|

Report from

North America

Imports gained in 2021

Imports of sawn tropical hardwood grew by 25% in

2021 according to figures released by the US

Department of Agriculture and the US Census

Bureau. The data also show substantial gains over

2020 in several hardwood categories.

Imports of hardwood plywood rose in volume by

32% while spending on imports rose 35% for

hardwood flooring and 64% for assembled flooring

panels. Imports of wooden furniture rose 27% to

nearly US$24 billion in 2021 and cabinet sales grew

by 14.6%. Imports of tropical hardwood veneer,

however, fell by 1%.

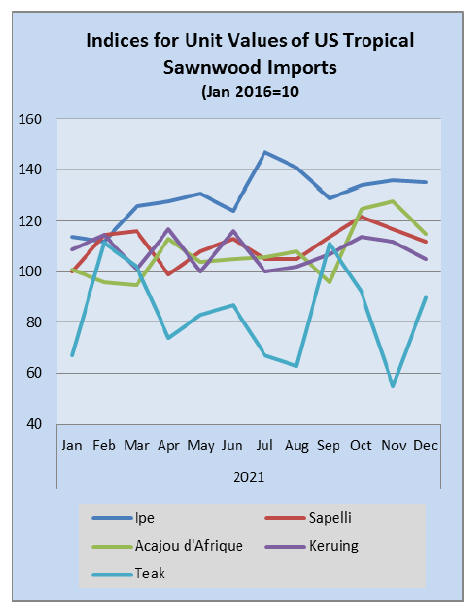

Tropical hardwood imports

US import volumes of sawn tropical hardwood rose

2% in December remaining steady to close out the

year. Imports of Sapelli rose 9% over the previous

month and ended the year 36% higher than 2020.

Imports of Mahogany and Padauk both fell in

December but more than doubled in 2021. Imports of

Balsa fared the worst in 2021, falling by 27%, while

imports of Iroko were down 24% for the year.

Imports of Jatoba fell by 3% in December but grew

by 77% in 2021 and weres by far the most imported

species of the tropical hardwood. Second was Ipe

imports, which rose 63% in December, but ended the

year down 6% from the previous year. (Both Ipe and

Jatoba were removed from the tropical hardwood

imports category by the USDA earlier this year).

Counting Jatoba and Ipe imports, 2021 saw a 25%

gain in US imports of tropical hardwood lumber over

2020 figures.

Canada also saw steady tropical hardwood imports in

December and for the year imported 8% more than in

2020. In 2021, imports from Cameroon grew by 34%

as that country distanced itself as Canada¡¯s top

trading partner, while imports from the US fell 55%

among US/Canada trade dispute.

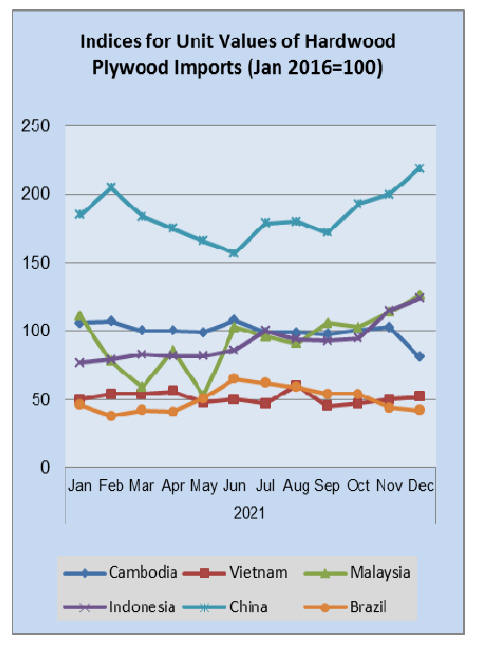

Hardwood plywood imports soar

US imports of hardwood plywood rose 33% in

December to record their highest level in more than

six years. The December import volume of 379,185

cubic metres was the most since June 2015. Imports

from Indonesia jumped by 171% in December and

ended 2021 49% higher for the year as Indonesia

emerged as the top supplier for the US Vietnam was

the second largest supplier, up 30% for the year.

All major supplying countries increased volume by

more than 10% for the year except China which saw

a decline of 1%. Total imports for 2021 were 32%

higher than 2020.

Veneer imports slide

US imports of tropical hardwood veneer fell 27% in

December as 2021 imports came up just short of the

previous year¡¯s totals. Imports from Italy, by far the

top trading partner, fell 60% in December but ended

the year up 11% over their 2020 total.

Imports from China gained 2% in December but for

the year ended down 19%. Imports from Cameroon

in December rallied to their highest month since 2017

but still ended down 2% for all of 2021. Total

imports for 2021 lagged 2020 imports by just under

1%.

Hardwood flooring imports retreat

After a strong November, US imports of hardwood

flooring declined by 21% in December. A monthly

decrease of 16% from Brazil and 28% from Malaysia

lead to the overall drop.

Despite the loss, imports for 2021 surpassed 2020

totals by 35% as imports from Brazil grew by 88%

and imports from Malaysia grew 28%. Imports from

China and Indonesia were both down significantly in

2021 although both saw strong gains in December.

Imports of assembled flooring panels also fell in

December, dropping 7% from November totals.

Vietnam emerged as the top trading partner for the

year after gaining 58% over 2020, while Canada fell

to second after rising only 6% for the year. Total

imports for the year came in up 64% over 2020 as

imports from Brazil increased more than 10 times

and imports from Thailand nearly quadrupled.

Moulding imports reach three-year high

US imports of hardwood moulding rose 23% in

December to their highest level since December

2018. Imports from Malaysia and Brazil both rose

more than 70% for the month.

Imports from Malaysia ended the year up 25% over

the previous year. Imports from Canada, by far the

top trade partner, increased by 51% in 2021 despite

falling 9% in December. Imports from China fell by

39% in 2021 but did manage a 33% increase from

November to December. Overall hardwood

moulding imports rose 27% in 2021.

US wooden furniture imports rise to end record

year

The US imported nearly US$24 billion of wooden

furniture in 2021, an average of just under US$2

billion per month and 27% higher than in 2020.

Imports rose 27% in December to US$1.94 billion as

imports from Vietnam rose 60% for the month.

For the year, Imports from Vietnam, the top US trade

partner, rose by 23%, while imports from Mexico and

India both grew by more than 60%. Imports from

every chief trading partner grew by more than 10% in

2021, with the exception of Malaysia, where imports

rose only 2%.

Cabinet sales rose nearly 15% in 2021

US cabinet manufacturers reported an 1.1% overall

gain in sales in December, according to the Kitchen

Cabinet Manufacturers Association¡¯s (KCMA)

monthly Trend of Business Survey. The month-tomonth

comparison showed stock sales gaining 2.1%,

semi-custom sales rising 0.4%, and custom sales

dropping by 1.8%.

The numbers look much better compared with last

year. The survey showed that participating cabinet

manufacturers reported an increase in overall cabinet

sales of 15.2% for December 2021 compared to the

same month in 2020. Custom sales rose 14.7%, semicustom

sales were up 8.9%, and stock sales jumped

by 19.5%.

December capped a very strong year, with overall

cabinet sales in 2021 up 14.6% when compared to

2020. Custom sales were up 19.5%, semi-custom

sales were up 10.7% and stock sales increased 16.4%

compared to last year.

See:

https://www.kcma.org/news/pressreleases/October_2021_trend_of_busines_press_release

US lumber prices fluctuate wildly

Softwood lumber prices fell 30% over the last two

weeks of January, only to spring back to their

previous levels in early February. Business Insider

reported that lumber hit a low of U$934 per thousand

board feet on 1 February. That was down from

US$1,338 as recently as 14 January. That slump was

the softwood lumber industry¡¯s longest since July,

Bloomberg reported.

The slump was a prospect of a cooling housing

market tied to higher mortgage rates and ongoing

supply-chain issues. Part of the decline has been

attributed to rising mortgage rates, which some

industry experts say will lead to a slowdown in home

sales.

The average 30-year fixed mortgage rate increased 50

basis points to 3.55% between late December 2021

and late January, according to Freddie Mac. The

Mortgage Bankers Association projects that the rate

will climb to 4% by the end of 2022.

But after the brief cool off, softwood lumber futures

rose for each of the first sixth sessions of February

Wednesday, hitting US$1,204.90 per thousand board

feet on February 9.

See:https://www.gobankingrates.com/investing/realestate/lumber-prices-crash-30-as-mortgage-rates-startgoing-up/

|