US Dollar Exchange Rates of

10th

Jan

2022

China Yuan 6.3762

Report from China

Adjustment of tariff in 2022

The Customs Tariff Commission issued a notice on 15

December that adjusted some import tariffs, tariffs for

most-favored-nations and conventional tariffs. Also there

were adjustments to tax regulations.

From 1 January 2022 China will apply tariff rates that are

lower than the most-favored-nation tariff rates for 954

imported commodities to assist the manufacturing sector.

In accordance with free trade and preferential trade

arrangements signed by China and partner countries the

conventional tariff rate will be implemented for some

commodities originating from 29 countries. Signed

bilateral free trade agreements between China and New

Zealand, Peru, Costa Rica, Switzerland, Iceland, South

Korea, Australia, Pakistan, Georgia and Mauritius tariff

rates will be reduced.

The Regional Comprehensive Economic Partnership

(RCEP) and the China-Cambodia Free Trade Agreement

took effect from 2 January 2022 and reduced tariffs will be

applied.

From 1 July 2022 China will implement a seven-step

reduction of the most-favored-nation tariff rates for 62

information technology products. After the adjustments

overall tariff rate levels will be maintained at 7.4%.

See:

http://gss.mof.gov.cn/gzdt/zhengcefabu/202112/t20211215_3775137.htm

Changes to HS codes for wood products

Some import and export tariff codes have been changed.

In all 84 customs codes have been changed, 60 added and

24 deleted. The detailed changes are as below.

Added HS codes for wood products are as below.

Sawdust or sawdust sticks£¨4401.3200¡¢4401.4100

¡¢4401.4900£©£»

Carcoal£¨4402.2000£©£»

Teak logs£¨4403.4200£©£»

Sawnwood£¨4407.1300¡¢4407.1400¡¢4407.2300£©

Plywood £¨ 4412.4100¡¢4412.4200¡¢4412.4911¡¢

4412.4919¡¢4412.4920¡¢4412.4990¡¢4412.5100¡¢

4412.5200¡¢4412.5911¡¢4412.5919¡¢4412.5920¡¢

4412.5990¡¢4412.9100¡¢4412.9200¡¢4412.9920¡¢

4412.9930¡¢4412.9940¡¢4412.9990)

Radiata pine made frame of pictures, photos and

mirrors£¨4414.1000¡¢4414.9010¡¢4414.9090£©£»

Construction woodworking products, including glued

laminated timber, cross-laminated timber (CLT) and

I-beam £¨ 4418.1100 ¡¢4418.1910 ¡¢4418.1990 ¡¢

4418.2100¡¢4418.2900¡¢4418.3000¡¢4418.8100¡¢

4418.8200¡¢4418.8300¡¢4418.8900¡¢4418.9200£©

Wood tableware and kitchen utensils£¨4419.2000£©

Tropical wood carving or bamboo carving £¨

4420.1110¡¢4420.1120¡¢4420.1190¡¢4420.1911¡¢

4420.1912¡¢4420.1920¡¢4420.1990£©

Coffin£¨4421.2000£©£»

Wood seats£¨9401.3100¡¢9401.3900¡¢9401.4110¡¢

9401.4190¡¢9401.4910¡¢9401.4990¡¢9401.9100¡¢

9401.9910¡¢9401.9990£©£»

Wood furniture parts£¨9403.9100¡¢9403.9900£©¡£

Deleted HS codes of wood products are as below.

Sawdust, wood waste and chips£¨4401.4000)

Teak logs£¨4403.4910)

Teak sawnwood£¨4407.2910£©

Plywood £¨ 4412.9410¡¢4412.9491¡¢4412.9492¡¢

4412.9499¡¢4412.9910¡¢4412.9991¡¢4412.9992¡¢

4412.9999£©£»

Radiata pine made frame of pictures, photos and

mirrors£¨4414.0010¡¢4414.0090)

Construction woodworking products, door, window,

frame and threshold £¨ 4418.1010 ¡¢4418.1090 ¡¢

4418.2000¡¢4418.6000£©;

Wood or bamboo carving£¨4420.1011¡¢4420.1012

¡¢4420.1020¡¢4420.1090£©;

Leather or bonded leather faced chair which can be

used as bed£¨9401.4010¡¢9401.4090£©

Wood furniture parts£¨9403.9000£©

Pine wood imports ¨C only through designated ports

The quarantine requirement for imported pine (Pinus spp)

wood (including logs and sawnwood) from countries

where pine wood nematode (Bursaphelenchus xylophilus)

infestation have been identified has been released. This

aims to prevent the introduction of pine wood nematode.

The quarantine requirement will be effective as of 1

February 2022 and applies to Canada, Japan, Korea,

Mexico, Portugal, Spain and the United States of America.

The quarantine requirements are as below.

Prior to shipment

Logs

Prior to export, the phytosanitary authorities of the

exporting country shall take samples from each batch of

logs to be exported to China for laboratory testing for

Bursaphelenchus xylophilus. If detected the logs shall not

be exported to China.

Even if pine wood nematode is not detected each batch of

logs should be fumigated with methyl bromide and

sulfuryl fluoride before export to eliminate longhorn

beetles and other forest pests.

Sawnwood

Prior to export heat treatment should be carried out for

each batch of sawwood to kill pine wood nematode,

longhorn beetles and other forest pests. If heat treatment is

not carried out samples shall be taken for laboratory

testing then the goods shall be fumigated.

The fumigation or heat treatment shall be carried out under

the supervision of the competent department of the plant

quarantine office in the exporting country to ensure that

the quarantine treatment is effective.

The plant quarantine office in the exporting country shall

issue a plant quarantine certificate for the timbers that

passed the quarantine inspection.

The type, duration, ambient temperature and dose of

fumigant should be indicated in the plant quarantine

certificate for logs or sawnwood tested and fumigated and

the following statement shall be included in the certificates

¡°This consignment of pine wood has been sampled and

tested in the laboratory and Bursaphelenchus xylophilus

was not detected.¡±

In addition the centre temperature and duration of heat

treatment shall be indicated in the plant quarantine

certificate for the sawnwood.

Pine imports shall be through designated ports only, these

ports are :

Lianyungang Port and Nanjing Port in Jiangsu Province.

Beilun Port, Zhoushan Port, Wenzhou Port and Taizhou

Port in Ningbo city of Zhejiang Province.

Fuzhou Port (Mawei and Jiangyin) in Fujian province.

Huangdao Port, Rizhao Port, Rizhao Lanshan Port and

Dongjiakou Port in Shandong Province.

Foshan Nanhai Shanshan Port, Zhaoqing New Port,

Huangpu Port, Dongguan Port, Zhuhai Wanzai Port and

Shantou Guang¡¯ao Port in Guangdong Province.

See:

http://dalian.customs.gov.cn/nanchang_customs/496828/496870/yqfkhlwlb55/3619495/4077979/index.html

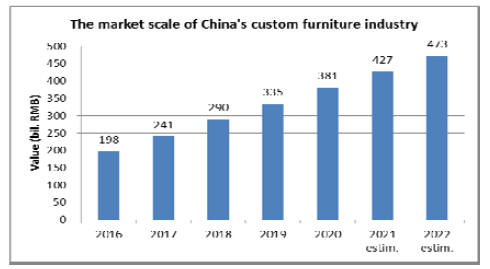

Custom furniture market forecast

China¡¯s custom furniture industry has developed rapidly in

recent years growing 10-20% annually. The Covid

pandemic had an impact on the custom home furnishing

industry at both the production end and the customer end

and the growth rate is likely to fall but rebound when the

pandemic is over.

It has been estimated by the China Commerce Industry

Academy that the market size of China¡¯s custom furniture

industry will likely be RMB427 in 2021 and will rise to

RMB473 in 2022.

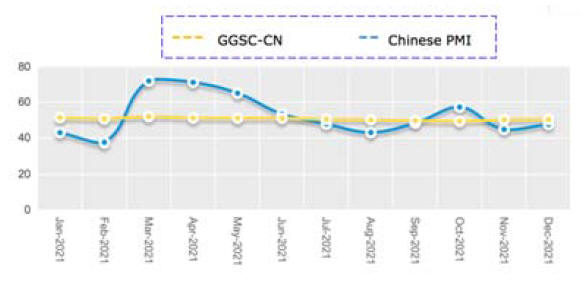

GGSC-CN Index Report December 2021

In December 2021, China's PMI index registered 50.3%,

an increase from the previous month and in

the expansion range (above 50%) for 2 consecutive

months.

In December production and manufacturing in timber

industry contracted compared with the previous

month reflecting the decline in export orders for most

enterprises. It was reported that the price of raw materials

fell for two consecutive months.

The GGSC-CN comprehensive index for

December registered 47.5% (52.0% for last December and

55.6% for December 2019) an increase from the previous

month and was below the critical value of 50%. This

indicates that the operations of the forest products

enterprises represented in the GGSC-CN index shrank

from the previous month. See Figure 1 for more details.

Challenges

Oak and Zingana are in short supply.

Products in short supply

Cumaru£¬Merbau£¬Oak£¬Zingana

Commodity for which the price has been increased

Waterproof agents, base material, glue, formaldehyde

Commodity for which the price has declined

Colored paper, Eucalyptus MDF, Eucalyptus fuelwood,

Urea, Melamine

In December 2021 three sub-indexes of GGSCCN

increased and one decreased. The production index

registered 37.5%, an increase from the previous month but

still below 50% for three months. Production from forest

products enterprises represented by GGSC CN was worse

than that November.

The new order index registered 56.3% in December an

increase from the previous month reflecting the ability of

enterprises to obtain orders was better than in November.

Among them the new export order index registered 31.3%,

an increase from the previous month.

The main raw material inventory index registered 43.8%, a

decline from the previous month. This indicates that the

raw material inventory of the forest products

enterprises was less than that of last month.

The employment index registered 56.3%, an increase from

the previous month while the supplier delivery time index

was 37.5%, a drop from the previous month indicating

slower deliveries.

See:

http://www.itto-ggsc.org/site/article_detail/id/232

|