Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Feb

2022

Japan Yen 115.45

Reports From Japan

Forecast decline in growth in

Q1

Prominent economists have suggested the Japanese

economic growth is likely to decline in the first

quarter of 2022 because the latest surge in Omicron

cases has dented prospects. The number of reported

covid cases in Japan topped 100,000 in early

February as the country struggles to contain a sixth

wave of infections driven by the Omicron variant.

The total number of coronavirus cases reported in

Japan is around 4 million.

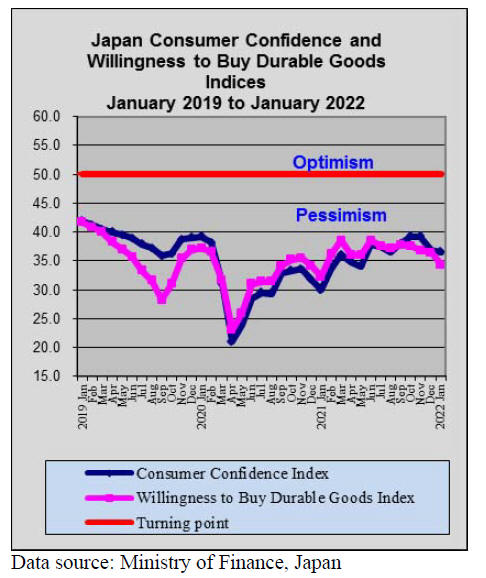

Consumer confidence fell in January suggesting

consumer had cut back on spending. In addition,

prospects for manufacturing output weakened with

one of the top car makers saying it had cut

production. The general view is that until the booster

shot programme is speeded up confidence wil be

undermined.

GDP had a roller coaster ride in 2021 falling an

annualised 2.9% in January¨CMarch 2021 after which

it recovered growing 2% in April¨CJune quarter but

fell back again in the July¨CSeptember quarter only to

move back into positive numbers in the fourth quarter

of the year as restrictions were lifted and the chip and

parts supply issue was partially overcome.

In fiscal 2022 GDP is forecast to increase around 3%

but the full impact of the Omicron variant has not

been factored into this estimate.

See:

https://www.japantimes.co.jp/news/2022/02/02/business/economy-shrink-covid-omicron/

and

See:

https://www.nippon.com/en/in-depth/d00778

More foreigners allowed to enter

The government has changed its view on the entry of

foreigners after lobbying by Japanese businesses.

Masakazu Tokura, chairman of the Japan Business

Federation (Keidanren) said it is unrealistic for the

government to ban the entry of foreign nationals with

the new omicron coronavirus variant having become

prevalent within the country¡±.

On the issue of the government¡¯s suggestion that

wages should be raised by 3% Tokura commented

that having a standard level for wage increases was

unrealistic as conditions vary from company to

company and sector by sector.

Last year major Japanese companies offered the

lowest wage increases (below 2%) in eight years as

the pandemic hit corporate profits.

https://www.japantimes.co.jp/news/2022/01/24/business/keidanren-travel-ban-japan-unrealistic/

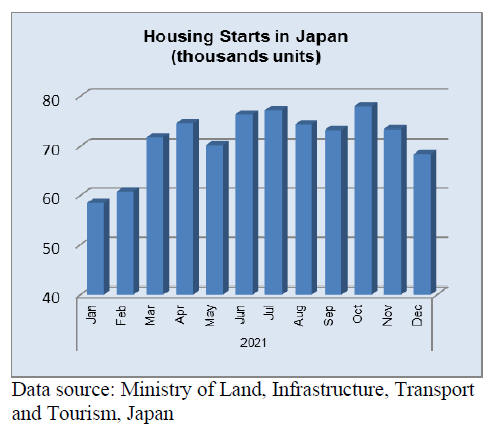

Remote working cause of relocation from Tokyo

More people moved out of Tokyo than moved in

during 2021, the first time this has been recorded.

The Ministry of Internal Affairs and Communications

has reported the number of people moving into

Tokyo outnumbered those leaving by 5,433 last year.

This change if sustained will impact demand for

housing. The capital's total population also declined

for the eighth consecutive month since June 2021,

down 9,872 from the previous month.

A Cabinet Office survey found people who decided

quoted "the implementation of teleworking" was

35.4% before the pandemic, the current figure is at

47.9%.

Yutaka Murayama, a Director General at the Cabinet

Office said, "People who already had an interest in

moving out of the city were prompted to move by the

fact that the coronavirus pandemic made teleworking

in regional areas possible."

Labour shortages and supply side disruptions

could drag down production

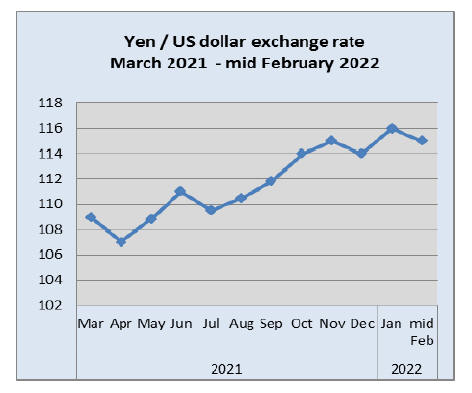

Between January 2021 (a 9-month high) and January

2022 (a 4-year low) the yen depreciated about 13%

against the US dollar but has stablised recently.

Looking ahead to 2022 it is likely that labour

shortages, made worse by self-isolation rules and the

continuing supply side shortages are likely to further

pull down production output thus undermining the

ability of manufacturers/exporters to fully benefit

from a competitively priced yen.

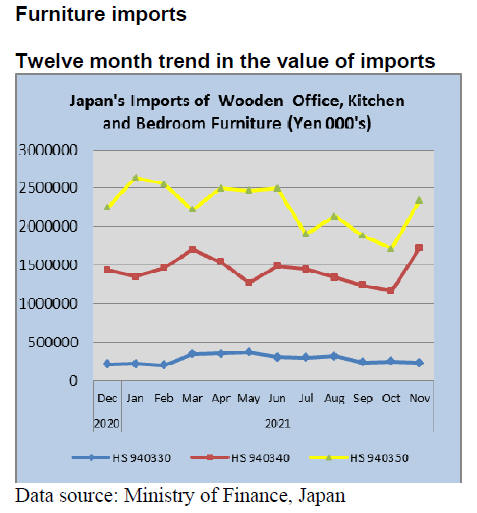

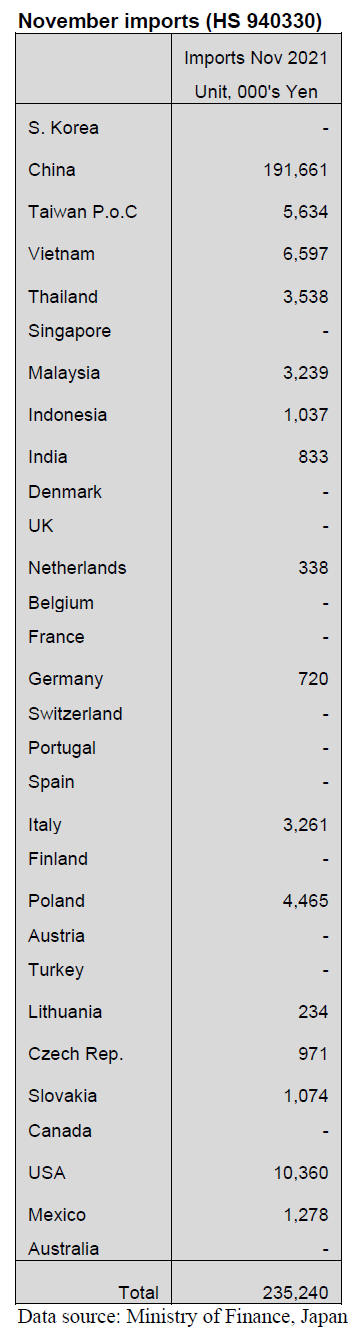

Office furniture imports (HS 940330)

The value of Japan¡¯s wooden office furniture imports

(HS940330) remained on a steady track throughout

2021 and are set to end the year higher than in 2020

and even higher than in 2019.

In November 2021 the year on year value of imports

of wooden office furniture were 15% up on 2020 but

compared to the value of October¡¯s imports there was

a 7% decline.

The top shipper of wooden office furniture to Japan

in November 2021 was China taking an 82% share

of the total value of wooden office furniture imports.

This was a significant rise on the 66% share in

October this year.

The US was the second ranked supplier in November

providing a further 4% of imports but this was less

than half than in October. Imports from Taiwan P.o.C

dropped by half in November and there were small

imports from Vietnam, Poland and Thailand.

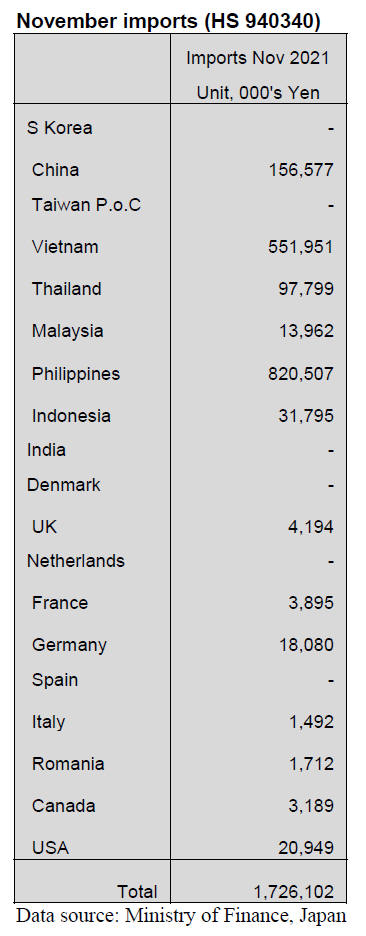

Kitchen furniture imports (HS 940340)

After four months of steady decline the value of

Japan¡¯s imports of wooden kitchen furniture

(HS940340) more than doubled in November and

year on year there was a 20% increase in imports in

November last year. Monthly imports of wooden

kitchen furniture were volatile in 2021 moving from

peaks and dips, unlike the more steady flow of

imports in 2019. The value of imports in the first 11

months of 2021 were higher than in 2020 and had

reached almost the same level as in 2019.

Year on year, the value of November 2021 imports

was 20% up on November 2020 with the Philippines

being the major shipper accounting for around 48%

of November 2021 import values. Shippers in

Vietnam came a close second in November

accounting for 32% of imports with China

acoounting for a further 9%.

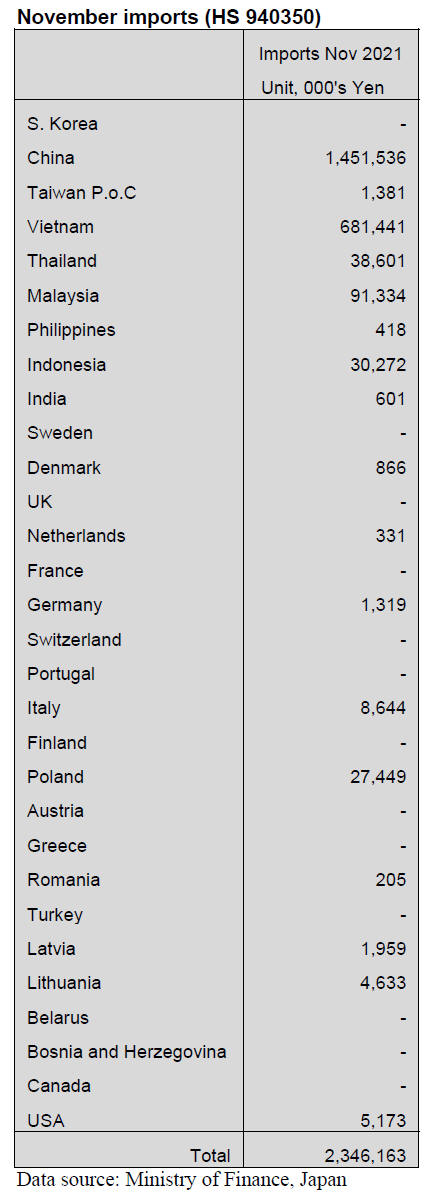

Bedroom furniture imports (HS 940350)

Since mid-2021 there has been a downward trend in

the value of Japan¡¯s imports of wooden bedroom

furniture (HS940350) but this was reversed in

November when the value of Japan¡¯s imports shot

higher. Compared to October there was a more than

35% rise in the value of November imports.

In the first 11 months of 2021 the value of imports

of

wooden bedroom furniture was around 7% higher

than in 2020 but had recovered to the same level as in

2019.

The top suppliers in terms of value in November, as

was the case throughout 2021,were were China 62%

(72% in October) and Vietnam 29% (20% in

October).

Shipments from both China and Vietnam in October

were down being impacted mainly by logistic

problems. With these two main shippers accounting

for over 90% of the value of November imports,

other shippers had to be content with small

shipments. Only shippers in Thailand managed to

maintain the same level of exports to Japan in

November.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription

trade journal published every two weeks in English,

is generously allowing the ITTO Tropical Timber

Market Report to reproduce news on the Japanese

market precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Projection of import wood products

The Japan Lumber Importers Association disclosed

projection of imported wood products for the first

half of this year. It becomes obvious that log import

will decrease after Russia bans log export so North

America becomes main source of log import. On

lumber import, North America and Europe hold 74%

of lumber supply share.

Estimated volume will exceed last year¡¯s volume

except for South Sea lumber. Confusion of supply

chain continues but volume of imported lumber is

increasing at major ports.

Supply of logs and lumber from North America

seems uncertain because of active housing starts in

the U.S.A, and supply is confused by weather factors

like flood and handling at loading ports by lack of

workers and increased cargoes.

European supply should improve but high cost

remains. Russian lumber is expected to recover as it

is all dries products now so increase of supply of stud

and lamina is expected.

Price hike in domestic softwood plywood

Some plywood companies in Eastern and Western

Japan decided to raise the price of 3x6 of 12mm as of

February. The price will be ¥1,600 per sheet

delivered. This is ¥ 100 up from January. As per cbm,

it will be ¥80,000 and this is ¥5,000 up.

Domestic logs are now very high-priced due to tight

supply and the imported logs are high-priced as well.

So the domestic plywood companies had no choice

but to raise the prices. 3x6 of 24mm is ¥3,200, ¥200

up from last month and 3x6 of 28mm is ¥3,750, ¥250

up from last month.

The reason of raising prices is that the prices of logs

increased at the year-end and New Year holiday.

There is a competition for cedar logs for plywood in

Easter Japan by laminated lumber companies. Since

there was a heavy snow covered Eastern Japan, there

were not enough logs at the markets and that made an

increasing price of logs.

The cedar logs for plywood in some areas of Eastern

Japan costs ¥2,500 as per cbm and it is about ¥ 1,000

more than last month. Other areas of Eastern Japan, it

costs ¥17,000 as per cbm because of intensification

of competition by laminated lumber companies.

Plywood companies in Western Japan also try to

collect cedar logs from various markets including

Eastern Japan, so the prices went up as well as

Eastern Japan¡¯s situation. Not only cedar logs, but

also larch logs cost higher. It is ¥20,000 - ¥22,000 as

per cbm, ¥2,000 increased. It is very difficult to buy

cypress logs in Western Japan as well.

The imported Russian larch veneer has not arrived to

Japan on time, which is one of main materials to

produce plywood because of confused of vessels and

bad weather in Russia. It is influencing the

production of laminated 12mm lumber in Japan.

There are not enough supply of logs from North

America and export prices are climbing. So it is very

hard to cover a shortage of logs in Japan. The

demand of plywood in Japan is still lively so the

difficult situation keeps going for some time.

Imported substitution materials like tropical structural

plywood and wooden board also tight in supply so

the market has no choice but to wait for supply from

domestic plywood mills. Like precutting plants,

plywood supply is key to the operations and there is

no complaint on prices.

A delay of vessels

There is still delay of importing European lumber due

to difficulty of loading and unloading at ports in the

world. There is no confusion of production and

transfer from plants to the ports in Europe, but there

is a delay at ports which further stagnate container

handlings.

There are not enough containers as well. This

situation will continue for a while because Chinese

New Year and Beijing Winter Olympics were held in

February which stagnate transshipment of containers.

For example, it takes a week to transport from

northern Europe to Central Europe normally, but it

takes three to four weeks because of shortage of

feeder vessels in Europe. Around Singapore through

China, electric products and food are given priority

on loading and unloading at ports.

Also, a delay occurs at Busan port in Korea and that

makes a schedule of vessels delay to Japan. The other

reason of delay is that the sea around Japan is rough

in winter.

As a result of these confusions, third quarter

contracted cargoes continue arriving through

February and the fourth quarter contracted cargoes

will not arrive Japan until April. Arrival of the first

quarter volume will be in May. In short, the prices of

earlier quarters will influence the market for

prolonged time.

Review of 2021

On 7 January 2021 the state of emergency was

declared on COVID 19 pandemic, which was the

second emergency declaration since April 2020.

Everybody anticipated stormy year with this

declaration since imported wood prices soared with

expansion of the demand in the North America and

China in 2020 and available volume decreased.

However, nobody anticipated that wood products

prices skyrocketed with very tight supply until wood

shock hit the market.

New demand by nesting to avoid pandemic increased

worldwide then unexpected confusion of marine

transport occurred, which resulted in very tight

supply of imported wood products. Grave situation

became apparent in March when container ship ran

aground at the Suez Canal, which blocked canal

traffic.

This is the route of European wood products for

Japan and lamina supply stopped. Major laminated

lumber manufacturers had to reduce the production

and this impacted precutting operations. This created

chaos in the market and precutting plants bought

materials haphazardly and the demand centered on

domestic wood products since imported.

products are not available. Domestic wood products

prices rocketed up. In the third quarter negotiations

with overseas suppliers, volume is priority than

prices. The prices are record high. Canadian SPF

lumber prices shot up to US$1,800 per MBM C&F,

3.6 times higher than the bottom then European

laminated lumber prices soared to Euro 850-1,150

per cbm C&F, two to three time higher.

Supply shortage and higher prices are common on all

the wood products and the market prices increased to

coordinate climbing future contract prices of overseas

products.

There was no resistance to higher prices so the

importers, dealers and precutting plants could pass

higher prices without any problem so they enjoyed

unprecedented profit. In particular, domestic lumber

mills made record breaking profit. However, shortage

of softwood plywood was unexpected incident.

Raw material is 90% domestic wood so supply

shortage of imported wood was thought nothing to do

with domestic plywood supply but the demand was

so large that full production cannot satisfy the

demand. One of the reasons is difficulty of log

procurement because of competition with lumber and

laminated lumber manufacturers.

In short, everything was tight and the prices are high.

Fortunately, house builders accepted higher prices to

secure the necessary materials when demand of house

recovered and house buyers are aware of inflation of

building materials.

Covid 19 pandemic continues worldwide in 2022.

Confusion of marine transport and shortage of

containers seems to continue in 2022. Overshot

prices of wood products are likely to drop but not to

the level before the wood shock days.

Covid 19 pandemic changed housing market.

Because of stay-home quarantine and remote work,

demand of suburban house increased and people are

restricted to travel so they send more money for

house renovation. Not only wood products but prices

of other basic materials such as steel and crude oil

escalated in 2021. Crude oil prices renewed seven

years high in October. Higher oil prices pushed prices

of oil based products such as chemical products like

adhesive.

|