|

Report from

Europe

EU27 tropical wood imports slowed in the second half

of 2021

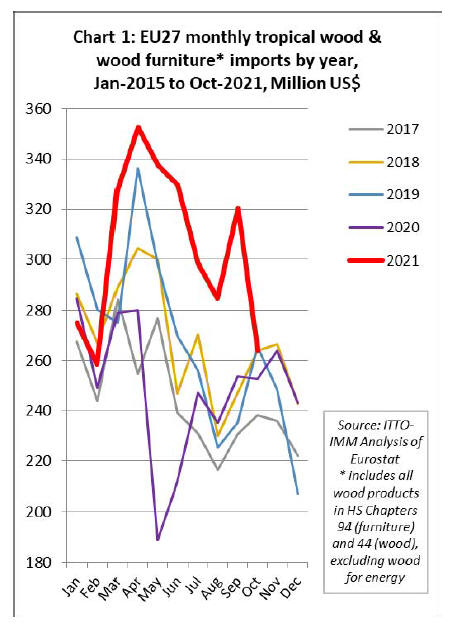

After reaching the highest level for nearly a decade in the

first half of 2021, the US dollar value of EU27 imports of

wood and wood furniture products from tropical countries

declined sharply in July and August. After a brief revival

in September, imports fell away again in October (Chart

1).

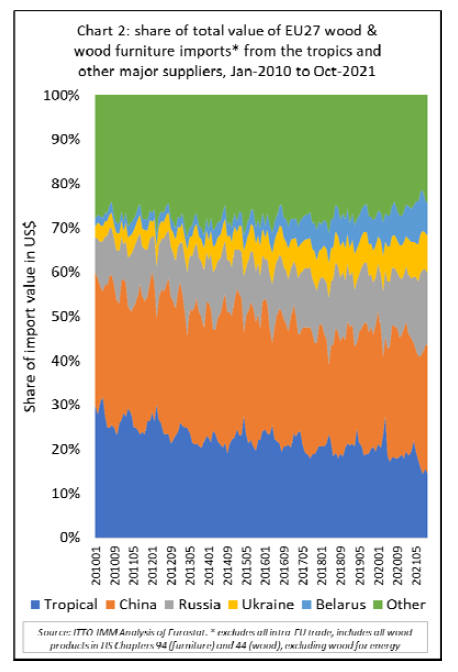

While the value of EU27 imports from the tropics

rebounded in 2021, imports from other parts of the world

increased at a faster pace so that the long-term decline in

market share for tropical countries continued. The decline

in share for tropical countries accelerated in the second

half of last year (Chart 2).

Total EU27 import value of all wood products and wood

furniture in the first ten months of 2021 was US$17.46

billion, 40% more than in the same period in 2020.

Import value of all tropical products was US$3.05 billion,

23% more than the same period in 2020. However import

value from non-tropical regions was US$14.41 billion, a

44% increase. Imports were up by 39% from China to

US$4.55 billion, by 68% from Russia to US$2.80 billion,

by 70% from Belarus to US$1.45 billion, and by 58%

from Ukraine to US$1.44 billion.

The 40% increase in EU27 import value from the tropics

in the first ten months of 2021 was not mirrored by an

equivalent increase in import quantity. In quantity terms,

imports from tropical countries during the period were

1.46 million tonnes, only 6% more than in 2020 and still

7% down compared to 2019.

A large part of the gain in import value of tropical

products was due to a significant rise in prices, partly

driven by rising freight rates which were at unprecedented

levels in 2021.

The Drewry World Container Index shows that global

rates for a 40 foot container peaked at over US$10000 in

the middle of September 2021 compared to US$2000 in

the same month in 2020. At the start of 2022, rates were

still at around US$9400 dollars compared to US$5000 at

the start of 2021.

FOB prices for tropical wood products were also driven up

during 2021 in response to the sharp increase in global

demand at a time when supplies were scarce and tropical

producers continued to operate under extremely

challenging conditions during the pandemic. This in turn

encouraged EU27 importers to buy larger quantities from

more accessible suppliers in the European neighbourhood

and a continued loss of market share for tropical suppliers

in the EU market.

Wood furniture drives rise in EU27 import value in

2021

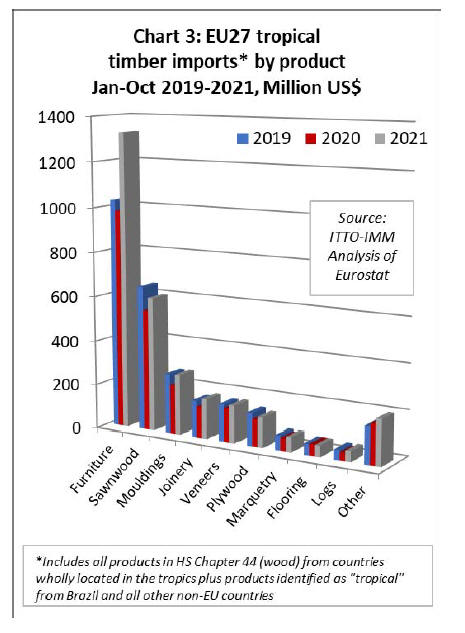

The 2021 increase in the value of EU27 imports from

tropical countries was heavily concentrated in wood

furniture products. For these products, import value in the

first ten months of 2021 was well in excess of imports

during the same period in both 2020 and 2019.

Although import value of all other wood products from

tropical countries was higher in 2021 than in the previous

year, for some (including key products like tropical

sawnwood and plywood), import value was still below the

level prevailing before the COVID pandemic in 2019

(Chart 3).

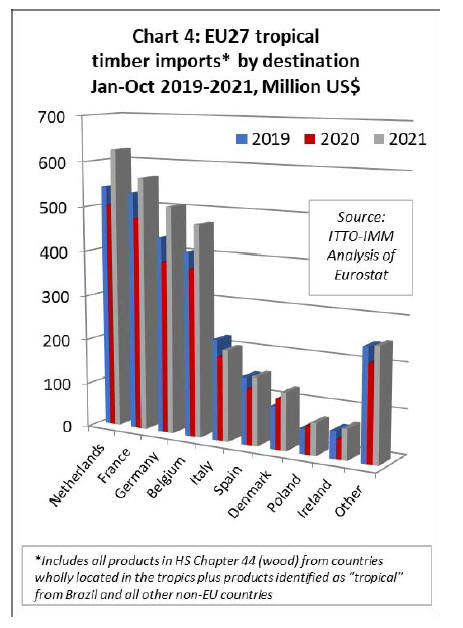

In the first ten months of 2021, import value into all the

largest EU27 destinations for tropical wood and wood

furniture products was significantly higher than in the

same period in 2020. Furthermore, of the largest markets,

only in Italy was import value in the first ten months of

2021 less than in the same period in 2019 before the

pandemic (Chart 4).

EU recovery expected to continue but significant

downside risks are emerging

Longer term market prospects in the EU27 look

reasonable as the economic expansion in the region is

expected to continue, but there are significant downside

risks. According to the EU's latest Autumn 2021 forecast,

the EU economy is expected to have grown by 5% in 2021

and to maintain growth of 4.3% this year before easing to

2.5% in 2023.

While strong domestic demand is expected to continue to

fuel economic expansion in the EU, the forecast recovery

is heavily dependent on the uncertain evolution of the

pandemic, both within and outside the EU.

The improving health situation, which allowed the

economy to bounce back in 2021, is now being challenged

by rising infections linked to the Omicron variant across

the EU. For now, hospitalisations and deaths associated

with COVID-19 infections remain low compared to

previous waves. But they are slowly rising, posing a risk

to economic prospects.

Inflation is another source of uncertainty for the European

economy. As in other parts of the world, surging prices are

hitting customers across the region with soaring food and

energy bills. Germany, Europe's largest economy, saw the

biggest price increase for almost 30 years in December,

beating forecasts. In Italy, economists have said the

recovery could be muted in 2022 by rising prices,

especially fuel prices. Poland has also reported a high

inflation not seen over the past 20 years.

Supply bottlenecks and combined with rising demand,

boosted by government stimulus measures, have caused

consumer prices to rise. Rising energy prices and

disruptions in global logistics, leading to severe shortages

and price increases of key raw and intermediate inputs, is

also holding back manufacturing across the EU. While this

may be only a temporary phenomenon as supply

bottlenecks are widely expected to ease in the course of

2022, an inflation rate of below 2 percent is not expected

until 2023.

At the same time, activity in the construction sector in the

EU, a key driver of timber demand in the region, remains

fragile. The IHS Markit Eurozone Construction Index

gradually increased from 49.5 in August last year to 53.3

in November before slipping to 52.9 in December.

Overall, the recent trend has been positive but, with 50.0

being the dividing line between contraction and growth,

the index implies that sentiment in the sector is very

mixed.

The rise in eurozone construction activity in the last

quarter of 2021 was led by a marked upturn among Italian

companies. French firms recorded a softer rate of growth,

while Germany noted a sustained decrease. Overall

though, in December last year new orders placed with

eurozone construction companies expanded at the fastest

pace since February 2019 at the end of 2021.

Anecdotal evidence pointed to new projects coming to

tender amid sustained government incentives for the

sector. Meanwhile, a majority of eurozone construction

companies continued to cite higher raw material prices due

to widespread supply shortages.

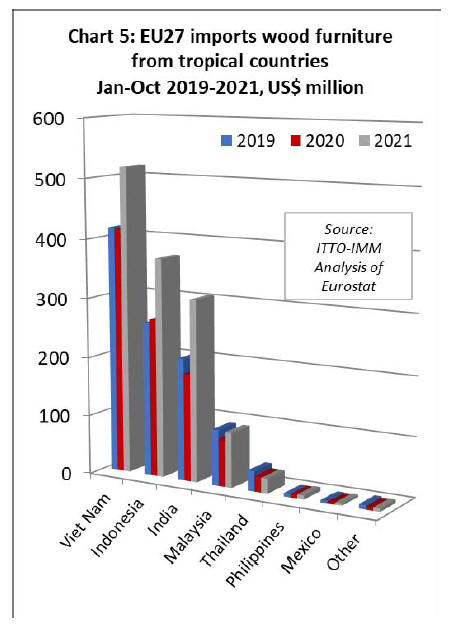

Rising EU27 wood furniture imports from Vietnam,

Indonesia, and India

In the first ten months of 2021, EU27 import value of

wood furniture from tropical countries was US$1.33

billion, 35% and 29% higher than the same period in 2020

and 2019 respectively. For all three leading tropical supply

countries of wood furniture to the EU27 ĘC Vietnam,

Indonesia, and India - import value in the first ten months

of 2021 was higher even than in 2019 before the

pandemic.

After a slow start to the year, the value of EU27 wood

furniture imports from Vietnam and Indonesia increased

sharply from the second quarter onwards. By the end of

the first ten months, import value was up 25% from

Vietnam to US$518 million, and up 38% from Indonesia

to US$370 million. Imports from India, which were

consistently high throughout the first ten months of 2021,

totalled US$306 million during this period, 68% greater

than the same period in 2020.

In contrast, EU27 imports from Malaysia were very strong

in the first half of 2021 but slowed sharply in the second

half of the year. Imports from Malaysia in the first ten

months of 2021 totalled US$92 million, 17% more than

the same period in 2020 but 2% less than the same period

in 2019. Imports from Thailand were US$25 million in the

first ten months of 2021, 3% less than the same period in

2020 and down 27% compared to 2019 before the

pandemic (Chart 5).

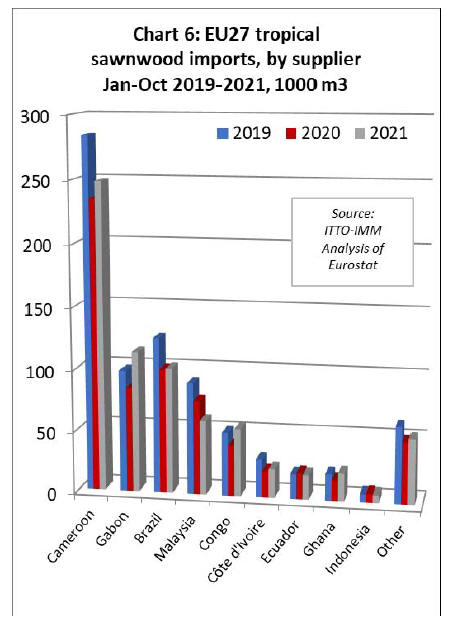

EU27 imports of tropical sawnwood still below pre-

COVID level

In the first ten months of 2021, EU27 import value of

tropical sawnwood was US$602 million, up 10% on 2020

but down 7% compared to 2019. In quantity terms,

imports of 700,300 cu.m in the first ten months were 8%

higher than the same period in 2020 but still down 11%

compared to the same period in 2019 before the pandemic.

Imports of 248,600 cu.m from Cameroon in the first ten

months of 2021 were 6% higher than the same period in

2020 but still 13% down compared to 2019. Imports of

101,300 cu.m from Brazil were up 1% compared to 2020

but down 19% compared to 2019.

Sawnwood imports from Gabon and Congo fared better

during the first ten months of 2021. Imports from Gabon,

at 113,300 cu.m, were up 34% on 2020 and up 15%

compared to 2019. For the Congo, imports were 54,600

cu.m in the ten month period, up 34% on 2020 and 7% on

2019.

Imports of sawnwood from Côte d'Ivoire were 22,900

cu.m in the first ten months of 2021, up 9% compared to

2020 but down 25% on 2019. The long term decline in

EU27 imports of sawnwood from Malaysia continued in

the first ten months of 2021, at 59,800 cu.m 21% less than

the same period in 2020 and 34% down on 2019 (Chart 6).

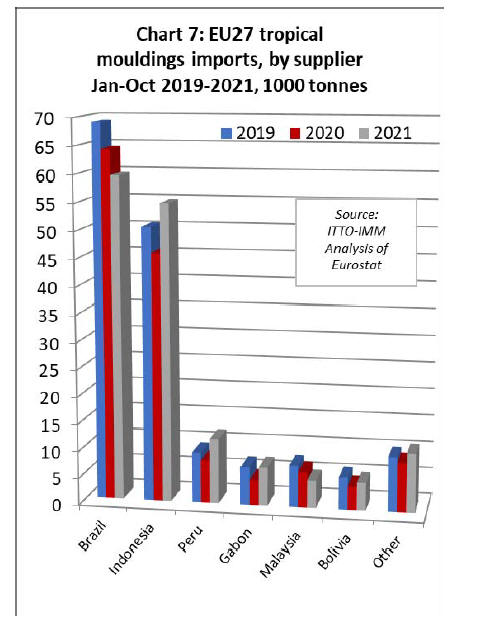

In the first ten months of 2021, EU27 import value of

tropical mouldings/decking was US$271 million, up 23%

and 1% compared to 2020 and 2019 respectively. In

quantity terms, tropical mouldings/decking imports

increased 8% to 154,800 tonnes in the first ten months of

2021 compared to the same period the previous year.

However import quantity was still down 3% compared to

2019.

Imports of 59,600 tonnes from the largest supplier Brazil,

were 7% down on the same period in 2020 and 14% less

than in 2019.

Despite widespread reports of supply shortages for

Indonesian bangkirai decking, imports of

mouldings/decking from Indonesia were 54,800 tonnes

during the first ten months of 2021, 20% more than the

same period in 2020 and 9% more than in 2019.

Imports of mouldings/decking from Peru were 12,000

tonnes, 51% more than in 2020 and 28% up on 2019.

Sawnwood imports from Gabon were 7,200 tonnes in the

first ten months of 2021, 52% more than the same period

in 2020 and 1% more than in 2019.

Imports from Malaysia were 5,100 tonnes in the first ten

months last year, 22% less than in 2020 and 34% down

compared to 2019 (Chart 7).

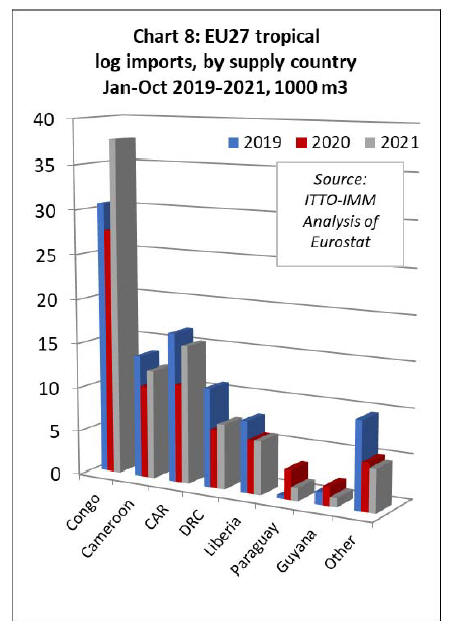

In the first ten months of 2021, EU27 import value of

tropical logs was US$47 million, 30% up on 2020 and 3%

more than in 2019. In quantity terms, imports of 85,800

cu.m were 19% more than the same period in 2020 but 6%

less than the same period in 2019.

Imports of 37,700 cu.m from Congo, now by far the

largest supplier of tropical logs to the EU, were 37% more

than the same period in 2020 and 23% more than the same

period in 2019.

Imports in the first ten months of 2021 from all other

leading supply countries - CAR (15,400 cu.m), Cameroon

(12,200 cu.m), DRC (7,200 cu.m), and Liberia (6,000

cu.m) - were all more than the same period in 2020 but

still down on the level of 2019 before the pandemic.

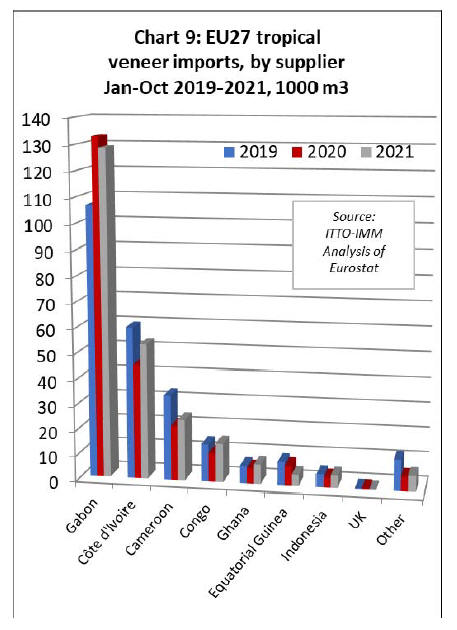

Only marginal gains in EU27 imports of tropical veneer

and plywood

In the first ten months of 2021, EU27 import value of

tropical veneer was US$168 million, 11% more than the

same period in 2020 and a 1% gain compared to 2019. In

quantity terms, imports were 245,200 cu.m in the first ten

months of 2021, a gain of 4% compared to 2020 but 2%

less than in 2019.

After a rapid rise in 2020, veneer imports from Gabon

were 128,800 cu.m in the first ten months of 2021, down

3% compared to 2020 but still 21% more than in 2019. At

53,400 cu.m, veneer imports from Côte d'Ivoire were 18%

more than in 2020 but still down 11% compared to 2019.

Imports of 24,200 cu.m from Cameroon were 12% more

than in 2020 but 28% less than in 2019. Veneer imports

from Congo were 15,300 cu.m in the first ten months of

2021, 35% and 3% more than the same period in 2020 and

2019 respectively (Chart 9 above).

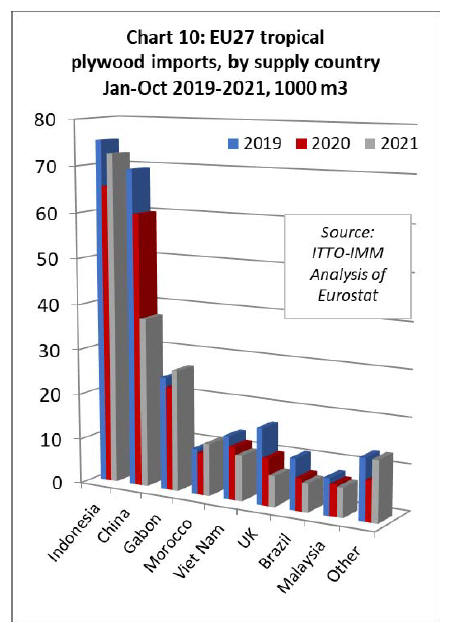

In the first ten months of 2021, EU27 import value of

tropical plywood was US$135 million, up 11% compared

to 2020 but down 8% on 2019. In volume terms, imports

of 190,300 cu.m in the first ten months of 2021 were 6%

less than the same period in 2020 and 22% down

compared to 2019.

EU27 tropical hardwood plywood imports from Indonesia,

the largest supplier, made up some lost ground in the

second half of 2021 after a slow start in the first half of the

year. Imports from Indonesia were 72,500 cu.m in the first

ten months of 2021, 11% more than the same period in

2020 but still 4% down compared to 2019.

There were also positive trends in EU27 imports of

tropical hardwood plywood from Gabon and Morocco in

the first ten months of 2021. Imports from Gabon were

26,600 cu.m during the period, 17% more than the same

period in 2020 and 7% more than in 2019. Imports from

Morocco were 11,500 cu.m, 24% and 15% more than the

same period in 2020 and 2019 respectively.

In contrast, imports of tropical hardwood faced plywood

from China were 37,300 cu.m in the first ten months of

2021, 38% less than the same period in 2020 and 46%

down compared to 2019. EU27 imports of tropical

hardwood plywood from Vietnam, Malaysia and Brazil,

and indirect imports from the UK, all continued to slide in

the first ten months of 2021 (Chart 10 above).

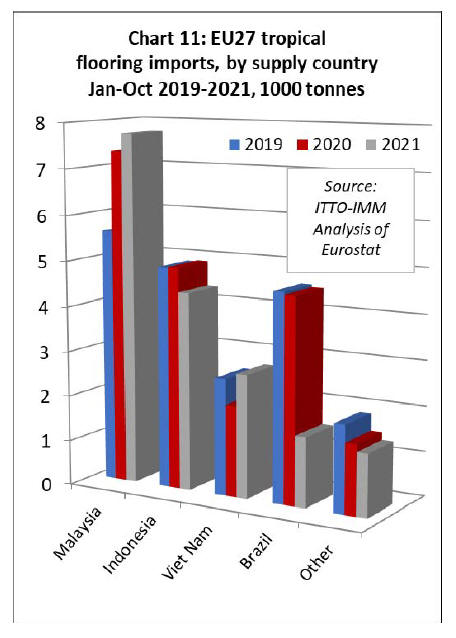

Rise in EU27 imports of tropical flooring from Malaysia

continues

In the first ten months of 2021, EU27 import value of

tropical flooring products was US$52 million, equivalent

to the same period in 2020 and 2% more than in 2019.

However in quantity terms, imports of 17,800 tonnes in

the first ten months of 2021 were 13% down compared to

2020 and 9% less than in 2019. The rise in EU27 wood

flooring imports from Malaysia, that began in 2020,

continued into 2021.

Imports of 7,750 tonnes from Malaysia in the first ten

months of 2021 were 5% more than the same period in

2020 and 38% greater than in 2019. Imports of 2,730

tonnes from Vietnam during the ten month period were

also 35% greater than in 2020 and 6% more than in 2019.

In contrast, flooring imports from Indonesia of 4,400

tonnes in the first ten months of 2021 were 11% less than

the same period in both 2020 and 2019. Imports from

Brazil also continued to slide last year, at just 1,550 tonnes

in the first ten months, 66% down compared to both 2020

and 2019 (Chart 11).

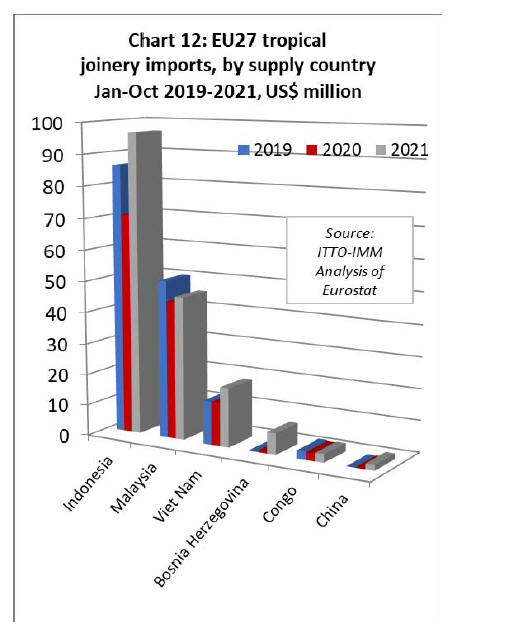

The value of EU27 imports of other joinery products from

tropical countries - which mainly comprise laminated

window scantlings, kitchen tops and wood doors -

increased 28% to US$179 million in the first ten months

of 2021.

Imports were up 37% to US$97 million from Indonesia,

up 4% to US$46 million from Malaysia, and up 37% to

US$19 million from Vietnam. In the case of Indonesia and

Vietnam, import value of these joinery products also

exceeded the pre-pandemic level in 2019.

In 2021, the EU27 has also began to import joinery

products manufactured using tropical hardwood from

Bosnia. Import value from Bosnia was US$6.6 million in

the first ten months of 2021, up from a negligible level the

previous year (Chart 12).

|