Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Feb

2022

Japan Yen 115.54

Reports From Japan

Supply problems affect factory

production

An article prepared for Seeking Alpha by IHS Markit

discusses the issues driving the February Jibun Bank

Manufacturing PMI which was at 52.9 down from 55.4 in

January. Factory production levels fell in February in

response to supply chain problems and these had a knockon

impact on producer input prices which jumped to the

highest level in over a decade.

Seeking Alpha says ¡°The biggest drag on the headline

PMI in February was a fall in manufacturing output, as the

Omicron wave of the COVID-19 virus disrupted

production and supply chains¡±.

See:

https://seekingalpha.com/article/4488809-japanmanufacturing-output-falls-prices-rise-amid-worsening-supplysituation

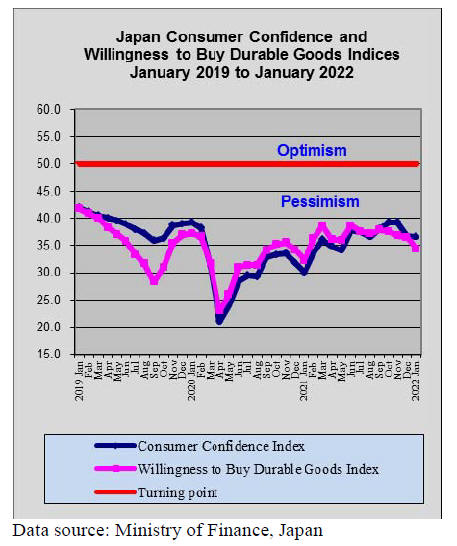

Consumer spending dips

In mid-February the government lowered its assessment of

prospects for the economy noting that consumer spending

has dropped. This downgrade was the first in five months.

Prospects for residential construction was also

downgraded on the basis of fewer housing starts. On the

other hand prospects for business investment were

upgraded.

The government warned of risks from the impact of the

Omicron variant, supply-chain disruptions and rising rawmaterial

costs. This report was published before Russia

began what appears to be a full scale invasion of Ukraine.

See:https://www3.nhk.or.jp/nhkworld/en/news/20220218_25/

Businesses wary of economic security legislation

The government will soon introduce legislation to

strengthen the country¡¯s economic security. This has

received mixed reaction from the private sector. While

recognising the importance of economic security business

leaders are concerned that government intervention may

disrupt business activities.

The economic security bill is expected to address four

issues:

security of key infrastructure

supply chain stability

public-private development of new technologies

securing patents on sensitive technologies

Businesses are aware this will result in a burden on

them.

For example the government is expected to require

companies in certain sectors to report on plans to install

infrastructure management systems identifying the

suppliers so they can be screened.

See:

https://www.japantimes.co.jp/news/2022/02/14/business/economic-security-law-business-worries/

Russia sanctioned

Japan imposed economic sanctions on Russia and two pro-

Russian separatist regions in Eastern Ukraine after Russia

recognised these two areas as independent and ordered

troops to invade. Japan has condemned the latest Russian

attacks on Ukraine as a violation of the sovereignty and

territorial integrity of the country as well as international

law.

As a result of further Russian aggression Japan joined the

US and European countries in imposing additional

sanctions. Russia is the second largest sawnwood supplier

to Japan after the EU. There is no news as yet on whether

this trade will be affected by Japanese sanctions or

retaliation by Russia.

Energy prices a 41 year high

Consumer inflation rose in January from a year earlier as

energy prices rose to the highest in 41 years. The Ministry

of Internal Affairs says the Consumer Price Index,

excluding fresh food, was up 0.2% in January from a year

earlier. The index rose for the fifth straight month.

Gasoline was up 22%, electricity bills rose 15.9% and gas

prices rose almost 18%. Overall, energy prices surged 17.9

percent, the biggest jump since January 1981 when Japan

faced its second oil crisis.

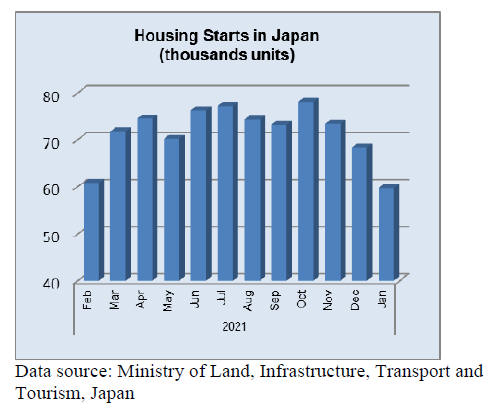

Housing starts

From a peak in October housing starts in Japan have been

steadily falling. Construction activity always slows during

the Japanese winter and the January housing starts data are

much the same as in January 2020.

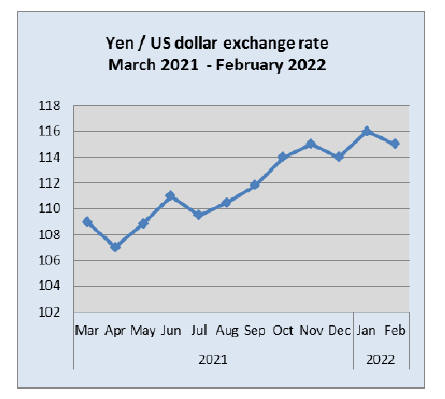

Expect currency volatilty

The US dollar jumped to its highest level in nearly two

years and the Russian rouble plunged to a record low after

Russia launched an invasion of Ukraine as investors fled

to ¡®safe-haven¡¯ assets.

Against other ¡®safe-havens¡¯ the dollar rose 1% against the

Swiss franc while the Japanese yen weakened 0.52%

against the US dollar to over just 115 per dollar.

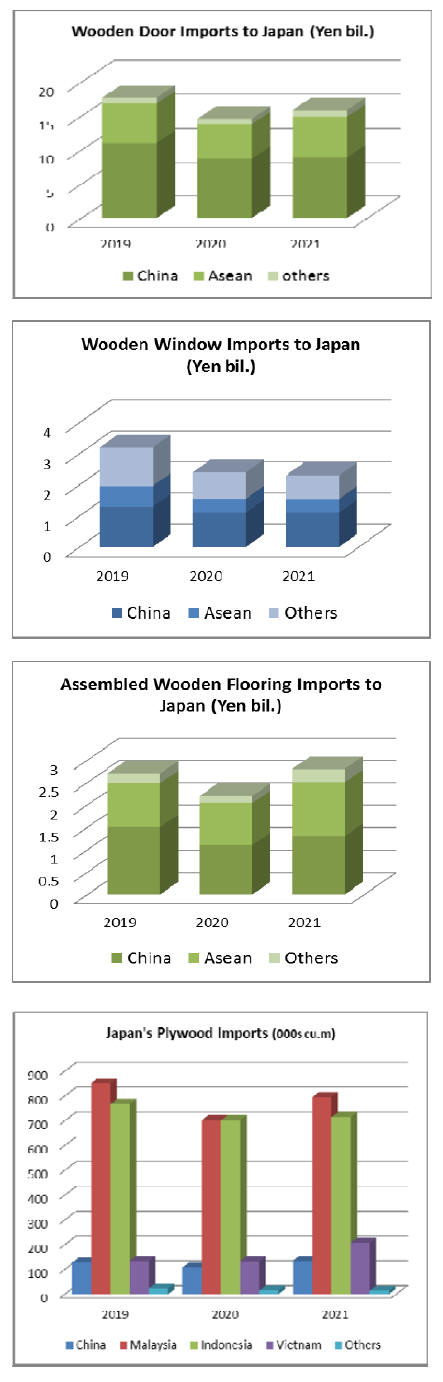

Import update

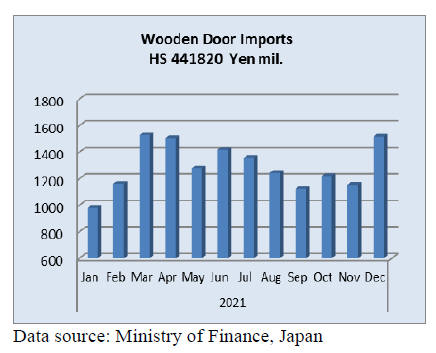

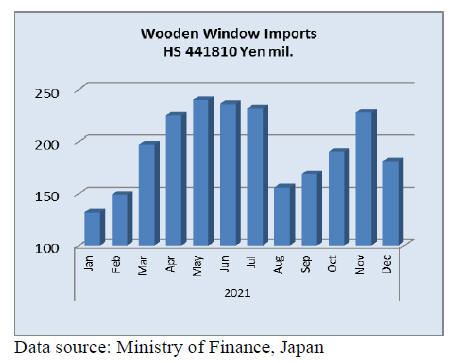

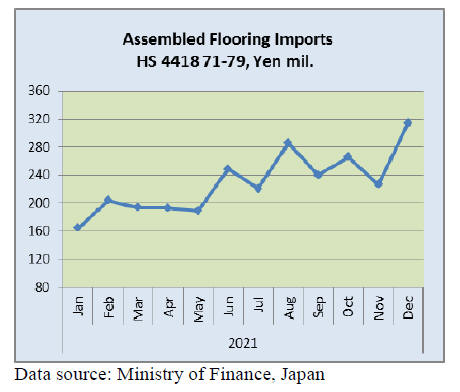

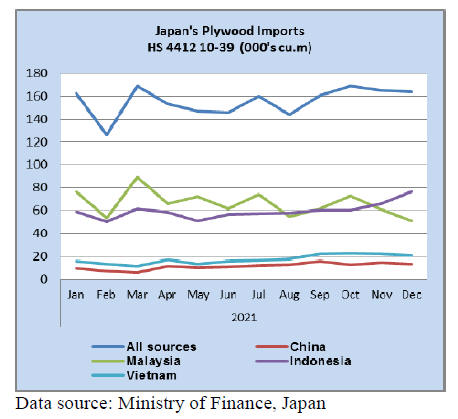

Trends in imports of builders¡¯ woodwork and plywood are

illustrated below. There was a modest recovery in imports

in 2021 compared to a year earlier for wooden doors,

assembled flooring and plywood. Yet to catch up is

imports of wooden windows the value for which still

hovers at 2020 level.

However, it was only imports of assembled flooring that

edged a little higher compared to levels in pre-pandemic

2019. The value of wooden door and wooden windows

and the volume of plywood imports still have a way to go

to get back to pre-pandemic levels.

A remarkable feature of the illustrations below is that

manufacturers in China and ASEAN countries dominate

Japan¡¯s imports of the featured products.

December wooden door Imports (HS441820)

In December shipments of wooden doors (HS441820)

from China accounted for 53% of all Japan¡¯s wooden door

imports. The other main shippers in December were the

Philippines (29%) and Indonesia (8%).

Year on year, December 2021 wooden door imports were

10% higher than in 2021 but 31% higher than in

November 2021. The rise in December 2021 imports of

wooden doors marked a major turning point in the year

after a clear downward trend.

December wooden window imports (HS441810)

Up until the December 2021 decline the value of Japan¡¯s

wooden door imports (HS441810) had been steadily

rising since August 2021 to reach a high in November of

the same year.

The correction arrived in December 2021 when compared

to the value of November imports there was a 21% decline

in December. Year on year, December 2021 imports were

10% down. Around 46% of wooden window imports came

from China with a further 22% from the Philippines and

12% from Sweden.

December assembled wooden flooring imports

The value of Japan¡¯s assembled wooden flooring imports

(HS441871-79) have steadily trended upwards from May

2021 and the rise in December 2021 which was more

noticeable than in previous months has added to this

upward momentum.

The main category of assembled flooring imported by

Japan is HS441875 accounting for around 74% of

December 2021 imports with the main suppliers being

China and Vietnam and Malaysia. The second ranked

category in terms of value of imports was HS441879

shipped mainly from China, Thailand and Vietnam.

Compared to December 2020 imports of assembled

wooden flooring more than doubled in December 2021

and compared to a month erlier, December imports

jumped 38%.

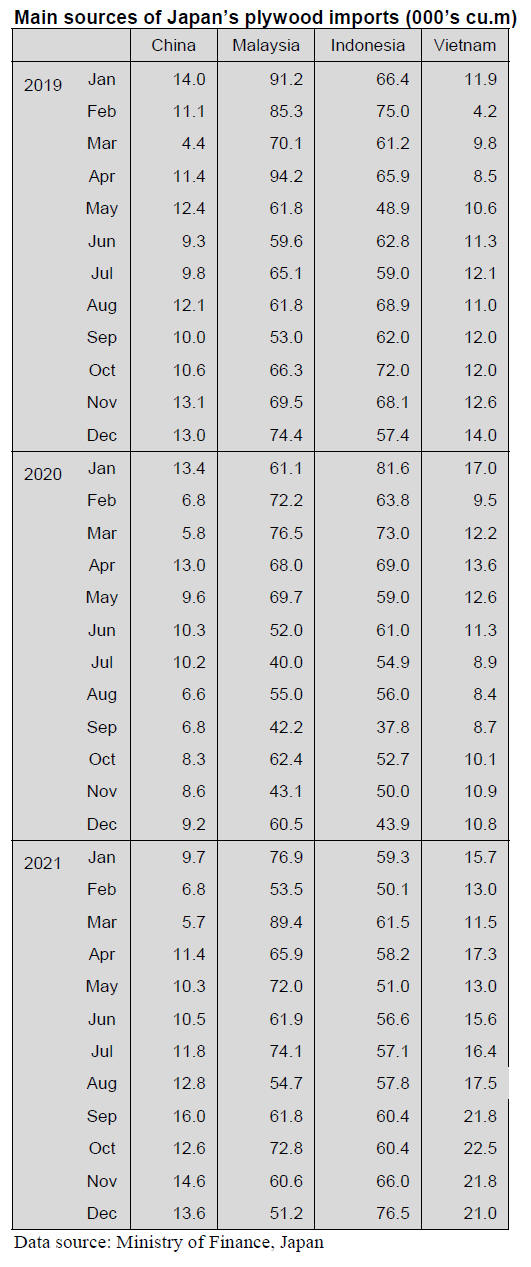

December plywood imports

In the last quarter of 2021 Japan¡¯s imports of plywood

have risen sharply as the country experienced a surge in

demand for plywood and was unable to meet this demand

from milling domestic logs. Year on year, the December

2021 volume of imports of plywood (HS441210-39)

jumped 30% but there was little change in the volume of

imports compared to November.

Indonesia and Malaysia dominate the supply of plywood

to Japan and in December shipments from Indonesia rose

compared to a month earlier but shipments from Malaysia

dropped.

Of the various categories of plywood imported in

December 2021(as in other months) HS441231 was the

most common accounting for almost 90% of imports.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Total wood product imports in 2021

Here is a result of imported logs, lumber, boards and

construction laminated lumber in 2021. The total volume

of all categories is 4.7% more than 2020. It is recovering

slightly from 2020¡¯s result. People had attention on

volume of imports from North America, Europe and New

Zealand because the 3rd wood shock occurred in Japan.

The grand total of logs is almost 18% increased because

logs imported from Canada increased. The grand total of

lumber is just only 4% decreased, not as much as people

were concerned about an influence on confusions of

delayed containers.

The delivery of plywood was good but construction

laminated lumber decreased nearly by 9%. People had

worried about the volume of imports would be over 10%

decreasing due to the 3rd wood shock, but it did not.

The volume of Douglas fir logs from North America

increased 25% from 2020. However, lumber was as same

as 2020¡¯s. Since demands in the U.S.A. were lively, the

exporting Japan decreased. There are negative factors like,

supply companies were limited, a natural environment had

changed and there were problems of labors at ports.

The volume of logs from the U.S.A. were almost as same

as last year. However, the logs from Canada increased

instead of the U.S.A. It was 460,000 cbms increased. Total

volume of logs and lumber from Canada to Japan were

more than the U.S.A. as a result.

Lumber from Europe decreased 7.2%. One of reasons is

that time lag from contracts and actual ariivals is longer

and unpredictable. Construction laminated lumber

decreased by 9%, but it is nearly the average volume

during 2017 and 2019 so it is not a bad situation.

Logs from New Zealand and lumber from Chili were

almost same volume as 2020¡¯s. However, the importing

costs in Japan could change easily by the prices of logs for

China from New Zealand.

Tropical hardwood plywood and Russian logs became a

level of 20,000 ¨C 30,000 cbms. This is due to export

restrictions in Russia and less demands in Japan.

The volume of imported plywood increased about 19%

even though people in Japan were anxious about not

enough volume. MDF was only 2 % decreasing although

there were a lot of demands in overseas and confusion on

transporting. OSB seemed growing market but there was a

limit of supplying in overseas.

South Sea logs and lumber

Not only logs but also supply in Japan is still low. The

lumbering companies in Japan have a difficulty in

producing due to a delay which caused by a lack of

containers. There is another reason such as not enough

trucks. However, lumbering companies in Japan control on

balancing product and demand even though the situation is

difficult.

Malaysia and Papua New Guinea are in rainy season so

the volume of shipping is low. It is not easy to book

vessels because demands in Japan are not much. Some

Japanese lumbering companies try to buy South Sea logs

from Taiwan but the importing costs are high.

People are hopeless for the volume of imported South Sea

logs from Sabah, Malaysia. The demand will be stayed

low in this year as well as last year.

Movements of South Sea hardwood lumber from China

had calmed down. There are enough inventory so new

orders have settled down in Japan. However, the prices in

South Asia are still high because of the prices of red pine

lumber from Russia and freights in China.

The movement of South Sea hardwood lumber would be

slow due to a lack of trucks in South East Asia.

Demand for South Sea hardwood logs in Japan would stay

low for all through this year. Movement of Chinese made

laminated free board has been quiet. Red pine lumber

prices are US$1,030-1,050 per cbm C&F. Indonesian

mercusii pine lumber prices are US$960-990 per cbm

C&F.

Use of domestic lumber for housing

Wooden Home Builders Association of Japan announced

use of domestic lumber in 2020 of housing companies.

48.5% of domestic lumber were used. The investigation in

2017, which was as last time, was 46.2%. 2.3% increased

at this time. This is the highest percentage in past six

times. Domestic laminated cedar lumber and LVL

increased a lot. The investigation was started in 2006, and

held in every three years.

49.5% of domestic lumber were used as pos. It was 41.5%

at last time. It is increase for three straight times.

Laminated cedar lumber was 30.9%. It was 20.7% in last

survey. Laminated redwood lumber was 36.6%, 40.3%

was the last time and laminated whitewood lumber was

13.8% decreasing from 17.2% in 2017.

It was 74.6% used for foundation and increased from

69.4%. Share of KD cypress was 44.2% increased from

38.6% last time. Beams of domestic species decreased to

9.2% from 9.8% in last time. Douglas fir was 19.3% and it

was 24% last time.

Laminated redwood beam lumber 52.9% decreasing from

54.1% but laminated whitewood increased to 9.2% from

4.7% in 2017. Stud from domestic species were 71.9%

increased from 56.6%. Especially, LVL were 36.6%

jumped from 0.3%. Brace was 17.6% and small sized

lumber was 48% increasing from 43.9%.

Laminated cedar lumber was 34.8% increased from

29.6%. Laminated whitewood lumber was 11.4%

increased from 8%.

North American log market

The suppliers¡¯ log purchase prices in January climbed by

about US$300 compared to last December prices so the

increase of export prices would be certainly up but steep

price increase at one time is hard for the buyers in Japan

so it is reported that February FAS prices on IS sort are up

by US$125 a tUS$1,275 per M Scribner.

With progressing trend of depreciation of the yen, import

cost would be up by 3,000 yen per cbm CIF and with

recovery of lumber of 50%, lumber cost would be up by

about 6,000 yen per cbm. Douglas fir lumber

manufacturers in Japanese are not ready to increase the

sales prices in February yet but the supply side are likely

to increase FAS prices in March to recover the difference

but this is just guess.

Assuming FAS prices go up by US$175 in March,

Douglas fir lumber manufacturers may be forced to

increase the sales prices. It all depends on how log market

and lumber market in North America change at the time of

March log price negotiations.

Future market prices of competing imported redwood

laminated beam is down to 125,000 yen per cbm FOB

truck port yard so Douglas fir lumber mills are worried

about narrowing price difference with redwood laminated

beam.

Douglas fir log prices for plywood mills are related with

Douglas fir log prices for sawmills. If the prices climb

same as sawlogs, February prices would be over US$250

per cbm CIF, which costs over 30,000 yen.

|