - record trade balance

The state of Acre, one of the main producer states of

tropical timber in the Amazon, started 2022 with a positive

trade balance. According to the Ministry of Economy in

January Acre exported US$4.2 million and imported

US$77,000. This amount represents a new record for its

foreign trade for the month of January. Timber and wood

products accounted for 54% of exports along with brazil

nuts (27%).

9. PERU

Expand timber sector for job

creation

The wood processing industry has the potential to generate

around 400,00 formal and decentralised jobs which would

benefit regional development, tax collection and fiscal

control according to the president of the Association of

Exporters (ADEX), Erik Fischer Llanos in a meeting with

the executive director of the National Forest and Wildlife

Service (SERFOR), Levin Rojas Meléndez. Fischer said

wood processing requires a lot of labour and even low

skilled workers can be trained.

Regarding foreign trade, he noted that shipments of wood

products generate at least 302 jobs for every million new

sol exported. Only traditional agriculture (635) and

clothing stores (329) surpass it in that ranking.

The forestry sector, he added, promotes the formalisation

of the entire production chain as the companies have all

their workers on the payroll with social benefits. In

addition workers bank their payments. Expanding the

forestry and wood processing sectors offers a great

opportunity for the country.

To capture the opportunities Fischer considered it essential

that the new processes for forest concessions be

implemented and concession should be granted only to

companies with adequate technical, managerial and

financial resources. Fischer noted that under the previous

conession arrangement around 7.5 million hectares was

allocated but only around 2 million were operational.

He added, the presence of the private timber industries in

the forest ensures forest sustainability sticking to

management plans, by not allowing a change in land use

and guards against illegal felling and mining.

Forest zoning must value forests

A regulation on forest zoning will provide for establishing

basic guidelines that allow granting rights for the use of

these resources and will ensure their responsible use

according to Manager of Services and Extractive

Industries in the Association of Exporters (ADEX), Lucía

Rodríguez. However, she added, currently there are

elements in the regulation that, far from valuing the

enormous potential of the Amazon, threaten its

sustainability.

This is the case of the categorisation of Category 1 Forests

(permanent production forests from which raw material for

the wood industry is extracted). The Methodological

Guide for Forest Zoning, prepared by Serfor indicates that,

to be considered category 1, the average potential timber

volume must be greater than or equal to 90 cu.m per

hectare which is unrealistic and would affect the

productivity of formal companies in the sector.

Faced with this situation organisations such as the

National Forestry Confederation of Peru (Conafor), the

Association of the Forestry Sector of Loreto (Aseforel)

and the Association of Forestry and Wildlife Regents of

Loreto (Areffal) issued a statement rejecting the first stage

of the Forest Zoning in the Loreto region.

Rodríguez added “Technical criteria were not used to

differentiate the types of forests in the area but everything

was standardised and most of the areas have been declared

as fragile or reserve areas. This violates the ancestral

rights of indigenous peoples, who have the right to prior

consultation, in addition to not allowing any type of use of

forest products”.

UK to promote agroforestry in native communities

A project "Mitigation of climate change with inclusive

sustainable agroforestry businesses that contributes to the

development of "Good Living" of the Indigenous Peoples

in the Peruvian Amazon" is financed by the UK PACT and

implemented by the Peruvian NGO Association for

Research and Integral Development (AIDER).

Activities began in January this year and will last for

twelve months with the objective of strengthening the

capacities of small agroforestry producers in nine native

communities of the Shipibo-Conibo and Cacataibo ethnic

groups, in Ucayali and the Ese'Eja in Madre de Dios.

The Chamber of Commerce of the Indigenous Peoples of

Peru (CCPIP) and the company Bosques Amazónicos

SAC (BAM) are associated with this project. CCPIP will

design commercial proposals for native communities that

promote ‘Good Living’ so agricultural and forestry

products can contribute to the sustainable development of

native communities. BAM will prepare investment plans

for native communities that incorporate carbon

sequestration in their agroforestry plots.