4.

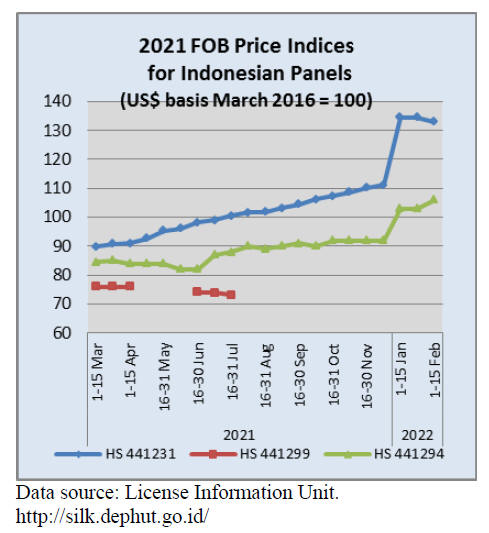

INDONESIA

Furniture factories going under as

shipping costs

soar

Container costs continue to rise and this has become

critical for furniture exporter pushing many SMEs

into bankruptcy. Data compiled by the Indonesian

Furniture and Crafts Industry Association (HIMKI)

shows the cost of container shipments have risen

900% with the current cost for shipping a 40 ft.

container to the US is US$19,100 whereas in 2020 it

was only US$2,000.

The cost for shipping a 20 ft. container is US$15,100,

up 907% from 2020 which was only US$1,500.

Container shipping cost also increased for the EU

market +900%, Middle East +400%, Japan +350%,

Australia +500%. There are difficulties regarding the

availability of containers, especially to America. At

these costs it is not profitable to ship the products.

It has been estimated by the HIMKI that around 25%

of the 2,500 businesses registered as HIMKI

members have gone bankrupt as a result of the high

cost of shipping.

See:

https://www.cnbcindonesia.com/news/20220127131139-4-310925/kiamat-kontainer-serius-pabrik-pabrik-furniturbertumbangan

Indonesia's exports of ‘Light Wood’ products can

grow even more

According to Setyo Wisnu Broto, Chairman of the

Indonesian Lightwood Association (ILWA),

Indonesian exporters have benefitted from the shift

by buyers in N. America from China to Indonesia.

He said two major US buyers are able to absorb as

many as 2,500 containers per month. He said that the

highest demand for ‘Light Wood Products’ is in

America and is said to be worth IDR172 billion of

which Indonesia only supplied a fraction. This must

be increased said Setyo but much will depend on the

availability of raw materials.

See:

https://merahputih.com/post/read/imbas-perangdagang-amerika-dan-tingkok-ekspor-produk-kayu-ringanindonesia-meningkat

Economic recovery appears on track

Febrio Kacaribu, Head of the Fiscal Policy Agency at

the Ministry of Finance, has said the successful

control of the pandemic, public participation in

implementing health protocols and vaccinations, the

effectiveness of fiscal stimulus policies by the

government and good coordination between

ministries has helped accelerate economic recovery.

In 2021 the Indonesian economy grew by 3.69%

which was close to the forecast by the Ministry of

Finance.

In related news the Minister of Finance, Sri Mulyani

Indrawati, expressed optimism that Indonesia’s

economy will grow strongly in the first quarter of

2022 despite the increase in Omicron infections. She

said "If the health protocols are maintained the

impact of the pandemic on the economy will not be

as severe as seen in the first quarter of 2021.

See:

https://en.antaranews.com/news/213069/economicsector-to-show-growth-in-first-quarter-minister

and

https://en.antaranews.com/news/214021/despitechallenges-strong-economic-recovery-appears-on-track

Social forestry is the way forward for Indonesia:

Ministry

Erna Rosdiana, Secretary at the Directorate General

of Social Forestry and Environment Partnership in

the Ministry of Environment and Forestry, has said

social forestry is the future of Indonesia's forestry.

Social forestry has opened opportunities for many

parties after legal access was provided for the people,

she noted.

In Indonesia, social forestry (perhutanan sosial), also

referred as community-based forest management, is

defined as a sustainable forest management system

in the state or non-state forest areas carried out by

the local or indigenous communities to improve their

welfare, environmental outcomes and protect the

socio-cultural heritage.

See:

https://en.antaranews.com/news/211633/social-forestry-isthe-way-forward-for-indonesia-ministry

Regulation to boost rehabilitation of degraded

ecosystems

The government is will soon issue a regulation that

will support a carbon offset mechanism in the

forestry and other land-use sectors, a decision that

will strengthen rehabilitation of degraded ecosystems,

including mangrove forests.

This new regulation will be included in the recently

signed carbon pricing rule that forms the basis of

Indonesia’s carbon pricing scheme.

See:

https://www.thestar.com.my/aseanplus/aseanplusnews/2022/01/31/indonesia-new-government-regulationexpected-to-boost-mangrove-restoration

5.

MYANMAR

6. INDIA

Risk of imported

inflation

The Indian economy continues to face many

structural challenges that existed prior to the

pandemic and new challenges brought on by the

pandemic.

The latest Economic Survey 2021-22 presented by

the Finance Minister, Nirmala Sitharaman, has

forecast the economy will grow by 8-8.5% in the

fiscal year beginning in April.

The Survey notes that supply chain disruptions and

slow economic growth have contributed to an

increase in inflation, also the unwinding of stimulus

measures in developed economies is likely to affect

capital flows into the country.

The survey says “The surge in energy, food, non-food

commodities and input prices, supply constraints,

disruption of global supply chains and rising freight

costs have brought risks of imported inflation.

See:

https://www.firstpost.com/business/economic-surveyof-india-2021-22-gdp-expected-to-expand-at-9-2-keypoints-10335451.html

Covid altered real estate business dynamics

The Confederation of Real Estate Developers'

Associations of India (CREDAI) held a Finance

Conclave in late 2021 to explore new avenues of

financing given the sudden post-covid rise in housing

demand.

Satish Magar, chairman of CREDAI National said

covid has been a great teacher and has altered

business dynamics and led to significant changes in

customer buying patterns. He also mentioned that

more and more milennials are now looking to invest

in a house.

He also mentioned that in response to the many

challenges posed by covid control measures,

especially labor movement, the thought process of

developers has changed and they have begun to

embrace new technology and they have become more

financially disciplined.

The optimistic outlook at the end of 2021 has been

tempered by the pandemic’s third wave which has

dented sales of new homes reversing the upward

trend in sales late last year.

The March quarter is considered as a seasonally

strong period for sales of residential properties but

with consumer concerns over infections and

government restrictions on mobility causing delays in

site visits with potential buyers the sector is bracing

for a slow start to the year.

Sector players had hoped for a boost from the budget

but there was little in it for the housing sector. Even

though real estate sales were almost back to the prepandemic

late last year builders were hoping the

budget would deliver something to boost demand

such as relaxation in GST on under-construction

properties, a reduction of GST on key raw materials,

a higher interest exemption for homebuyers

and granting 'infrastructure' status to the real estate

sector but were disappointed.

However, the Finance Minister did announce

increased spending on infrastructure and made

massive allocations for subsidised housing.

See:

http://timesofindia.indiatimes.com/articleshow/89293011.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

and

https://www.credai.org/media/view-details/253

Online Transit Pass facility at Kandla Port

As part of its efforts to improve the ease of doing

business for timber importers and traders the state

Government of Gujarat has implemented a Transit

Pass Management System for Imported Timber, an

online process for facilitating transit passes.

The system provides seamless issuance of transit

passes that helps in monitoring and recording transit

permits for inter-state and intra-state transportation of

timber.

Before the new system was introduced obtaining the

Transit Pass was very time consuming. Kandla Port

has become India’s first port to facilitate online

transit pass. Navneet Gajjar, president of Kandla

Timber Association (KTA) said members greatly

appreciate the efforts of the Gujarat Government

adding that now the process of securing the Transit

Pass has become very efficient.

See:

https://www.plyreporter.com/article/92813/timberimport-online-transit-pass-facility-announced-at-kandlaport

Pay attention to treatment

Media reports say some overseas buyers have

complained of insect infestation in mango wood

handicrafts shipped from the Jodhpur handicraft and

furniture sector. It has been reported that the mango

wood coming from Bengal is to blame.

There has been a strong reaction from exporters who

are suffering financially and the reputation of

Jodhpur handicraft and furniture industry is becoming

tarnished.

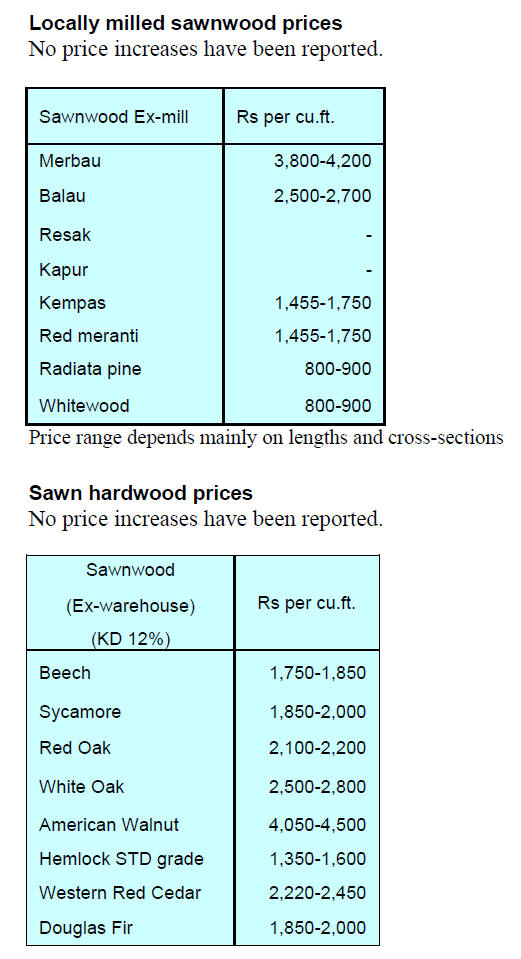

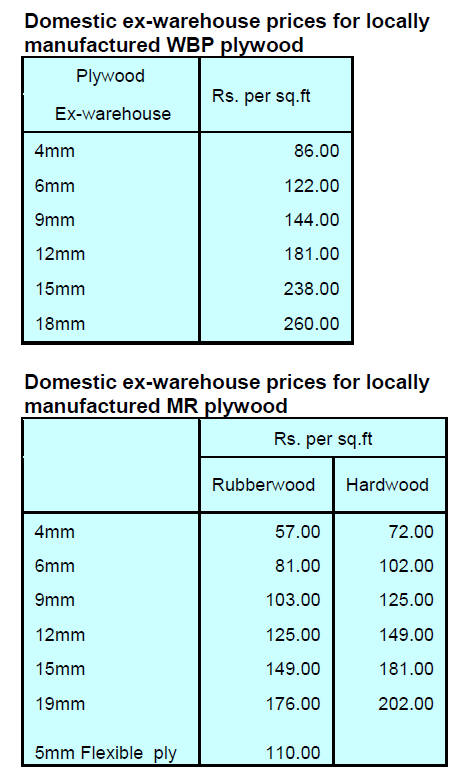

Plywood

Manufacturers across India are facing steep increases

in raw material costs which, coupled with the higher

price of fuel, many are seeing rapidly weakening

bottom lines with some having to downsize

operations to stay in business.

Producers have said fuel costs have risen at least

three times in the past six months such that with everincreasing

fuel costs transportation has also become a

cost centre of concern. Soon timber end-users will

have to pay more.

2021 State of Forest report

The Ministry of Environment, Forests and Climate

Change recently released the India State of Forest

Report 2021. The report showed a continuing

increase in forest cover across the country but experts

flagged some of its other aspects as causes for

concern such as a decline in forest cover in the

Northeast and a degradation of natural forests along

with the definition of forest.

See:

https://fsi.nic.in/forest-report-2021-details

7.

VIETNAM

Wood product export prospect for 2022

Vietnam aims to achieve wood and wood products

(W&WP) exports of US$18 billion in 2022. Export

prospects in the US, South Korea and many other

markets look quite bright but not without challenges

for Vietnamese businesses.

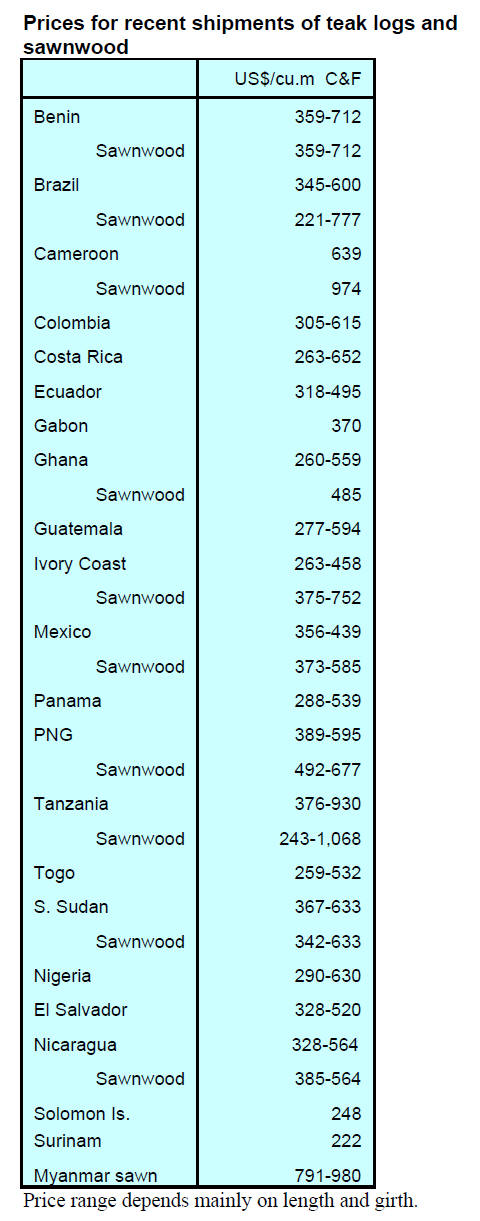

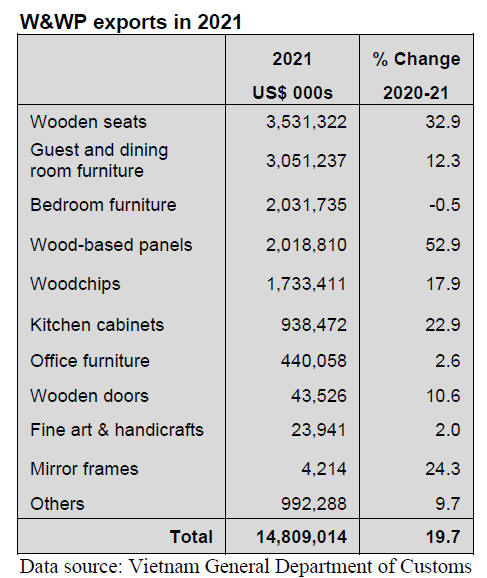

W&WP exports in 2021

In 2021 W&WP exports reached US$14.8 billion, up

by 19.7% against 2020. Of this, WP exports

generated US$11.1 billion, up by 16%.

Vietnam’s W&WP export outlook

Do Xuan Lap, chairman of the Vietnam Timber and

Forest Production Association, stated that in 2022

Vietnam’s wood and wood products export would

aim for US$17.5 – 18 billion. In particular, wooden

chair export would aim to account for US$4.1 billion,

wooden furniture US$10 billion.

In the US the trend of working from home may

continue and spending on home and home office

furniture is expected to increase in 2022. The US

market still has plenty of room for growth in wooden

furniture and wood products because the housing

market is growing well.

The share of Vietnamese furniture in total US

imports increased to 38.7% in 10 months of 2021,

from 36.9% in 10 months of 2020. However,

challenges remain when exporting W&WPs to the

US. Trade barriers are the foremost challenge for

Vietnam’s wood exporting companies.

Although Vietnam and the US have reached an

agreement on controlling the origin of wood several

Vietnamese products could be investigated. In

addition, due to a shortage of empty containers,

logistics fees will be a problem for Vietnam’s wood

and wood product exporters.

The cost of transporting one container of wooden

furniture to the US ranges from US$20,000 to

US$30,000, four times higher than pre-pandemic.

According to statistics from the Korea International

Trade Association, on average S. Korea imports

nearly US$1.1 billion of wooden furniture every year

of which imports from Vietnam account for about

18%. Vietnamese wood and wood products still have

room to expand in the Korean market. The Korean

economy shows strong signs of recovery and

domestic consumption is recovering.

Source:

https://vietnamcredit.com.vn/news/vietnams-woodexports-prospect-for-2022_14623

and

https://en.vietnamplus.vn/wood-furniture-exports-to-usexpected-to-hit-10-billion-usd/220865.vnp

Government circular on classifying wood

processing and export enterprises

As a further step toward VPA/FLEGT

implementation, on December 29, 2021, the Ministry

of Agriculture and Rural Development of Vietnam

issued Circular No.21/2021/TT-BNNPTNT to

specify the classification of wood processing and

export enterprises. This Circular will take effect from

May 1, 2022.

The Circular specifies the classification of wood

processing and export enterprises. The targets of this

Circular are enterprises that have simultaneous wood

processing and wood export businesses and

organisations and individuals with activities related

to the processing and export of wooden furniture.

The Circular stipulates the classification of

enterprises based on the principle of ensuring

publicity, transparency, competence, order and

procedures specified in the Government's Decree

No.102/2020/ND-CP dated September 01, 2020, to

promulgate Vietnam’s Timber Legality Assurance

System (VNTLAS).

The forest/wood industry sectors will be focused on

three key product groups including: W&WPs, nontimber

forest products (NTFPs) and forest ecosystem

services to generate revenue and investment in

forestry development. Based on specific advantages,

local conditions and market demands, local

authorities will be encouraged to have policy

mechanisms and prioritise investment resources to

develop key forestry products at the provincial level,

ensuring products of high quality, high value, with

geographical indications and traceability.

In order to achieve the targets VNFOREST has

proposed a number of tasks and solutions such as

continuing to innovate policy mechanisms,

mobilising resources, strengthening communication

and raising awareness; developing and improving the

level of research, application of science and

technology, innovating and improving the quality of

human resource training; synchronous forestry

infrastructure construction, modernisation of forestry

industry and logistics services; improving operational

efficiency, production and business organisation;

strengthening international cooperation, better

utilising market opportunities provided by

international agreements and commitments.

See:

https://tongcuclamnghiep.gov.vn/LamNghiep/Index/cocau-lai-nganh-lam-nghiep-theo-chuoi-va-nang-cao-gia-trigia-tang--4491

Forestry to become modern economic-technical

sector

The Prime Minister has recently approved the

Vietnam Forestry Development Strategy for 2021-30

with a vision toward 2050. Under Decision 523/QDTTg

dated 1 April 2021 the strategy is to convert the

forestry sector into a modern economic-technical

sector and establish, manage, protect, develop and

sustainably optimise forests and forest land areas.

This strategy aims at guaranteeing equal participation

of economic components to forestry activities,

mobilising social engagement and boosting scientific

and technological applications to forestry

development.

The strategy also centres on the role of forests in

socio-economic development, protecting the

environment and water security, mitigating natural

disasters, responding to climate change and

preserving natural resources and biological diversity.

Through this strategy Vietnam can become one of

world’s leading manufacturing and trading centres

for wood products. Application of technology is

expected to contribute up to 30% of sector growth.

See:

https://vietnamlawmagazine.vn/forestry-to-becomemodern-economic-technical-sector-37702.html

Vietnam to pilot carbon trade exchange

On 7 January the government issued a decree

requiring the establishment and trial operation of a

carbon trading exchange by 2025.

According to Decree 06 on mitigation of greenhouse

gas emission and protection of the ozone layer by the

end of 2027 legal norms on management of carbon

credits, commercial exchange activities and carbon

credits will be issued and a regulation on operation of

a carbon credit exchange will be enacted.

A pilot mechanism for exchanging and offsetting

carbon credits in potential sectors will be

implemented, while guidance on implementation of

the domestic and international carbon credit

exchange and offsetting mechanism will be provided

in accordance with Vietnam’s law and treaties to

which the country is a contracting party.

By 2028, the carbon credit exchange will be put into

official operation and activities of connecting and

exchanging domestic carbon credits with regional

and global carbon markets will be regulated. Under

the new Decree, exchange of greenhouse gas

emission quotas and carbon credits must be carried

out on the carbon credit exchange and domestic

carbon market.

See:

https://vietnamlawmagazine.vn/vietnam-to-pilotcarbon-trade-exchange-48233.html

8. BRAZIL

More time at home – furniture sales

get a boost

The pandemic has meant people spend more time at

home which has stimulated investment in home

improvements and one sector that benefited from this

is the furniture sector.

The firm demand seen in 2020 extended into 2021

and it is estimated that furniture sales in Minas Gerais

State have grown about 2% over the previous year.

The increase could have been higher but for the

problems the sector faced in securing production

inputs and the rising prices of raw materials. For

example, prices for one of the main inputs, MDF

panels, more than doubled.

Expectations for 2022 are positive for the furniture

sector. Demand growth will be driven by civil

construction which is on the rise and job growth

which will lead to increased purchases.

The advance of the vaccination efforts and the

resumption of social activities also favoured the

furniture sector.

Overall, the timber sector achieved positive results in

2021 despite the pandemic, global economic

uncertainty, rising production costs and logistics

problems. In 2021 forest production and processing

were little affected. International market demand was

firm in 2021 and Brazilian products could satisfy

some of this demand in North America, European

and Asia.

In the domestic market the timber industry was able

to supply the main consumer markets such as

construction, packaging and furniture. The timber

sector was successful in maintaining jobs despite the

official unemployment rate of 12% in late 2021. The

outlook for 2022 is positive in terms of the

resumption of global economic growth, investments

in infrastructure and resumption of domestic and

international demand.

Mato Grosso manufacturers increased wood

product exports in 2021

The Mato Grosso State, one of the largest tropical

timber producing states in the Amazon region,

achieved an 18% increase in export earnings in 2021

to reach US$21.5 billion. According to FIEMT

(Federation of Industries of Mato Grosso State) it is

likely that exports of wood products in 2022 will

grow even more due to the advance of vaccinations

and the improving the pandemic situation.

According to IEMI (Market Intelligence Institute)

furniture production in the country in 2021 grew

2.7% in volume and 9.8% in revenue compared to

2020 recovering most of what had been lost in the

previous year. Exports jumped 50% in 2021

compared to 2020 and earned US$898.7 million.

Even though Brazil is the sixth largest furniture

producer in the world the country is placed in the

28th position in the ranking of the largest exporter,

well below its potential. The United States remains

the main destination for Brazilian furniture importing

35% of Brazilian furniture exports in 2021.

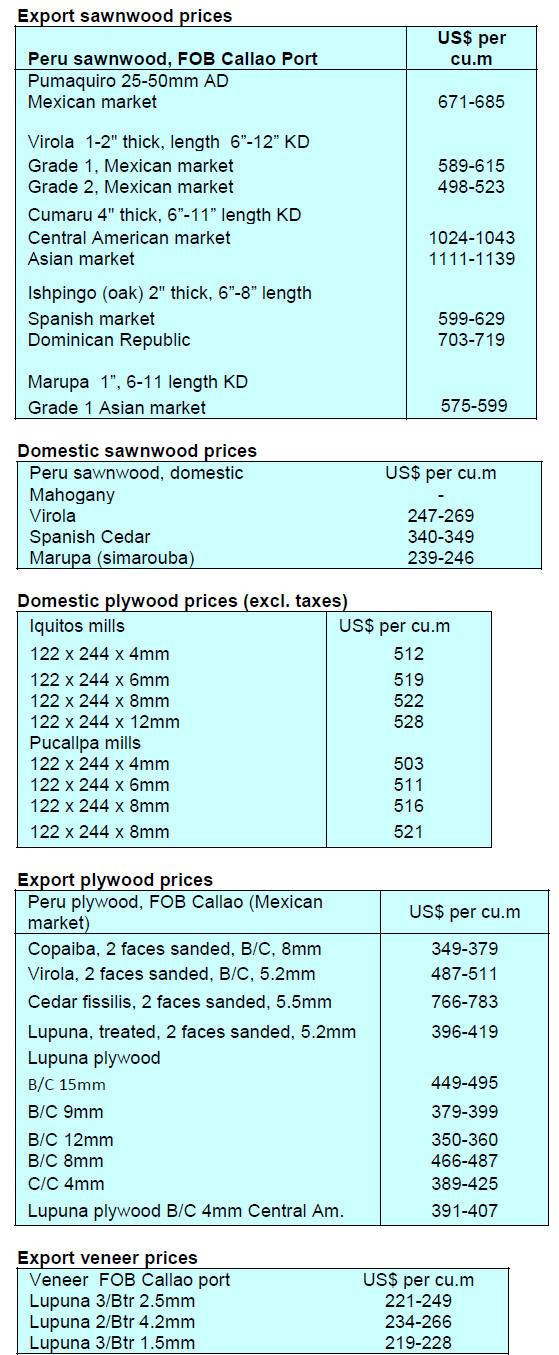

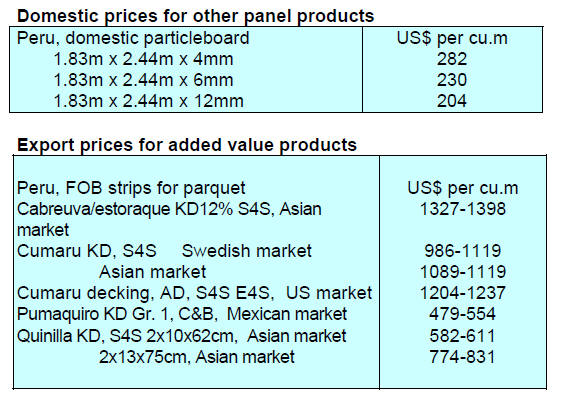

9. PERU

Furniture imports – Brazil the top

shipper

In November 2021 Peruvian imports of wooden

furniture reached US$6.5 million, more than double

that in October. Brazil remained the biggest supplier

in November 2021 shipping US$4.2 million and

accounting for almost 65% of the total imported in

the month. The second largest supplier was China

($0.9 million) and Colombia ($0.4 million).

Wood product exports began recovery in 2021

The Association of Exporters (ADEX) has reported

that the value of wood product exports in 2021

totalled US$122.8 mil., up 31% compared to 2020

(US$93.9 million) however, the value of 2021

exports was still below that in 2019 (US$124.9

million).

ADEX also pointed out exports by the forestry sector

represented just 0.75% of the total of all nontraditional

exports and that this needs to be corrected

through government measures that promote the

development of the sector since it generates formal

employment much of which is in rural areas.

The Commercial Intelligence unit ‘ADEX Data

Trade’ has reported of total timber shipments semimanufactured

(US$72.2 million) were the most

important with growth of 30% in 2021 and an almost

60% share of all shipments. ADEX said of

manufactured wood products ipe mouldings,

unassembled strips and friezes for parquet flooring

and other profiled products accounted for most of the

balance.

The second ranked export product was sawnwood

(US$33.6 million) demand for which increased by

34%. Sawnwood accounted for 24% of wood product

exports.

In addition, products for construction (US$6.2

million) were exported; furniture and parts (US$4.2

million); plywood (US$3.1 million); other

manufactured products (US$1.4 million);

sheets/veneers (US$1.3 million), firewood and

charcoal (US$0.9 million) and fibre and particleboard

(US$0.8 million).

Despite declining purchases (-27% in 2021) China

was the top buyer of Peruvian wood products taking

US$36.9 million or around 30% of exports. Other

shipments were to France (US$22.3 million), the US

(US$12.9 million), the Dominican Republic (US$9.4

million) and Mexico (US$8.8 million). Also in the

top 10 export destinations were Vietnam (US$5.5

million), Belgium (US$5.3 million), Denmark

(US$4.4 million), Ecuador (US$2.8 million) and New

Zealand (US$2.6 million).

Direct financing programme for forest plantations

In coordination with the Ministry of Agriculture the

Forest Service (SERFOR) managed to access the

AGROPER┌ Fund which was created in 2009 and

supports small sized forestry operations with an area

of up to ten hectares registered in the National

Registry of Plantations.

SERFOR will be the implementing agency for the

Direct Financing Programme for Forest Plantations

approved by the Board of Directors of AGROPERU.

Funds available up to December 2023 amount to

US$12.9 million.

It is estimated that this can support about 3,300 small

forest plantation producers helping the establishment

of 16,500 hectares. The programme will finance up to

70% of the total cost of the forest plantation.